GoGo: A Wide Moat At a Free Cash Flow Inflection? (Ticker: GOGO)

A full one hour podcast + show notes (for free)

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Show Notes

Financial history and how we arrived where we are in 2024:

Gogo is not a sexy stock. When searching on YouTube and Spotify, I found minimal coverage from traditional financial media and indy channels. You might have a perception of the “GoGo Inflight” service on commercial airlines and its lackluster performance (as well as the easy-to-see poor negotiating spot that service has with the large commercial airliners). The stock chart is also underwhelming:

However, I think this might be a fascinating opportunity, a potentially high-moat business, and a double-digit free cash flow yield with a cleaned-up balance sheet. So let’s get right into it.

First, we need to discuss how GoGo got to where it is today. I am going to gloss over some parts of the history but want to hit three things that are important for shareholders to understand.

In 2006, GoGo made the (lucky? smart?) decision to buy exclusive spectrum from the FCC for $31 million. What is Spectrum? “Spectrum refers to the invisible radio frequencies that wireless signals travel over. Those signals are what enable us to make calls from our mobile devices, tag our friends on Instagram, call an Uber, pull up directions to a destination, and do everything on our mobile devices. The frequencies we use for wireless are only a portion of what is called the electromagnetic spectrum.” Spectrum is what all internet service providers like GoGo use to make their services work. For GoGo, this access to exclusive spectrum is important. For one, the FCC is not going to give out any new licenses (it is too valuable). So nobody can compete with GoGo directly with an exclusive spectrum product. This is vital to understand because this exclusive network is what gives GoGo much more reliable internet speeds vs. any business jet competitor in North America today (more on this in the competition section).

Oak Thorne was brought in to turn the business around in 2018. Throne and his family own over 20% of GOGO stock, while a private equity firm called GTCR owns 25%. I think this is important because the company now has an aligned CEO who also knows the industry extremely well. As a note, Thorne is fairly old and the PE firm has been with GOGO for a while, so I wouldn’t be surprised if the company decided to sell itself if they successfully launched these two new products (5G and LEO).

GoGo decided to sell its commercial operations in 2020 to Intelsat for $400 million. In hindsight, I would call this a fantastic decision as it infused the company with cash at the right time (the balance sheet is now cleaned up), got rid of a low-quality business, and gave GoGo the financial flexibility to invest aggressively to launch its next-generation products.

