YouTube

Spotify

Apple Podcasts

For our Q3 earnings round-up, we decided to look at four stocks (two each) on our watchlists that we would buy on a 20% earnings dip.

These are stocks we would not buy today, but think are great businesses. It is important to keep track of businesses you like but think the stock is overvalued so you can buy if a compelling price presents itself. Do the research before the stock drops so you have the confidence to buy.

Below, you will find our show notes and charts from this week’s episode.

-Brett

Brett Stock #1: Airbnb

Back in July of last year, we did a detailed show on Airbnb titled “Why We Don’t Own Airbnb.” The stock was around $130 then and remains around that level today.

Well, neither of us owns the stock today, either. Here’s why I still like the business but don’t love the stock. At the end of this section, I will go through the price at which I would buy.

Why the business model helps you measure the moat

Airbnb has a simple business, but one that is hard to perfect for every customer. It operates a marketplace where hosts offer lodging (and sometimes tours/experiences) that people can buy. In exchange for matching up a host and a guest on the marketplace, it takes a cut of the dollars spent on Airbnb. This is known as the take rate.

I like a few things about Airbnb. First, the customer value proposition is easy to understand. When I say customers, I mean two sets: hosts and guests. The hosts want to make money by consistently having guests at their place. The guests want to find the right place to stay for their specific occasion (location, duration, size). Airbnb can work hard to facilitate this for both stakeholders.

So, the more guests on the platform looking to stay where the hosts are, the better the value proposition is for the hosts. And the more hosts on the platform, the better the value proposition is for the guests. Do I need to spell it out? Airbnb has a network effect.

It is easy to measure whether this network effect is shrinking or expanding. Are there more hosts on the platform than the year prior? Are more guests spending more money with Airbnb this year? If yes to both, then the moat is widening.

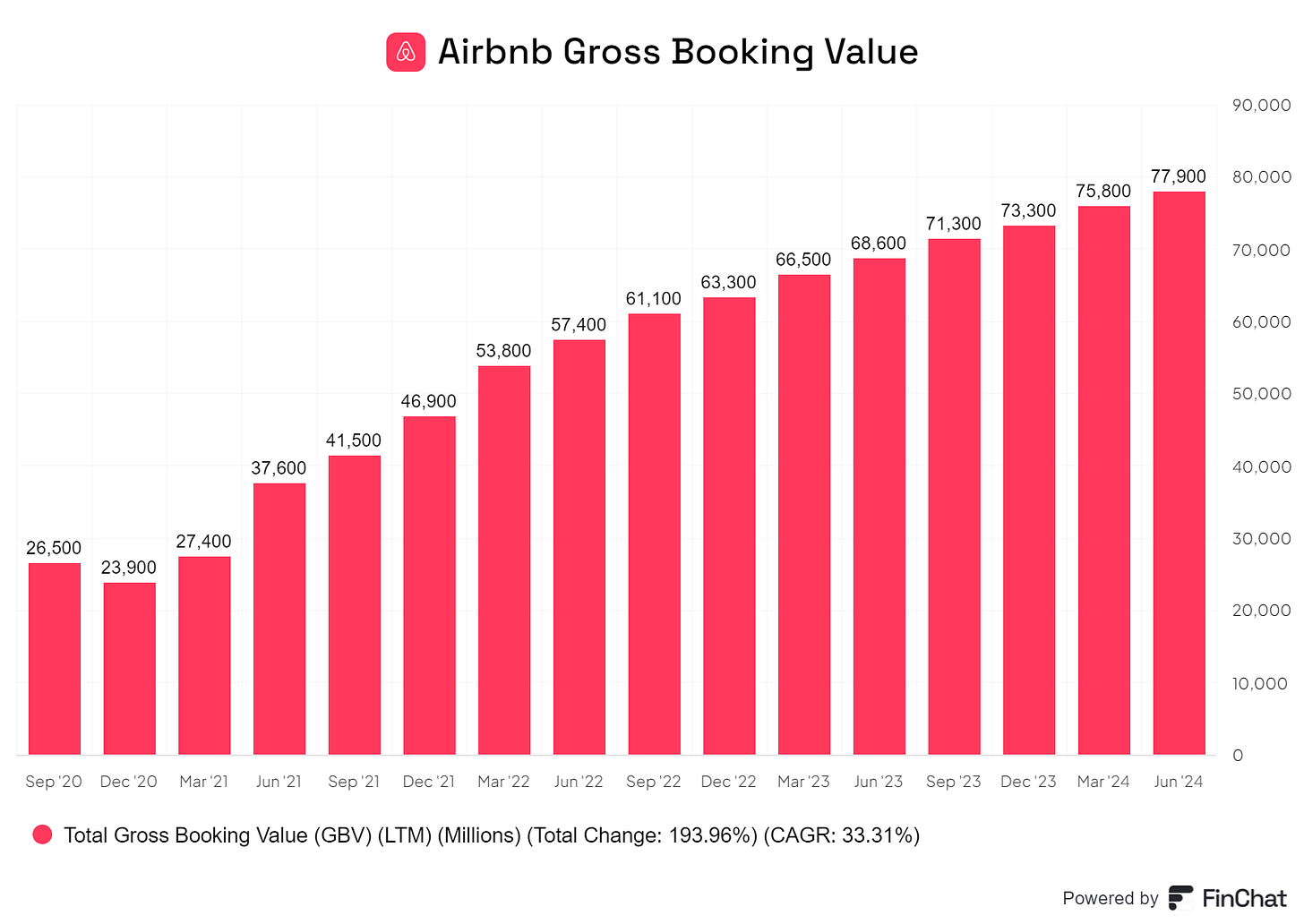

Over the last 12 months, guests have spent $77.9 billion on Airbnb. This has grown at a 33.3% annual rate since September 2020. It grew 12% year-over-year (Fx neutral) last quarter.

As this figure grows, the opportunity for hosts to earn money grows. Which drives more hosts to sign up for Airbnb. Last quarter, it hit 8 million active listings around the world while trimming bad locations to improve quality for guests. This is up from around 5 million at the start of the COVID-19 pandemic and has grown every single year except 2020.

“Last year, we shared our commitment to making hosting just as popular as traveling on Airbnb. We’ve been focused on raising awareness around the benefits of hosting and providing better tools for hosts. In Q2 2024, we surpassed 8 million active listings, driven by continued growth across all regions and market types. But we’re not just growing supply; we’re committed to ensuring it’s high quality. As part of this commitment, since we launched our updated hosting quality system in April 2023, we’ve removed over 200,000 listings that failed to meet our guests’ expectations to ensure we consistently deliver high-quality stays.”

