*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

**If tables/charts are not showing up, click on the link to read the web version.

Brett here.

Let’s talk Teladoc, the one shining light in an all-around terrible investing month. If you don’t know, Teladoc is a worldwide virtual healthcare provider. They connect patients to doctors through their mobile app and website and allow check-ups to be done from the convenience of a patient’s own home. The stock is up 20% since the market started tanking. Why? A few reasons.

One is they beat on “earnings” (they lose money, so they really lost less money than people thought they would), revenue, and users in their fourth-quarter report.

Analysts also think COVID-19 could be big for Teladoc (really connected the dots there) because people will not want to go to doctor’s offices to get standard check-ups.

I’m glad the stock is doing well, and that investors finally realize the fantastic potential the company has, but that is not why I am bullish on the company. I like Teladoc because it is building a sustainable, high-margin digital business in a gigantic market (healthcare) with little to no scaled competition.

The company is also getting into hospital-level telehealth with the acquisition of InTouch Health and has started offering mental health and nutrition offerings in recent quarters. Basically, they want to offer every kind of virtual wellness/medical service as possible.

They are unprofitable at the moment but are growing organic sales at a good clip (about 20-30% annually). I believe with stellar management, tremendous industry tailwinds, and huge customer demand, Teladoc can continue this strong sales growth for years to come.

Teladoc’s valuation is not cheap, and I am definitely not adding shares at the moment. The stock’s P/S ratio is over 16, which is quite high for a company with its growth and margin numbers. However, I still am a believer in the long-term prospects of the stock, so I am not planning on trimming my position unless the price gets completely out of hand.

Alright, now to my personal portfolio.

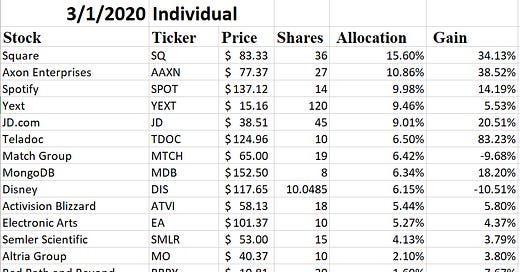

Individual Account

Trades Made (in chronological order):

Sold 2 shares of the Trade Desk at $309.59

Bought 8 shares of Match Group at $75.95

Bought 1 share of Spotify for $147.57

Bought 10 shares of Semler Scientific at $52

Bought 5 shares of Match Group at $70.54

Bought 2 shares of Disney at $132.14

Bought 2 shares of EA at $107.05

Bought 1 share of Spotify at $142.95

Bought 4 shares of Match Group at $69.18

Bought 5 shares of Bed Bath and Beyond at $11.09

Bought 4 shares of Sprouts Farmers Market at $16.49

Bought 25 shares of Bed Bath and Beyond at $9.82

Bought 2 shares of Match Group at $65.12

Bought 5 shares of Semler Scientific at $49.19

Bought 2 shares of Axon Enterprises at $74.17

Bought 10 shares of Altria Group at $38.89 (if you think this is morally wrong, read this)

Wow. Looking back, I ended up being very active this month. I added five new companies, and, strangely, three of them were deep-value plays. I typically am a buy-and-hold/growth investor, but these opportunities were way too good to pass up.

I may have been early buying the dip (my cash is now mostly gone) if the market tanks even farther, but I cannot know for certain that will happen. All I know is that I purchased shares in companies I believe are trading at a discount to their future value.

Portfolio Statistics

Average Consensus P/E: 52.2

Average Consensus EPS growth: 42.51%

Average Consensus Rev. Growth: 26.51%

Portfolio Diversity: 67.51% Tech, 10.83% Industrials, 7.84% Consumer Cyclicals, 6.53% Healthcare, 4.11% uncategorized, 2.45% Consumer Non-Cyclical, 0.73% Cash

Returns since January 27th, 2020 (when I connected to Atom Finance):

This is for my individual account only. The returns below also include my Roth IRA.

Stocks on My Watchlist

StoneCo

Sea Limited Co.

Telaria

Roku

These are companies I would love to own if they got a 30-50% haircut.

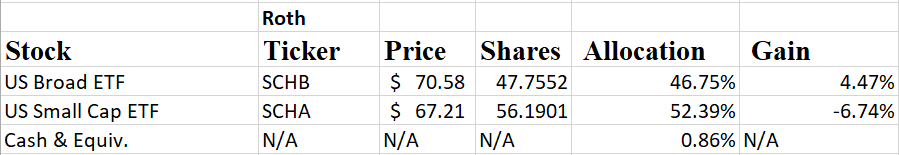

Roth IRA

Trades Made:

Bought 6 shares of SCHA

Bought 7 shares of SCHB

Portfolio Performance Since January 2017

Another month catching back up to the S&P 500! This isn’t the end-all-be-all for investors, but for someone my age, I think it is fun to compete against the broad market. Historically I’ve been pretty bad at it, but over the last year or so things have gotten a lot better. I have a long investing career ahead of me (50 years vs. 3 years of experience) so I am not worried about coming out of the gates and trailing the market. All I am worried about is finding quality businesses to own for the long-term.

Alright, that’s it for my February 2020 portfolio update. Make sure to follow us on twitter @chitchatmoney, subscribe to this newsletter if you haven’t already, and check out our podcast here for more of our content (and analysis on a lot of the above companies).

See you in a month,

Brett Schafer

*I am not a financial advisor. Nothing I write is advice or a recommendation.