YouTube

Spotify

Apple Podcasts

This article is playing off of the famous Warren Buffett Op-Ed during the Great Financial Crisis. I doubt it will be as eloquent. I know it will get a tiny fraction of the readers.

Investors can’t get enough of United States stocks right now. The S&P 500 has posted a total return of 33.9% in the past year, 15.7% in the past five, and 13.2% in the last 10. Phenomenal. Nasdaq 100 holders have done even better.

The S&P 500 trades at a P/E of 30.4 — a 3.3% yield — compared to a 4.4% yield on the 10-year U.S. treasury.

I struggle to find attractive opportunities in the United States, especially among mid and large-cap stocks.

This is why my gaze has gone international. Mexican, Latin American, Swedish, and Japanese companies look wildly attractive vs. U.S. equities at the moment.

But especially Mexican stocks. Its economy is primed to boom while stocks trade at low-growth multiples.

The re-shoring narrative in Mexico is real and will only accelerate if the United States gets more hawkish on China.

GDP per capita in Mexico is already soaring, up from $8,896 in 2020 to $13,926 in 2023:

Foreign direct investment is hitting an all-time high. Prominent companies such as Foxconn and Taiwan Semiconductor Manufacturing are planning to invest in the region.

Mexico is about to become an industrial powerhouse. More workers will move from low-paying work (agriculture, for example) to higher-paying manufacturing roles.

According to the OECD, the average household income in Mexico is $16,000 USD a year. As this grows, households will have more money to spend on discretionary items.

You can move into a new, more spacious house. Or upgrade your existing one with modern HVAC systems. Take that vacation to the coast. Eat out at restaurants. You get the point.

It will be a multi-decade journey, but Mexico has everything at its disposal to join the Western and East Asian nations with $50k+ GDP per capita.

Let’s not forget its optimal population pyramid. The country’s largest population groups are aged 10 - 30. All these people will enter their prime spending years (30 - 50) within the next few decades, start a family, and (hopefully) spend their growing incomes.

With ideal economic conditions, where do we find Mexican stocks? Trading at dirt-cheap multiples. Perhaps a third or a fourth of what you would find in the United States.

Are you really going to pass on these stocks because of the Cartel boogeyman? Seriously.

You have Bolsa Mexicana de Valores, the Mexican stock exchange I covered in detail on this week’s podcast (ticker BOLSAA in Mexico and BOMX.F in the United States). It trades at a P/E of 12.2 and has a dividend yield of 6.5%. It is a duopoly with 80%+ market share.

Or Alsea (ticker: ALSEA). The restaurant operator for foreign brands like Starbucks and Domino’s Pizza sits at a P/E of 13.5, a 2.5% dividend yield, and has grown revenue at a 15% annual rate over the past 10 years.

(Note: all this information is getting pulled quickly from Finchat.io. Use our link finchiat.io/chitchat and get 15% OFF any paid plan).

Or Grupo Rotoplas (ticker: AGUA), which sells water equipment. It trades at a 4% dividend yield and should benefit greatly as Mexico enriches itself.

I could go on. We can’t forget the three airports, either: Grupo Aeropuertario Del Pacifico, Grupo Aeropuertario Del Sureste, and Grupo Aeropuertario Centro Norte. All three are high-quality companies with strong dividend payouts that should grow faster than the overall Mexican economy.

We didn’t even talk about railroads, housing stocks, or grocery stores. There is a plethora of cheap-looking stocks in Mexico at the moment. Not all are high-quality businesses, but they don’t need to be.

There is a lot more to research, which I plan to do on the podcast in 2025. The only one I feel comfortable buying today is the Mexican stock exchange, which I go over in detail in this week’s episode of the podcast (links at the start of this piece).

You can also check my show notes on the company below.

-Brett

Why a stock exchange is a wide-moat business

Stock exchanges are one of the first examples of Stratechery’s Aggregation Theory in modern capitalism. They aggregate supply and demand for financial assets, making it increasingly impossible for competitors to replicate as you maintain the most supply on your exchange.

