*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

**If tables/charts are not showing up, click on the link to read the web version.

Brett here.

This month I want to talk about Electronic Arts (ticker: EA), one of the largest American video game studios. I am a shareholder in the company, and, as you can see below, it makes up around 5% of my portfolio. Here are a few reasons why I am long the stock.

Valuation. EA trades at an EV/FCF (enterprise value divided by free cash flow) of 17. That is quite low for a company I believe is in the 5th or 6th inning of its lifecycle.

Key franchises. EA owns the Fifa and Madden NFL franchises, two of the largest sports games on the market. And, even though they are both over twenty years old, engagement still goes up every year. For example, matches on Fifa Ultimate Team were up 40% this quarter.

eSports. It is a hyped-up industry, but I believe over the long-term EA will benefit greatly from the emerging eSports market. They own the IP and therefore control the destiny of what happens to a ton of leagues.

Live Services. I believe this includes eSports, things like Apex Legends, and Fifa/Madden Ultimate teams. This portion of the business is growing 27% annually, and I believe it has a long runway ahead of it. It is also a more consistent revenue stream than bulk-selling a game.

You can read EA’s earnings report here. If these catalysts line-up and we see consistent sales/cash flow growth from the company, we should see not only fundamental improvement but also multiple expansion (likely a 25-30 EV/FCF, but you can never be too exact with these things) over the next few years. That is why I think EA can outperform the S&P 500 and why I own it in my portfolio.

Individual Account

Trades Made:

None

No trades made this month. We are right in the heart of earnings season, with only one of my positions (EA) having announced their quarterly numbers so far. I do not trade on earnings, so unless there is a bomb of a report, expect nothing more than trimming and/or adding to positions.

I plan on holding these companies for as long as they are quality businesses with the potential to provide outsized returns over the long haul. That likely will not change after one quarterly result.

Portfolio Statistics

*New segment alert*

I recently synched-up my portfolio with Atom Finance and noticed they provide some interesting statistics on your portfolio. Here are some of my favorites that I plan on updating each month.

Average Consensus P/E: 53.8

Average Consensus EPS growth: 43.54%

Average Consensus Rev. Growth: 27.89%

Portfolio Diversity: 64.6% Tech, 10.8% Uncategorized, 10.6% Industrials, 6.2% Consumer Cyclicals, 5.86% Healthcare

As you can tell, I lean towards being a growth-to-value type of investor.

Stocks on My Watchlist (Dropped Starbucks, Mercadolibre, added Semler Scientific)

StoneCo

Sea Limited Co.

Telaria

Roku

Match Group

Target

Semler Scientific

Roth IRA

Trades Made:

none

Annualized Portfolio Performance

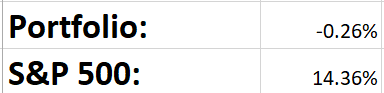

I am still in the hole from some rookie mistakes a year or two ago. However, the last 3 months have been solid for the portfolio, up 10.75% vs. the market’s 6.72%. That’s not a terribly long time period, but hey, at least it is heading in the right direction. Looking back, it’s amazing how ignorant and stupid you can be as a rookie investor, and how refined my style has become in the last year.

Alright, that’s it for my January 2020 portfolio update. Make sure to follow us on twitter @chitchatmoney, subscribe to this newsletter if you haven’t already, and check out our podcast here for more of our content.

See you in a month,

Brett Schafer

*I am not a financial advisor. Nothing I write is advice or a recommendation.