YouTube

Spotify

Apple Podcasts

Today, we released a podcast episode covering four stocks led by founders that have crushed the market. Well, three have crushed the market and the fourth is a promising growth stock that Ryan owns (I am interested but it remains on the watchlist).

We wanted to analyze and try to identify trends among founder-led companies that lead to wonderful stock returns, presented by our episode sponsor The Inside Ownership Index.

What patterns did we notice? Why do these type of stocks — on average — crush the market over the long haul?

Sure, you have the obvious financial alignment. Founders have the majority of their wealth tied up in their companies, which makes them aligned with outside shareholders.

However, this is only

What I have found studying hundreds of stocks over the last decade is that the mission-focused founders win more often than not.

Jensen Huang has a mission to build the most advanced semiconductors for AI applications. Daniel Ek wants Spotify to build the largest audio platform in the world. Mark Zuckerberg wanted everyone in the world to spend time on Facebook/Instagram, and has now pivoted to make it a mission to win in AI and the next computing hardware layer (i.e. The Metaverse).

Unlike a bureaucratic organization with slow moving committees that may change the overall business strategy every few years, founder-led companies can have clear vision with an extended time horizon, giving them an advantage over the competition, even if the competition has a “right to win” like with Nvidia vs. Intel or Apple vs. Spotify.

Here are the show notes from the episode. Give it a listen! I think you can learn something.

-Brett

Brett’s Stock #1: Spotify (24% CAGR since 2018 IPO)

Spotify is a music and audio streaming platform founded in 2006 by Daniel Ek and Martin Lorentzon. Today, Ek owns 6% of the stock. Lorentzon owns 9.76% (Lorentzon as a future Ballmer candidate?)

Ek remains the CEO to this day. You have alignment with the founder, CEO, and ownership group of the company. Combined through ownership certificates, Ek and Lorentzon have majority control of this business.

Why has Spotify been successful since its IPO?

For one, we can look at the growth of the business. Since 2016, Spotify’s total MAUs have grown at a 24% annual rate from 91 million to 678 million.

Total revenue has grown at a 26.6% annual rate since 2016. Going from $2.1 billion to $18.6 billion (in USD).

Ok, so why has Spotify grown so quickly?

I believe a few reasons. Some that are related to having a founder at the helm.

Riding a wave. Music streaming and podcasts are taking share from linear radio. There is a rising tide that is lifting every player in this space, which Spotify can take advantage of. It would be much harder to operate as a legacy radio platform and try to transition into music streaming (cough, cough, SiriusXM).

Intense focus on the core category. Unlike competitors in big tech, Spotify’s sole goal is to win in audio streaming. The Apple’s, Amazon’s, and Google’s of the world have the entire “right to win” here. And yet they don’t, because they don’t really care about making the perfect product. Spotify does.

Ability to focus on the long-term. Spotify has a north star of increasing consumption hours on its platform. It can keep dedicated to this north star without management getting bogged down in short-term bonus targets because Ek, the founder, is still leading.

Spotify stock went in an 80% drawdown in 2022. Investors did not understand the business. Activists and consultants may have started to circle and look to switch things up. With Ek and Lorentzon in control, they were able to keep their gaze focused on the long-term

Why is Spotify’s stock winning today?

Discussions around Spotify can feel intense. The company was at once “going out of business” in 2022 (it never was) to now a profit machine.

In reality, nothing changed about the business besides Ek’s discipline in hiring and R&D spending. The unit economics of the music and audio business remain the same.

Ek realized they had too many people. Instead of going through endless meetings on the matter, he was able to take action and cut off the unnecessary level of workers at the company. They got rid of unprofitable moonshots such as the car streaming device.

Oh, and they started raising prices on music streaming subscriptions after years of delays. Again, this shows the long-term thinking of the founder. Ek could have easily raised prices years ago, but he wanted to get to enough scale first. Now, he can with Spotify users locked-in and with so many features on the platform.

Operating margin has gone from -12% to 11%, and people realized that the business is actually viable. That is why the stock has 10x’ed.

Ryan’s Stock #1: Meta

This is probably one of the first companies that comes to mind when you think of “founder-led” businesses.

Meta (formerly known as Facebook) was founded in 2004 by 4 co-founders: Mark Zuckerberg, Eduardo Saverin, Dustin Moskovitz, and Chris Hughes. None of the founders except Zuckerberg still work at the company.

Many people have probably heard this story already, but the company was originally called thefacebook.com and the concept was simple. It was a website where college students could post information about themselves, exchange messages and befriend one another online.

