Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Public.com!

Public.com has just launched its new high-yield cash account, offering an industry-leading 5.1% APY*. No fees, no subscription, and no minimums or maximums–just 5.1% interest on your cash. Sign up today at https://public.com/chitchatmoney

*As of 12/14/2023, annual Percentage Yield (APY) is variable and may change without notice. A High-Yield Cash Account is a secondary brokerage account with Public Investing, member FINRA and SIPC. Funds from this account are automatically deposited into partner banks where they earn a variable interest and are eligible for FDIC insurance. Neither Public Investing nor any of its affiliates is a bank. US only. Learn more.

Show Notes

What is the Hims and Hers business? (HIMS going forward) Give a brief history of this business

If we look at the HIMS 10-K, it defines its business as:

“...a consumer-first platform transforming the way customers fulfill their health and wellness needs”

In practice, this means HIMS does a few things. First, it runs a website and mobile application that allows doctors to offer telehealth consultations, manage electronic records, make digital prescriptions, and perform pharmacy fulfillment. HIMS is not allowed to own a medical practice, so it has to outsource its clinical doctors to these providers. However, if you read the fine print…

“the Affiliated Medical Groups were incorporated and established with our assistance for the specific purpose of providing clinical services to patients through the Hims & Hers platform and have no other operations or activities outside of the provision of services through the Hims & Hers platform”

For all intents and purposes, these doctors work for HIMS. The customer doesn’t know the difference. To simplify things on the backend, HIMS does NOT deal with insurance at all. Of course, this restricts what HIMS can legally have its doctors prescribe to patients, but it makes things much less complicated to not deal with insurance. Management believes the tradeoffs in not using insurance are positive for the company.

Second, HIMS runs two consumer-facing marketplaces – Hims and Hers – to connect people with these medical providers. It focuses on sexual wellness, hair loss, anxiety, and is expanding into weight loss.

Here is the front page of the Hims website:

Here is the front page of the Hers website:

As you can see, HIMS is going for the modern DTC style for its web layouts. Its products also have this same style as they are trying to build a modern-looking brand.

Importantly, HIMS is marketing a lot of its own products to consumers with either the Hims or Hers brand. For example, it recently launched Hims Hard Mints to help with erectile dysfunction in males. It plans to release more of these personalized products with an aim to differentiate itself from just a provider of generic over-the-counter drugs to people.

A customer journey on either Hims or Hers will start with landing on the website, finding what problem they have, scheduling a discussion with a licensed physician, and then buying the product. HIMS sells most of its products through a monthly subscription and delivers them to their doorsteps. Its overarching goal is to make it as seamless as possible for someone to buy these drugs/products.

To reiterate, HIMS does not deal with insurance. This is a selling point for people – especially younger ones – who can get frustrated with the healthcare system. Yes, you may pay a bit more out-of-pocket for your ED pills, but if it saves you a headache and a lot of time, it won’t matter in the end. That is why HIMS focuses on relatively cheap products.

Websites:

HIMS makes money the more people are ordering medication through its subscription offerings. Therefore, its goal is to attract more people to its website who are looking for solutions to things like ED, hair loss, and weight loss and convince them to get a subscription (or two).

To sum things up, HIMS:

Provides a telehealth service (but doesn’t deal with health insurance)

Has its own consumer brands that its telehealth service sells to customers

Sells products mostly through subscription offerings

Hims and Hers (just Hims at the time) was incubated by Atomic Labs in 2017. Its founder/CEO is Andrew Dudum, who was working for Atomic Labs at the time. He still has a relationship with this VC, but this is an extremely young business that has grown like gangbusters in the last few years. It went public through a SPAC during the bubble in 2021.

