Arch Capital Episode: Why We Own Wix.com (Ticker: WIX)

This website builder has promising industry tailwinds, but we have some looming concerns with the management team

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

This is our monthly Arch Capital episode where we cover a stock owned in the Arch Capital limited partnership. If you are interested to learn about the fund, check out our website here.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Charts and data

Show Notes

(Brett) What is Wix?

Wix is a software-as-a-service (SaaS) content management system (CMS) provider. CMS just means a development platform for website creation, and SaaS in this case means having a vertically integrated solution where the platform (i.e. Wix) does the hosting, security, domain name, and performance of the website all through a single product.

Traditional CMS providers include WordPress, Magento, and Jumla. SaaS CMS providers include Wix, Shopify, Squarespace, and a bit of WordPress as well (Wordpress has its fingers in a lot of pies). 10% of active websites are now built with SaaS CMS providers.

Wix makes money in two major ways:

Subscription solutions for its website-building software. These are billed either monthly, annually, or on a multi-year basis. Users pay for access to Wix’s website-building tools, domain names, and more. Creative Subscriptions are the majority of Wix’s business today and did $1.07 billion in ARR last quarter.

Business Solutions revenue. This includes a large chunk of Google Workspace revenue share agreements, however, that has low margins and is not very relevant to shareholders. What is important for the long-term growth of this segment’s profitability is Wix’s payments revenue, which is driven by a take-rate on dollars spent through its e-commerce, bookings, and other payment solutions. Transaction revenue was $36 million last quarter.

Wix has a few major cost centers for its business:

Hosting, domain name, and customer care costs are included in the cost of revenue for creative subscriptions. Creative Subscriptions had 76% gross margins last quarter.

Revenue share agreements with Google Workspace and payment processing fees, which are included in the cost of revenue for Business Solutions. Business Solutions had a low gross margin of 22% last quarter. We will be looking for this to rise as the payments business scales over the next few years.

Personnel costs. These include R&D employees, salespeople, and a G&A staff. Wix expects these costs to gain some operating leverage over the next few years as revenue grows quicker than the overall headcount. We will be watching this line item closely as a sign of health for Wix’s business in the future.

Marketing costs. This is a large portion of Wix’s business and is focused on cost-per-click, search, and social media ads based on a lifetime value-to-customer acquisition cost equation. Wix will spend more on marketing if it is seeing strong returns because a website-building subscriber has a very predictable lifetime value.

In 2021, 58% of Wix’s revenue came from North America, and 26% from Europe.

(Ryan) Give some history and important context for the investment:

Wix was founded in 2006 by 3 Israeli developers, Avishai Abrahami, Nadav Abrahami, and Giora Kaplan. All founding members still appear to work at the business in some capacity. The initial genesis for the company came from the same realization that many others were having at the time, they tried to build a website from scratch but realized that it’s really difficult for non-tech savvy people to do on their own. So the three of them started to assemble their own website builder.

Having had prior success in the tech world, they quickly received venture backing from some prominent VC firms and by 2010 they already reached 3.5 million registered users. Since then, the platform has undergone several big changes and iterations. Some of the most notable include vertical-specific platform offerings, the onset of business solutions revenue (Q1 2018), and the launch of EditorX (2020).

As for more recent history, right as Wix was beginning to hit their stride profitability-wise (17%+ OCF margins in Q3 2019), the company saw a major boost in new website formation thanks to the pandemic. In response, the company began to invest heavily in increased customer support, began quickly acquiring new business solutions offerings to help their users function online, and was in the heart of their new HQ buildout. Additionally, they continued leaning into greater marketing spend because they were seeing such strong adoption. However, those trends quickly reversed throughout 2021. As of Q1 2021, the annual growth in active websites on the internet was 5%. A year later, that number dropped to just 0.8%, resulting in a poor cost structure and diminished profitability.

Management has clearly recognized this and completed a layoff within the last several months along with some smaller cost-cutting measures. Ultimately, management estimates that the business can achieve close to 20% free cash flow margins by 2025 with greater than that long-term.

(Brett) What are Wix’s products?

Wix has dozens and dozens of individual products, but only five categories are important for investors to understand:

Do-it-yourself (DIY) website creation. These are for individuals and small businesses looking to build a website presence in a cost affordable manner by themselves (and without software development experience).