More granularly, Airbnb is doing a lot to reduce friction and make its platform better for the hosts and guests. There are hundreds of small improvements it makes to the platform every year in order to get it incrementally better than the competition. In 2024, it perfected the messaging function, added auto-replies, personalized recommendations for guests, and built a “co-hosting” network where existing hosts help onboard new hosts.

I can attest to this. Even if I don’t solely use Airbnb for my travel needs, I find the platform the easiest to use by far. The search is the best, the messaging with hosts is the best, and the layout is the best. I would much rather book through Airbnb because it is so intuitive. It is where I turn to first for a vacation stay.

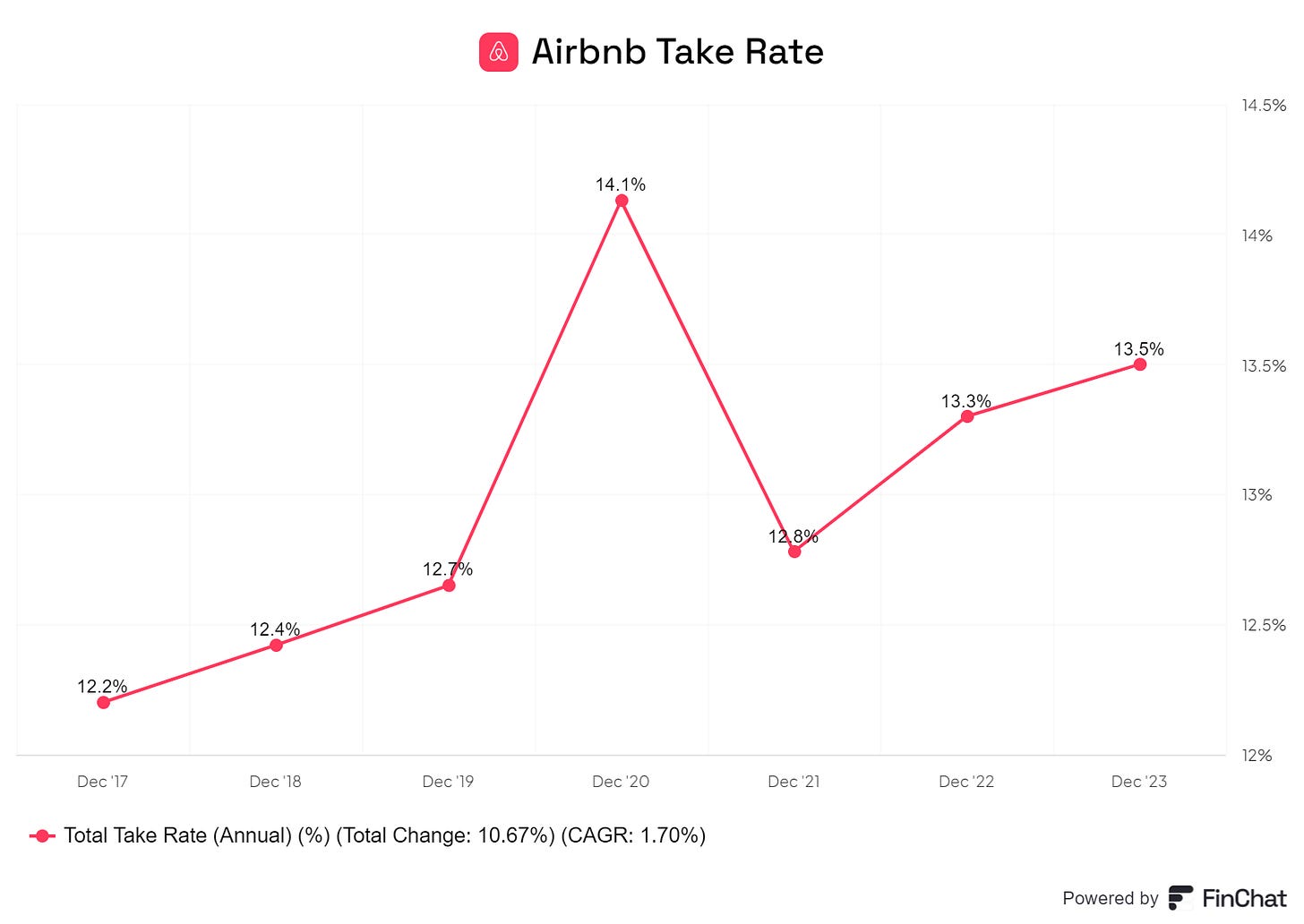

As Airbnb’s value proposition grows for both hosts and guests (which I believe is happening), it will be able to extract more value from its marketplace. We are already seeing this with slight increases in the take rate every year. At the end of 2023, Finchat estimates the take rate at 13.5%. This could jump to 15% and I don’t think hosts or guests would bat much of an eye.

This growing competitive advantage should allow Airbnb to steal market share in the travel industry.

Multiple tailwinds working for Airbnb

I believe there are multiple factors working together that can drive 10%+ revenue growth for Airbnb over the next five years.

Inflation protection. Let’s get this one out of the way. Airbnb earns a % of the dollars flowing through its platform, making it inflation-protected. If inflation is 3% annually for 10 years, Airbnb’s bookings will grow at 3% a year, all else equal.

Travel growing as a % of GDP. As people get richer and have more disposable income, they spend more on travel. Spending on travel expenses has grown as a % of GDP for decades, and I see no reason this stops over the next decade. If global GDP grows at 3% for the next five years, travel may grow at 6%. Airbnb can ride this wave.

Expanding to new countries. Perhaps the most important. Airbnb is expanding its product and tailoring it to new markets. Here is an extended quote from the recent conference call. Essentially, they want to build a product that fits a certain region and then pump in marketing to build the network effect.

