Arch Capital Episode: Why We Own Autodesk (Ticker: ADSK)

There are multiple competitive advantages at play with this leader in engineering and architectural software

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Brett) What is Autodesk?

Autodesk is a software provider for multiple industries. These include architecture, construction, engineering, manufacturing, and media. It sells software products through subscription packages and enterprise agreements, typically to other businesses.

Here is the full definition from its website:

“Autodesk is changing how the world is designed and made. Our technology spans architecture, engineering, construction, product design, manufacturing, media, and entertainment, empowering innovators everywhere to solve challenges big and small. From greener buildings to smarter products to more mesmerizing blockbusters, Autodesk software helps our customers to design and make a better world for all”

Software is sold on monthly, annual, or multiyear contracts directly by Autodesk (through sales reps or its website) and by 3rd-party distributors. With minimal variable costs (mainly just cloud computing, set-up, and maintenance costs), Autodesk has extremely high gross margins greater than 90%.

The majority of its operating costs come from two buckets: its sales staff and research and development (R&D). Last fiscal year, $1.11 billion was spent on R&D (25.4% of revenue), and $1.62 billion was spent on sales and marketing (37% of revenue). Despite these large costs, Autodesk produced a strong free cash flow margin of 33.6% last fiscal year. This year, if it hits the top end of its revenue and free cash flow guidance it will achieve free cash flow margins of 39.6%. Over the long term, management thinks it can consistently support a free cash flow margin greater than 40%.

Lastly, Autodesk is very diversified geographically. Here is its revenue allocation by global region:

Americas: 40.2%

Europe, Middle East, Africa: 38.8%

Asia Pacific: 21%

With the majority of its revenue coming out of the United States, Autodesk has been negatively impacted by the rising value of the U.S. dollar in 2022.

(Ryan) Give some history and important context for the investment:

The actual CAD software the company was built on was initially created by a man named Michael Riddle. Riddle was a really bright programmer and he actually started developing these CAD programs throughout the 70s, so right at the onset of personal computing. After building his first 2D program, he wasn’t satisfied so he scrapped it and started a new one. This new one would eventually become what is now known as AutoCAD.

Early iterations of the software required their own computer in conjunction. And eventually, Riddle sold as many as 30 computers, which unsurprisingly wasn’t enough to really turn this into a business. So he was introduced to a gentleman named John Walker by the guy who was making his computers. After haggling over price, Riddle sold Walker the business for $1 plus 10% of all sales of AutoCAD (called Interact at the time) and the early formation of Autodesk began. After a long legal battle, the royalty was eliminated and Autodesk began to operate independently. Walker quickly took the company public, and by 1989, Autodesk possessed a 60% market share in the CAD market.

Being early helped Autodesk become the company that it is today. Fueled by cash from the public markets, Autodesk began its acquisition spree in the early 90s. There have been more acquisitions than I can track since that point, including some of their main products today. One other critical evolution that occurred was the pivot to a cloud-based SaaS offering as opposed to on-premise licenses. This shift, which started I believe around 2010-2011, helps Autodesk in a number of ways, but ultimately it gives them more control.

(Brett) What are its most important products?

Autodesk has three main software “clouds” (its definition) it now calls Forma, Fusion, and Flow.

Forma: The software products cover the architecture, engineering, and construction (AEC) market. Engineers in this case mainly mean civil engineers. These software products include AutoCad, Revit, the Autodesk Construction Cloud (ACC), and others. Over time, management says the goal for this software cloud is to connect building and infrastructure construction from land purchase down to operating a completed project. Various software products within this suite either help people design, manage, or optimize building/infrastructure construction.

Within Forma, the most important single product is Revit, which we’ll cover in the BIM section of the podcast. There is also the ACC, which we’ll cover in a section as well.

Fusion: The software products cover manufacturing, mechanical engineering, and industrial systems. The most important products here are Inventor, Fusion 360, and Upchain. Over the long term, management wants to connect “the top floor to the shop floor” in the manufacturing process. What this means is they want to have the design, simulation, testing, and building of products all be connected to the Fusion Cloud.

The most important product in this Cloud is Fusion 360, which we’ll cover in another section.

Flow: The software products for the M&E markets. Like with the engineering/construction side of things, Autodesk wants to connect workers from the inception of a project to the final product. The most important product here is Maya. We will not be focusing much on M&E during this podcast, so we can hit it briefly during this segment.

Lastly, on top of Forma, Fusion, and Flow sits Autodesk Platform Services (formerly known as Forge). This is a set of APIs and programming tools that allow Autodesk customers who want to customize software experiences to connect software products within the three clouds and across them. For example, this could mean a specific customer who wants to use Revit but also Fusion 360 for a project but to do so in a seamless manner.

Intro to Fusion, Forma, and Flow: https://adsknews.autodesk.com/pressrelease/au22-digital-transformation

(Ryan) Why does Autodesk have an advantage over its competitors? Where does it come from?