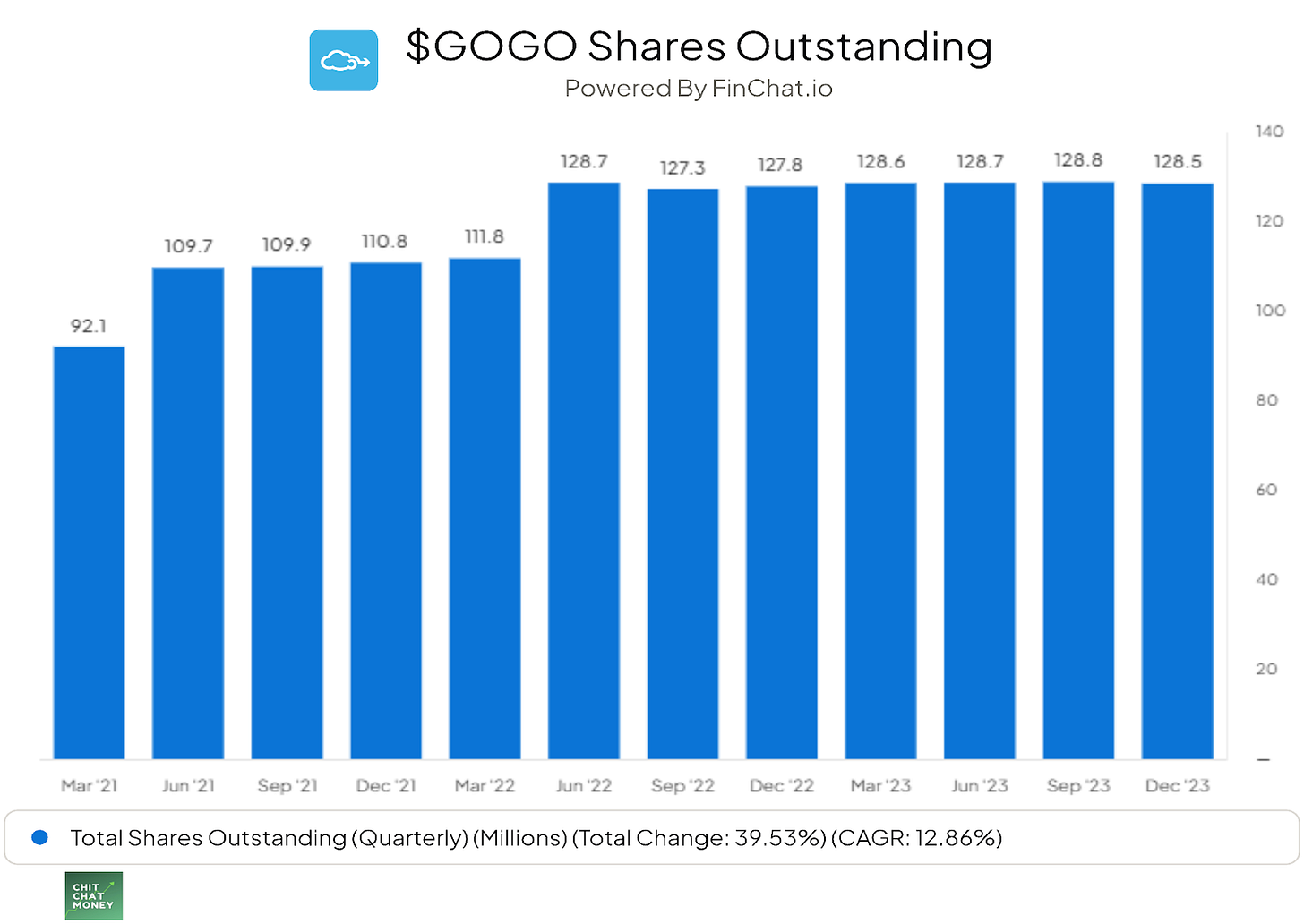

Here are two charts to help readers/listeners understand the capital structure. First, we have a change in long-term debt. Second, we have shares outstanding. GoGo decided to dilute shareholders a bit to clean up the balance sheet (some convertible notes were converted too) but I think that was the right move.

Note: In late 2023 and early 2024, GoGo’s management started returning cash to shareholders through buybacks.

What does GOGO offer business jet customers today?

With its exclusive spectrum in North America, GoGo is now focused primarily on serving private jets with internet service in this market. But how does this service work?

GoGo outfits cell towers across North America with antennas that beam its exclusive spectrum in the skies. They make interlocking cones that a jet can intersect with and connect with. On planes, GoGo outfits them with antennas and equipment made to connect with this spectrum. That’s the simple (and perhaps improper wording) way to say GoGo allows a private jet to reliably connect to the internet.

Within these existing solutions, GoGo has two sets of customers: legacy and AVANCE. The legacy customers have its 3G/4G solution which has capabilities for just fairly slow internet speeds (let’s say 10 Mbps and below). For anyone not fluent in Mbps, this would be fine for a phone call or messaging, email, possibly some other work, but terrible for video chatting or any streaming video. From an investor perspective, I see it as a valuable service for these private jet customers, but one that can be greatly enhanced if speeds can be improved.

AVANCE customers just mean customers that have equipment on the aircraft that the company calls AVANCE which can make a higher speed connection to its existing network. Importantly, AVANCE equipment allows an existing customer to upgrade to 5G with minimal additional equipment. Since the 5G network is not launched yet, these customers have not gotten higher speeds yet.

At the end of 2023, GoGo had 7,205 total ATG (air-to-ground) aircraft, with 3,976 having the AVANCE equipment. These are important KPIs to track for the company.

This is a good time to look through the total amount of business jets in operation globally. According to the Q4 call, there is an estimated 39k business jets in the world, with just over half of them coming from the United States. However, due to long product lifecycle and difficulty going in for maintenance to specifically add internet connectivity, only a small portion of these planes actually have internet capabilities. Within the market, GoGo has a large market share (more on this in the competition section).

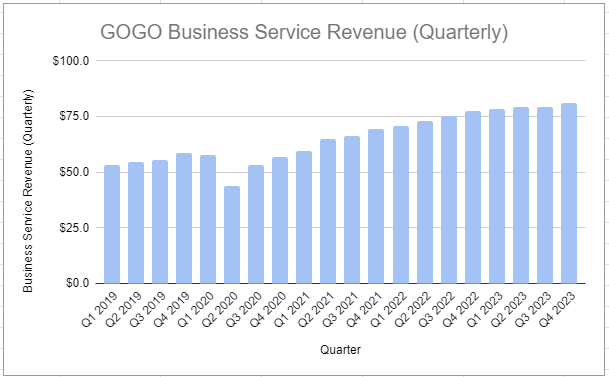

Here are some stats I compiled to show the growth of GoGo’s private jet business. Notice the small downtick in cancellations during the pandemic. These are price-insensitive customers with (generally) large budgets. Monthly ARPU is closing in on $3,500.