Some may define this as a network effect, which I think is analogous but not entirely what a stock exchange does.

A stock exchange is a marketplace where financial assets are listed and available to be bought and sold by investors. In modern times, exchanges are almost entirely digital, and investors are buying and selling financial assets digitally through registered broker-dealers (for example, our sponsor Public.com).

Most countries have only one or two major exchanges supplemented by an over-the-counter (OTC) market for stocks that are public but do not meet the listing requirements of the major exchanges.

The competitive advantage of a stock exchange derives from aggregating the supply of primary listings (stocks, bonds, etc.) on the marketplace. This drives demand for the exchange. Investment bankers and backers of initial public offerings (IPOs) will want to list on the exchange with the most activity. Brokers will care about getting access to the exchange with the most listed financial assets (to improve the value proposition for their investing customers). And on and on it goes.

Being the custodial of financial assets is a high-trust operation. As an exchange gets older and older, the brand gets trusted more and more. Would you rather list on the New York Stock Exchange or a random upstart exchange with zero listings?

We can see this play out with how lindy stock exchanges are. The Lindy effect is an idea that the longer something has been around, the better chance it has of sticking around in the future.

The London Stock Exchange began in 1698. The Tokyo Exchange in 1878. The New York Stock Exchange in 1792. All are still the dominant players in their fields today.

Which brings us to Bolsa. The Mexican Stock Exchange was formed in 1894 in Mexico City. In 1975, the company merged with the Guadalajara and Monterrey stock exchanges. In 1988, it started digitizing its systems, and without boring the readers, it has tried to digitize and internationalize its services ever since.

Today, it remains the largest stock exchange in the country and the second largest in Latin America with a total listed market capitalization of $530 billion (US dollars).

In order to further hammer home this vital point, let’s look at how upstart competitors fare when competing with legacy stock exchanges. Seven years ago, Mexico gave the green light to BIVA, a second exchange in the Mexican market. This rightfully spooked Bolsa investors as it broke its monopoly. BIVA has gained share, likely due to the fact it was the “new kid on the block” and the government wanted it to break up the 100% market share of Bolsa.

Now, we have a “terrible” situation for Bolsa. It is in a duopoly business with over 80% market share. A market share that has started to stabilize once the shine of BIVA has worn off. Oh no, the horror.

Should you be bullish on the Mexican economy? (Hint: Yes)

It’s no secret that we are bullish on the Mexican economy at Chit Chat Stocks. I have started to call the 2020s the Mexican decade.

Mexico's GDP per capita is starting to soar:

As a country’s GDP per Capita breaks through the $10k barrier and moves towards $20k and eventually even higher, discretionary spending increases rapidly. Why? Because more and more people now have leftover income after the basic essentials of food, shelter, utilities, and transportation.

You can spend that excess money on a nice restaurant meal for your family. You can take a week-long vacation to the beach. You can finally remodel that house and get a nice patio and HVAC system.

Or, you can save some of that money and invest it in the stock market. Due to this and the fact brokerages now have good products in Mexico (two different examples: Interactive Brokers and Nu Bank), the amount of retail brokerage accounts is soaring in the country:

I am confident that Mexico’s GDP per Capita will keep growing because of the changing strategic shift of the United States and its reshoring strategy. This is something you have probably read about before, so I’ll sum it up quickly:

China is acting more and more like an adversary to the United States

The United States relies on China for manufacturing goods, and does not like that

Mexico can replace this manufacturing supply

We are already seeing tons of demand for this. Recent headlines:

Mexico Sets Historic Record with $31.1 Billion in Foreign Direct Investment

Private Investors Looking to Capitalize on Nearshoring Trends Turn to Mexico

Foxconn building Nvidia superchip facility in Mexico, executives say

U.S. Tech Giants Turn to Mexico to Make AI Gear, Spurning China

As more high-paying jobs come to Mexico, Mexican workers will have higher disposable incomes. Higher disposable incomes mean more money to invest, which means more demand to buy stocks, ETFs, and index funds to save for retirement.

