Can We Talk About a Weakening US Dollar?

A potential reversal in a multi-decade policy for the United States

YouTube

Spotify

Apple Podcasts

(On this Sunday’s podcast, we discussed some growth stocks in a drawdown, Delta’s guidance revision, and whether Buffett actually was timing the market with his cash balance. Listen at the links above!)

Let’s talk about a weakening US dollar.

A member of our Substack chat group asked about what stocks would benefit from a weakening US dollar during the Trump administration.

This weekend, the Wall Street Journal had an illuminating article highlighting why the new executive branch wants a weak US dollar. Long story short, a weak US dollar aligns with their policy goals of bringing manufacturing back home.

Here are some key quotes from the article:

“Now, though, Trump and some of his advisers are making it clear that they want to expend fewer resources protecting allies. And they are saying they want a weaker currency to boost domestic manufacturing, by making goods cheaper to foreign buyers.”

“Many on Wall Street, however, fear the downside of such changes. A weaker dollar would make imports more expensive, boosting inflation and making it harder for the Federal Reserve to cut interest rates. Outflows from U.S. assets that depress the dollar could also drive down stock prices and lead to higher U.S. borrowing costs.”

“The euro has temporarily gained against the dollar at other times in recent decades. But this time the move could be durable because what Europe is promising is “not just a one-off thing, like the Covid stimulus,” said Sonu Varghese, global market strategist at Carson Group, a financial advisory firm.

So far, the decline in the dollar’s value has been modest, hardly enough to make a major difference for U.S. exporters.

Even so, the move has caught Wall Street’s attention because it is consistent with Trump’s long-held ambitions. Trump has often argued that the dollar should be weaker, claiming last year that the currency’s strength was “a disaster for our manufacturers.”

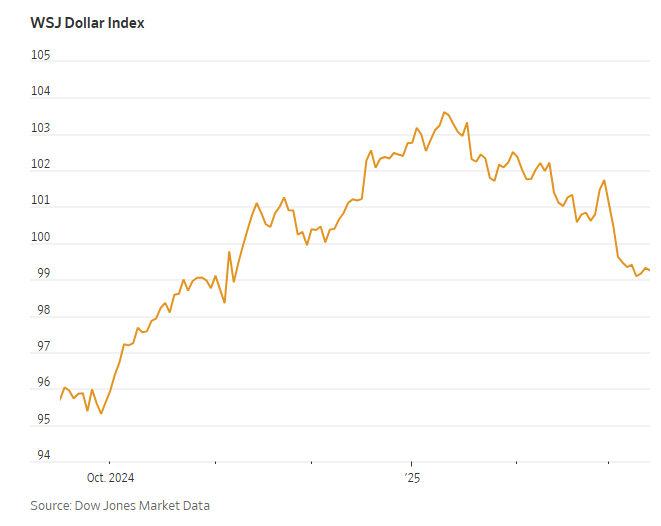

The US Dollar Index has moved lower in 2025, but it is barely back to where it was on Election Day in the United States:

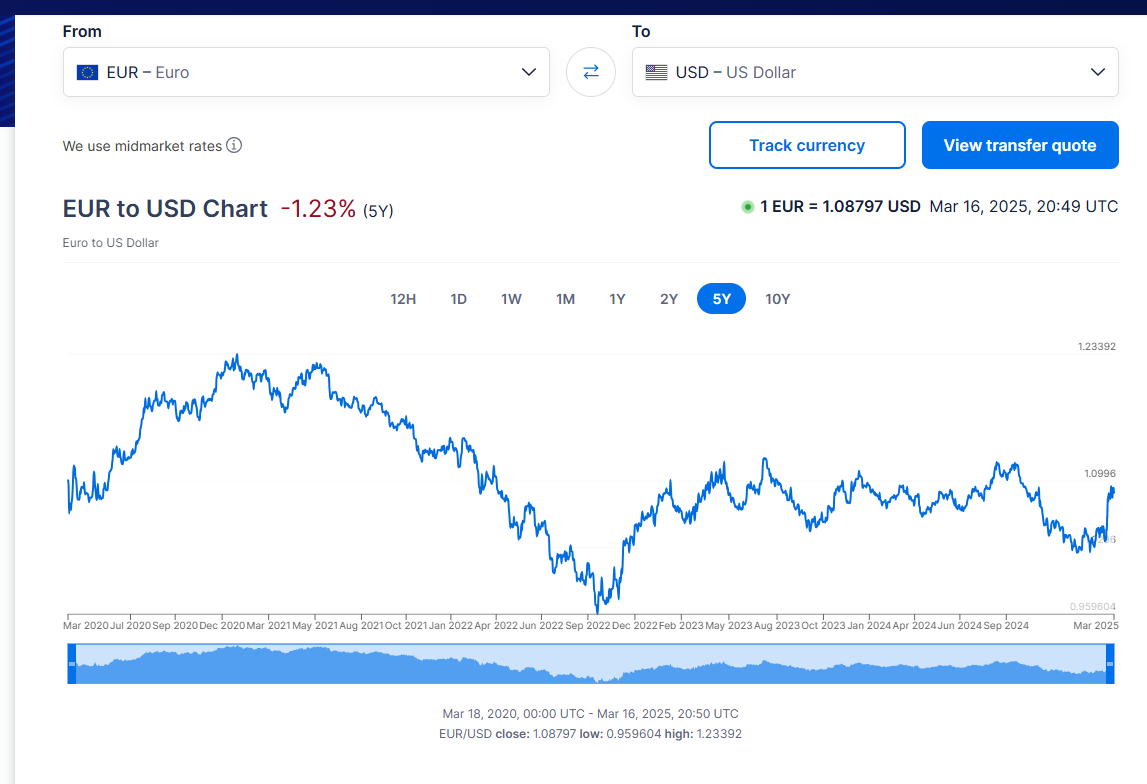

We are seeing movements in the Euro, Mexican Peso, and Japanese Yen but are still nowhere near recovered from the post COVID surge in the dollar:

Again, let me reiterate: the people currently in charge of the US government would like a weaker US dollar. They are not guaranteed to succeed (and they may change course next year), but they will do everything in their power to make it happen. The Plaza Accords provide historical precedent.

Personal opinions on this policy aside, we need to invest in the world as it is. Here is how I think about the US dollar and my portfolio:

A strengthening dollar benefits companies with expenses outside of the United States that sell goods (or services) in the United States. This is why China manipulates its currency to be cheaper vs. the US dollar, because it makes it more attractive to manufacture goods in the country. The US government calls this an unfair trade advantage.

A strengthening dollar benefits individuals that earn in US dollars but spend it outside the country. The prime example is wealthy US citizens taking international vacations.

A weakening dollar benefits companies with expenses in the United States that sell in the United States and internationally. This trickles through to the workers at these companies, with the idea being that a weaker dollar benefits the middle class.

I am writing as an investor who cares about my purchasing power in US dollars. You might care about another currency, so think about your personal situation.

A portfolio laden with US companies that outsource expenses to cheap foreign countries will do poorly with a weakening US dollar. These companies — generally megacorporations in consumer goods, electronics, and technology — have benefitted from a strong dollar.

A portfolio laden with companies that operate outside the United States (or the rare company with the majority of its costs in the United States but sells internationally) will benefit from a weakening US dollar.

Most of the Mexican Airports generate revenue in Mexican Pesos (although parts of the business are tied to the dollar). The Majority of Coupang’s operations are in South Korean Won. If these currencies appreciate vs. the US Dollar, revenue and earnings growth in US dollar terms will quicken. Which is what I care about.

You could even dive into some second order effects. A sustained weak US dollar should help boost the middle class and weaken the purchasing power of the wealthy. American Express might get hurt while fast casual restaurants benefit. Not sure if that is an investable thesis but it makes sense to me.

I invest with the goal of owning high quality assets with global diversification. Global diversification gives you a more robust and antifragile portfolio in the face of foreign currency movements. Anyone with a portfolio entirely made up of US multinational consumer goods and technology players is not going to enjoy a weak US dollar.

With how my portfolio is constructed, I think I will do fine regardless of how the US Dollar Index moves over the next five years, and my purchasing power in the currency I care about will be retained.

What are some stocks that will benefit from a weak US dollar?

-Brett