What does GOGO hope to offer business jet customers in the near future?

GoGo is planning two upgrades to its service: 5G and low earth orbit (LEO) connectivity.

GoGo 5G is an upgrade to the ATG service on the exclusive spectrum (so still only in North America). It will allow customers with AVANCE to seamlessly upgrade to faster internet speeds and reach modern capabilities. This should provide customers of GoGo a lot more value, which will give GoGo more room to raise prices.

The problem is – and this is perhaps the #1 reason the stock is down so much – that GoGo originally planned to have 5G launch multiple years ago. There were contractor issues, chip supply issues, and other stuff that frankly gets confusing. I think many investors and analysts are confused and frustrated with the company. However, this apparently has nothing to do with the technology but just getting the damn system set up.

The longer moonshot opportunity is the LEO product (GoGo Galileo) that the company is building in partnership with the OneWeb constellation. OneWeb is a Starlink-type company building an LEO constellation that can beam internet connectivity to anywhere on the globe. GoGo is partnering with them to offer high internet speeds for business jets not just in North America, but everywhere. This opens up a greenfield opportunity for them.

As a note, when customers are flying over North America they will be able to “double up” internet speeds if they are connected to both GoGo 5G and the LEO network, giving them very strong speeds.

Financial situation today

Here are some charts outlining GoGo’s financial position:

GoGo’s long-term financial charts don’t look that great. But readers/listeners need to remember that GoGo cut out a big chunk of its business in 2020 when it sold the commercial avation unit. Since Thorne has arrived, the company has posted stable gross profit numbers (excluding a small downtick during the COVID-19 pandemic) while turning the busines to operating and free cash flow positive in 2021 - 2023.

From a balance sheet perspective, the company’s main debt is now its term loan facility:

“As of December 31, 2023 and 2022, the outstanding principal amount of the Term Loan Facility was $606.9 million and $714.1 million”

This is a variable rate loan. They have some hedges in place. As a cash flow positive company with $140 million in cash on the balance sheet, low amounts of current interest expense, and the term loan not due until 2028 (I think) there is not a concern about this balance sheet. I would expect them to continue paying down debt if they keep generating positive free cash flow.

Competition: Why the existing business is high quality/high moat

In this section we are going to look at the lack of competition, GoGo’s easy defense from competition, and why the company is high quality due to where its sits in the aviation value chain.

To reiterate, GoGo has zero competition from an exclusive ATG network since nobody else has the spectrum. I would expect this to continue as long as the use the network. Some companies have tried with unlicensed spectrum, but that will inherently have a worse product because there is a ton of interference over big cities.

The competitors investors are worried about are the other satellite providers, most notably Starlink. Long range satellites (GEOs) are the legacy competitors to GoGo. These are satellite 20k miles away from earth that blast internet connectivity around the world. They require very expensive and sizable equipment on your plane to run, which makes it only usable for larger jets that are jetsetting around the world (the most spendy private jet goers).

A LEO constellation like Starlink solves some of these issues. It has better latency and global coverage. We’ve even seen Elon Musk himself set up a prototype on his private jet which apparently works. The problem is, these LEOs at the moment still require large pieces of equipment in an aircraft, which only works for the bigger private jets. The company is also apparently working to sell to private jets for $25k a month, so much more expensive than GoGo.

So GoGo wins out on price, and when its LEO product launches with OneWeb it will have an equivalent product to Starlink. If you add on the North America, it will have better internet speeds for a much lower price. For existing AVANCE customers, they will require no new equipment, which gives GoGo a competitive advantage. There are major switching costs here.

I find it hard to believe that many customers outside of the largest jets will choose Starlink instead of GoGo, especially if they are existing AVANCE users. It doesn’t make sense from a time spent perspective, cost, or speed. However, this is if (and perhaps the only if we need to ask) 5G and LEO launch smoothly. I doubt SpaceX cares about a few hundred million in revenue from a small niche of the industry, either. They are going for the broad market audience.

I think GoGo is defending its moat and will likely succeed in keeping its moat defended. But what I also like about this business is that it is a relatively low cost product in the value chain with strong negotiating leverage.

Here is how it adds up:

GoGo is the best and only reliable product in North America

Operational costs on a private jet are estimated to be $1 million a year. A customer’s full annual budget (whether business or individual) is likely in the millions each year

GoGo costs around ~$3k a month, making it an inconsequential purchase for the value

It is negotiating with each customer instead of an entire airline, giving it better pricing power

Yes, there are the NetJets of the world, but these companies are not going to use someone else if GoGo clearly has the best (and really only) product out there. Importantly though, NetJets just signed a 10 year contract extension with GoGo that will bring on 5G and LEO too.