As the country gets wealthier, more companies will want to IPO and list on the public markets.

Both supply and demand should grow for the leading Mexican stock exchange if Mexico’s GDP per capita keeps growing. Which will lead to growth in revenue and earnings.

Discussion question: What is the weakest part to this reshoring thesis?

Bolsa’s business segments

Bolsa’s business model from a bird’s eye view is simple: it wants to aggregate financial assets on its marketplace. It just has a lot of different revenue segments that can overwhelm those who look for the first time.

Note: Once you understand Bolsa’s various businesses, the KPIs to track are revenue growth, EBITDA margin, volume traded, and capital formation

Here is a list of Bolsa’s different business offerings:

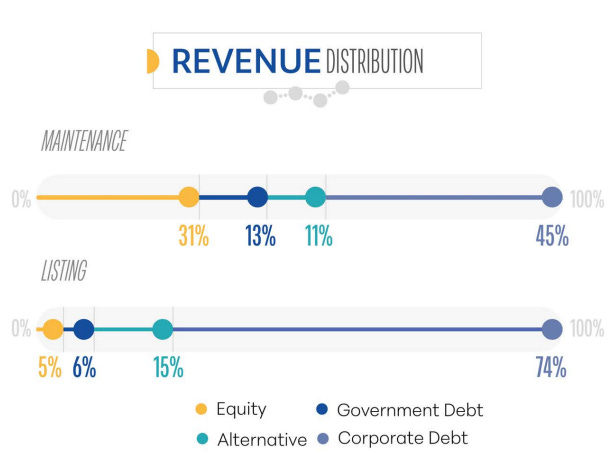

Capital formation. This is the listing and maintenance revenue for a financial asset to be tradeable on BOLSA. The company has struggled to attract new equity listings but has thrived in getting debt to be listed on its exchange. However, it is still earning revenue from existing listings that is classified as “maintenance” revenue.

Equity Trading. One I think readers will clearly understand. They earn money through trades. Also, a third of this segment is “value-added services” which are recurring revenues.

Derivatives Trading. Similar to equities, but with derivatives. Dollar futures and foreign currency trading are important here.

OTC Trading. Revenue associated with trading on OTC markets (including Chile).

Central Securities Depository. Custody, clearing, and settlement of financial instruments traded. This is actually Bolsa’s largest revenue driver, but it is not a majority of sales. I will also include its two clearinghouse segments here.

Market Data. Again, almost self-explanatory. They sell valuable market data to institutions that want it. There is a partnership with S&P to develop index benchmarks.

Price Vendor, Valuation, and Risk Management. Again, more value-added services.

I would incorporate four large buckets that drive Bolsa’s business model. You have the capital formation (listings), trading, depository/clearinghouse, and software/analytics.

All of these segments benefit from growing capital markets in Mexico. With more supply of financial assets and more traders, you will get more trading revenue, more listings revenue, and can sell more software/analytics services.

This is the fulcrum of the investing thesis. Can activity pick up in the Mexican stock market?

Note: This is for the equity trading segment to illustrate the growth of the debt markets but the stagnation of equity markets

Note: This is the combined trading revenue segment for Bolsa. Fine, but not explosive growth.