EditorX, professional development, and partners' website development (more on this in the next section).

E-commerce websites. These allow individuals and businesses to sell items online, process payments and do order fulfillment by connecting to third-party platforms like fulfillment by Amazon.

Vertical-specific solutions. This includes restaurants, fitness, hotels, and more. These products allow small businesses to offer bookings, reservations, subscriptions, and more through their Wix websites to help improve their customer experiences and build their business.

Ancillary tools. These include email marketing, domains, social media advertising, SEO tools, and more. Wix steadily builds out more of these tools for its paying subscribers, which should translate into the ability to raise prices over time since it is providing more and more value to them.

(Brett) What is EditorX? Why do we think this can help drive websites to run on Wix? (Partners revenue growth)

In early 2020, Wix launched a product called EditorX. EditorX is an advanced development platform for designers and web professionals, which will help Wix expand beyond its core DIY customer. There are a few reasons this will be beneficial to Wix that are not intuitive at first glance.

First, the obvious reason is that Wix has tools that will be attractive to professional web developers and more advanced designers. Previously, these customers were served by other platforms like WordPress. Now, they can come to a vertically integrated solution that isn’t a jumbled-together mess from a bunch of open-source solutions.

Second, it can help drive e-commerce/business solutions revenue growth. Many businesses looking for professional web development are likely also looking for a way to sell products online. While the DIY solutions from Wix and Shopify can be great for a lot of people, custom solutions can be a better value proposition for a lot of customers looking for professional design, which means a lot more professional designers will be incentivized to use EditorX over other solutions, driving revenue to Wix.

Third, EditorX improves the value proposition when Wix offers partnerships to companies like Vistaprint and LegalZoom, as they now can give the most comprehensive product offering compared to other upstart SaaS CMS providers (economies of scale that only grow over time). These partners can steadily drive new subscribers to Wix.

EditorX is barely a few years old, and we will be watching it as a key driver of growth for Wix over the next three to five years and beyond. There will be two key ways we watch this growth. First is partners’ revenue growth, which was 24% year-over-year last quarter and now 25% of overall sales. Second is Wix’s market share vs. WordPress. WordPress, as we will have talked about a lot on this podcast, still has the majority of the market share in CMS. If EditorX is successful, we think it can help Wix steal market share from the incumbent over time.

(Ryan) Who are Wix’s competitors? Does Wix have an advantage over them?

As Brett mentioned in the explanation of what Wix does, the company is a Software-as-a-service content management system provider. So they directly compete with platforms like Squarespace, Shopify, Weebly, and several others, which all offer an integrated solution to get a business up and running. While each platform has its nuances and perks, functionally they’re similar.

However, if you asked Wix’s management team who they’re competing with, the answer would be WordPress. WordPress is a CMS, but it’s not SaaS. It’s open source, so anyone can build for it, however as a non-technical person it feels more like a hodge-podge of disparate solutions that are hard to set up and integrate. Some might say that the open ecosystem is a benefit to users, but from the DIY user’s perspective, it’s far more complex to build and manage. However, its been around the longest, and many agencies/website-building experts have relied on it, which has allowed it to hold the majority of the market share over the last decade. With the recent success of EditorX (Wix’s solution purpose-built for partners), I believe that dominance is starting to erode.

(Ryan) Why do we think Wix is well positioned to grow market share?