Long story short, as a small piece of a customer’s budget, GoGo’s internet services have strong pricing power. If they launch 5G and LEO successfully, I think they could raise prices for 5% indefinitely and see minimal churn from existing customers.

Potential cash flow inflection from 5G and GOGO Galileo + moat expansion

Building two new products at the same time is expensive. Revenue growth has also slowed down with these delays as customers wait for the new upgrades. This means we are seeing slowing revenue growth at a time when GoGo is doing a lot of one-time expenses.

In 2024, the company is expecting to generate just $20 million - $40 million in free cash flow.

However, in 2025, they expect to generate $150 million - $200 million in free cash flow if both products launch on time. This will couple with steady double-digit revenue growth for the next five years:

“Now turning to our long-term targets. We recently updated our long-term model, which reflects the launch of Gogo 5G and Galileo in the fourth quarter of 2024 and the build-out of the LTE network and associated customer conversion related to the FCC reimbursement program by 2026 our long-term targets are as follows. We expect revenue growth at a compound annual growth rate of approximately 15% to 17% from 2023 through 2028 at Galileo contributing to revenue beginning in 2025. We expect to continue to expect free cash flow in the range of $150 to $200 million in 2025.”

A few things attract me to this situation. The company’s legacy business is highly attractive, generates positive free cash flow, and is virtually impossible to disrupt. On top of this, there is an opportunity to see free cash flow inflect higher, which I don’t think is priced into the stock.

Then the cherry on top is the potential for significant moat expansion in the next few years. The more customers that choose AVANCE, the more customers there are with huge switching costs if they ever wanted to go to a competitor. But why would they want to switch if GoGo is the only company that can provide the best in-flight connectivity globally (and especially in North America)?

Thoughts on management? Do I trust them?

I like the management team. Thorne knows this business well, isn’t a consultant robot, and has a ton of skin in the game with his family office. I think he is aligned with shareholder interests and cares about creating shareholder value over the long-term.

One benefit (or maybe downside) is that Thorne has sold companies in the past. There is also a large PE firm with a stake here. They could decide to sell the business if the stock goes up a significant amount. That will be great for a 2x - 3x gain, but could cap some further upside given how moaty this business is.

I like that the management team has started to repurchase stock. It shows to me that they understand excess cash flow should be returned to shareholders. I also like the commercial aviation sale. Using the term “outsider” is cliche, but they seem like sharp operators that I would trust with my savings.

Is the stock cheap? Will I buy shares?

I will be buying shares of GoGo stock, using our internal trading guidelines. The stock has a market cap of $1.12 billion and roughly $500 million in total debt on the balance sheet. Let’s say the EV is approximately $1.6 billion.

If the company hits its $200 million FCF target, it’s easy to see how the stock is cheap. And once it hits this threshold, I can comfortably say it will generate at least that much every year going forward due to its pricing power and high incremental margins.

$200 million in cash flow on a $1.6 billion EV is a 12.5% FCF yield. What this means is either GoGo will start eating its entire shares outstanding or the stock will rip higher (eventually it will have to rip higher). I like these situations.

I think it is likely that business jet usage continues to grow each decade. I also think it is highly likely that in 10 years most jets will have internet connectivity. This provides a secular tailwind for GoGo.

The downside is limited-ish. What I mean by this is that the existing operations can still generate cash, pay down the debt, return cash to shareholders if the company fails to expediently launch 5G and LEO. I don’t think the stock works well and there might be some take-under risk, but I am not concerned about a huge permanent loss due to the cleaned-up balance sheet.

What could go wrong? What risks are we watching out for?

There are two risks I will be watching for.

Technological innovation. With the entrance into the global market and some well-capitalized potential competitors (Amazon, SpaceX), GoGo has some risks there is a huge technological breakthrough at some point in the next decade that leads to a moat erosion. This would leave them vulnerable to competitive pressures, erode pricing power, all that good stuff. Nobody knows how likely this is, but there are risks here.

5G keeps getting delayed. LEO starts getting delayed (hasn’t been delayed yet, apparently). If 5G doesn’t launch successfully they are opening themselves up to more competition over the long run, and frustrated customers.

Sources and Further Reading

Business Breakdowns with CEO: https://www.joincolossus.com/episodes/90983440/thorne-gogo-internet-for-private-jets?tab=transcript

GoGo IR team:

VIC write-up: https://www.valueinvestorsclub.com/idea/GOGO_INC/4887320127#description

Interesting company that I have not seen before! Thanks for posting and I will be looking further into this company as a potential investment!