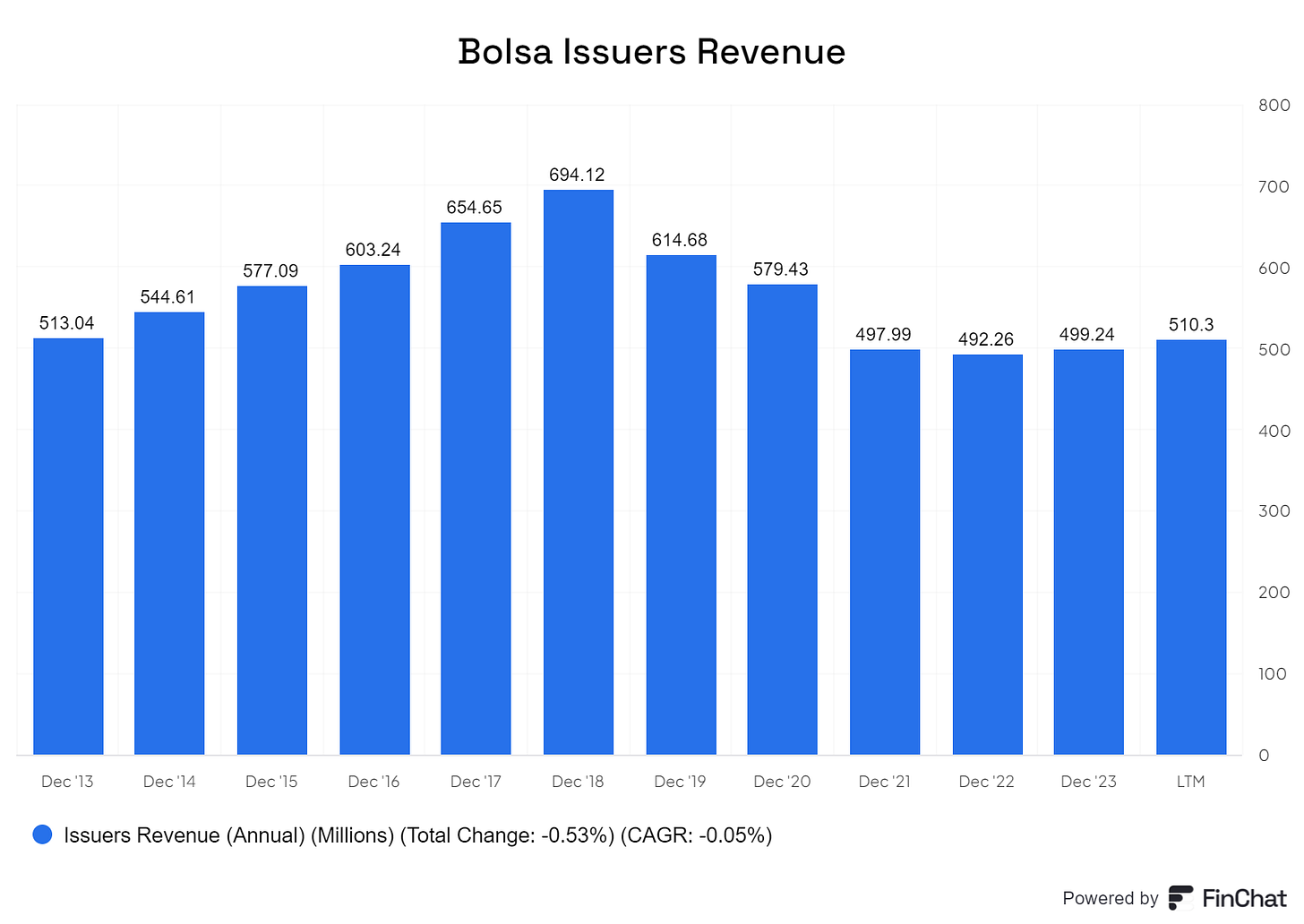

Note: Issuers revenue has declined but has stabilized in recent years. Stock listings have still not picked up.