So, there is not much history. For any investor today, the two important things are:

HIMS is still run by its founder

It rapidly raised a ton of money through VCs and now the public markets, using the classic Silicon Valley blitz-scaling strategy

Historical financial overview, important KPIs

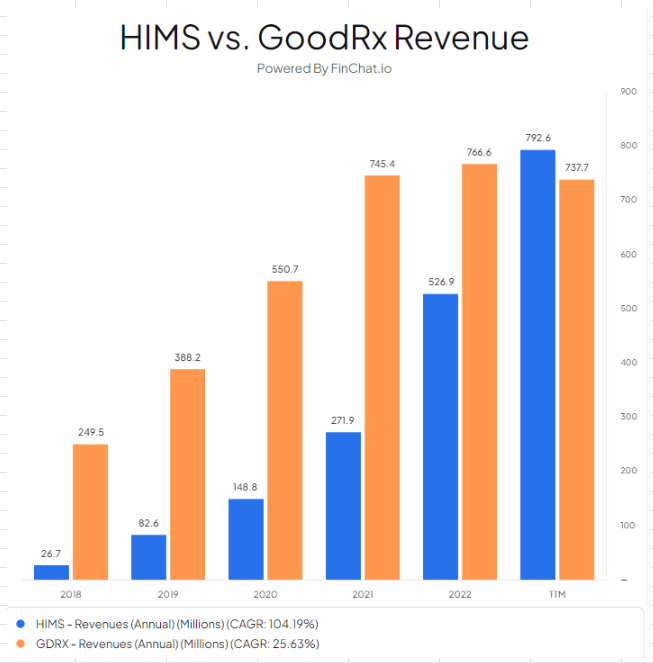

HIMS has grown extremely quickly since its founding in 2017. Let’s begin with revenue and gross profit. As you can see from the charts below, HIMS is putting up impressive revenue growth numbers and expanding margins. Since 2018, revenue has grown at a 104% CAGR. Compared with competitor GoodRx, well, it isn’t really a competition right now (chart above).

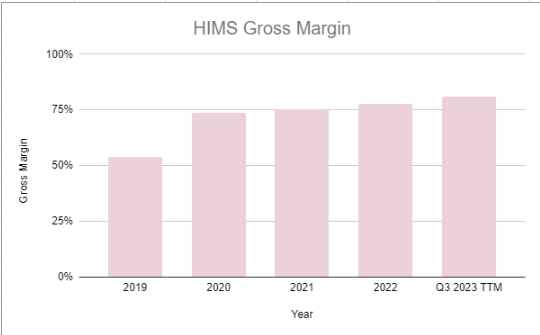

At Chit Chat Money, we care a lot about unit economics. HIMS has fantastic unit economics that are only getting better as it scales. Its gross margin has gone from 54% in 2018 to 81% over the last twelve months. If we look at its cost of revenue, its variable costs are only product costs, shipping, packaging costs, and the labor associated with all these things.

An important note: HIMS does not include operations and support or D&A in its cost of revenue line item. One may argue these should get included in the COR line, but we’ll leave that up to the listener to decide.

Moving to the bottom line, HIMS has historically been unprofitable. However, it has not hemorrhaged money like other SPACs or VC-backed start-ups. Last quarter, it had an $8.5 million operating loss on $227 million in revenue. I would expect them to break even in 2024.

So if the company has such strong unit economics, what is keeping it unprofitable?

It is the same reason the company is growing so quickly, which can be answered in the next section…

Why do you think they have grown so quickly? What is the “secret sauce” here?

Let’s be frank: HIMS is growing so quickly because of how much it is spending on marketing. Here is what the company has to say about marketing:

“We acquire new customers and drive brand awareness through various marketing channels, including social media, online search, television, radio, other media channels, presence in brick-and-mortar retail stores, and physical brand advertising campaigns”

It does a lot of targeted advertisements on places like YouTube, Instagram, and TikTok. In branded advertisements, it works with celebrities. For example, they have worked with Rob Gronkowski for Hims and Kristin Bell for Hers.

Over the last twelve months, HIMS has spent over $400 million on marketing. In 2018, it spent $55 million on marketing.