“So, the question you asked about international is interesting because it's kind of like a medium term horizon, like one to three years. And to frame this, Airbnb is in 220 countries and regions. We're one of the most global companies in the world on the Internet, 220 countries and regions. We operate nearly in every country in the world. But there's only really five markets where we're penetrating. And those markers are the US, UK, France, Canada and Australia. And you'd think like, well, if there was one company in the world that would truly be like have a lot of international penetration it’d be a global travel network, right? A website where you want to travel, use one platform to travel around the world. So there's a number of countries. Just to give you a couple of examples of our some big expansion markets, Germany and Brazil we've seen a lot of progress. Those are huge travel markets and the biggest travel markets in the world. And we're continuing to go bigger. In Europe, Italy and Spain, we have low penetration compared to France and UK and these are major destinations. Then in Latin America, we've had a lot of progress in Brazil but there's really Peru, Chile, Colombia, Argentina, these are a huge opportunity markets, and that's Latin America is the fastest growing region alongside Asia. And Asia, you really have like the big four, big five countries. So you have China, Japan, Korea, India and then maybe we could kind of call out Southeast Asia as a holistic region. So what we're going to do is we have an international playbook, which is really product and marketing. First, need to localize the product, you need to make sure you have the right regulation in place. You need to make sure you have the right foundation. We've highlighted in our Investor Letter that we’ve retooled our product for Asia. Asia are different character counts. And so it's more laborious in certain languages to type in so like in Korea and Japan they prefer to do browsing than search. So we've had to retool our product and that's yielded some huge conversion rate increases. So some of these are going to pay back sooner, like some of North - like Switzerland, Belgium, Netherlands, they're going to pay back sooner.”

Expanding to new categories. This is what management calls “beyond the core.” It is unclear exactly what this will be, but a lot of it will be centered around Experiences. Experiences is a fancy Airbnb word for tours. They are planning to invest a lot in this over the next few years, but I have no clue if it will work or not and therefore don’t want to handicap it. I think it is all upside if they succeed.

Three of these are easy hurdles for Airbnb. The first two are just riding a market tailwind, and the third one is taking a proven product and tailoring it to new markets. Add all three together and 10% revenue growth is doable for a long while.

If you add in strong execution of “expanding beyond the core” I think this revenue growth can tick up to higher levels.

And the best part: the bigger the business, the wider the moat. It is simple to track whether the moat is expanding. The more an investor is “right” about Airbnb the more confidence they can have in the durability of the platform. I am a fan of this.

What price would I buy the stock?

The Airbnb valuation is kind of a tough nut to crack. The free cash flow is always wonky (it collects cash upfront from guests) and it currently has some one-time items that are screwing up the income statement.

I’m going to keep my numbers simple. Over the long run, I believe Airbnb can reasonably hit a 25% operating margin. This margin figure may prove conservative as Booking has a 29% margin, but that margin is real and Airbnb still has not proven any sort of steady-state figure yet. There is uncertainty here.

On $10.5 billion in trailing revenue, a 25% margin is $2.6 billion in earnings. Today’s market cap is $86 billion, so it trades at a 33x earnings multiple based on my steady-state estimates.

Grow revenue at 10% for five years, and this earnings figure gets to $4.23 billion. That is a 20x multiple on the current market cap.

I don’t think that is cheap. But what is?

I like the stock at 13x my five-year forward earnings estimate. That is a $55 billion market cap or a share price of roughly $90. I think the stock will be valued at more than 13x earnings in five years, which will lead to adequate returns. Apologies if you are looking for a complex model, we don’t do that here.

Plus, at a cheaper price, the buyback will work wonders. Management is spending close to $1 billion a quarter on repurchases. Think of what can happen if the stock is at a market cap of $55 billion and this buyback keeps growing? Giddy up, that’s some downside protection baby.

Something bad needs to happen for the stock to fall to $90. I want to prepare for the negative headlines and how that can drive sentiment. I am confident in the competitive advantage, and would take the plunge into the stock around $90 even if the numbers look ugly.

I feel like it could be a buy-and-hold forever” type of position. Which is the best position to be in, you keep getting wealthier by just sitting on your ass.

Discussion Q: What is the pushback for my thesis? Let’s also discuss management

Ryan Stock #1: Amazon

Brief History:

At the very end of 2022, Amazon entered its worst drawdown in more than 10 years. It had dropped just over 55% from highs and was trading at $84 per share. For reference, it currently trades at ~$187 per share.

Why did that happen? Let’s walk through our notes from a while back:

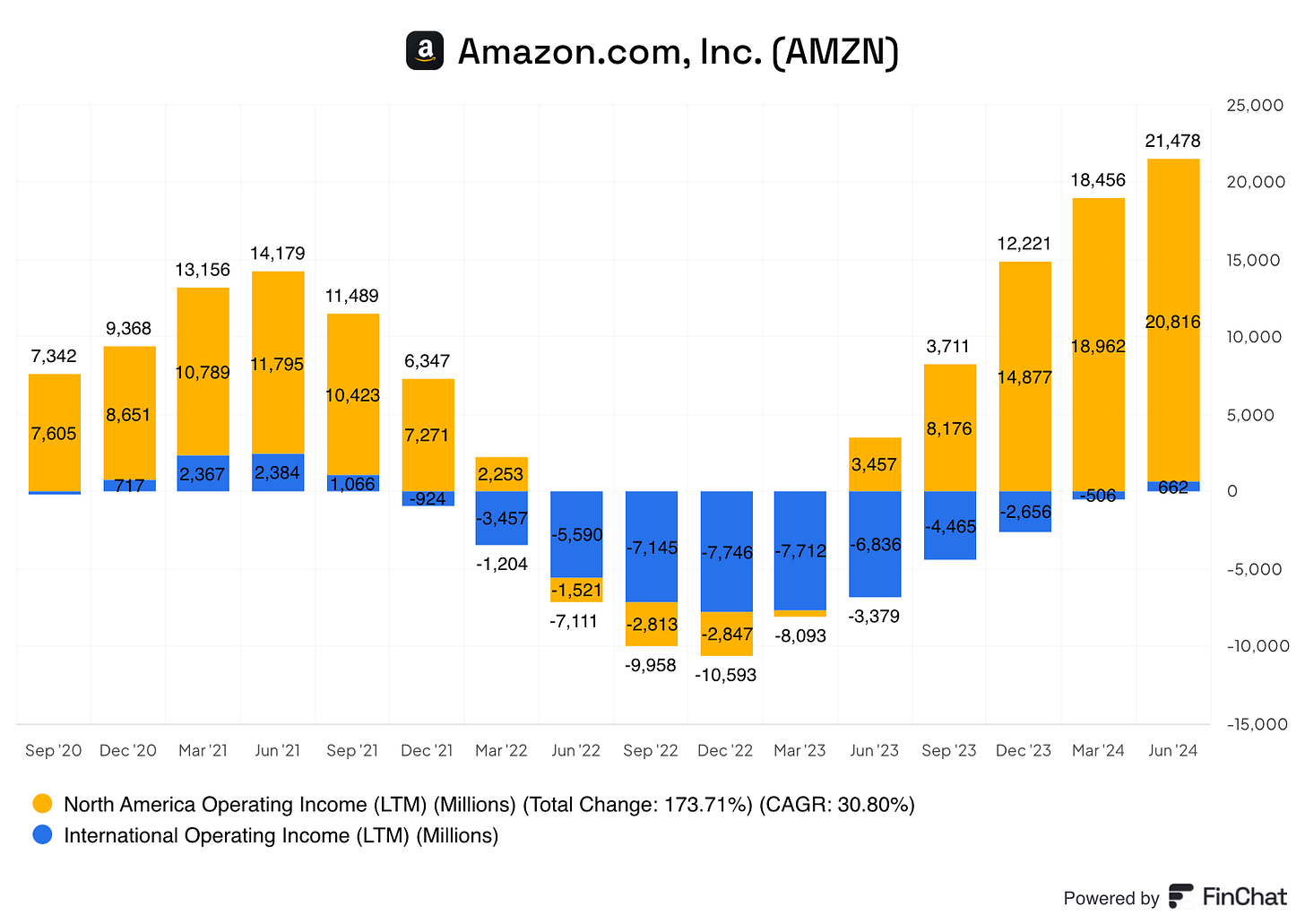

“In the first quarter of 2020, COVID hit. Unsurprisingly, this spurred tons of demand for online shopping. In fact, in 2020, Amazon’s retail sales grew by 39% off of a $245 billion base (in 2019, they were growing by 18%). Management even said that their fulfillment centers were working as close to 100% capacity as they could. Andy Jassy said in a recent interview, they were forced to either drastically expand capacity or fail to serve many of their customers. They chose to expand. In the following 2 years, they doubled the size of the fulfillment network that they had built over the 25 years prior and developed a transportation network that they were expecting to build over 6 to 10 years. Keep in mind, it takes ~18 months or longer to get a FC up and running. So they had to guess what sales would look like 2 years out and during this period customers were receiving stimulus checks as well which further exacerbated demand.

Well around the end of 2021 to the start of 2022, shopping trends started to revert. People were spending less and shopping more in person. This led to excess capacity across their fulfillment network and at the same time, nearly all their major variable costs were skyrocketing. Ocean freight, air freight, trucking/linehaul, and fuel costs all contributed to a rising cost of revenue. Additionally, they were over-employed in their FCs as they double-hired to fill roles during Omicron. This has all led to diminished income for 2022”

Here’s what has happened since:

At the same time, AWS was in the midst of a “slowdown”. They kept using the word “customer optimizations” aka customers were trying to reduce their cloud bill however they could. However, that too has reverted.

Why do I like it?

Infrastructure as a moat. Amazon has consistently entered industries where the TAM is massive but the biggest barrier to entry is the capital requirements (retail fulfillment, cloud computing, now Project Kuiper).

I wrote this 2 years ago, and I think it still holds up “The physical footprint and logistics network enables Amazon to offer prices and services that others simply can’t compete with.”

Not to mention, it feels like they are tightening things up regarding corporate expenses. They’ve reduced their total employee count by nearly 100,000 people over the last 2 years, and this 5 days in the office will likely reduce it further.

This has all helped expand operating margins from 2% to 9% over the last couple years, and I imagine as their higher margin initiatives (AWS, Advertising, Prime (maybe)) continue to outpace overall marketplace growth they’ll see margins continue to rise.

I think it’s very possible for them to get in the 15% operating margin range.

What Price would I pay?

I already own a starter position, but if I’d need to see a pretty sizeable drop for me to feel compelled to add.

Right now, it’s trading at an EV/EBIT of 38x and a forward EV/EBIT of ~30x. I think Amazon can grow earnings at 10%+ for a decade, so I’d probably be willing to pay 20x forward EV/EBIT or call it 25x trailing for a business like that. In other words, based on the current numbers it would need a 30% haircut at least.

The one nice thing is, this has been a stock that has proven to have big drawdowns in the past.

Brett Stock #2: Alphabet

Alphabet is the parent company of Google. We all know Google, the company that is losing in AI, right?

