Have Food Brands Lost Their Pricing Power?

Plus more from this week's Investing Power Hour live podcast episode!

YouTube

Spotify

Apple Podcasts

I have a new goal to write for our Substack/newsletter at least 30 minutes uninterrupted every day. Fair warning, this will mean more newsletters in your inbox (but no more than two per week).

On this week’s Power Hour, we discussed the ugly Starbucks earnings. Companywide comparable transactions growth fell to negative 6%, which was a drastic shift compared to 3% growth in the two prior quarters.

We talked for a while specifically about Starbucks and why the future is quite uncertain for this stock. After recording, it got me thinking of the struggles other large food brands (whether fast food or packaged goods) have gone through in recent quarters.

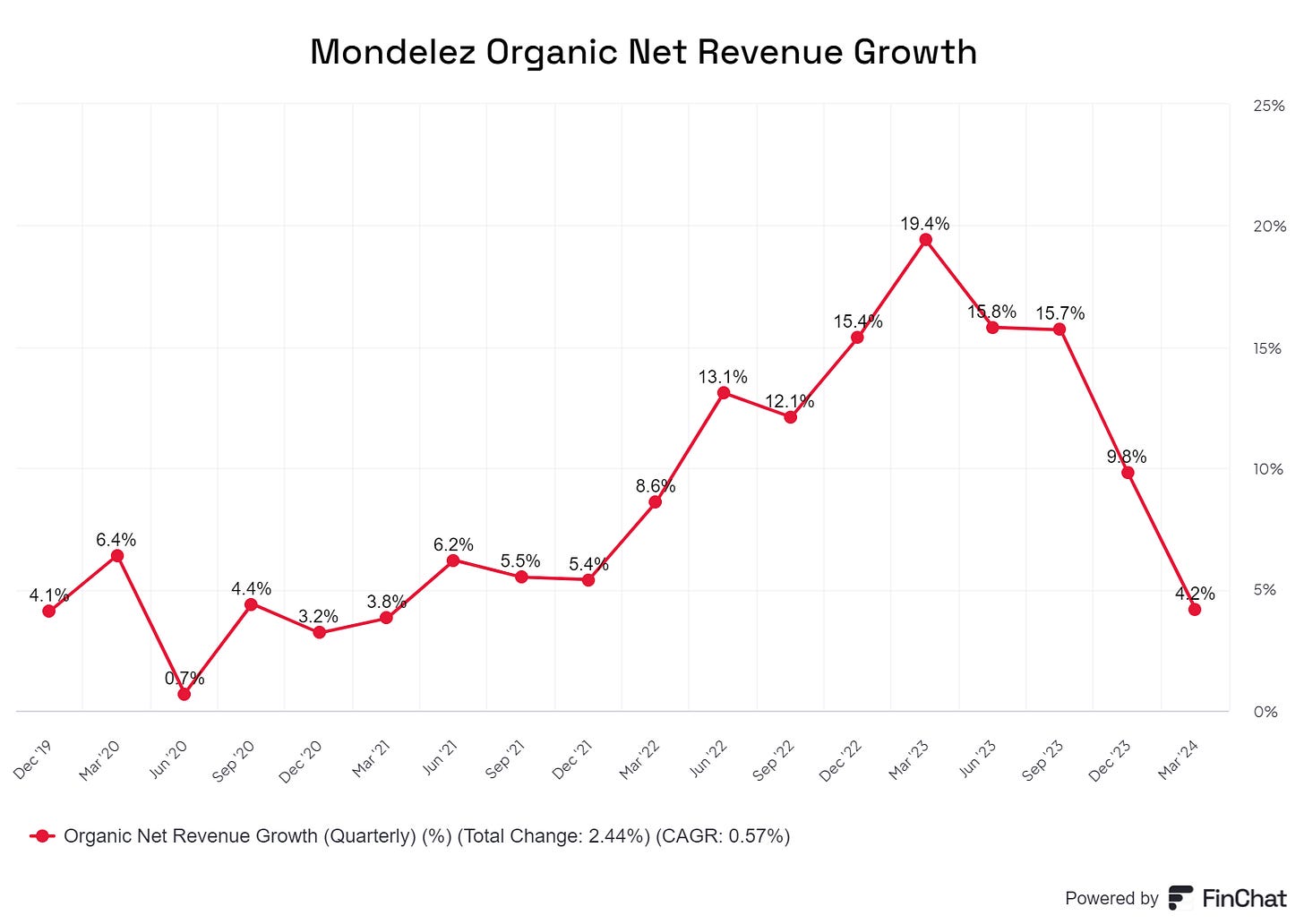

Here are some charts from our friends at Finchat.io to illustrate what I mean:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

The trend seems to be worse for restaurants, but some of these charts for the CPG brands are organic revenue growth and not volumes. All are moving in the wrong direction.

For decades, we’ve been told that fast food and CPG brands (collectively: multinational food brands) are fantastic businesses because they can raise prices above the rate of inflation.

And this has been largely true post World War II. A snack food such as a bag of Lay’s Potato Chips is a small purchase at the grocery store. The consumer doesn’t notice (or doesn’t care) when the price of potato chips climbs from $0.10 to $0.20 and then $5 50 years later. As long as it isn’t a significant “hit” to the grocery bill.

The same can be said for a can of Coca-Cola or a McDonald’s hamburger. Or a cup of Starbucks coffee. A beautiful business model that has led to fantastic stock returns.

No company has infinite pricing power. Eventually, a Lay’s bag becomes too expensive, and a consumer will either switch to a different brand or give up the purchase altogether. If a regular bag of Lay’s was $100 at every United States grocery store and gas station tomorrow, unit volumes would fall 99%.

The question is: when do all these price hikes impact unit volumes and anger customers? I think we are approaching this zone today.

Yes, some of this is still some comps from the COVID overhang. Yes, the Starbucks CEO may not be the right person to lead the business. Yes, inflation has generally been high and angered people and is now subsiding.

