Arch Capital Episode: Why We Own Dropbox Stock (Ticker: DBX)

The stock has gone nowhere for years. Is that about to change?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What does Dropbox actually offer its customers? Pros/cons of the platform? How has it changed?

Today, Dropbox is a file-sharing and content collaboration platform for individuals and teams. In other words, they are trying to be the dashboard/workspace for all of their users' digital needs. However, that hasn’t always been the focus. A common criticism I hear for Dropbox is that they’ve lacked innovation or that the platform hasn’t changed since the early days. That really isn’t true.

Early Days Dropbox was focused solely on syncing or storing a user’s files (photos, videos, documents, presentations, etc.) in the cloud. They weren’t the first to market, but they were probably the best early solution. Here’s what that platform looked like at launch:

However, as well-capitalized competitors began to undercut Dropbox on cost, Dropbox was forced to shift its focus. In a 2019 interview with Reid Hoffman, CEO and founder Drew Houston actually calls out a particular conversation he had with an employee at SpaceX where he asked him how they collaborate internally and he said “A lot of emails and a lot of files”. This was apparently where the focus began to migrate towards helping groups work better together. Here’s what Dropbox looks like today:

Now with Dropbox, if you are working on a team, you can share all sorts of different file types (including Microsoft products, Google Drive products, or even Dropbox’s native solutions) with your team members and can work together on those files in a shared space. This means you can edit documents simultaneously, you can live chat while editing, or you can hop into any one of Dropbox’s integrations (Zoom, Adobe, Slack) from within the platform.

In terms of differences between Dropbox and other digital workspaces, there are some granularities that make Dropbox a little unique. For starters, Dropbox is file-type agnostic. So whether you are ingesting files from Microsoft, Google, Adobe, or wherever, users won’t have a difficult time collaborating on that content. Additionally, Dropbox has templates for legal documents (Formswift acquisition) and a native signature solution that allows for documents to be signed within the platform (Hellosign acquisition). Dropbox also has a multitude of different sharing capabilities such as password protection on files, sharing expirations, and file analytics (Docsend acquisition).

Dropbox’s pricing varies depending on needs, team size, and storage space, but for a standard small team, it costs $15/month per user. And today, Dropbox touts more than 700,000 team customers.

(Brett) Why has Dropbox been able to grow users and raise prices despite tough competition? Is Dropbox a good business?

These questions relate to each other as I would define a good software business as one that can profitably grow/retain users while also raising prices.

For context, Dropbox’s competitors are large and wieldy platforms. The main ones include One Drive (from Microsoft), Google Drive (or Google Workspace), and iCloud (from Apple). These companies all have a billion (maybe less for Microsft?) users of their operating systems around the globe that offer a very similar base product as Dropbox for free (file storage up to a certain gigabyte level).

So why has Dropbox been able to profitably grow since hitting the public markets? We asked ourselves the same question as our instinct was to think like every other investor who just throws aside the stock because “it is a commodity with huge competitors that will crush them.” I bet a large chunk of you have thought that exact thing during this episode.

I think it comes down to a few main reasons. First, Dropbox went viral out of the gate and created this category. It has over 700 million registered users that got comfortable with its service that it can easily upsell once they hit a file storage limit or want to start a small business.

Second – and more importantly – Dropbox is focused much more on workplace software than these three other companies. In fact, I don’t think the Dropbox competitors even sniff the top 10 in strategic priorities at Alphabet, Apple, or Microsoft. This has allowed Dropbox to improve its service even though it has a much smaller workforce. Taking this a step further, Dropbox has worked to expand greatly out of the traditional file storage offering with the products Ryan mentioned above. This is something that we will be watching to hopefully expand over time as Dropbox adds on even more features for small businesses on top of things like e-signatures, security features, and document analytics.

Third, Dropbox is platform agnostic. Plenty of people or small businesses share files across devices/software powered by more than just one company. A lot of small businesses will be using Apple, Microsoft, and Google enterprise software services simultaneously. Each of those existing companies has Dropbox competitors that don’t want to talk to one another very nicely. Dropbox tends to work better for people using a lot of different software programs, which it has no conflict of interest in doing.

But why is Dropbox able to raise prices without significantly affecting its churn? We think it is because it has a competitive advantage in switching costs. Changing the backbone of your workplace software is a pain, and there’s little incentive for someone to spend six ingratiating and boring hours switching to a competing service just because Dropbox raised your subscription fee by $25 a year. Plus, this moat should only expand over time as more people stick around (and increase their usage of Dropbox) year after year.

