5 Stocks We Would Buy Right Now

A new episode format! Let's go through some stocks on our watchlist

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

By sharing 50% of their options revenue, Public has created a more transparent options trading experience. You’ll know exactly how much they make from each trade because they literally give you half of it.

Activate options trading at Public.com/chitchatstocks by March 31 to lock in your lifetime rebate.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

For each options transaction, Public Investing shares 50% of their order flow revenue as a rebate to help reduce your trading costs. This rebate will be displayed as a negative number in the “Additional Fees” column of your Trade Confirmation Statement and will be immediately reflected in the total dollars paid or received for the transaction. Order flow rebates are only issued for options trades and not for transactions involving other assets, including equities. For more information, refer to the Fee Schedule.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Show Notes

1.) Coupang (Ryan): Coupang is the leading e-commerce provider in South Korea. They are sometimes referred to as the Amazon of South Korea, and while I typically hate comparisons like that, Coupang’s business model is quite similar to Amazon (excluding AWS).

Coupang is home to just over 20 million active customers, and those customers on average, spend ~$100 a month (or $1.2k a year) on Coupang. What are they spending that money on? Anything. Coupang’s platform sells items ranging from fresh groceries to electronics or apparel. And those items are mixed between 1st party items (Coupang makes them) and items from 3rd party merchants.

Here’s the best part. Coupang has spent the better part of a decade now building out a robust fulfillment network. Today they have 47 million square feet of logistics and fulfillment center space. That’s equivalent to 816 football fields, and that puts more than 70% of South Korea’s population within 7 miles of a Coupang logistics center. So Coupang is able to deliver an incredible 99.3% of orders within 24 hours!

Similar to Amazon Prime, Coupang has a subscription service called Rocket WOW. Right now, it costs the equivalent of $4/month but this is free shipping on all items. It also gives members things like dawn delivery (delivery before 7AM on orders made before midnight) and free returns. There are currently around 11 million Rocket WOW subscribers vs. a South Korean population of 52 million.

Beyond its core retail business, Coupang has some other initiatives that are important when it comes to driving profitability.

Coupang Logistics: “Coupang has built a vertically integrated delivery network, meaning they do all the storage, transportation, and drop-off for Coupang merchants. The company is starting to open up the network to other merchants (similar to Fulfillment by Amazon), which should give it even more room to reinvest. However, it is still very early days for this, with Fulfillment by Coupang only at 4% of units sold last quarter.”

Coupang Eats (food delivery), Coupang Pay (payments app), Coupang Play (video streaming): These are all kinds of “side bets” but they help increase the value of a rocket Wow Membership

Let’s run through the numbers: Coupang today has a market cap of ~$26 billion. They have ~$5B in cash (huge IPO) and less than $1B in debt. The recent Farfetch acquisition is gonna change this a bit, but still the right ballpark. That means they’ve got an enterprise value of about $22 billion.

Over the last 12 months, they’ve generated $1.8 billion in free cash flow. However, they sit on cash that doesn’t belong to them so their free cash flow is going to look a lot larger relative to their GAAP numbers. The company has really turned the corner profitability-wise over the last year. They generate 8%-9% free cash flow margins currently, but not all of that is real earnings.

I think they can generate ~5% NOPAT margins in the long run or significantly higher. So if we assume they grow revenue by 10% a year for the next 5 years (42% CAGR over the last 5), they’d be at $33 billion in revenue and just under $2 billion in NOPAT. Assuming any reasonable multiple, you’re probably getting near a double on the stock price. I think those estimates are far too conservative btw. Just for headline numbers, they trade at ~43x EV/EBT and 12x free cash flow.

Want access to great charts such as these? Try out Finchat.io and use our LINK to get 25% OFF any premium plan! https://finchat.io/chitchat/?lmref=J3bklw

Discussion Q’s:

Do you own the stock today?

If you don’t, what price would you buy? (or just waiting for more cash)

When would you sell?

2.) Ally Financial (Brett)

(disclosure: don’t own shares today but could see myself buying shortly)

Ally Financial is a consumer bank. There are two sides to a consumer bank:

Attracting deposits

Making loans

Ally attracts deposits as an online-only bank with high-interest rates. It goes after younger, millennial-type consumers. For example, it currently offers a 4.35% APY on its online savings account. This is much higher than the national average. It is able to do so because it is an online-only bank with no physical locations, saving on overhead costs.

It currently has 3 million deposit customers and $142 billion in retail deposits. While not a hyper-grower, Ally has consistently grown its deposits/depositors over the last 15 years. It started operating independently after the GFC when it was spun out of GM Financial.

