*If images don’t show up in the email, try the web version.

Brett here.

This is my first crack at a portfolio update. I’m sure it will fluctuate and change, but right now Ryan and I each plan on writing about our personal investments once a month, along with our mock portfolio that we’ve been running for almost a year now. That comes out to three newsletters delivered to your inbox monthly.

Since most of you don’t know anything about my investing style, on this first post I’m going to do a small preamble about my approach. I like to (or, at least try to) keep my investing simple, by buying quality businesses at a reasonable price and holding for the long-term. Since I am 22 years old with little responsibilities outside my own wellbeing, I can afford to have an extended time horizon.

I’ve learned my lesson on speculative investments (lost about $1000 betting on a penny stock in 2017), so I try to stay away from anything but the simple buy-and-hold approach.

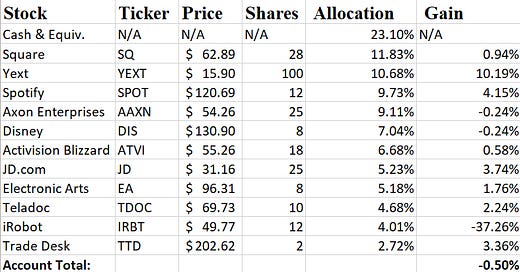

With that out of the way, let’s talk about how my portfolio is set-up. I have two accounts, both housed at Charles Schwab. The first is a regular investing account, where I own 8-15 individual stocks. The other is a ROTH IRA where I plan on buying and holding broad market ETFs for, well, as long as I can.

Individual Account

I have so much allocated to cash at the moment for two reasons. One is the fact I am going on a trip this spring that I’ve set aside a few thousand bucks for. The other is because I’ve set a limit order for JD.com at $29 a share for 25 shares. Exclude that and I’m at about 5% cash.

I also need to set-up the starting date for this portfolio, which does get a little tricky. Everything except iRobot was bought on or around October 11th of this year (when I switched to Schwab from my Robinhood account), so I’m going to say that is my starting date.

Why do I care about the starting date? Because that is what I’m going to use to calculate the returns of the S&P 500 and compare it to my own. I’ll start doing that next month.

In subsequent months I’ll highlight some of the stocks I own and why, but I think that is good enough for this inaugural post.

Stocks on My Watchlist

StoneCo

Sea Limited Co.

Telaria

Sonos

Mercadolibre

Starbucks

Roku

Match Group

Target

Roth IRA

Not much to say about the Roth. All I plan on doing here is dollar-cost-averaging into these ETFs for the foreseeable future. Eventually, I want to max this portfolio out since all capital gains are tax-exempt after a certain age.

Alright, that’s it for my first monthly portfolio update. Make sure to follow us on twitter @chitchatmoney, subscribe to this newsletter if you haven’t already, and check out our podcast here.

See you in a month,

Brett Schafer

*I am not a financial advisor. Nothing I write is advice or a recommendation.