We believe Autodesk possesses a number of lasting competitive advantages.

Bundling/Pairing: Because Autodesk’s portfolio of products extends beyond simply the design phase, the company is able to cross-sell many of its solutions as a part of a bundle. This allows Autodesk in many cases to be the low-cost provider, while simultaneously selling more licenses and increasing the difficulty of switching for its customers.

The Resume Moat: Within many of the end markets that Autodesk serves, its products are often considered the industry standard. This means that the workforce now expects potential hires to be equipped with an understanding of Autodesk’s various products even before they join their team. Autodesk leans into this by giving students free limited-term access to most of its product suite. Students, in turn, can list their proficiency in these products on their resumes and become more attractive job applicants.

Brand: The last one I’ll mention is the brand. Although I’m typically reluctant to talk about this as an “advantage” since it can change, it’s hard not to mention it here. This kind of goes hand in hand with the “Resume Moat”, but they’re the name brand in architecture design. If you’re building a competitive solution, you not only have assembled vastly superior software, but you have to win the reputational battle against the likes of Revit and AutoCAD.

Ultimately, each of these factors helps increase the switching costs for Autodesk’s products. With high switching costs, you’ve got greater pricing power and a lower likelihood of customer churn.

(Brett) We expect Autodesk’s Building Information Modeling (BIM) products to see consistent growth this decade. Why?

Revenue from Autodesk’s AEC segment has grown at a CAGR of 18% from Q3 2017 - Q3 2023. The majority of this growth has come from Revit, the leading BIM software provider around the world. Combined with AutoCAD, Autodesk has more than 50% market share worldwide for the BIM market.

What is BIM? The definition is loose, but it essentially means creating and managing realistic 3D assets across the construction and infrastructure industries. Revit, with its 3D modeling platform, is the most popular software for architects to create and manage new projects nowadays.

Governments are starting to mandate BIM software be used on construction projects. Along with general industry trends, this has increased the usage of BIM over the last few decades. But as you can see from this chart below, the vast majority of countries are still under 50% BIM penetration. This should steadily converge close to 100% as government mandates flow through the architecture industry. As the leader in the space, Revit should benefit greatly from this.

(source: Autodesk Investor Day 2022. Anything that isn’t green is under 50%).

On top of government mandates, Autodesk has been able to tighten down on pirated software with its transition to cloud-based subscriptions over the past few years. With the ability to monitor and shut off accounts if customers misbehave, they have been able to “convince” pirating customers to start paying for what value Autodesk provides. Last quarter, they won a $5 million contract through these compliance methods.

Government incentives for infrastructure projects will not hurt either. Many governments are allocating hundreds of billions of dollars in incentives to improve and modernize their physical infrastructure this decade. One of the main ways to “modernize” is to increase digitization, which means increasing the use of Autodesk’s products.

Oh, and don’t forget consistent price increases. Revit prices have gone up by approximately 5% per year, and at only $2,675 a year as of this writing (compared to a six-figure-plus salary per architect employee, which you could argue provides less value to a firm these days due to all the automation in the Revit ecosystem), there is plenty of room to increase prices in the future.

Add up government mandates, compliance, infrastructure incentives, and price increases and Autodesk’s BIM-related products have a clear path to growing revenue at 10% - 15% a year through 2030.

(Ryan) Fusion 360 is growing like a weed. Why do we think it has so much potential to drive growth for Autodesk?

The way I understand it, Fusion360 is Autodesk’s all-in-one integrated solution. Users get design, manufacturing, engineering, and printed circuit board functionality all within a single unified system. In other words, Fusion360 simplifies the process of design-to-fabrication by combining what would have previously required multiple disparate solutions.

Fusion360 is also cloud-based. This means that a user’s progress can automatically be saved and uploaded to the cloud, so team members in different places of the world can collaborate on that same project. Additionally, as a bundled offering, Fusion360 saves customers tons of money. Not only is it significantly cheaper than buying individual solutions independently, but it’s a fraction of the cost of its closest competitor, Onshape. Onshape costs $1,500/year per user whereas Fusion360 costs just $495/year and offers free trials.

The opportunity here is huge (management estimates $38 billion), as Fusion360 can displace tons of separate point solutions at once. And Autodesk is able to address the opportunity from a position of strength. As a low-cost provider, Fusion360 is growing its subscribers at a rapid rate. Over the last 10 quarters, the subscriber count has increased from 85,000 to 211,000 (10% QoQ).

Here’s an overview of the product for those that want to learn more:

(Brett) The Autodesk Construction Cloud (ACC) came out around two years ago. What gives this software suite so much potential?

Autodesk likely saw the rapid growth of Procore (the leading construction management software) over the past decade and decided it was a market it wants to attack. After multiple acquisitions, it now offers software products for construction contractors and on-site workers through the ACC.

There are a variety of products, but the most important is Autodesk Build. The software program allows construction workers across a project to connect, communicate, and send documents digitally. It is virtually a copy of the core Procore product. I would recommend listening to our Procore episode for more product details.

