Booking Holdings Stock Report (Ticker: BKNG)

Can the largest travel company in the world keep growing?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

By sharing 50% of their options revenue, Public has created a more transparent options trading experience. You’ll know exactly how much they make from each trade because they literally give you half of it.

Activate options trading at Public.com/chitchatstocks by March 31 to lock in your lifetime rebate.

Paid for by Public Investing. Must activate Options Account by March 31 for revenue share. Options not suitable for all investors and carry significant risk. Full rebate terms here (https://public.com/disclosures/rebate-terms). US members only.

Show Notes

What is Booking Holdings? What brands do they own?

If you’re an American you might not be that familiar with them but Booking Holdings is the largest travel company in the world. They operate through 6 brands: Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK, and OpenTable. Booking.com is far and away their largest business and accounts for ~90% of their profits. Now the bulk of their business comes from people looking for places to stay but there are other elements to the business as well. I’ll talk about those in a second.

But to understand the business in its simplest form, Booking.com has a network of accommodations (big hotels, boutiques, alternative accommodations – think AirBnB) on its platform and users go there to book stays. The user can then typically choose to either pay for the stay right then and there (and typically get a discount) or reserve the room but pay at the time of their stay. If they pay at the time of their stay, the hotel will then send a commission to Booking. This is important because this is really what enabled Booking to become the largest travel company in the world.

This is how they make 90% of their revenue. If it’s a commission (so the customer pays at the hotel, and the hotel sends Booking their kickback), that’s considered Agency Revenue. If the customer books it at the time of the reservation (which Booking eventually passes along to the hotel and takes a cut), it’s classified as Merchant Revenue. Then some of their properties like KAYAK and OpenTable earn what Booking calls Advertising and Other Revenue (think of these like directories to other OTA’s where they get paid on a per-click model) but that’s a pretty small piece of the pie.

History: How’d they become the biggest travel company in the world?

Booking Holdings origins start back during the dot com craze. In the late 90’s there were tons of internet businesses that were attempting to tackle the online travel business. One was Priceline.com. Priceline was launched by Jay Walker in 1997 and took off really quickly thanks to their Name Your Own Price bidding strategy. It started with airline tickets, hotel rooms, and car rentals. And in 1999, 2 years after its founding, Priceline went public at a ~$13 billion valuation. The highest first-day value in history up to that point. They tried to expand into a bunch of other ventures, but when the dot-com bubble burst, they really had to re-focus their efforts and the founder left the company, and by 2001 they became profitable.

As other internet travel companies were struggling to come out of the dot-com bubble, Priceline acquired them. In 2005, one of those companies was Booking.com for $133 million. Booking was founded in the Netherlands and was quite popular with hotels across Europe thanks to their agency model. Because booking.com would let people reserve online but not actually pay until the time of their stay, hotels loved them. It’s very low risk to the hotel, right? Almost like an affiliate program. So Booking was the anti-Expedia. Expedia was also present in Europe, but they ran the pay upfront model which hotels didn’t really appreciate as much at the time. This helped Booking.com basically win Europe, while Expedia kept its dominant position in the US.

But the value of an OTA is substantially higher in Europe than it is in the US. Here’s why:

“In the US, over two-thirds of hotels belong to one of the major chains, whereas in Europe, this dynamic is reversed, with roughly two-thirds of hotels remaining independent…Franchised hotels benefit from the brand and marketing prowess of their deep-pocketed corporate partners. Independents, by contrast, have none of these resources so can receive considerable value by signing up with a large OTA.”

For context, today, Expedia is ~3x larger in the US than Booking.com. Meanwhile, Booking.com is 4x bigger than Expedia in Europe. So similar sizes in terms of bookings. $146B for BKNG vs. $103B for EXPE. But Booking is 6x larger on a market cap basis.

Since the Booking.com deal, they’ve made a number of other acquisitions. Sometimes they fold them into existing services, and sometimes they keep them independent. But nonetheless, Booking.com is the vast majority of this business.

What are their new initiatives? How are they trying to grow from here?

Booking’s management team talks a lot about going beyond the accommodations segment. They want to be a complete travel company. That means helping people find hotels, flights, rental cars, places to eat, and experiences. And they are trying to tie that all into one app.

I think the closest opportunity here for them is flights. They’ve done a decent job growing their flights business (probably through acquisition), but this seems like a logical next evolution for them. Glenn Fogel said in an interview, the first place people start when booking a trip is actually the stay. Then they book the flight. So offering this seems logical. However, it isn’t that valuable in the US given that, like the hotel business, the major airlines tend to have a more direct relationship with the customer.

Ultimately, I think the growth is largely going to come down to the growth of travel overall. There are things they can do to boost their take-rate on that, but it’s hard to know what’s really going to stick. They have done a good job implementing their own payment system for example. Just over half of their gross bookings were processed through their own payments platform last quarter, which should provide some incremental revenue to them.