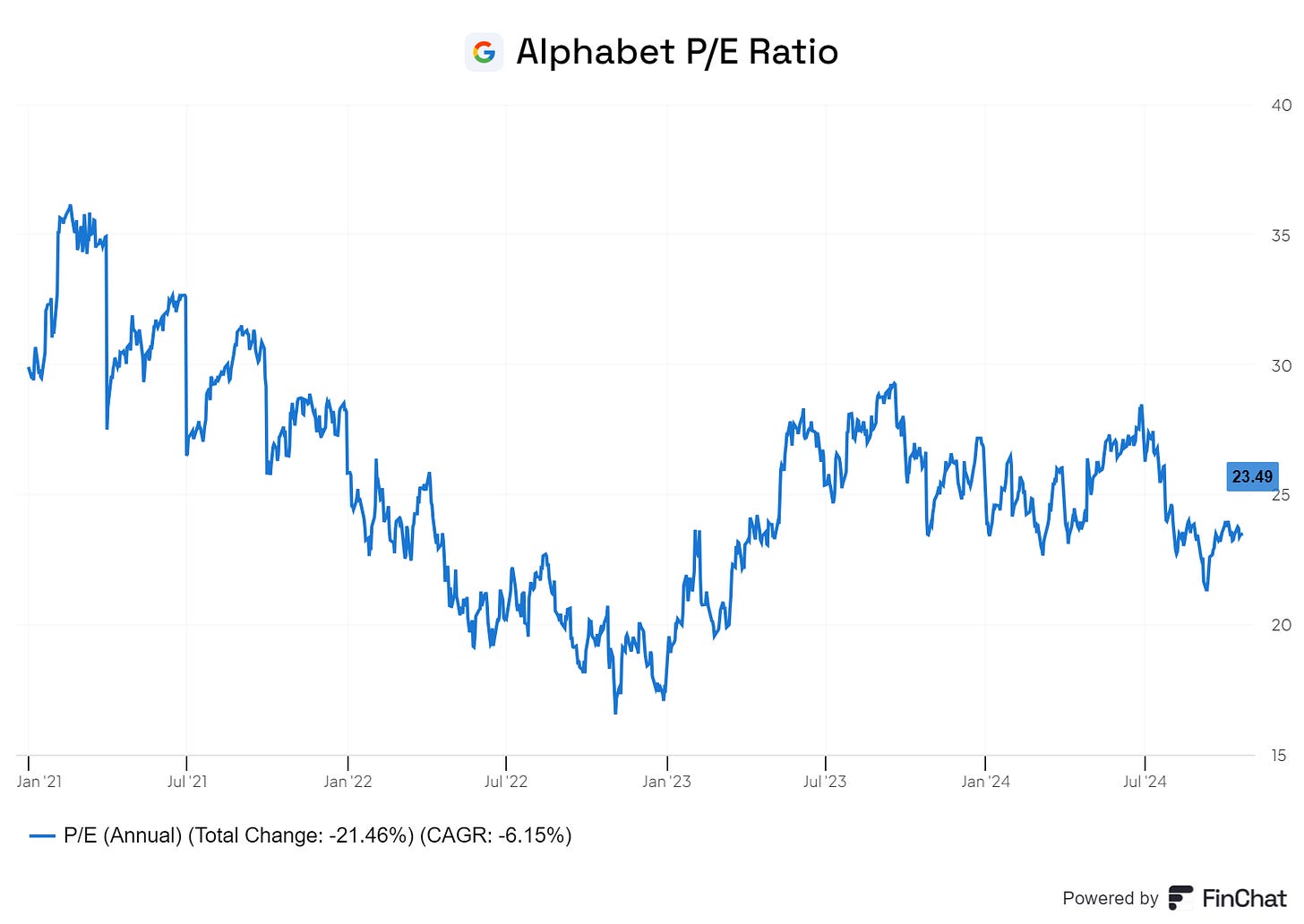

Well, I tend to disagree. Which is why the stock remains on my watchlist. I believe this is a high-quality business that can be a permanent holding at the right price. A price I was comfortable with occurred in late 2022, which is why we owned the stock then at around 16x - 18x earnings:

This is a non-comprehensive list of everything Alphabet owns:

Google Search

Anything else with the Google name on it (Google Drive, Gmail, Google Maps, Google Chrome)

Google computer hardware (Pixel phones, watches, laptops)

Android operating system

Google Cloud (AWS and Azure competitor)

Google Semiconductors (not the real name but what I will call the TPU/computer chip division)

Alphabet’s AI research lab (the old DeepMind team + Google team)

Waymo (self-driving cars)

I think Alphabet had a monstrous competitive advantage before the rise of AI (the old world). I also think they have a monstrous advantage in the age of AI (the new world).

Google’s old competitive advantage can be summed up as distribution and switching costs. Google's profits almost entirely came from Google Search. Therefore, the company wanted to own important distribution points on the internet and give them away for free. This includes Android, email, Google Chrome, Google Maps, etc. Billions of people use these products which drive a habit of using Google Search (guess what the default search engine is on Chrome?).

For what it didn’t own, it would license its Google Search to pay for default distribution (i.e. the deal it does with Apple).

Google Search generates close to $50 billion in high-margin revenue every quarter, so Alphabet can afford to make everything virtually free and pay billions to other hardware makers such as Apple. Another company may be able to replicate Google Search, but it is impossible to replicate the user base of Chrome, Maps, and Gmail, which connects everything together. And a start-up cannot afford an Apple licensing deal (Microsoft couldn’t even make it work!)

But what about in the new world of AI? I will not pretend to be an expert on LLMs, the frontier models, or any of the data points the cutting-edge tech analysts seem to care about. Luckily, consumers don’t care about this either. They care about efficiency, convenience, and a good product that provides them value.

Here’s what I do know:

Alphabet has a built-in infrastructure advantage that it has been preparing for over a decade

The AI start-ups are sketchier than people think

Alphabet is the only company in the world with all four of these assets:

Billions of users and data. This is the proprietary data to train AI tools on, and the billions of existing users who you can easily give the product out to. (Only other company with this: Meta Platforms)

Cloud infrastructure. These are the data centers that AI runs on. (Only other companies with this: Amazon, Microsoft, and Meta Platforms).

AI semiconductors. Alphabet has TPUs, which are AI-focused semiconductors that efficiently run its computationally intensive AI stuff (technically term). The latest TPU offered a 4.7x increase in computing performance. I don’t exactly know what this means, but it seems like a good thing. Other companies are sprinting to catch up here, but Alphabet has been investing in this for over a decade. (Only other companies with this: Nvidia and maybe AMD?)

AI research talent. Bringing everything together is the AI research talent that Alphabet has amassed over the last decade. It is hard to say what other competitors “do” or “don’t” have this advantage, but Alphabet is definitely in the lead. Can OpenAI say the same today?

The AI start-ups are sketchy. Look at the drama around OpenAI. Altman is not an honest person and seems to be scamming people with this non-profit stuff. The Perplexity CEO drives this car:

Not as bad as all the OpenAI nonsense, but this is some Erlich Bachmann nonsense. Is this the guy really going to beat Google?

Oh, let’s not forget that Alphabet has a huge war chest. It does not need to raise money like all these start-ups. And all these start-ups have to go to external cloud providers (Alphabet has its own).

With this huge head start, I believe Alphabet has the “right to win” in AI. Now, they may botch things due to being bureaucratic, resting on their laurels, and focusing on the wrong things. However, I think they did a complete 180 when ChatGPT started to gain popularity. Sergey Brin (the founder) is back, and Alphabet has now copied or bested all of its products.

My confidence level in Alphabet’s business is only growing.

What price would I buy the stock?

Today, Alphabet trades at around 23x - 24x earnings.

With the general tailwind of its services still at its back (internet penetration will still grow, it is a take rate on GDP growth, and YouTube + Google Cloud can grow at a healthy double-digit rate for many years) I think 7% - 8% revenue growth for the next five years is reasonable.

Profit margins are a bit hard to forecast. If defending its position in AI becomes very expensive, then margins may come down. On the other hand, there is a ton of operating leverage in its business, and Google Cloud is just turning to profitability.