Zuckerberg was in school when he started the company, and it’s been fascinating to see how he has evolved over the years.

Facebook went public in May of 2012 and it was one of the biggest IPO’s in market history at the time. The company hit a market cap of $104B in the early days of trading.

Now typically, that’s a concerning sign and that usually means rough returns ahead. When you get that much of a premium on your IPO it becomes hard to fulfill that valuation, but Meta was an exception. Though they had a rough year after the IPO, Meta has gone from a $100B market cap in 2012 to a ~$1.8T market cap today. That has resulted in a nearly 25% compounded annual return for shareholders.

While the results look good in hindsight, the journey certainly hasn’t been without its controversies. In fact, if it weren’t for Zuckerberg’s ownership in the business, you could argue he wouldn’t even be the CEO today.

Now let me remind you of something that always blows my mind. Mark Zuckerberg is 41 years old. He’s younger than Brian Chesky, he’s younger than Daniel Ek, the list goes on and on. He started Facebook when he was 19, so naturally when you have someone that young leading the company there are going to be some issues.

Let’s talk about some of those controversies:

Facemash: So this technically had nothing to do with Facebook, but during his sophomore year in college, Zuckerberg started a prank website called Facemash that allowed men to do sort of a bracket style tournament of the most attractive women on campus. This, as you might expect, sort of hurt his reputation in the eyes of many people.

Unconsented User Tests: In 2012, Facebook ran psychological tests on 70,000 unconsenting participants by removing certain words from users' newsfeeds to test how that affected their reactions to posts. This naturally made people pretty angry.

Conspiracy Theory Fiasco: In 2016, Facebook made changes to its algorithm that deprioritized journalist posts and instead prioritized the posts of family and friends. This ultimately led to conspiracy theories catching major traction and even resulted in ‘Pizzagate’ if you remember that.

Cambridge Analytica: This was probably the biggest one. A political consulting firm was able to access the data of up to 87 million Facebook users and reportedly influence many people’s political votes. Facebook failed to protect the user data and was fined $5 billion.

Content Moderation: Zuckerberg and Facebook exempted certain noteworthy figures (Trump) from content removal even if it violated their terms of service. This was highly controversial but it has been sort of addressed over the last couple of years.

So investors have certainly had their moments of doubt with Zuckerberg.

However, Zuckerberg owns ~13% of Meta’s total equity and 61% of the voting power thanks to their dual class share structure. I’d argue this has made him somewhat untouchable from any sort of removal given the power he has.