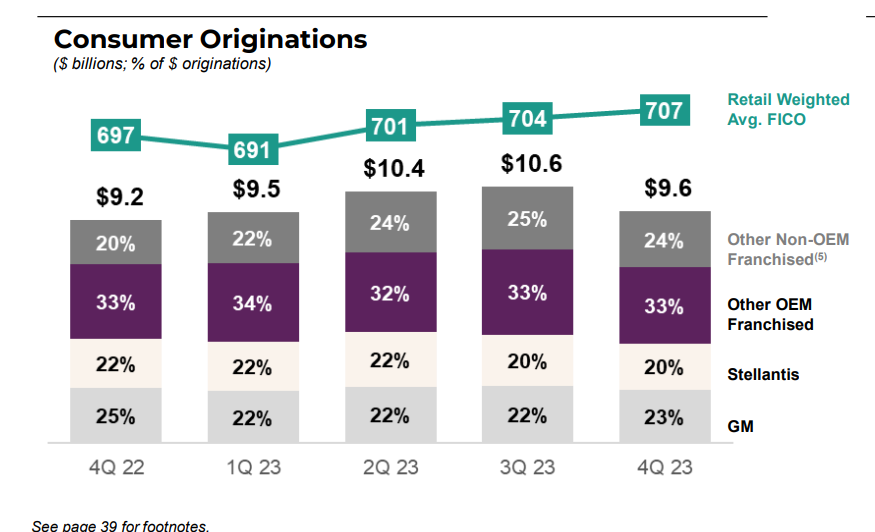

On the lending side, Ally focuses on making consumer automotive loans. It has relationships with automotive dealers – even providing them with loans – giving them the first pass at a lot of automotive loans that come through the door.

At the end of last quarter, it had $84.7 billion in automotive retail loans on the balance sheet, which is the most important part of the loan book. It also has some real estate loans, although it is much smaller than its automotive business.

Ally is off ~36% from its all-time highs because of the headwinds it is facing in both automotive lending and consumer banking. With depositors, higher interest rates from the Fed made it so Ally had to raise the interest rate it paid depositors. This increases their costs.

On the automotive lending side, Ally has three things hurting it: Lower interest rate auto loans from 2020 - 2022 sitting on the balance sheet, reduced used car prices, and increased charge-off rates in automotive loans. This is causing its NIM to compress from above 4% down to 3.2% last quarter. This has caused net income to go from $3 billion down to $1 billion.

But I think it has an easy journey to get to the other side of these headwinds.

What do I like about Ally’s set-up from here?

NIM headwinds should abate in 2024. Ally’s loan book gets refreshed every 2 - 3 years, meaning once we get 2 - 3 years away from the interest rate hiking cycle, it won’t have any headwinds from the Federal Reserve interest rate hikes. We are already 1 year in. This will allow it to grow earnings again (NIM expansion, used car price headwinds stop, growing depositors)

It has a proven playbook for attracting more deposits. This consistency gives it a huge runway for reinvestment and can lead to an expanding moat as it gets more and more of the economies of scale larger banks have.

It has a competitive advantage due to its lock-in with dealerships in the automotive lending space. Yes, making car loans is somewhat of a commodity but Ally has longstanding relationships with these dealers and decades of making profitable loans for them.

It has a culture of conservatism and returning capital to shareholders. It has a nice dividend payout and has grown its dividend per share at an impressive rate. Buybacks are also utilized when they have the capital available, reducing shares outstanding by 37% in the last 10 years.

The stock is cheap. When looking at trailing earnings we are at a P/E of around 12. But I think Ally is severely under-earning. At a market cap of $11 billion, I think Ally could be trading at a 2 - 3 year forward P/E of around 5.

Risks?

It’s a bank, it could blow up. I’m not Buffett and not an expert financial analyst. I just have the 3 - 4 KPIs I look at and think are underpriced.

Management exodus (discussed more on the podcast)

Car lending market is much worse than we think (i.e the ticking time bomb videos are correct)

(Audience Q’s)

Which of the business segments are you most encouraged by (Auto lending, insurance, credit card, home/invest, etc.)?

Are you at all discouraged at the lower buybacks the past 12-18 months given the lower price? Is this a structural disadvantage of banking that when your stock is depressed you're unable to deploy capital in buying back stock efficiently?

How are you treating dividends? Reinvesting?