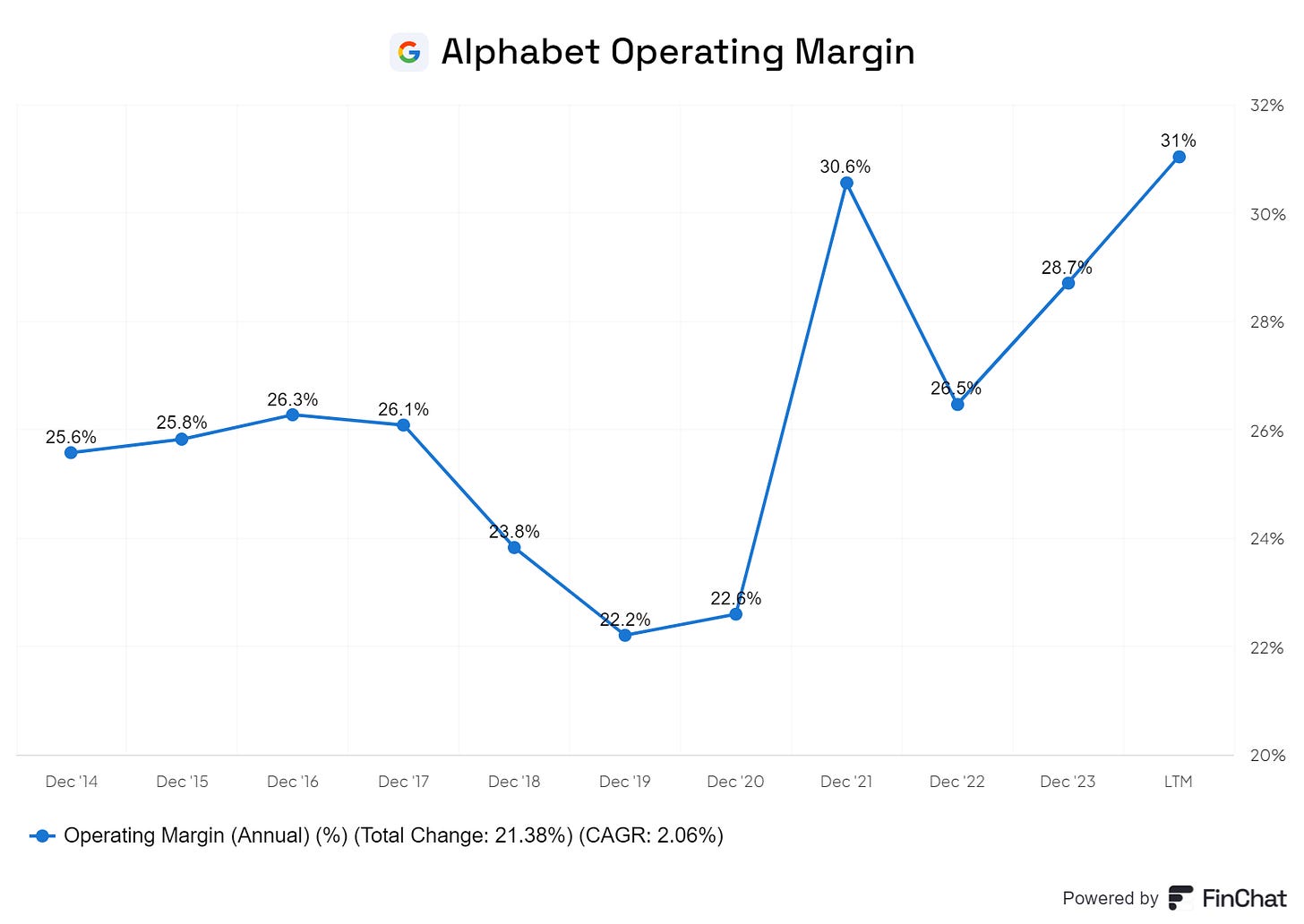

Here are TTM margins over the past 10 years:

I am not forecasting any more margin expansion. Perhaps it will even come down. Who knows. But let’s say that bottom-line earnings will grow in tandem with revenue.

So that leaves us with 7% - 8% growth at 24x earnings. Not too appealing.