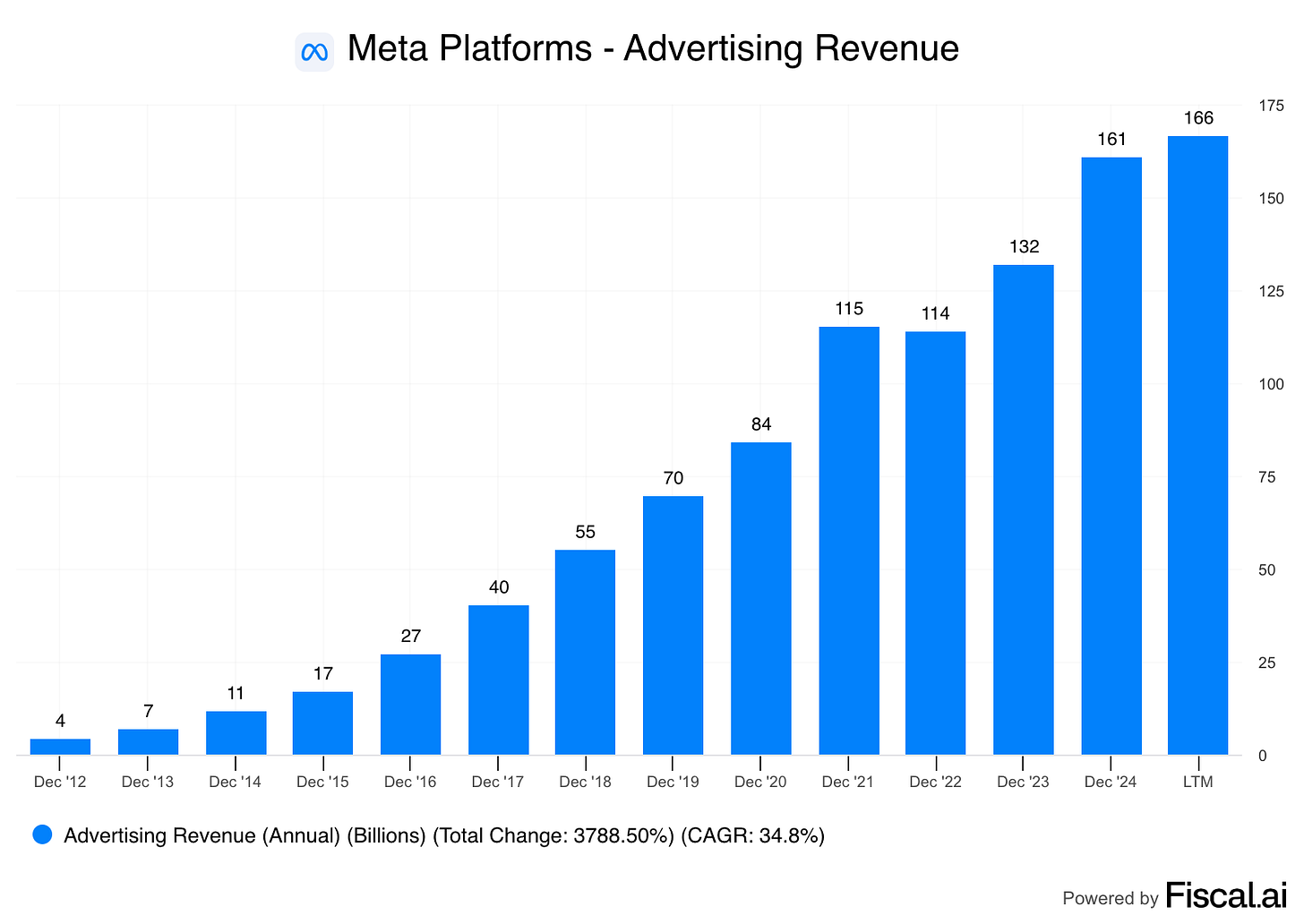

Now with all those controversies considered, I think shareholders have been happy to have him. I went back through the S-1, and in 2007 Facebook had $153 million in revenue. Most, if not all of that, was advertising revenue. 18 years later Meta now generates $166 billion in revenue. Suffice to say, it’s been a nice ride for investors.

What made Meta/Zuckerberg special?

I think Zuckerberg’s time at Meta has been a great example of how fast an organization can move when the founder is still leading the company. Even at this extreme size.

Not everything works out (cough, cough, Metaverse), but the company is able to experiment with long-term upside projects because you have someone who isn’t reliant on short-term results. I think the acquisition of Instagram is a good example. In 2012, Facebook bought Instagram for $1 billion. That was literally a company with just 13 employees and it seemed outrageous at the time, but I think he knew what he wanted to build with it.

It’s hard to know what makes Zuckerberg special today. Obviously, he was a technical founder, so in the early days he was able to build awesome products and features and that’s what resonated, but I doubt he’s still writing code today. So what makes him special? I thought these words from Susan Li (Meta’s CFO) were very insightful.

“Mark is really good at giving feedback. Like really world class at it… It’s very timely, it’s very direct, and it’s very respectful. It’s never mean, it’s never belaboring some point… but you cannot be mistaken after you have received the feedback.”

I thought that was an interesting quote. At that size, I think the primary role of a CEO is setting the strategic direction of the company and setting the tempo/urgency, and I think in order to do that you have to be an effective communicator. It’s hard to be as effective of a communicator as you want to be if you’re just trying to get people to like you or be on your side which I imagine is a common thing for mercenary CEOs.

Brett’s Stock #2: Nvidia (36.6% annual total return since IPO in 1999)

Nvidia was founded in 1993, went public in 1999, and is still being run by founder Jensen Huang today. If you invested $10,000 in Nvidia at the IPO, it would be worth $38.3 million right now. Not bad!

Throughout the entire journey, Nvidia has been run by Jensen Huang, the current CEO. Typically he just goes by Jensen. Of the big technology players founded in the 1990’s, he is the only founder still running his company today (Zuckerberg is close but not as long tenured).

Nvidia may be the best example (so far) of a founder having a vision of the future, sticking with a strategy even though it looks financially stupid for years, and eventually being handsomely rewarded.

I want to talk about that story and see if we can learn any lessons as investors.

We will not dive into the full Nvidia history. I can recommend the book The Nvidia Way (link) for listeners who want more information.