Who do they compete with? Do they have any advantages?

Let’s start with what I think is their big competitive advantage and that’s scale.

At this point, they now have so many accommodations on their platform that for consumers, it’s a very convenient place to go if you’re booking a trip. On the flip side, given all the consumers that are on the platform, you really have to be on there if you’re a boutique hotel or something.

Here’s a quote from the CEO of Ctrip (which is China’s largest OTA):

“Booking.com is a global brand, and in hotels, they are just so far ahead of anybody else. I think it will be very difficult for anybody to come close to them.”

As for the competition, there are pretty much 2 big players that compete with them – AirBnB and Expedia. Some people see Google as a threat, but that risk hasn’t seemed to materialize so let’s start with direct competitors.

Expedia: We’ve already talked a bit about them, but I think they are in the most difficult position of the OTAs. They are large in the US but hotels tend to hold direct relationships with their customers so their value prop isn’t quite as high. They own VRBO, but that really seems to play 2nd fiddle to both AirBnB and Booking.com and frankly, I have no idea what the economics look like for that.

AirBnB: This to me is the biggest worry if I were a shareholder today. AirBnB really succeeded by going after a customer (individual property owners) that really wasn’t being served yet. Booking has a good amount of alternative accommodations on their platform, but from what I understand, they’re a little different than AirBnB’s inventory. Where AirBnB serves sort of the individual property owner, Booking is more enterprise style. So like condo buildings vs. homes.

Here’s what Glenn Fogel had to say about AirBnB: “Look, Brian and his team have done a great job… What I really admired though, was his Hoozpah, is one way to put it. Because in many of the places that he did business, it was illegal.”

Here’s how the 3 square up against each other:

Why not worry about Google? This has been talked about as a risk for the better part of the last decade and it hasn’t amounted to much, but I’ll still address it. Many people are concerned that Google themselves will disintermediate Booking’s model and become an online travel agent themselves. That hasn’t happened and I think there are a few reasons why:

Google has largely remained a directory and a very profitable one. In fact, in 2017, Skift estimated that Google was generating $14 billion in travel advertising. No doubt, that has grown since. That would actually make Google the largest travel company in the world. And it would likely make Booking.com one of if not the largest customer for Google. I’m talking mid-single-digit percentage of Google’s ad revenue.

Being an OTA requires a little more than just being a good tech platform. Your customers are actually the hotels and accommodations, not the users. And you have to go attract that supply, which in many cases means building out real relationships with hotels. That’s not Google’s core competency.

An increasing percentage of Gross Bookings for Booking.com are coming through their mobile app. 51% of room nights booked last quarter came through the mobile app. So for the majority of Bookings transactions, Google actually is not an intermediary.

What do we think of management? Thoughts on the proxy statement

The CEO is Glenn Fogel. Fogel was named CEO in 2017 but he’s been with Booking Holding since February of 2000. Fogel owns $71 million worth of stock. A solid amount but he gets paid a ton in options so he must sell a good amount of stock.

We’ll talk about his compensation in a second, but as for my thoughts on Fogel, I really don’t have strong opinions either way. I think he’s the right guy for Booking at this time and he seems to do a good job managing a very large organization, but I rate a guy like Brian Chesky at AirBnB much higher.

As for the proxy, I thought it was alright. There are 4 named executives on the proxy and they all make relatively small base salaries – each less than $1M. However, they made $155 million in total between 2021 and 2022 from bonuses. Most of that going to Fogel.

75% of their bonus compensation comes from performance stock units. This used to be all of their compensation but I’ll explain why that changed in a second. But the PSU’s are based on 5 different criteria:

Revenue: Targeted 35%-40% growth. Not bad.

Compensation EBITDA: This is Adjusted EBITDA but they’ve made some further adjustments that I think are actually shareholder-friendly.

“Is impacted by stock-based compensation expenses;”

“Excludes results of acquisitions that were not incorporated into the targets set at the outset of awards to prevent ‘buying results’”

“Excludes the impact of foreign exchange rate changes”

“Treats all capital expenditures as expenses”

Relative total stockholder return: Return vs. travel and tourism peers. Don’t really love this.

Absolute total stockholder return: Good.

Individual contributions: Don’t love this. Basically it’s up to the committee’s discretion to award some extra bonuses for non-financial performance.

Now here’s the thing:

“In June 2022, the say-on-pay proposal did not receive majority support from stockholders.” So, “The Company’s 2022 financial results were significantly more positive than initially expected. As a result, the annual bonus pool formula would have resulted in maximum funding for bonuses, including the NEOs' bonuses, at 3 times target. However, since our 2022 compensation planning occurred when the ongoing impact of the pandemic on the Company's business was uncertain, and in response to stockholders’ feedback that target setting may have been conservative relative to consensus expectations, the Compensation Committee considered that a judicious, structured use of negative discretion would be appropriate in this circumstance.”