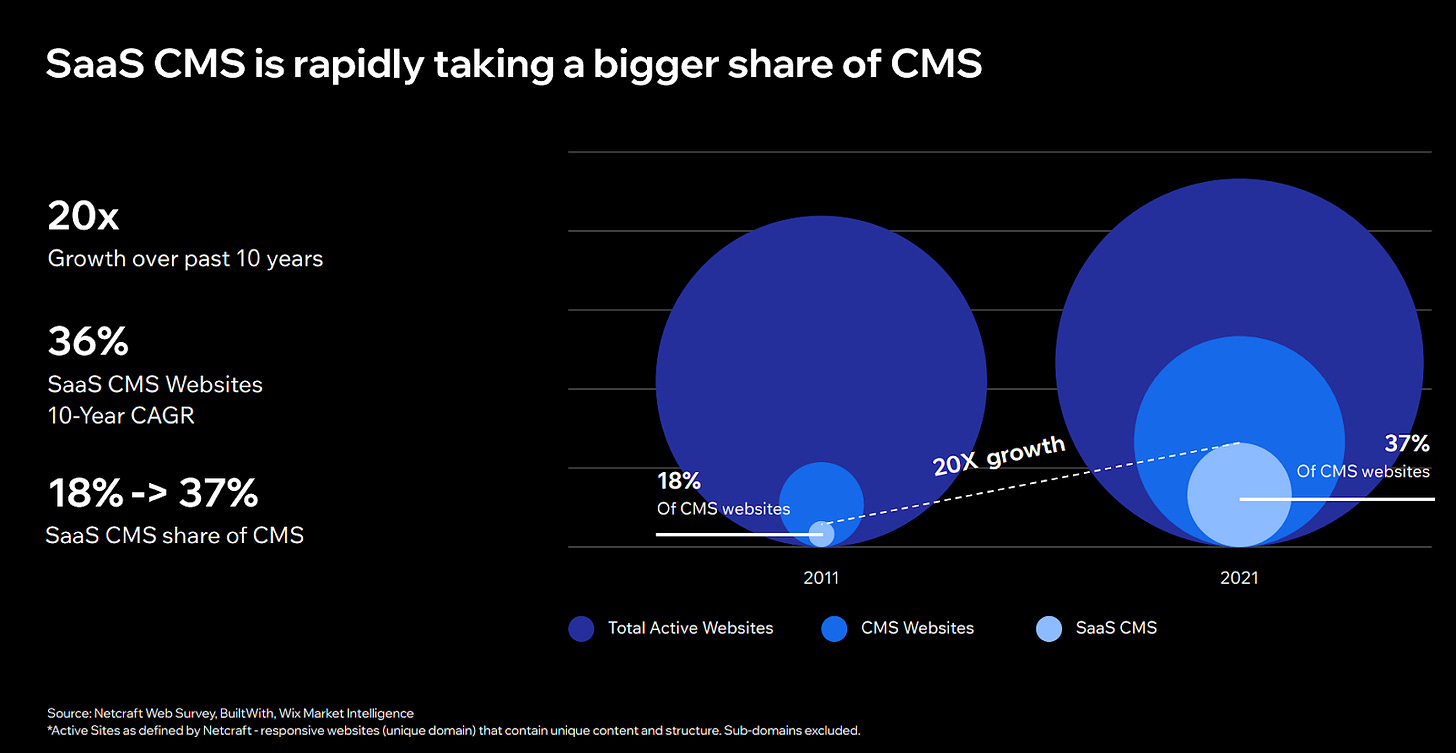

Over the last decade, both likely due to better available options and general awareness, more and more people are coming to the realization that they can build a website themselves. This chart demonstrates that quite clearly (referencing the SaaS CMS slide):

SaaS CMS as a category continues to become the go-to solution when it comes to building a new website and Wix is well-positioned as the most versatile solution for that trend. Since most SaaS CMS providers offer much of the same functionality, the differentiator seems to be the platform that can get the widest array of end users to convert from a free user to a subscriber. With Wix’s vertical-by-vertical offering, robust business solutions functionality (scheduling, seating maps, curb-side pick up), and variety of templates, the platform has become the easiest destination for most businesses to establish an internet presence.

(Brett) Who is on the management team? What do we think about them and their capital allocation? Any concerns with them?

Wix is based in Israel and has a long-tenured management team. This includes the founder/CEO Avishai Abrahami, who has been with the company for its whole existence. We think it is great that the executive team has stuck with the same company for so long, which is a sign that they actually care about long-term growth and not hitting quarterly earnings results. They also just built out a sizable headquarters in Israel that shows their long-term ambitions to be one of the key technology companies of that region.

Wix’s capital allocation has been mixed. It has a great track record of spending on marketing to build a long-term growth engine (revenue per share is up 1,110% over the last 10 years) and has made some great product decisions. However, they have a loose policy with stock-based compensation, acquisitions, and a buyback framework that just seems to be something to hand waive to the public markets. Recently, they outlined the $500 million free cash flow target to hit by 2025, but the market clearly does not believe they will hit this number given the current stock price.