Nvidia began its journey as a computer chip designer by working in the video game market. It built a chip coined “graphics processing unit) or GPU, which processes tasks in parallel instead of in sequence like a traditional CPU. At its most simplest, this allowed graphics to process quicker.

This is a lucrative market, but limited in size. Jensen and the team believed that GPU’s and parallel processing could be applied to more computing processes.

To begin, they invented Cuda in 2006. Cuda, to keep it the most basic, is a software program that helps developers optimize the usage of a GPU for any task they can come up with.

This is what Nvidia has to say about Cuda today:

“We’re constantly innovating. Thousands of GPU-accelerated applications are built on the NVIDIA CUDA parallel computing platform. The flexibility and programmability of CUDA have made it the platform of choice for researching and deploying new deep learning and parallel computing algorithms”

This brings up machine learning, artificial intelligence, and parallel computing. In the early 2010’s, Nvidia noticed that researchers were utilizing Cuda for AI. There were also green shoots showing new advances in AI, such as image detection and self-driving vehicle technology. Google bought Deepmind in 2014.

At this junction of the company, Jensen decided – from my best recollection reading The Nvidia Way – to push AI as the next leg of growth for Nvidia.

From the book:

“Former marketing executive Kevin Krewell recalls meeting Jensen on the street outside the NeurIPS conference in Barcelona, Spain, in 2016. NeurIPS is an academic conference held in December, where machine-learning and neuroscience experts present their latest findings…Krewell knew Jensen wasn’t scheduled to speak and asked him what he was doing at the conference. Jensen replied “I’m here to learn.” Nvidia’s CEO had not assigned someone to attend and take notes on his behalf. He had shown up himself so he could absorb the recent developments in artificial intelligence.”

I think this story highlights why Jensen is a winning founder: intelligence + insatiable drive + playing the right game.

However, if you were an investor in Nvidia at the time, things did not look all sunshine and roses financially.

From 2007 to 2015, Nvidia’s revenue barely budged. It was investing heavily in its AI ecosystem and trying to expand beyond gaming, but the results were not showing up. Earnings weren’t much higher than 2007, either.

Moving a few years later, Nvidia’s sales started to pick up. Revenue more than doubled from 2015 - 2018. However, this was for an entirely different reason than AI: cryptocurrencies. Cryptocurrency miners saw that Nvidia GPUs were the best way to mine things like Bitcoin.

Nvidia didn’t plan on this happening, it just did. Investors were nervous at the time the company was seeing a one-time boost from a highly cyclical (some might call bubble) market with minimal long-term viability.

If we go back to the segment and KPIs from 2019, the majority of Nvidia’s revenue was still from gaming, which is where the cryptocurrency revenue was showing up (as well as the steady true gaming business).

And yet, the company kept investing behind its AI vision. Jensen believed that machine learning and other forms of AI were the future of computing, and didn’t deviate from the plan.

I think you know how this story ends. As we sit here today, Nvidia is a Top 3 most valuable company in the world by market cap, worth $3.5 trillion.

It was the bet on AI that finally paid off in the last five years.

In 2014, Nvidia’s data center revenue (think of this as cloud and AI sales) was $317 million. Intel still dominated the cloud. Nvidia had invested for years in this segment with little financial success. But they did not throw in the towel.

In 2020, data center revenue was $6.7 billion.

In 2025, Nvidia generated $132 billion in data center revenue. The bet worked. Nvidia’s dominance in AI computer chips today began close to 20 years ago with the start of Cuda.

Nvidia spent over a decade building the software and hardware infrastructure to dominate the advanced computer chip market, which is getting used heavily in AI and cloud computing today. It could not have done so if you had a rotating committee of mercenary executives worried about short-term earnings targets, executive compensation, and Wall Street.

Let’s take Intel as a comparison. Even just a decade ago, Intel was significantly larger than Nvidia. It dominated the personal computing market and had a large cloud computing business with its CPUs. It had more money, more scale, a better-known brand, better customer relationships, and built its own computer chips (building your own chips may have turned into a disadvantage, but that’s a story for another day).

Intel had $53 billion in revenue in 2012 vs. $4.3 billion for Nvidia. Today, Intel is still generating $53 billion in revenue. Nvidia’s has soared to $148.5 billion.

So what was Jensen’s vision? He believed that the most advanced computer chips with parallel processing for intelligence computing would win. I’m not so sure I could have understood whether this was a good bet back in 2010, but anyone with semiconductors within their circle of competence probably cloud.

It just takes patient capital partnered with patient management.

Discussion questions:

Would you have been able to hold Nvidia?