Does he have any thoughts about the recent exodus of C level executives at Ally? Because banks are such black boxes it can be concerning. Could this just be a cultural and management shift due to the change in CEO?

3.) Harbor Diversified (Ryan): Harbor Diversified is bit of a strange one. Not typically the kind of thing I invest in, and I’ll start right out and say it’s not a great business by any means. I’m not investing in it because of any sort of “lasting competitive advantage” or anything like that. This is a $90 million market cap company that I think is attractive purely because of its valuation.

Let’s give some context about the business though: Harbor Diversified is now the parent company of Air Wisconsin – a regional air carrier operating routes to 36 cities all departing from or arriving at Dulles International (Washington DC) or O’Hare (Chicago). While I don’t love the airline business by any means, I think regional air carriers are at least a little better because they aren’t as asset-intensive. Don’t have to pay for fuel and they don’t have to find the flyers. They are just operating on behalf of a bigger airline.

Here’s the way the business model works: Air Wisconsin used to have an agreement with United Airlines. That has since expired and they signed a new deal with American Airlines to fly exclusively on their behalf until 2028. This means Air Wisconsin is responsible for providing the aircraft and crew necessary to conduct the flights, while United designs the routes, sells the tickets, and pays for the fuel (among other costs).

As I mentioned earlier, they’ve got a quoted market cap of $90M. But they have some preferred stock that if we assume eventually converts to normal stock, their fully diluted market cap comes out to a $124M market cap. Remember that number.

They had $52 million in debt, but it looks like they just paid all of that down early. So with that paid off, their net cash on hand stands at ~$106 million. That leaves Harbor Diversified with an enterprise value of $18 million.

However, they had some contract disputes with their previous partner (United) so they currently going through arbitration to fight over $52 million. That $18M enterprise value assumes that they wouldn’t get any of that.

Now let’s boil it down. For an $18M enterprise value, what do you get? Well for starters, HRBR owns 64 planes (CRJ-200 jets). The average age of this fleet is ~20 years old. So they’re not gonna be worth a ton. But let’s assume that each one is worth $300k. That’d be $20M if they liquidated the whole fleet right now. But, that’s not what they’re doing.

They have 4 more years at least on their agreement with American Airlines. Right now, they’re flying 45 of the jets and as they add more pilots, they have a deal to up that to 60 of the planes. I don’t know what they’ll earn when they’re operating at capacity but to provide some context, in their last normal year (2019), they earned $30 million in earnings before taxes.

If they did that this year, they’d earn almost 2x their entire enterprise value in profits in a single year. And they’ve got 4+ years on their contract.

Something could go wrong, but I really think the upside here is massive and worth the risk.

4.) Nintendo (Brett):

Ok, so this one is always fun. Nintendo is one of the largest entertainment companies in the world. It makes gaming hardware and gaming software.

Let’s give a quick overview of how the business model works, and where its profits come from.

Nintendo’s business model begins with its innovative gaming hardware unit. It has a history of not being on the cutting edge from a computational perspective but creating fun ways for family-friendly gaming (Gameboy, Wii, the Switch, etc.).

Importantly, Nintendo decided to merge its handheld and console units with the Nintendo Switch, which is a hybrid gaming device. It is the most popular pure gaming hardware in the world, selling over 100 million units and counting 122 million active playing users.

But Nintendo doesn’t make much in profits selling gaming hardware. It makes up for this with its vertically integrated gaming studio/publishing business. Every year, it will publish games from its own franchises such as Mario, Zelda, and Animal Crossing, making these games exclusive to its gaming hardware.

Let’s go through an example with the new Zelda game, Tears of the Kingdom. The game was the most popular on the Switch last year, selling over 20 million units since launch less than a year ago. Assuming the global average selling price was $50 (it went for $70 in the US), that is $1 billion in revenue. Rumors are that this game hit around breakeven at 3 million unit sales.

The key is they pay nothing to third parties after this due to the vertical integration. So the 17 million extra units sold past breakeven are pure profit. The single Zelda game could contribute $750 million in earnings to Nintendo so far this year.