Autodesk Build monthly active users (MAUs) grew 60% quarter-over-quarter in Q3 on top of 40% QoQ growth in Q2. Clearly, customers are liking what Autodesk Build has to offer.

The ACC has so much potential because of how early digitization still is within the construction market. Procore and the ACC have a clear path to building a duopoly in this space, and with how large the market opportunity is, both companies could be doing north of $1 billion in annual sales within a few years.

Plus, Autodesk has an advantage over competitors because it can bundle the ACC with its other products like Revit, AutoCAD, etc. while also making it easier to connect documents, data, and other important things that need to happen when passing off projects from architects down to the actual construction.

This is a small part of Autodesk’s revenue today but from 2025 onward we think it can drive meaningful topline growth for the company while widening its moat.

Autodesk Build: https://construction.autodesk.com/products/autodesk-build/

(Ryan) What does the valuation look like today? Why do we think the stock is cheap?

At its current share price of just under $208, Autodesk has a market cap of $44.8 billion. With $2.6 billion in total debt and $1.8 billion in cash and marketable securities, that puts their enterprise value at $45.6 billion.

Over the last 12 months, Autodesk has generated $1.84 billion in free cash flow and management expects to finish the current fiscal year with $1.9-$1.98 billion. Meaning Autodesk currently trades at an EV/TTM FCF of 24.8x and an EV/CY FCF of 23.5x.

While that might not seem like the cheapest business we’ve ever discussed on this show, we have a high degree of confidence that Autodesk will compound our claim on earnings at a double-digit rate over the next 5 to 10 years because of everything we mentioned above. For reference, over the last 8 years – from the pre-cloud transition peak to the current fiscal year – Autodesk has compounded its free cash flow per share at 16% annually.

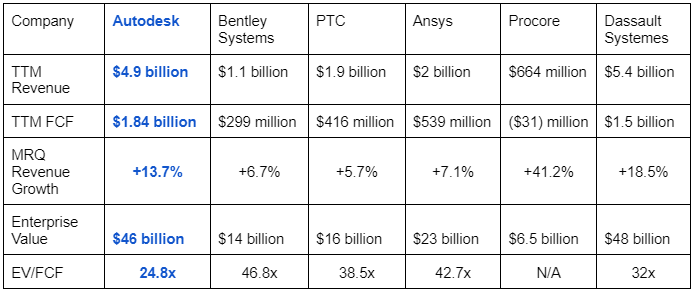

While we don’t typically use relative valuation in our own analysis, here’s a glimpse at how Autodesk shakes out versus the other engineering software companies we looked at this month.

(Brett) What are our thoughts on the management team and capital allocation?

From our vantage point, we give Autodesk management a fantastic grade for product execution and a passing grade for capital allocation.

The company is led by Andrew Anagnost, who has excelled at every position at the company and has been the CEO since 2017. Before that, he was in charge of Inventor and took it to a $500 million revenue business and managed the business model transition to cloud-based subscriptions. He has been instrumental in Autodesk’s growth and tightening its competitive advantage while also focusing on improving the company’s product offerings for customers.

What gives us confidence and comfortability with management is their willingness to disrupt themselves. They did this with Revit, are now doing it with Fusion 360, and plan to do it even more with the long-term goal of building the 3 cloud platforms.

On the capital allocation front, the company is a mixed bag. Management uses heavy stock-based compensation and has repurchased stock in the past to “offset dilution.” It also spends on acquisitions without valuation/price in mind. These are both concerns for us that we will be watching. However, the CFO Debbie Clifford has shown a strong capability to repurchase more shares if the stock gets depressed, as they have been in 2022. Shares outstanding are down only 4% in the last 10 years, but with all the cash the company is set to generate over the next five years, we think shares outstanding could decline at an accelerated rate. Management will be important in determining whether this is the case.

(Ryan) What are the main risks we are watching? How will we know if its competitive advantages are deteriorating?

There are a couple of ways that we might be able to see if Autodesk’s business quality is deteriorating.

Diminishing pricing power – Many of Autodesk’s customer contracts already have built-in price escalators. This has allowed Autodesk to report a dollar-based net revenue-retention figure in the 100%-110% range. If we see them cease reporting that figure, it might be cause for concern.

Market Share Losses – Though this isn’t always easy to track, it’s important that Autodesk maintains greater seat additions than its public peers within its core markets.

Increasing acquisitions as a percentage of their enterprise value – Autodesk has been a serial acquirer for a long time, but as of late, the acquisitions have been quite small relative to the overall size of their business. If we see them spending a significantly greater percentage of their enterprise value on acquisitions, it could mean that they’re feeling threatened by competitors (we don’t want a Figma situation).

Sources and Further Reading

Autodesk Investor Day: https://investors.autodesk.com/news-events/investor-day-presentations

Autodesk University 2022: https://www.youtube.com/@AutodeskUniversity