There are also benefits on the small business side where Dropbox can bundle things like document analytics (Docsend) and e-signatures to increase its average revenue per user (ARPU).

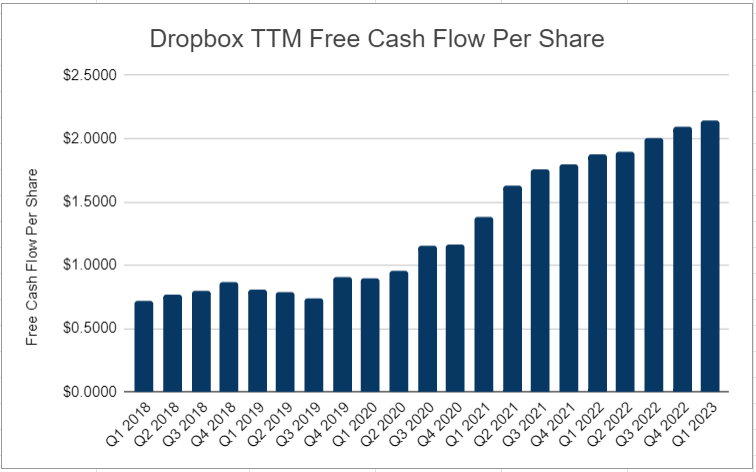

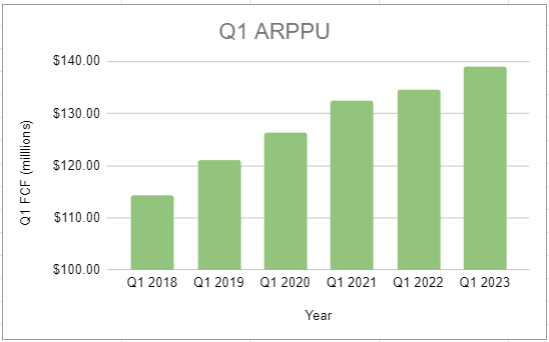

Below, you will find two charts of metrics we track each quarter: Total paying users and ARPU since 2018. Both have grown fairly linearly while profit margins have expanded. We think this is a good indicator that this is a quality business.

(Ryan) Who runs the company? How has Drew Houston evolved as a leader? What’s management’s capital allocation philosophy?

The person to really focus on and get to know when trying to evaluate Dropbox is Drew Houston (CEO). Houston owns 90 million shares and 75% of the voting power, so the show starts and stops with him. I will however briefly mention the CFO, Tim Regan. Tim Regan stepped in for the previous CFO in September of 2020 after serving as the Chief Accounting Officer for 4 years. Throughout Regan’s time so far he’s helped successfully institute some price increases, staff reductions, and a continuation of their large buyback program. Hard to assess, but so far he seems competent.

As for Houston, I genuinely like him. He’s obviously a bright individual. He attended MIT, dropped out after launching a fairly successful SAT prep business, then got into Y-Combinator and co-founded Dropbox when he was in his early 20s.

After listening to lots of interviews with him, it’s been interesting to see how he’s changed over the years. I think the overwhelming competition from big tech really helped sharpen his focus. Prior to Google’s announcement of free photo sharing, Houston said that Dropbox had acquired a whole bunch of different businesses and was quickly becoming spread too thin. Afterward, they quickly disposed of a number of initiatives and honed in on the content collaboration side of things.

In another interview he did a couple of years ago, he mentioned that he sought out some feedback/coaching from others and realized one of his big weaknesses was avoiding hard conversations. He said he’s been working to improve on that since. In general, Houston strikes me as someone who’s a big believer in the “talent density” concept. In fact, during that interview, he said “People don’t usually want to join companies where the people are less talented than them, so talent density is really important”. And in the last 3 years, he seems to have demonstrated that focus. Despite growing the business at an impressive rate since 2020, they’ve cut the workforce by more than 10% on two separate occasions. Most recently, last month when they announced a workforce reduction of 16%.

Perhaps it’s because he serves on the Meta board and has seen the impact less bureaucracy can have, or maybe because Dropbox is becoming increasingly easy to run, Houston seems focused on increasing per share cash flow.

(Brett) Dropbox consistently acquires software companies to add to its bundle. What do we think of this strategy? What do we think of the recent pivot to AI?

Dropbox has stated numerous times that it plans to acquire software companies that it can bundle into its workplace platform. It has backed it up through actions as well. Essentially, it wants horizontal software functions that it can upsell to existing Dropbox customers. This can also work vice versa with the customers of the software program it acquires.