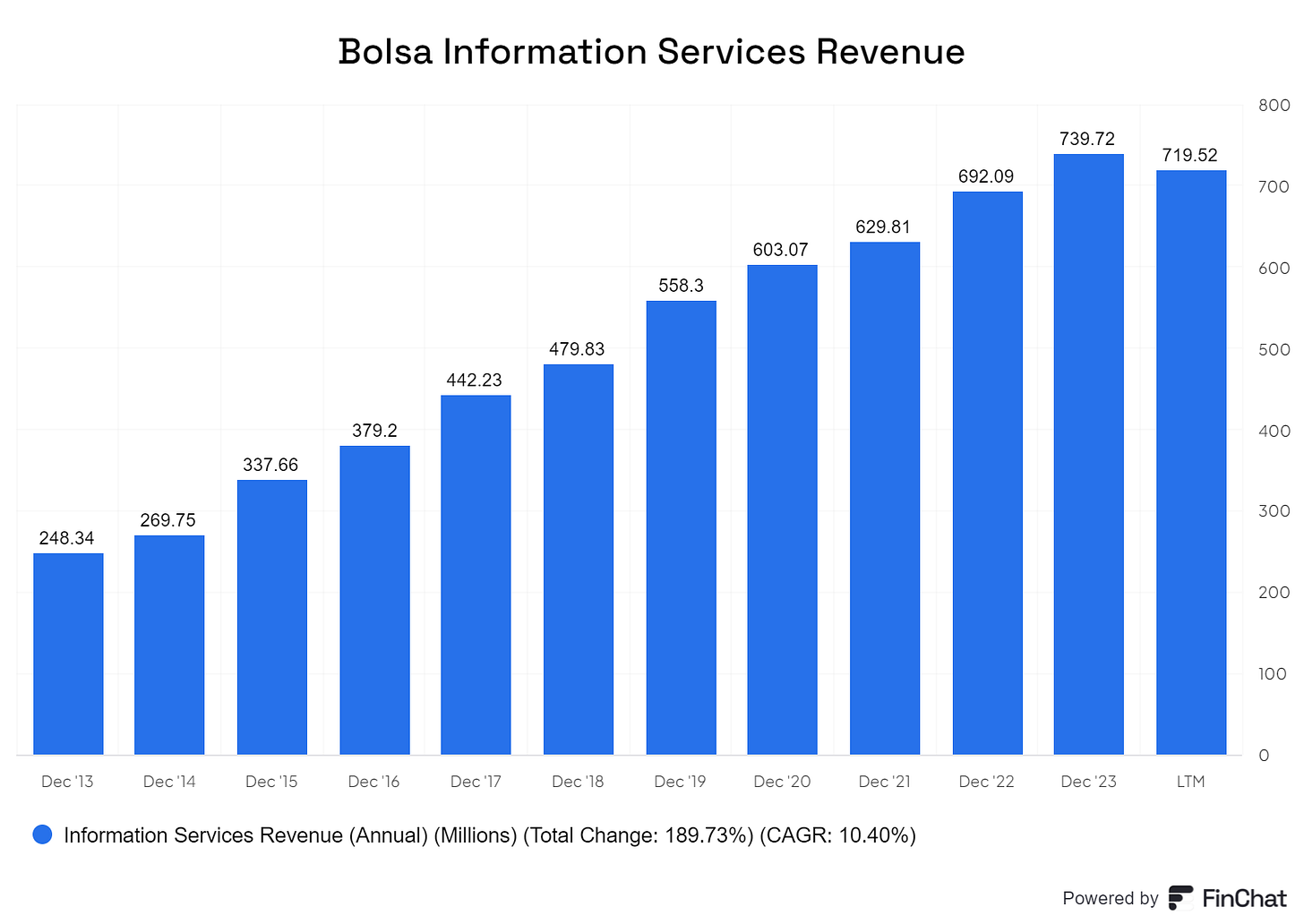

Note: Information Services has grown revenue at a 10% annual rate since 2013.

Fantastic unit economics, durable profitability, inflation protection

One thing we don’t have to worry about with Bolsa is unit economics. It has a few fixed costs (cloud, database, overhead) that barely scale with the business. It can grow without much capital reinvestment. Sounds like the perfect Buffett gross profit royalty operation.

No wonder the operating margin has been close to 50% or higher even in a trough earnings period:

EBITDA margin was 57% in 2023. It was 58% last quarter. I have no concerns over Bolsa’s ability to extract profits from the financial ecosystem as long as it can maintain a good enough scale. If it can’t, well the entire thesis is busted anyway.