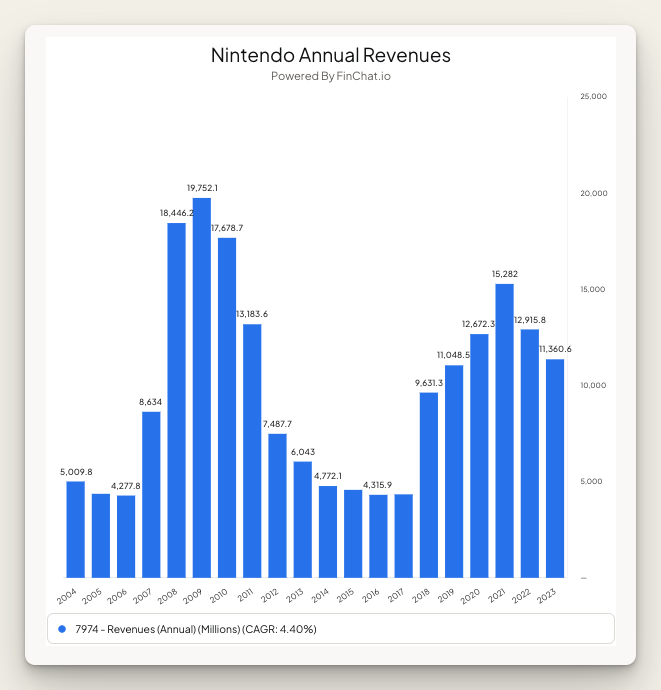

This fiscal year (ending March 2024), Nintendo is guiding for around $3 billion in earnings. Fx rates can have a big impact on what the company earns in dollar terms (especially Yen depreciation), but this is not far off from the $4 billion - $5 billion it earned during the peak of the pandemic.

What is the opportunity with the new console? Entertainment expansions? What are the risks?

Nintendo has been beaten down due to investor concerns over declining console sales and whether the next gaming device they release will flop like the Wii U (although that may have changed in the last few months). If you read management commentary, they are greatly worried about this happening and it looks like the next hardware will be a safer “Switch 2.”

With online accounts, its subscription service, and an already high active player base, I think Nintendo’s hardware business can be more like Sony’s going forward. Will it still be a bit lumpy? Yes. But I have confidence that they can pump out 20 million units for 3 - 4 years once the next Switch releases, which is rumored to be happening this year. I mean, they still are going to sell 15.5 million units of the first iteration this year and it is highly outdated at this point.

As the new gaming hardware comes into play, Nintendo will have the ability to release updated versions of its flagship games such as Mario Kart, 3D Mario, Animal Crossing, etc. The key is to keep these 10 million+ unit sellers that have high incremental margins due to the vertical integration. Unlike other gaming publishers, Nintendo does not make its profits from microtransactions and add-on content.

If the new gaming hardware can sell around 20 million units per year, I think the core gaming business can generate at least $3 billion in earnings, likely $4 billion in earnings, each year going forward.

But Nintendo is going beyond just gaming. You may have seen the blockbuster Super Mario Movie or heard of the theme parks they are building with Universal Studios. Nintendo can make a decent amount of high-margin royalty revenue here, and the key will be how much they expand the theme parks and how much visual content they produce. I wouldn’t expect a Marvel-type strategy, though.

I think the new entertainment initiatives can not only make money on their own but will further entrench kids/families to love Nintendo brands and keep them playing (and buying) the highly profitable gaming software. Don’t believe me? Look at management’s own slide deck. They know what butter’s their bread:

Key risks I am watching:

Uncertain future of hardware business if management takes a big risk with a “unique” form factor

Stagnation in active users, deterioration in quality titles coming from owned studios (Miyamoto retiring will be the key hurdle to get past)

New entertainment initiatives not leading to profit boost over next 5 years like we think (this will show up in IP initiatives revenue line item)

How do I think about valuation?

As of the end of 2023, Nintendo had $16 billion in cash and equivalents (taking Yen values and converting to USD at today’s conversion rate). It has minimal-to-zero financial liabilities. With a current market cap of $67 billion, that brings the EV down to approximately ~$50 billion. Assuming my $4 billion in earnings assumption is true, we are sitting at an EV/E of 12.5. Not crazy cheap, but not crazy expensive either for a low-growing company.

Add on the potential of theme parks, visual content, and the overall expansion of the gaming market and I think the company can average $5 - $6 billion in annual earnings. I am not as confident that this will occur, and frankly don’t know how to value this segment. If you asked me whether Nintendo would average $4 billion in earnings over the next five years, I would have a lot of confidence saying “yes.” But if you asked me if they will average $6 billion in earnings I would say “maybe, but a few things have to go right.”

I don’t think investors should be expecting Nintendo to start returning all this excess capital to shareholders, either. Should Nintendo be doing this? Absolutely. But it is not something we should expect given their history.