The big question is: Can they get leverage on these marketing expenses with scale? If they can, the path to consolidated margin expansion is there.

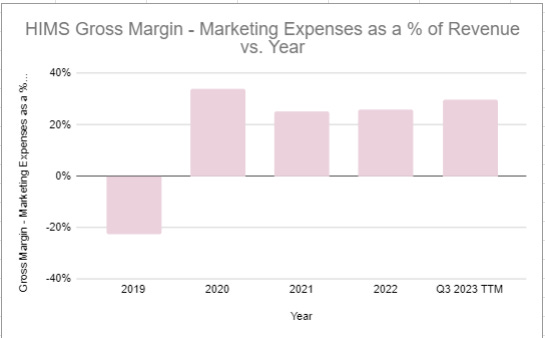

HIMS has shown progress with this, although skeptics may argue it has been minimal in recent years. I am looking at the spread between gross margin and the % of revenue HIMS spends on marketing each year. The wider the spread, the more room HIMS will have to see gross profit drop to the bottom line. It doesn’t require a ton of R&D spend, and its corporate overhead costs should (emphasis on should) grow slower than revenue.

In 2021, this spread was 25%. In the last 12 months, it was 30%. Over the next few years, investors should expect this spread to widen.

But is there a secret sauce here? Well, from a product perspective, not really. Minoxidil is Minoxidil (hair loss spray) at the end of the day. I think the company is betting it has a good product suite with a nice-looking brand, an easy-to-use website/app that reduces friction, and smart marketing that can drive recurring customers to its subscription services.

Yes, this will require a lot of ongoing marketing spend. But, with such strong unit economics, I think HIMS is betting it can get some leverage on this marketing spend as the business starts generating billions in revenue each year.

Does the company have a competitive advantage? If so, how strong, and can it expand over the next five years?

I’m not sure any company that started in 2017 can have a significant competitive advantage in 2023. However, I think they can be on the right side of the innovator’s dilemma.

If HIMS has any advantage that is leading it to success, it is the fact it is a young, lean company trying to disrupt the stodgy medical industry in the right way. The legacy way you get prescribed medication is to visit a doctor’s office, get a prescription, then go to a pharmacy and pick up your drugs. With HIMS, you can do all this from your couch and have a product delivered to your door (hopefully in a timely manner). This sounds much more appealing to me. It may cost slightly more at the end of the day, but it reduces a ton of friction and saves me time. By definition, the legacy solutions cannot do this.

From the Q2 2023 conference call:

“The patients that come to our platform every day, are first-time customers. And what that means is they often do not actually have a primary physician for which they know the name and have a relationship with. This is overwhelmingly the case for people in their 20s, 30s, 40s, and even 50s”

To be clear, HIMS cannot disrupt the doctor’s office visit for every medical condition. But the products they are targeting customers with (sexual health, hair loss, weight loss) are not things you generally need to go to a doctor’s office for. That, along with smart marketing, is why I believe HIMS has grown its revenue so quickly in the last five years.

Discussion question: Do we believe HIMS will be helped by the innovator’s dilemma in medical practice/pharma?

I will be curious Ryan’s thoughts, but I think there is clear room for HIMS to expand its moat in the coming years. To be clear, its moat is virtually nonexistent today.

Here’s my list of what they can do:

Increase the amount of (relatively) affordable products offered on HIMS for over-the-counter purchases. Why? Because there are a ton of competitors that offer just one of their solutions. For example, Keeps is a big competitor that focuses almost exclusively on male hair loss. It has virtually the same products as Hims, and a lot of the same brand style. If Hims can work into all sorts of drug products, it will have a better value proposition for customers to stick with them vs. these competitors. And the more products it offers customers to buy in a frictionless manner, the harder it will be for a direct competitor to replicate.

