Are 401k Plans Going to Drown In Private Equity?

Goodbye target date funds. Hello levered-up HVAC distributors.

YouTube

Spotify

Apple Podcasts

Many listeners asked us to discuss the recent news around private equity squeezing its way into 401k portfolios. We didn’t get to it on the podcast as there was too much fun stuff to discuss, but I wanted to write about it in this weekend’s newsletter.

According to the Wall Street Journal:

President Trump is expected to sign an executive order in the coming days designed to help make private-market investments more available to U.S. retirement plans, according to people familiar with the matter.

And:

An order could help pave the way for big managers of private assets such as Apollo Global Management and Blackstone to access the vast sums of retirement savings held by workers who don’t have a traditional pension. Institutional investors such as pension funds have largely maxed out on private markets, leading firms to look to individual investors for new sources of growth.

There is $12.4 trillion invested in defined contribution plans today. Private Equity groups are going to lobby the hell out of the government in order to get access to these large sums of money.

Why?

It’s simple. The more assets under management (AUM) these funds have, the more fees they earn. Other sources of capital are running dry, and they are now looking at the gargantuan amounts of capital sitting in individual retirement plans. I don’t fault them; it is their fiduciary duty.

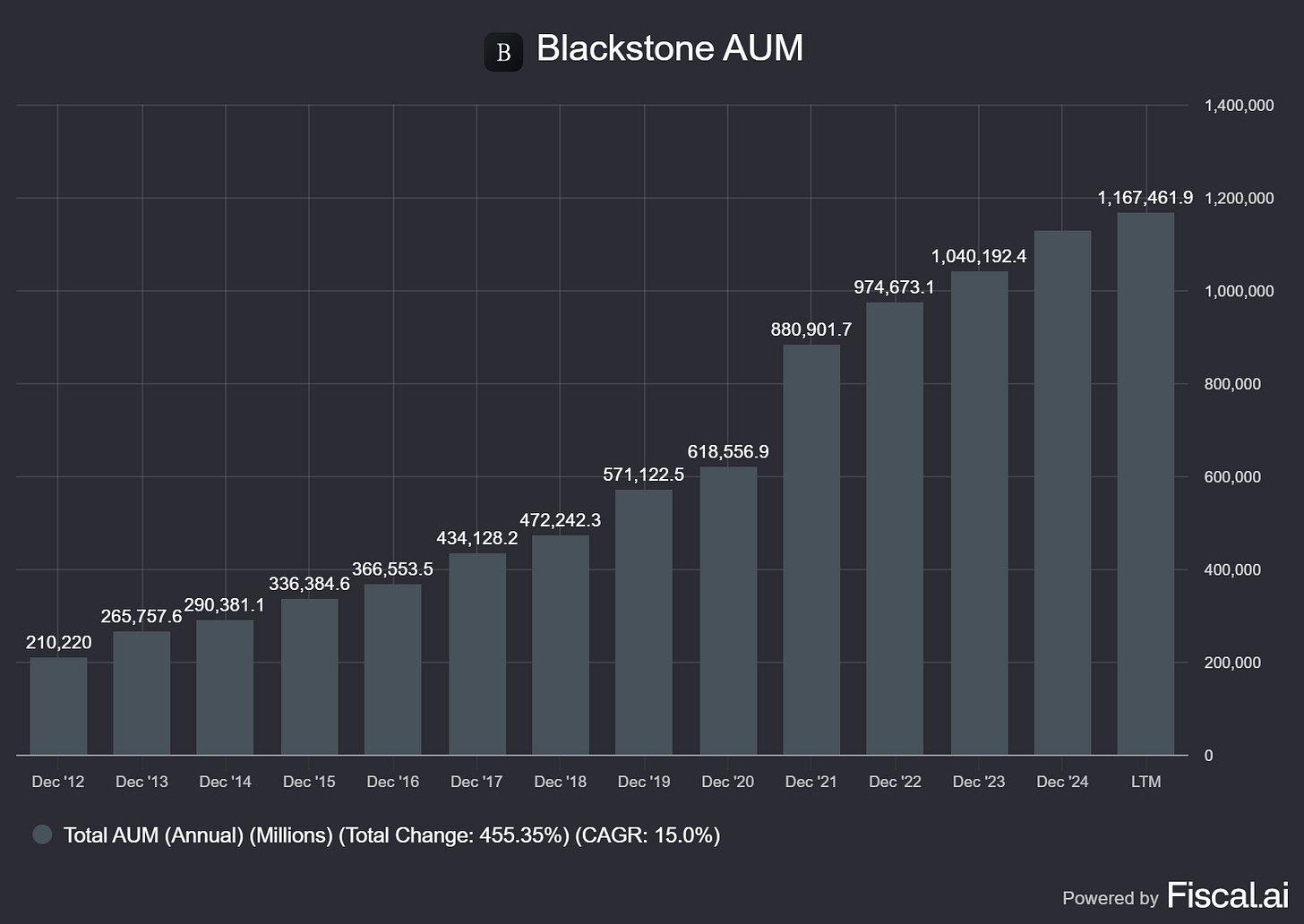

According to our friends at Fiscal.ai (use our link for 15% off!), Blackstone’s AUM has reached $1.17 trillion and has compounded at a 15% rate since 2012.