Another tidbit I will highlight is the inflation protection afforded by a stock exchange. Most of this business has a pure inflation hedge. Higher nominal trading volumes = more revenue. More capital in the central depositories means more revenue. If you are worried about inflation, an exchange is a good place to hide (of course, at a reasonable price).

Working the numbers on Bolsa’s valuation

Typically, I try to find a reasonable growth assumption for a stock and work back to its valuation. What will it be earning in three years? Five years? And what will it be trading at? Then compare it to the current price.

With Bolsa, I want to look at its current earnings profile and then look forward to any cherry on top that comes from growth. We don’t need growth to make money here, just stable earnings. But growth would lead to 15%+ annual returns.

Over the last twelve months, Bolsa has generated 1.8 billion Pesos in operating income (per Finchat). It currently has a market cap of 18.5 billion Pesos, or just 10x its operating earnings. Chop off about 3 billion Pesos in net cash and you have an EV/EBIT of 8.6.

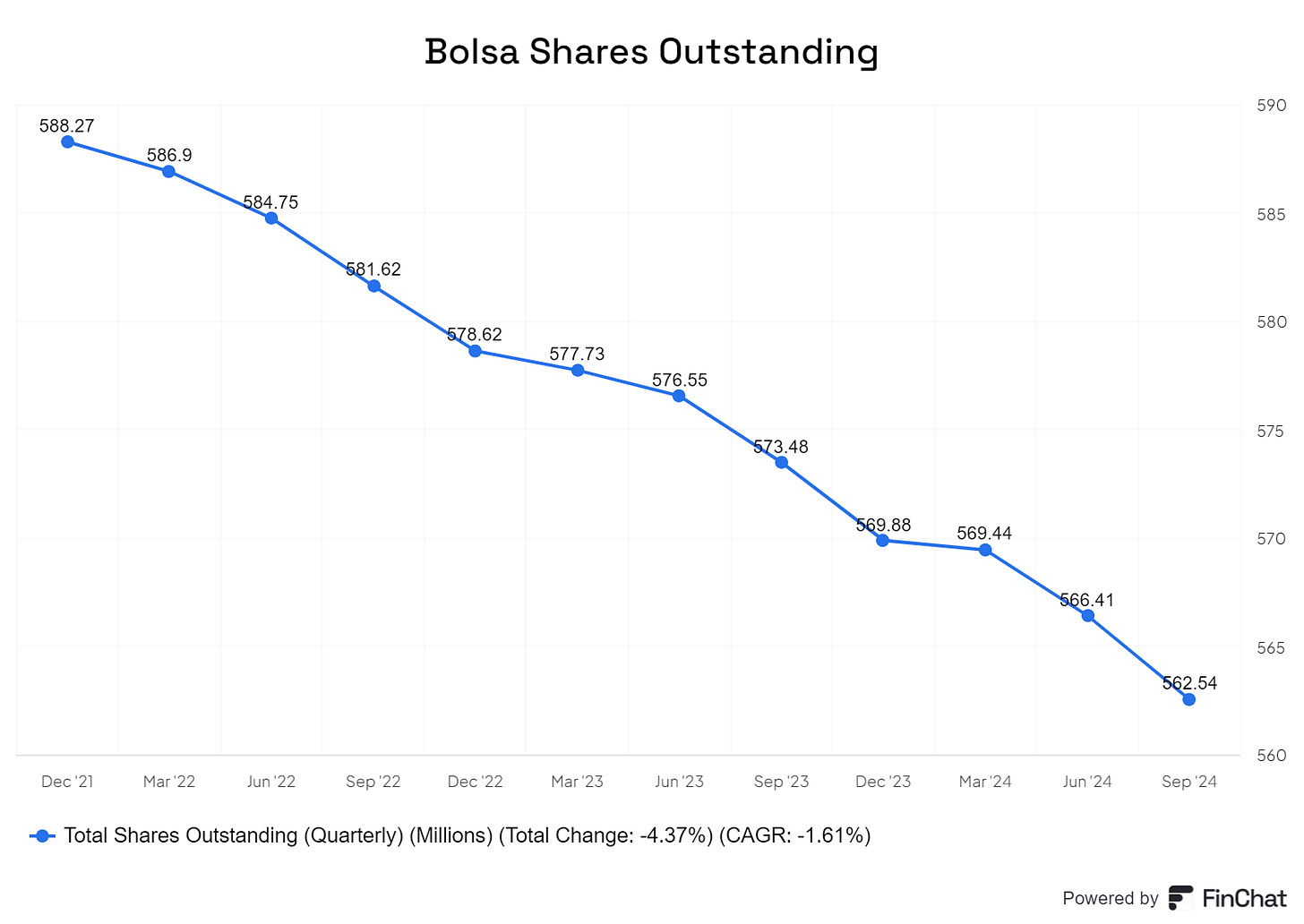

Bolsa pays a large portion of its earnings out as a dividend. A yield of over 6% today. It is also bringing shares outstanding down through buybacks, with the shares down at a 1.6% annual rate in the last few quarters:

Even if the Mexican financial markets do not come back to life, I believe through pricing power + inflation that Bolsa can maintain this dividend yield. You get a 6%+ annual return for being wrong. Not bad downside protection.

Of course, we could also see more multiple compression, but that has already happened to a major extent:

But what about the upside? I think there is a good case for the Mexican stock market coming to life over the next five years. We are really only missing one aspect of the equation, which I outline in the next section.

If the stock market recovers, we should see EPS grow in the double-digits due to revenue growth, slight margin expansion, and more buybacks.

Add on some multiple expansion + the dividend payouts and I think you can get a comfortable 15% return.

The major risk

There are a few risks to an investment in Bolsa. You are tied to the Mexican Peso, which could devalue. I can’t tell you how likely that is, and it doesn’t concern me much.