Use scale to reduce prices vs. online direct competitors (Keeps, Roman, etc.). With increasing scale, HIMS has shown phenomenal unit economics. Now, it plans to give back some of this to customers. Here is what the CFO said when asked about some recent price cuts:

“We will continue to explore various ways to give value back to consumers. I think that our approach there is very thoughtful and deliberate. And so typically, when we do take the decision to whether it’s making pricing adjustments or take other strategies to give value back to consumers, those are typically backed by experiments that happen over the course of several months. And so I think we’re going to be very thoughtful around how we think around how to give value back to consumers in the form of that. Constantly, we are experimenting, receiving feedback from consumers around various offerings that we do put into the market. I think over the mid-to-long term, our gross margin target has been in the mid-70s.”

Investing in the brand through continuous advertisements. Here, I am not talking about the targeted advertisements used on Instagram to lure people to the websites. But I am talking about classic brand marketing that they can employ on TV, podcasts, billboards, etc. Soon, I think they will be spending over $1 billion a year on marketing, which is a good thing. I am thinking about them less as a telehealth company and more as a CPG company looking to build a trusted everyday brand for consumers.

I don’t think there will be a network effect built here. I don’t think there will be a regulatory/IP advantage. But I do think they can invest and widen their brand moat significantly over the next five years. Less important is economies of scale, something I think can help them but not a huge advantage.

Thoughts on the founder/CEO Andrew Dudum

The founder of HIMS is Andrew Dudum. He is 34 and classifies himself as a serial founder and angel investor. As I mentioned above, he still has a relationship with Atomic Labs, which incubated HIMS. He owns 13% of the company but has 90% voting power due to the heavily disproportionate voting rights for the Class V stock that he owns. This is the Dudum show, he controls everything about this company.

He also quote tweeted our chart comparison of HIMS and GoodRx (maybe was searching the cash tag?): https://x.com/AndrewDudum/status/1747100608899989550?s=20

So, it is possible Dudum is listening to this. Even if he isn’t, I am going to list off some interesting things I found in the Proxy Statement and pretend like I have the ability to directly ask questions to him.

Here is the list:

“He is a serial founder, active angel investor and advisor to various startup companies, including Cherubic Ventures, a China and U.S.-based early-stage venture capital firm” Do you believe these other endeavors distract you from running HIMS? Assuming no, why not?

The Class V common stock gives you ~90% voting power of this business. Do you think this is necessary and/or a healthy way to run a business?

“an entity affiliated with Atomic Labs (such entity, the “Atomic Affiliate”) provided professional services to Hims, primarily to support engineering and operations functions. All services were provided at cost. For the year ended December 31, 2022, Hims & Hers recorded a total of $3.6 million for payments made to the Atomic Affiliate for services performed and costs incurred on behalf of Hims & Hers. There was no accounts payable balance with Atomic Labs and the Atomic Affiliate as of December 31, 2022” Would you describe this as self-dealing?

Your ownership stake in HIMS is currently worth $234 million, You have no personal financial restrictions and never have to work another day in your life if you don’t want to. Why are you paying yourself a $600k base salary each year?

“In February 2022, the compensation committee established a threshold, target, and maximum achievement level for each of these corporate performance metrics” These metrics are for annual bonuses. In 2022, your metrics were revenue and adjusted EBITDA. Your minimum target for your revenue bonus in 2022 was $350 million, and adjusted EBITDA was a loss of $33.6 million. You actually generated $527 million in 2022, and an adjusted EBITDA loss of $15.8 million. Do you believe these are metrics that quantify whether HIMS is creating value for shareholders? Do you believe your targets were reasonable with how fast HIMS was growing at the time? Do you think an adjusted EBITDA loss is a good target to have when paying out executive bonuses?

In 2022, you got over 500k RSUs, 1 million stock options, and a special CEO performance award of 2 million options that vest on the basis you are still employed by HIMS through 2026. Why do you need these stock awards if you already control HIMS?

I could go on. Clearly, there were a lot of red flags with this proxy statement. Frankly, a lack of trust in Dudum (watch what he does, not what he says) will probably keep me away from investing in this company.