Management has also mentioned it believes it will see more opportunities to acquire software products on the cheap during this software bear market. So this will be important to the thesis going forward.

Since 2018, these are the major acquisitions (estimated price, date):

Formswift ($95 million, December 2022)

Docsend ($165 million, March 2021)

HelloSign ($235 million, February 2019)

There have also been smaller acquisitions like Command E (a universal search tool to help easily locate files). Combining these three acquisitions, Dropbox spent $495 million to bring digital forms software (form swift), document analytics and tracking (Docsend), and e-signatures to its platform (HelloSign). Plus, there was existing revenue there.

Were these acquisitions worth it? We can discuss it on the episode, but I think they were. I believe this is a smart strategy to widen Dropbox’s competitive position and value proposition vs. someone like Google Drive or iCloud. If you are a small business that uses a lot of digital forms, you are going to choose the Dropbox/Formswift bundle for your storage needs, especially if you already use one or the other.

It looks like over the next year or so, Dropbox is going to be accelerating its development of AI tools. Here is what CEO Houston said in a letter to employees announcing a 500-person layoff:

“I've said in the past that our business is stable and profitable. So why would we take a step like this? What's changed?

First, while our business is profitable, our growth has been slowing. Part of this is due to the natural maturation of our existing businesses, but more recently, headwinds from the economic downturn have put pressure on our customers and, in turn, on our business. As a result, some investments that used to deliver positive returns are no longer sustainable.

Second, and more consequentially, the AI era of computing has finally arrived. We’ve believed for many years that AI will give us new superpowers and completely transform knowledge work. And we’ve been building towards this future for a long time, as this year’s product pipeline will demonstrate. The opportunity in front of us is greater than ever, but so is our need to act with urgency to seize it.

Over the last few months, AI has captured the world’s collective imagination, expanding the potential market for our next generation of AI-powered products more rapidly than any of us could have anticipated. However, this momentum has also alerted our competitors to many of the same opportunities.”

So we could easily see an AI acquisition, and likely some AI products coming online. Since they are competing with some of the AI leaders (Google, Microsoft), I doubt that they are going to add on one of their AI functions to improve the service. But I could easily see them partnering with another start-up to add on LLM AI functionality to the Dropbox platform, which could likely help people who use the service. Let’s not get too bulled up and overpay for a start-up during a bubble though, guys…

(Ryan) Why do we think the stock is cheap?

I’ve got a little more complicated work for anyone who likes reading these, but I’m going to try my best to walk through our assumptions and what kind of returns could be expected.

Ok, I’ve tried to air on the conservative side (everyone says that) but we’ll see where it gets us. For the next 5 years, I estimated:

4% annual paying user growth – Hard to know what rate this will be and it’s obviously somewhat dependent on the overall economy, but it’s grown at 9% over the last 6 years.

2% annual growth in ARPPU – There will be a big spike this year due to price increases flowing through, but they’ve historically increased at 3%-4%.

35% Free Cash Flow margins 2025 and on – They’ve guided for ~34% this year and the layoffs won’t even show up completely until next year. Very achievable.

Reduces share count by 6%-7% per year – Obviously, this number can fluctuate wildly depending on Dropbox’s valuation. But I assumed that they will spend 90% of free cash flow on buybacks and stock-based compensation will increase by about 3% a year. However, it should come down in the short-term due to the layoffs.

Terminal FCF multiple of 10x

If these ended up being accurate (obviously they won’t be), we’d end with a ~14% 5-year IRR. While we usually aim for 15%, I’m happy to take a more predictable 14%.

(Brett) We wrote a research piece outlining our thesis on the stock more than a year ago. Do we still agree with the analysis? Has anything changed since then?

Write-up: https://www.archcapitalfund.com/_files/ugd/d7eae5_7fe3bec124e9433283e57dd8e0649c28.pdf

The way I am going to update our piece is to go through some quotes that we wrote and see if we still agree or not with the statement:

“The unit economics work like this. An individual or small business signs up for one of Dropbox’s various premium plans and pays either a monthly or annual subscription. Storage and other costs of revenue come in at 20%, giving the business a gross margin of 80%. 20% of revenue is spent on marketing to acquire/keep these paying customers, and 10% is spent on general and administrative expenses. That gives Dropbox 50% of every dollar it brings in to either reinvest (R&D) or let fall to the bottom line. In 2021, management decided to spend 35% of revenue on R&D, leaving a GAAP operating margin of 12.7% (some of the numbers above were rounded).” Agree or disagree?