Getting access to 401k money could help firms like Blackstone keep compounding AUM (and therefore earnings).

Contrary to what readers might assume, I am not opposed to giving investors more choice when it comes to the investments they’d like to make. More opportunities, more freedom, the better.

My problem stems from investors suffocating themselves in investment vehicles before truly understanding how they work.

Many of you know how restrictive 401k investing is. But if you are reading this, you actually know how these investment funds work. Most don’t.

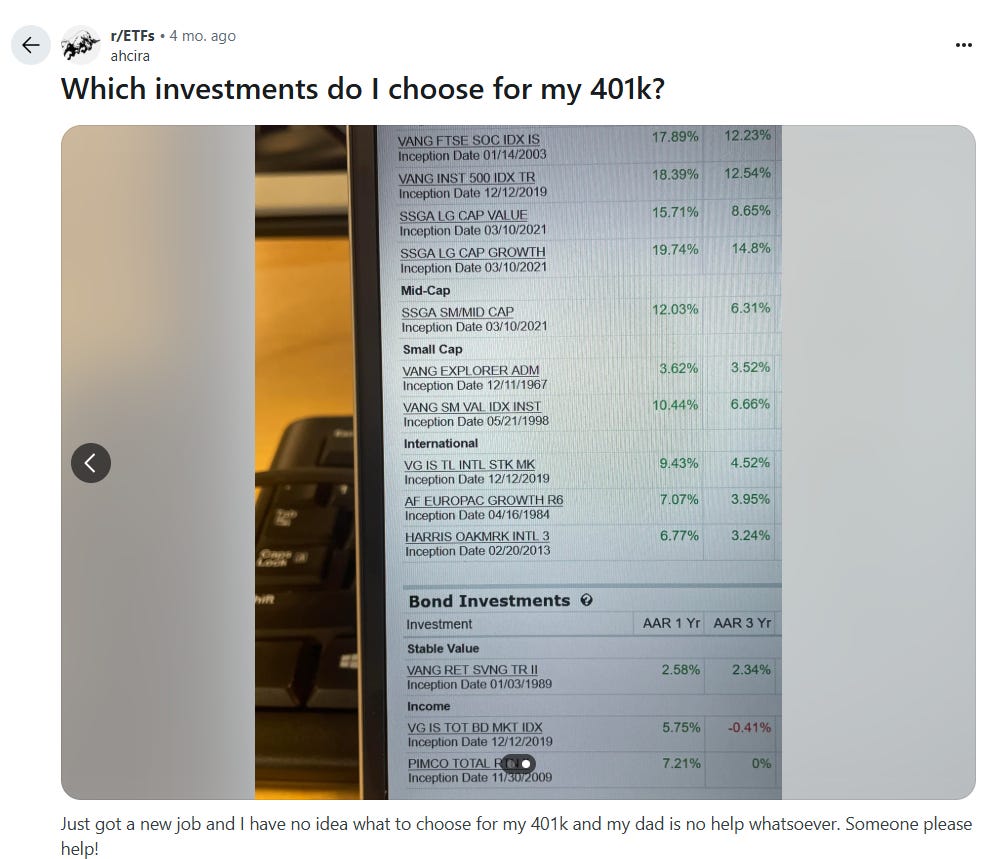

Take this Reddit post:

This new hire can buy Vanguard target date funds, bond funds, or, to spice things up, they can buy large-cap or small-cap value/growth. Exciting!

It really doesn’t matter what they choose. Their 401k is going to perform like everyone else’s and track the indices, with the inability to withdraw capital until they are 60, getting sucked into the defined contribution plan universe for most of their lives. Very fun, very fulfilling.

Hot take: 401k plans are dumb (Roth IRAs are much better). It is socialized investing that is shoveling Vanguard target date funds down our throats. They are only so big because of tax advantages and company matching plans. It forces you — even if you hate index funds like me — to make the economic choice and do the 401k match. Luckily for me, I have never had this problem and been offered a 401k matching program.

If my company matched 5% on 401k contributions on my $100,000 salary, I would much rather take a $5,000 pay raise (or even less to make up for the tax write-off) and invest the $10,000 in total money myself. It would give me the freedom to invest how I want.

Back to private equity. I don’t fault these large funds trying to get in on the 401k gold mine. It shouldn’t be a big deal to stick them in along with Vanguard target date funds and give people an option blindly shovel their long-term savings into.

What I do worry about is financial illiteracy. People are going to see huge historical outperformance from these funds and think they are the best ones to buy because of it.

They will be disappointed in forward returns. Eventually, it all just turns into beta at a large enough size, and that’s what these private equity companies are turning into. Getting even larger with 401k funds will make this looming issue even worse.

If investors get access to buy private equity funds in their 401k’s, you will do much better by owning the stocks of Blackstone, KKR, and Apollo instead. That is where the profits of the global economy will flow.

-Brett