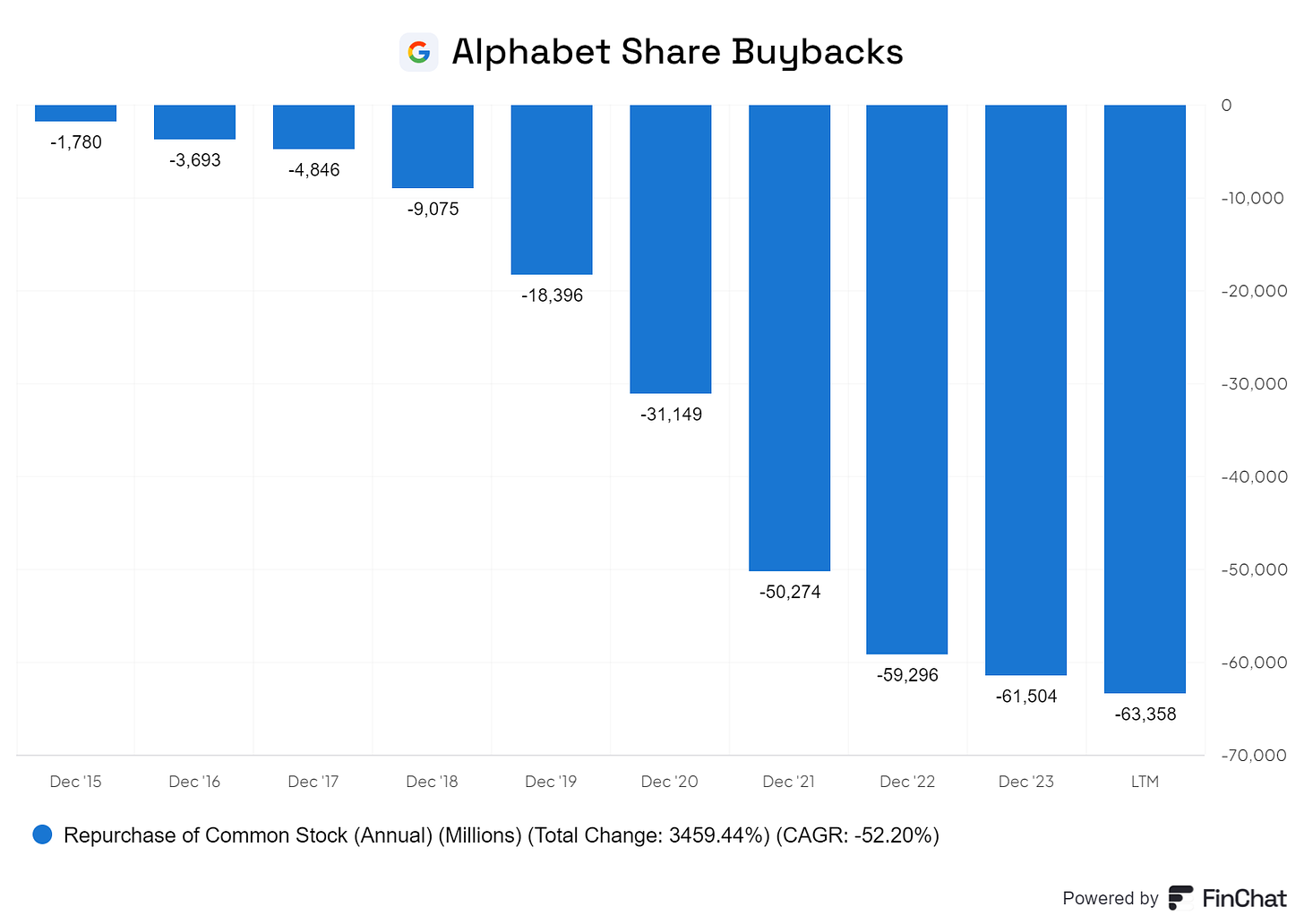

But wait, what about the buyback? Yes, of course. Alphabet has been pouring money into buybacks lately.

Let’s make this easy. I want a 15% annual return from Alphabet without multiple expansion. At 8% operating income growth, that means I need a 7% earnings yield. Or, a P/E of around 14. Don’t laugh, this could happen.

I will be patiently waiting for this to materialize, if it does.

Discussion Questions: Is management a hurdle? What are the holes in my thesis?

Ryan Stock #2: D.R. Horton

What do they do?

D.R. Horton is a business I have talked about a couple of times on this show before but they are the largest homebuilder in the US by volume. For reference, over the last 12 months they’ve closed ~89,000 homes.

D.R. Horton sells primarily entry-level homes (70% of their homes are below $400k) and they sell across 33 different states, but 50% of their volume comes from the south central and southeast, so Texas to FL.

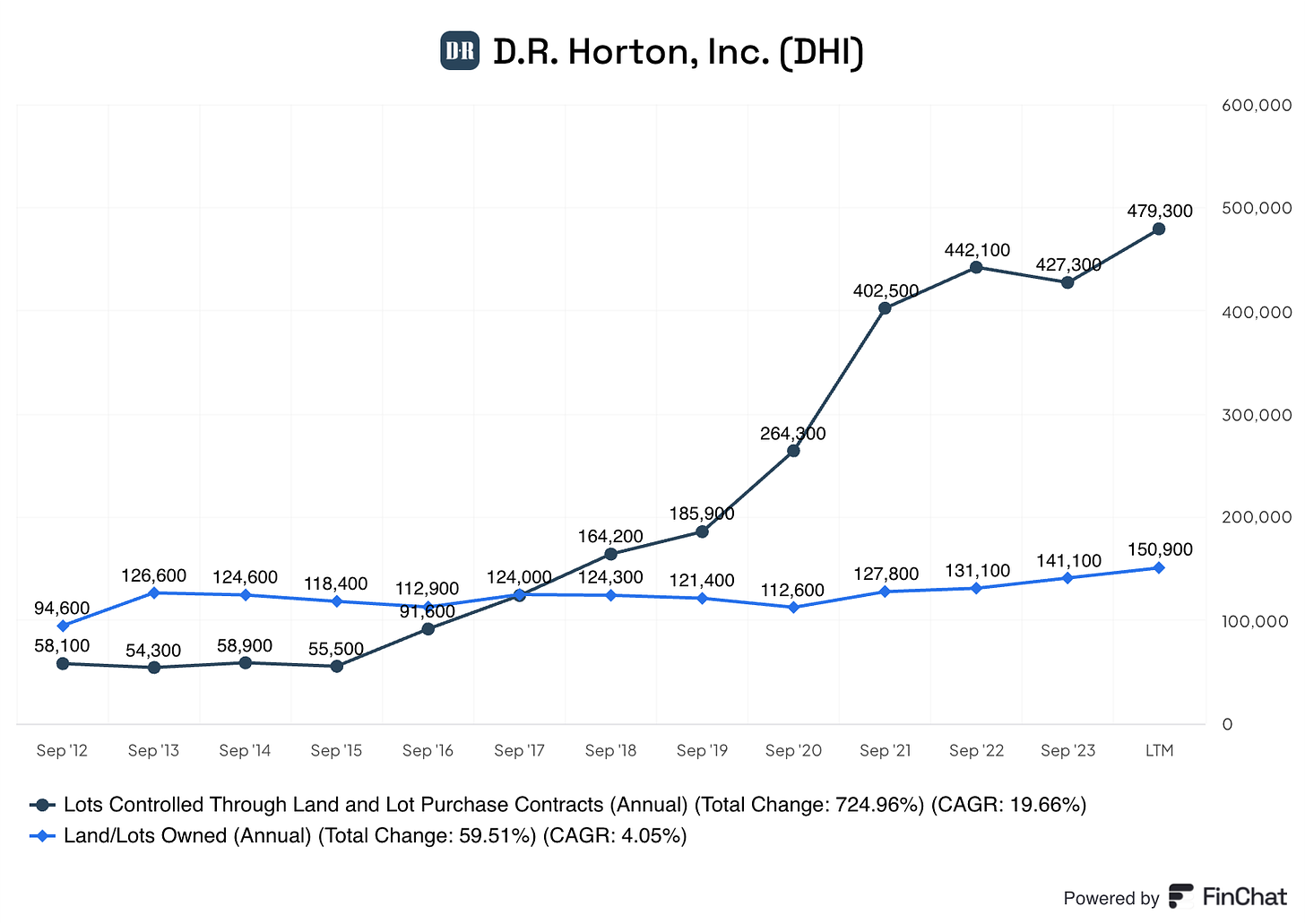

And it’s important to remember that the homebuilding industry has really undergone a big shift over the last 2 decades. It used to be very real-estate heavy, but has become more asset-light over time thanks to the land option model. For anyone who isn’t familiar with this, this just means that instead of going the traditional route of acquiring large plots of land and holding that land on your balance sheet while you develop homes on it, you would instead purchase an "option" on the land.

This typically means you pay 5%-7% of the land value upfront and then could exercise the right to pay the remainder once the lot was finished and you found a buyer. This model is considered “asset-light” as it keeps the inventory off of your balance sheet, which helps during market downturns.