But I would worry there is a material shift going on. What we “know for sure” about multinational food brands may not be true anymore.

There’s a difference between a company that can raise prices and not sacrifice unit volumes (the CPG and fast food brands of old) vs. one that has to think about how price hikes will impact unit volumes. Have these brands turned from the wonderful businesses Buffett espouses in his shareholder letters (i.e. those that don’t have to do a prayer circle before raising prices) to the opposite and just ordinary businesses?

Funny enough, there was an interesting piece in the WSJ this morning on this exact topic:

To hammer home the point:

“It’s not that I can’t afford it now…It’s the frustration that the same meal now costs nearly double what it did.”

Look, this could just be focused in California due to the recent legislation on minimum wages. It also may be some weight-loss drug impact. I’m not going to pretend it is a simple situation with one answer.

What I do know is it is possible these multinational food brands have hit the ceiling of how much they can squeeze from customers by raising prices. A lot of consumers are now frustrated and see the brands differently.

This may just be a small blip and a buying opportunity for those with a long-term time horizon. The future may look a lot like the past. But I am worried that the price hikes have gone too far and we have entered a new era in the food industry.

I am open to changing my mind if someone presents me with compelling data telling a different story 🤷

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Completely on point with your post today. Retail food has become more expensive and the portion sizes are shrinking at the same time. Consumers are quickly getting fed up with all of this as well as with elevated tip inflation everywhere. Even if you order food to go, you are presented with a digital screen asking for a tip. LOL.

I was at a baseball game with my family yesterday. Two margaritas = $25. I refused to tip the lady at the counter. Two burgers + fries + 2 root beers = $54! Wow.

After the game, we headed to a local mom and pop taco shop for dinner. Total bill for 4 of us $54. No kidding...we paid the same for dinner at the taco place as we paid for 2 burgers, fries and 2 root beers at the baseball game. And we were stuffed with the taco dinner...more food, better flavors and more fulfilling meal.

There are eateries where one can still get value for money and excellent food at that. Consumers are getting smarter about this stuff. Cheers!