There are no numbers or quantitative measurements going on to back up this claim, but both Ryan and I are nervous about Wix’s executive team and what their true north star is. Is it actually long-term growth in free cash flow per share? Or is it just to become as large of a company as possible with the aim of appeasing public market investors? Some of their actions and how they act during interviews give us a bit of pause that the management team is not someone we can trust with our capital. This is our largest concern as shareholders today.

(Ryan) What does the valuation look like today? Why do we think the stock is cheap?

As of the latest quarterly report, Wix had 58.35 million shares outstanding. At its current price of $76.50/share, that puts its market cap at $4.46 billion. Wix today has just over $1.2 billion in cash & short-term marketable securities with $930 million in total convertible notes, putting its enterprise value at $4.17 billion.

For context, over the last 12 months, Wix has generated just under $1.5 billion in total bookings with the lion’s share (76%) of that coming from its recurring subscriptions business. For our investment to reap attractive returns, there are a couple of assumptions that we’re making for the business over the next 4 years.

Premium subscribers grow at 10% per year (has compounded at 17.5% over the last 5)

Revenue per subscriber continues to grow by at least 3% each year.

Business solutions revenue grows by at least 15% per year and is cash flow positive (as Wix Payments grows as a percentage of overall revenue, this segment should be far less costly).

Free cash flow margins across the entire business reach 20% (this is management’s 2025 projection, which we’ll hold them to)

No change in share count. Wix has shown a willingness to repurchase lots of shares at depressed prices which I believe will at least offset SBC.

If our assumptions are correct, by 2026, Wix would be generating roughly $2.3 billion in revenue and at least $460 million in free cash flow. If the market values Wix at 15x that free cash flow figure, Wix would have a market cap of roughly $7 billion (~60% higher than today’s prices).

While some of our growth estimates might look optimistic at face value, I take some comfort in both Wix’s track record over the last decade as well as the long-term tailwind of the shift toward SaaS CMS.

(Brett) What are the main risks today? Why would the stock perform poorly from our perspective? What are we looking at as reasons to sell our shares?

The main risk for Wix stock going forward is the management team. We have high confidence the business will be larger three to five years from now, that its competitive position will be stronger, and that it will retain its strong unit economics. The choices of management over the next couple of years will determine whether these gross profit dollars actually get turned into value for minority shareholders.

For example, let’s look at revenue per employee. The metric is actually down from 2016, which is shocking for a business that has grown revenue as quickly as Wix has. Now, I think the executive team would argue this is because Wix has greatly expanded its product offerings like EditorX, e-commerce, payments, vertical solutions, and more since then. These products will hopefully scale up just like the core DIY solutions have over the past decade, which will lead to an expansion in revenue per employee and therefore profit margins. But if it doesn’t, that is a major risk to our investment not working out.

Will management waste more money on acquisitions? Will they continue to overhire even though they are claiming to Wall Street that spending is getting more rational? Are they going to continue to spend heavily on stock-based compensation? These are all questions we will be asking each quarter with Wix to see whether management is inhibiting what should otherwise be a quality business. This is no excuse if we are wrong, either. Evaluating management teams is important for our investment strategy, and we are concerned that we are wrong about Wix’s right now.

Of course, there is always a small risk that Wix’s business quality deteriorates enough that shareholders will get a bad return from today’s prices, even at such a discounted valuation. This could come through competition with places like Substack, Shopify, and even smaller competitors such as Squarespace. There is also the risk of AI tools taking over the website-building market, which is hard to analyze. However, even with these threats, we think it is very hard to look at Wix’s current market share, what its market share was three, five, seven, and ten years ago, the growth of website building around the world, and think that this business will have fewer subscribers in 2025.

If Wix hits its 2025 free cash flow target, which we think is fairly doable, the stock will likely do well for us. The big question comes down to one of our core tenets when making an investment decision: what will the executive team do with the cash that is generated for them? If that question is answered negatively, it will be time for us to sell our shares in Wix stock.

Sources and Further Reading

What is EditorX: https://www.editorx.com/

Wix market share of the CMS market: https://w3techs.com/technologies/history_overview/content_management/ms/y

Wix financials on Stratosphere.io: https://www.stratosphere.io/company/WIX/

2022 Investor Day Slides: https://investors.wix.com/analyst-and-investor-day

VIC Writeup from March 2022: https://www.valueinvestorsclub.com/idea/WIX.COM_LTD/5779042727