D.R. Horton has become a big fan of this strategy and pushed more and more toward it over time.

Why Do I Like D.R. Horton?

There are a couple reasons why I like them. For starters, the homebuilding industry has really become sort of a manufacturing competition. It’s all about who can build and sell the homes the quickest and most cost-effectively. D.R. Horton has proven that can be them.

Also, there are some benefits to being one of the biggest builders:

You can buy your land cheaper/better: You can buy bigger plots, get bigger discounts for buying more plots, and you are probably more likely to have land bank partners that are willing to help you option the land.

They get better rates from subcontractors: Think about it from the subcontractors POV. You can go from house to house to house with little to no downtime. You can bring all your materials to one place. It’s like an assembly line.

Your materials are cheaper per unit: Ed Wachenheim used this example when talking about DR Horton. He said “Horton buys its appliances from Whirlpool. They are now buying 90,000 dishwashers a year. They used to buy 30,000 or 40,000. They're getting a better price.”

And you can see this reflected in the numbers. In 2014, when D.R. Horton was selling 28k homes they had 11% operating margins. Now, over the last 12 months, when they’ve delivered 90k homes they’ve generated 17% operating margins.

Additionally, I think the homebuilding industry will be pretty resilient over the foreseeable future. They just passed a pretty clear stress test when mortgage rates jumped from 3% to 8%, and I think the data around the home shortage is proving to be more true than fluff. There are tons of different metrics you can pick from to support your view of the real estate/housing market, but it seems to be that there’s actually a healthy balance between supply and demand right now across the country overall.

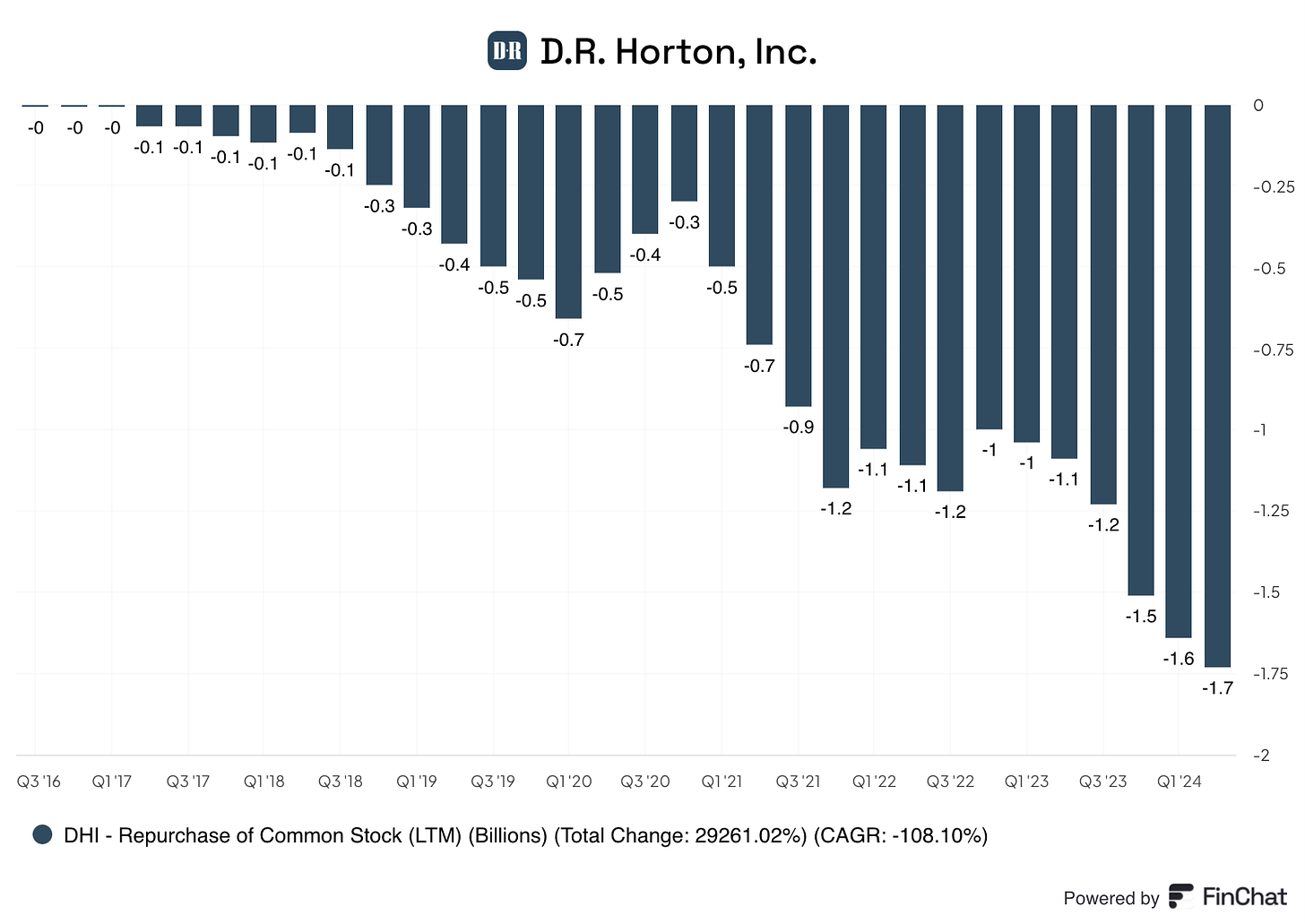

Capital Allocation:

They’ve really reduced their leverage over the last decade as well. Net Debt to EBITDA has gone from 3.3x to 0.4x, which is giving them more cash to plow into their buyback program. And that’s exactly what they’re doing.

And they also pay a relatively small dividend. Currently under a 1% yield.

What price would I buy?

To be honest, I’d be comfortable buying it here, but I think at 10x earnings, this is probably a home run where you can get near a 15% annual return. It currently trades at 12.5x, so it’d need a little over a 20% drawdown from here.

Risks:

The biggest thing for me and the reason I’m probably hesitant to make it a huge position even at what I think is a reasonable valuation is that maybe I’m wrong about this being a less cyclical business. Or maybe I’m wrong about the macro picture.

Like what if this recent drop in interest rates creates a flood of supply? I can’t imagine that it has a massive impact on D.R. Horton’s earnings but I just worry that the industry is tough to predict.

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.