When do you keep holding a founder-led company vs. dump a loser?

Ryan’s Stock #2: Wise

I wanted to do 2 different types of stocks for this episode. One as a great case study (Meta) and one that I think could become a great case study in the future. In other words, this is a stock that is founder led but I also think is attractive at today’s price.

The company is Wise (formerly TransferWise). Wise was founded in 2011 by Kristo Käärmann and Taavet Hinrikus (both older than Zuckerberg funny enough). And the genesis for the company was actually born out of a small solution to the problem the two of them were having.

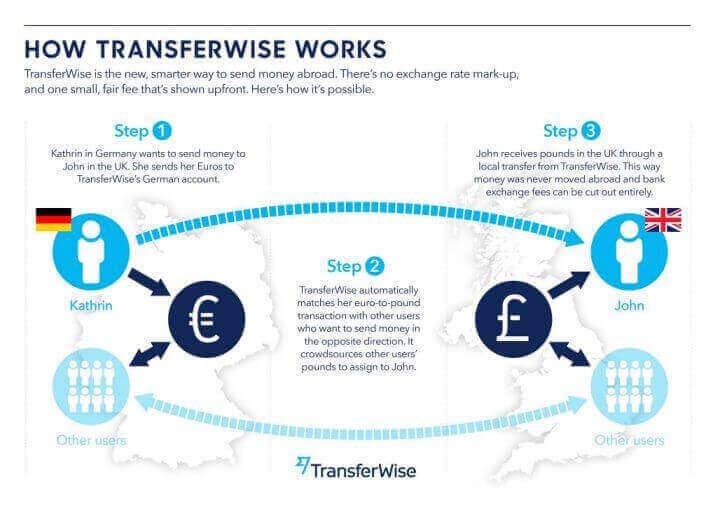

“They’re both from Estonia. Taavet, who was the first employee at Skype, lived in London but got paid in euros. Kristo worked for Deloitte, also lived in London, and got paid in pounds. But he had a mortgage in euros back in Estonia.” Basically, both Taavet and Kristo were paying transfer fees independently because they were transferring it with their banks.

So they had an idea: “every month, Hinrikus put euros into Käärmann’s Estonian account and Käärmann put pounds into Hinrikus’ English account. Both got the currency they needed almost instantly, and neither paid a penny more for exchange rates or other fees.”

This is pretty much how the business operates today but on a much larger scale.

By having local banking licenses Wise has built liquidity pools across many global currency corridors. This enables them to avoid the foreign exchange markets for most transactions processed on its platform.

This results in a couple of important benefits.