The reshoring narrative and GDP growth in Mexico might fall flat. Given all the stuff I am reading, that seems unlikely, but it is not an impossibility. Even if that happens, I still think we make money.

The key risk here is getting energy into the equity listings on Bolsa. This is the fulcrum of the investment I mentioned at the beginning of my report. I have a real fear that Mexican companies don’t want to list on Bolsa or would rather just list in the United States. If I were a globalized company based in Mexico, why wouldn’t I list on the NYSE with maybe a secondary listing in Mexico? The capital markets are deeper.

The good news is that we are seeing a ton of demand for debt offerings on Bolsa in 2024. The bad news: there have been zero equity offerings.

This is the one KPI table I will be following closely with Bolsa. If equity offerings don’t improve within the net 5 - 6 quarters, I would consider selling.

Portfolio management (How I plan to manage the position)

A few weeks ago, I made Bolsa a core buy-and-hold position in my Roth IRA. it is an approximate 5% position, and I wouldn’t be opposed to bringing it up closer to 10% over time.

I do not plan on reinvesting dividends. I will choose whether or not to reinvest more funds into the stock myself.

The plan is to hold Bolsa indefinitely until the business tells me I am wrong about my thesis or Mr. Market gets crazy. Getting crazy would be something like 40x earnings if it is growing earnings by ~10% under my bull scenario.

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

looking forward to a good series here. there is some analogies to the singapore exchange a few years ago when listing on china\HK became less attractive for those not punished by the CCP for leaving.

humor us a bit, and please comment on those specific mexican companies that look least vulnerable to Cartel and corrupt gov 'tax'.

on a related note, there was a very good post this week on bolsa, listing 5 KPI more important than new equity issues. (although they do acknowledge the problem)

given one should not expect this type of value stock w/out SOME problem, i am leaning towards forgiveness here.

https://mokapucapital.com/grupo-bmvbmvbolsaa-2024-annual-portfolio-review/