They revised their earnings down. I like this, and I don’t think it’s the end of the world if the executives are making $50-$100 million a year for solid performance.

Valuation

Booking Holdings today has 34.9M shares outstanding and a stock price of ~$3,532, giving them a market cap of $123B. They have $13.3B in cash & short-term investments on the balance sheet with $13.8B in total fixed-rate, low-cost debt. So market cap of $123B plus net debt of $500M, they’ve got an enterprise value of roughly $124B.

Over the last 12 months, they’ve generated $6.3 billion in Earnings before Taxes. This puts Booking at an EV/EBT multiple of 19.6x. It’s worth mentioning, however, that Booking has an expanding working capital advantage which allows the company to earn interest on its accounts payable balance. So free cash flow will likely continue to be higher than GAAP earnings for the foreseeable future. This should also serve as a boost to earnings with interest rates where they’re at.

Quick aside: Low SBC is something Booking prides itself on. Here is a comment from the CFO David Goulden on a recent conference call when he was talking about how much stock they were able to buy back. He says:

“We are proud of this accomplishment because it reflects both our commitment to return capital to shareholders and how carefully we manage our stock-based compensation expense and its dilutive impact. We continue to see many publicly traded companies pro forma out the very real expense associated with stock-based compensation. We strongly disagree with this approach, and therefore, every profit metric we report includes the negative impact of stock-based compensation expense. We view SBC expense as a very real cost of doing business across every stakeholder should fully count when evaluating the performance and returns of our business or any business. If anything, we view SBC dollars even more valuable than cash dollars because of our long-term expectation that dollars' worth of stock to date will be worth more in the future. It's the same expectation that serves as a rationale for pursuing our share repurchase program, a program that has meaningfully reduced our share count over time and has not just served to offset dilution from SBC. Simply offsetting dilution does not represent a return on capital to shareholders, but actually represents a cash drain on our business that does not get counted in many companies' pro forma reporting of profits.”

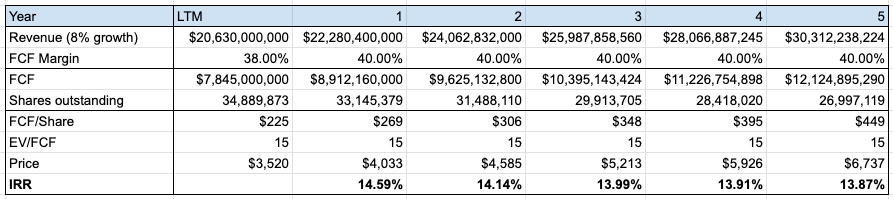

Here are some assumptions I threw into a simple model:

8% annual revenue growth (Double the growth rate of the travel industry)

40% free cash flow margins in 5 years (A/P will grow as more people book ahead and general operating leverage from in-app bookings)

100% of FCF will go to buybacks, which will lead to roughly 5% annual share count reduction. Obviously depends on what multiple they trade at.

15x EV/FCF multiple in year 5

That would get me a ~14% annual return.

What could go wrong?

AirBnB encroaching more into Booking’s market. As I mentioned earlier, this is the biggest risk in my opinion. Airbnb has not only carved out its own market but I imagine is also attracting many of the boutique hotels across Europe. I imagine most properties will just list across all the major OTA’s. That’s not the end of the world because Booking still has plenty of users, but if the battle becomes who can win more users, I think Airbnb might be better positioned.

Travel industry slowdown: One other element that’s important to understand is there are times when travel simply slows down. Especially following the quick rebound we’ve seen coming out of COVID. However, if this happens, I think I’d prefer to own the capital-light businesses that can still generate healthy profit margins in a downturn.

Consolidation or growth of branded hotels in non-US markets. Not sure whether or not this is likely, but would hurt Booking’s value prop in the event that this was occurring.

Is it investable today?

Yes. I think I will buy some shares (or a share) in the next week. As is evident by the bookings growth of both Airbnb and BKNG, I don’t think this is a winner-take-all market and I think both businesses can do well from here.

I imagine Airbnb will grow much faster, but I think Booking is still well-positioned to generate good returns for shareholders from here.

Sources and Further Reading

Ensemble Capital Presentation: https://intrinsicinvesting.com/2020/01/27/booking-holdings-playing-nice-with-the-google-monster/

Value Investors Club 2020 Writeup: https://valueinvestorsclub.com/idea/BOOKING_HOLDINGS_INC/8567638711

Very informative and actionable write up. Thanks for putting it out for us. It now prompts me to go take a closer look at ABNB versus Booking.com. Cheers!