“A classic argument against Dropbox is that it is “nothing special” and that “big tech is just giving away an equivalent product.” But if that were true, why have Dropbox's paying users and average revenue per user (ARPU) grown steadily over the last five years in spite of Google Drive, Microsoft One Drive, and Apple iCloud? Big tech has attacked Dropbox repeatedly over the past decade. So far, it has survived this moat test.” Agree or disagree?

“Our goal with any investment in the fund is to achieve a 15% compound annual growth rate (CAGR) over three to five years. With conservative assumptions for fundamental growth, we believe Dropbox can put up a 20.6% CAGR through 2026 if the market decides to give it a price-to-free cash flow (P/FCF) multiple of 15 five years from now. If the market decides to give it a P/FCF of 10, returns will be 11.2% under our assumptions.” Agree or disagree?

“Since Dropbox is a purely digital company excluding its data centers, the only macroeconomic headwinds that could hurt margins (and therefore forward returns) are rising capital expenditures and inflation in employee compensation. The most concerning to us would be inflation in employee salaries. However, given Dropbox’s healthy use of stock-based compensation and high gross margins, we think it has a lot more wiggle room than other companies (especially start-ups) to weather rising salaries. Dropbox hasn’t experienced a huge downturn in the economy yet as it was only a tiny company back in the later stages of the GFC. If we go through a sustained recession and more small businesses start filing for bankruptcy, Dropbox’s churn will likely increase. This is probably the biggest risk to Dropbox’s business over the next five years. It is unknowable when a recession will come, but if it comes, our forward returns will be worse than what we are modeling above. “ Agree or disagree?

Here are the financial assumptions we outlined in the write-up. Is there anything that stands out to change?

(Both) What are the major risks we are watching today? When would we sell our shares?

(Brett) To answer the first question, I have two big risks I am watching. One, I am worried about how they do going through a major recession, if it hits. They have not gone through an extended economic downturn (COVID actually helped them, somewhat). I do believe that file storage is not the first personal/business software product you drop when finances are tight, but it still keeps me thinking about the business. Two – and maybe very important to some – is the recent leap in AI capabilities allowing Microsoft and Google to leapfrog Dropbox and increase their value proposition for users. Big time TBD on this one, and Dropbox seems to be investing in AI tools to make sure they can take advantage and retain users as well.

Given that this is a low-growth, predictable story with a lot of buybacks helping us out at a low earnings multiple, I would want to sell Dropbox fairly quickly if the valuation got out of hand. I think 20x FCF gets hit and the forward returns look pretty bleak (to be fair, that is very far away from here). With $820 mil FCF this year, that is roughly a $16.4 billion market cap. Current market cap is $7.9 billion, so more than double from here. I would also be looking to sell if they made an expensive acquisition for some AI start-up or seriously saw deterioration in paying users/ARPU that would indicate to us it is not as high of quality as we thought. Pretty simple story though!

(Ryan) Like Brett, the one big concern I have will be their ability to grow paying users during a recession. First of all, lots of paying user growth come from existing customers adding new seats. If hiring slows or declines, that will be a headwind. Additionally, if teams look to consolidate their software spending, that could be another headwind since the alternatives (Microsoft and Google) can also bundle other solutions. So that’s the big one, consistently checking that they can retain their users.

The other things I want to continuously monitor are (1) that I’m right about Drew Houston and (2) that they don’t let stock-based compensation outpace revenue growth. For #1, his recent staff reductions and a clear focus on hitting $1 billion in annual free cash flow give me some assurance that he’s truly aligned with minority shareholders. And for #2, it’s just something I need to continue tracking. If I start to think that it will really impact the IRR, it could be worth looking elsewhere.

Sources and Further Reading

Latest IR presentation: https://dropbox.gcs-web.com/static-files/51a64b81-6879-4d70-9ed2-a05b8d785db4

Employee letter: https://dropbox.gcs-web.com/static-files/435c9724-1800-430b-9084-a38d53933ab3

Dropbox vs. iCloud: https://www.cloudwards.net/dropbox-vs-icloud/#:~:text=As%20a%20third%2Dparty%20service,sharing%20and%20file%20versioning%20available.

Our write-up from Q1 2022: https://www.archcapitalfund.com/_files/ugd/d7eae5_7fe3bec124e9433283e57dd8e0649c28.pdf