YouTube

Spotify

Apple Podcasts

Are you tired of the AI discourse yet? Good, let’s talk Adobe Systems (NASDAQ: ADBE).

Ryan pitched Adobe on the podcast this week. He has added the stock as a starter position in his portfolio.

I will be completely honest, I am about as close to the Adobe story as Nikola Motors was to actually producing a hydrogen fuel cell truck (RIP).

But here’s what I do know.

Adobe has generated a 238,000% total return since its IPO 50 years ago. Its revenue has gone up and to the right ever since it made its cloud transition. Cash flow conversion is great, and management consistently repurchases stock.

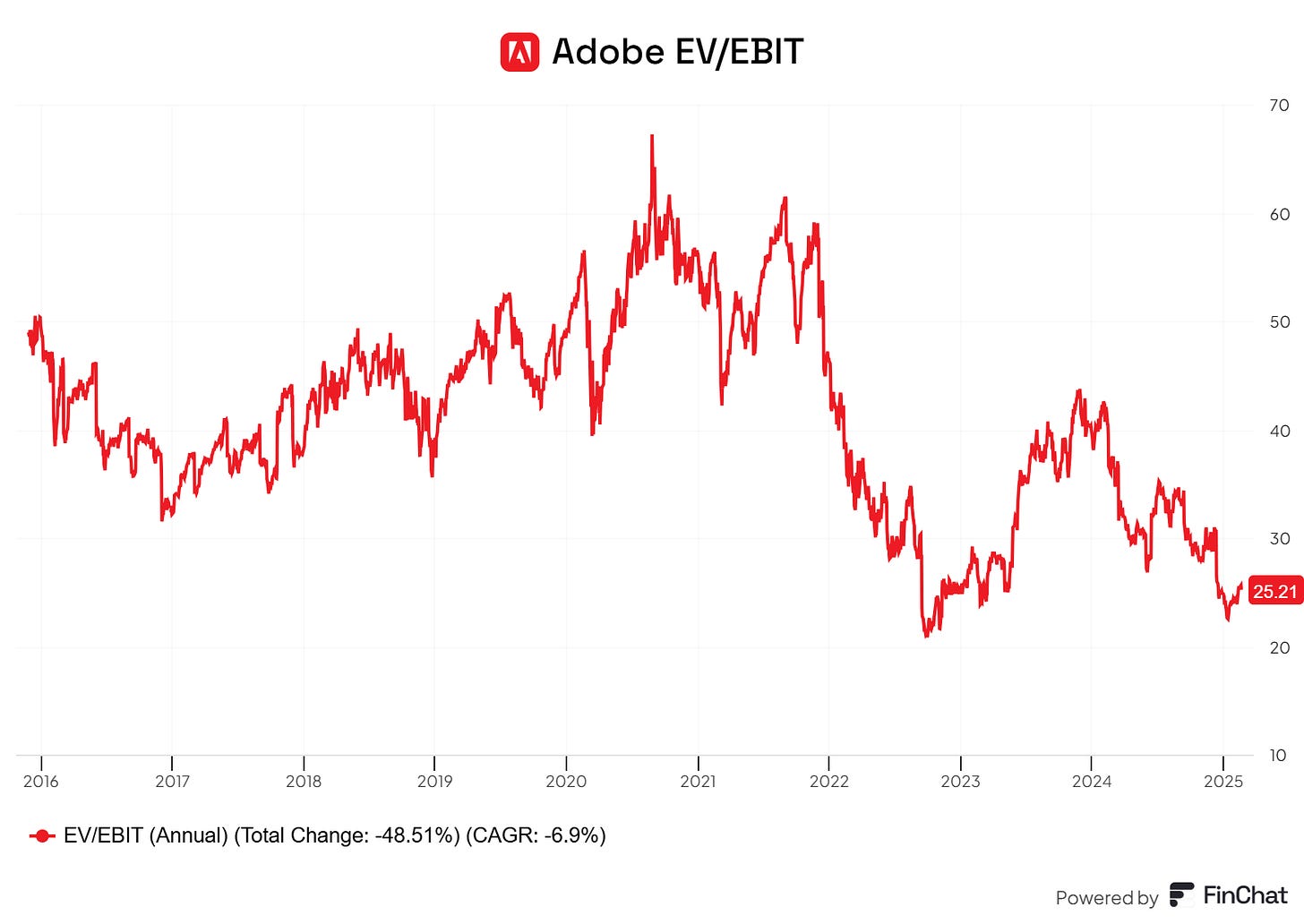

And, it now trades at an EV/EBIT of 25:

Perhaps it gets cheaper from here. I don’t know. The dip in price coupled with the historical attractiveness of the business at least makes it something interesting to look at.

The stock is down because of a narrative that AI will destroy the business. Ryan says it is time to embrace this uncertainty as an opportunity for investors. We do not know for certain how Adobe’s business will be affected by AI (it could be positive), but we do know that existing solutions have very high switching costs.

Ryan believes the business can grow revenue at around 8% - 10% a year going forward. Add in share repurchases and you likely get a good return over the next 5 - 10 years.

Listen to the full episode at the links above.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

As a designer, Ai is not hurting adobe yet, but figma does. I’m spending much more time on figma than adobe. Yes I’ll keep my adobe subscription and it’s still useful. But not seems an unbeatable giant than it used to be.