Overall, this is a hard company to model. But I think the brand/culture is rock solid and comes with a competitive advantage (hardware/software integration) with a management team that focuses on the long term. Over a 10+ years time horizon, I think it will be hard to lose money owning shares of Nintendo. Famous last words, I know.

Am I buying shares today? No. This is not because I think Nintendo is overvalued, I think shares will do well over the long haul. But with the stock up 30% in the last three months, I see a better risk/reward in other stocks at the moment (CPNG, MTCH, PM, as examples). It is one of the 8 - 10 stocks I want to own as I try to build out a quality/value portfolio, though. I think this is one of the most durable businesses in the world, even if management doesn’t care about consistent earnings.

Discussion Q’s:

How much of the thesis here rests on the success of the Switch Pro?

What if we are wrong and it’s just the same old cycle? How would you be able to tell? (For reference, I think it’s different this time as well, but when I look at a chart like this, it discourages me)

5.) Phillip Morris International (Ryan): It’s somewhat ironic, but I think Phillip Morris which is one of the oldest publicly traded companies around, will be one of the most surprising growth businesses of the next decade.

Right now, PMI is one of the world’s largest tobacco companies. The way I look at the company there are 2 businesses. Cigarettes and non-cigarettes. That’s not technically how they define it, but that’s how I think about it.

Cigarettes: Their cigarette business consists of the manufacturing and distribution of cigarettes internationally under the brands Marlboro (39% of cigarettes sold), Parliament, Chesterfield, L&M, Phillip Morris, and a number of popular brands in Indonesia and the Philippines. The operations are pretty simple. They have 53 manufacturing facilities located all around the globe that source a variety of tobacco leaves typically from suppliers within their local market, and sell via a number of different distribution channels. The gross margins on this business are typically around the high 60% range.

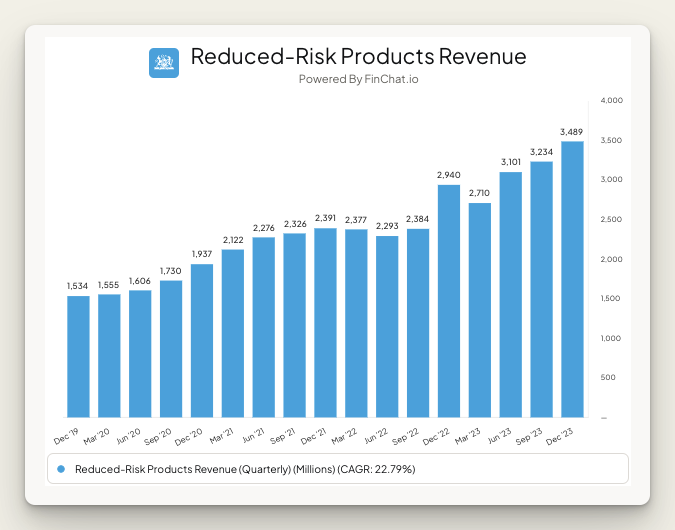

This quarter, combustibles (think cigarettes), accounted for 61% of total revenue. 4 years ago, it accounted for 80%.

There are actually a lot of things I like about the cigarette business. Barriers to entry, pricing power, addictive, low cost to produce. But for PM specifically, their volumes are only declining at about 2% per year. Not experiencing the huge drop in declines that cigarettes are seeing in the US.

Non-cigs: Their non-cigarettes business is primarily IQOS and Zyn:

IQOS has a number of different styles, but it is a pen-shaped device that heats tobacco instead of burning it. So the initial machine costs around $80 depending on the market, then customers buy the IQOS Heatsticks (basically cigarettes) on a recurring basis.

Zyn is the premier nicotine pouch brand in the US which they acquired in the Swedish Match deal. They tout 77% market share.

This is the business that excites me. Reduced-risk product revenue now accounts for ~40% of Phillip Morris’ overall revenue. It’s growing at 23% a year and much faster at Zyn. Management has said that it’s actually higher margin than cigarettes (although there are some costs associated with big launches).

In total, Phillip Morris generates about $10 billion in net operating profits after taxes. As the reduced-risk portfolio grows and cigarettes continue to at least tread water, I think we can expect potentially 10% annual growth in NOPAT, free cash flow, operating income, and whatever profitability metric you want to use. And they consistently pay that money back to shareholders. The EV/OI is 14.3x. And they have a 5.8% dividend yield currently.

Safe to assume HRBR thesis is unchanged after latest 8k since you were assigning $0 to the United arb case?

What did you guys think of latest HRBR earnings? Thesis unchanged? Thanks in advance!