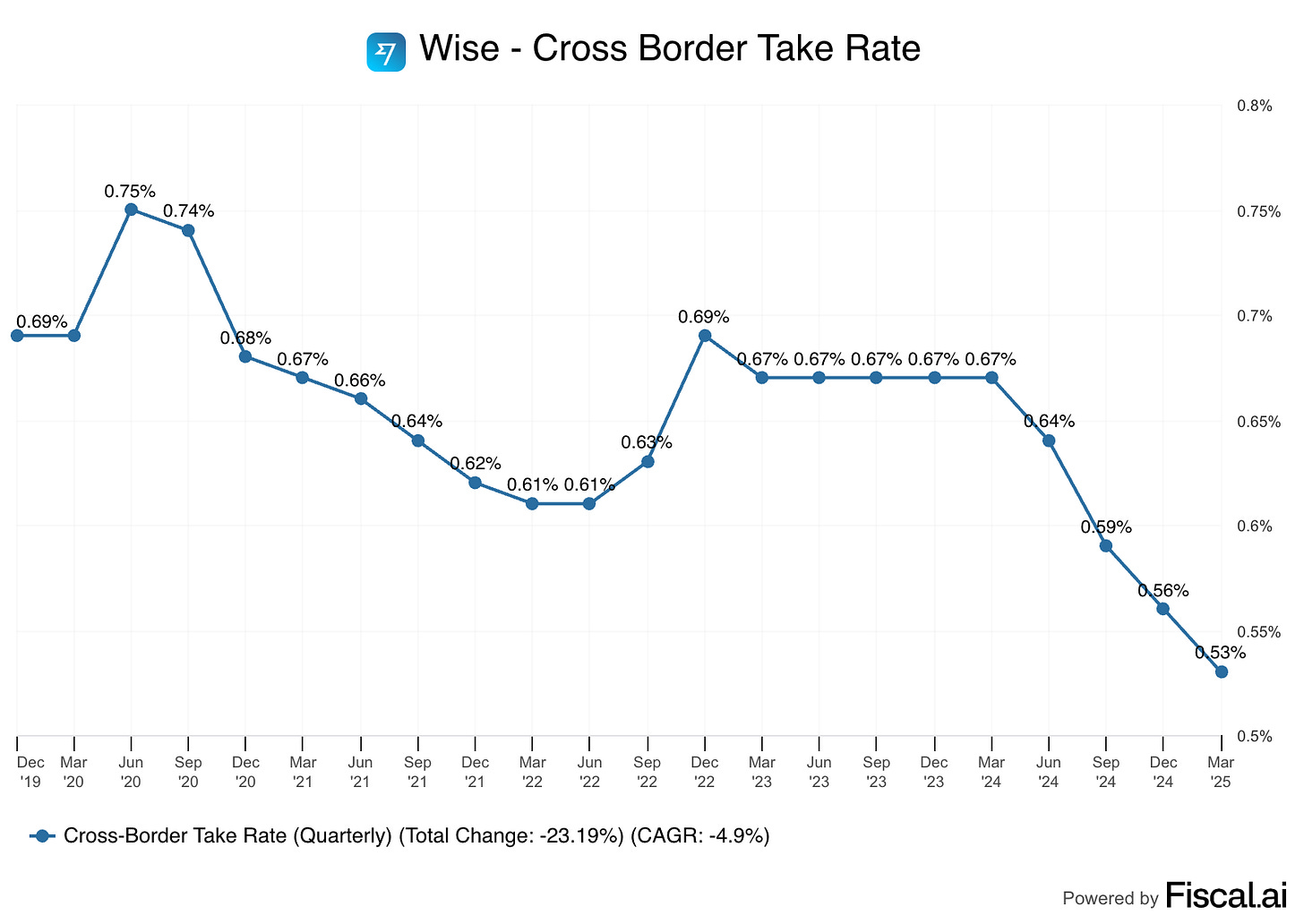

One, they can “transfer” money at a lower cost than competitors. As of the latest quarter, Wise charged customers 53 basis points on cross border transactions. For reference, according to the World Bank the average digital remittance cost in the fourth quarter of 2022 was 4%.

This is the most obvious advantage and it’s one they actively advertise. They want the world to know that Wise is the cheapest solution for most corridors. And it has been a big reason why they’ve been able to reach 9.3 million active customers.

Two, they can deliver those transfers faster than peers. Since they aren’t actually moving money across borders and it’s just adjusting the balances in local accounts, Wise can give customers their money quicker. This is a big deal for customers who also spend out of their accounts. According to Wise, 64% of their transfers arrive in less than 20 seconds and 95% in less than a day.

And three, customers can spend abroad for cheaper. When you travel to another country and use your credit card, there are typically some hidden fees. The alternative for a long time was getting cash, but guess what, that’s expensive too. So Wise created a debit card. This allows customers to easily spend money in whatever currency they are using, and Wise will use its own digital infrastructure behind the scenes to transfer that money cheaper.

This also provides another revenue line for Wise beyond transfer fees.

Why is it an advantage to be founder-led here?

I can’t think of any case where someone became the low-cost provider without having an owner-operator at the helm. And that’s the same case here.

Kristo Kaarman is the CEO of Wise currently and he owns 18% of the class A shares and 47% of the class B. So his voting power would effectively be more than 50%, but they have a voting cap in place that limits his voting power to be slightly below 50%. So fair to say, he’s very aligned with shareholders and I imagine his primary financial motivator is the long term performance of Wise’s equity.

Taavet Hinrikus is no longer involved with the company but he still owns a big chunk of the Class B stock.

There’s a massive long-term opportunity for whoever can be the low cost international transfer provider. If customers send and spend with you, there quickly becomes many ways in which you can earn adjacent revenue. Swipe fees, interest income on balances, transfer fees (although this likely comes down over time), and licensing your digital infrastructure.

If you look at who Wise is competing against, most of those competitors don’t want to lower their costs. It’s often a cash cow for their business. Whether it’s banks, PayPal, Western Union, etc. Almost all of those companies have leaders who aren’t the founders and they don’t want to sacrifice the short-term hit by lowering their prices. If they do, it’ll probably impact the company’s earnings and ultimately that executives personal compensation.

Or it’s just not their primary business. For example, I don’t think some legacy bank is trying to become the next big international money transfer business. It’s just a nice feature that they offer clients and it earns them some good profits.