What have you modeled out for financial projections through 2026?

Longtime listeners know we like to keep our modeling simple. We want to put out some reasonable assumptions and see what the company could be earning on a per share basis in a few years.

I am not going to tell you what I think forward returns will be. I have no idea. What I am hopefully going to illustrate is what HIMS could be earning in a few years based on what I think are reasonable assumptions.

Here are my assumptions:

Revenue grows at an average of 40% over the next three years

Shares outstanding grow by 4% each year

Stable gross margins at 81%

No leverage on operations and support costs (more on that below)

R&D spend stable

Slight leverage on G&A costs

Marketing as a % of revenue goes from 51% down to 35% in year 3

Under this scenario, the operating margin climbs to 10% in year 3, and the company will be generating $217 million in operating income in year 3. Even with share dilution, that puts the P/OI below 10, which I think is cheap. There is also the potential for the company to start returning more capital to shareholders with buybacks as they will likely be very cash generative over the next few yeras.

The key variable in this model is the amount spent on marketing. If they can grow marketing expenses slower than revenue, I think HIMS stock is cheap at these prices.

Are there major risks or red flags to this business?

I have concerns about Dudum’s focus, but those were discussed in the above section. I have one main concern with this business model:

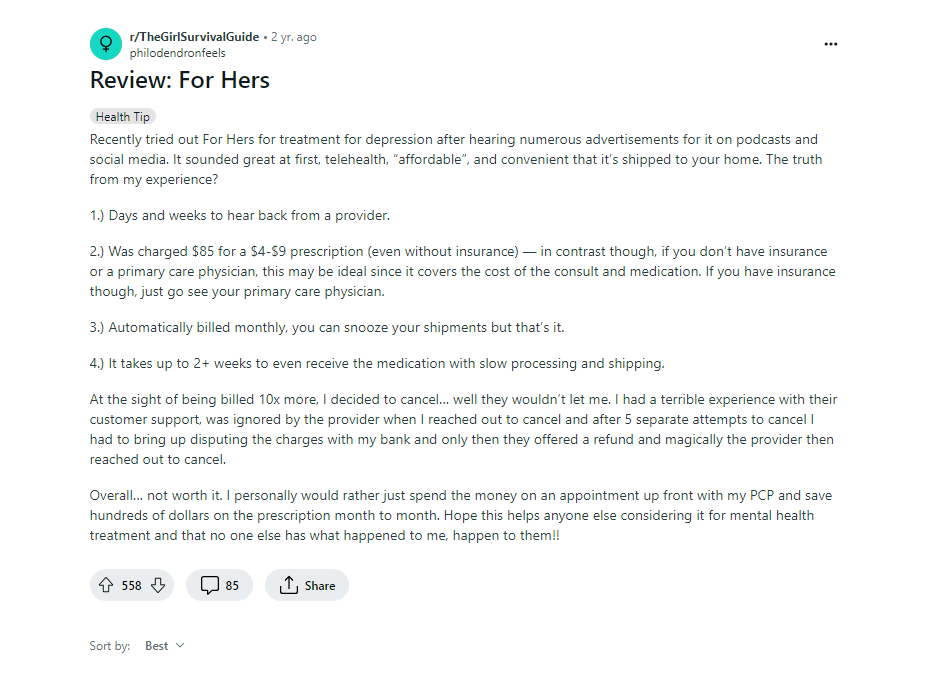

I am a little conflicted on what to think about here. The evidence seems to support (these are just a few examples) that HIMS is trying to greatly accelerate people to order subscriptions and then make it hard/frustrating to cancel. This can cause churn and revenue growth to look better in the short run, but it does no good for the brand over the long term. All these customers from these screenshots probably have a negative option

Does it make the stock uninvestable? No, I don’t think so. But HIMS definitely needs to invest more in customer support AND make it seamless for people to cancel their subscriptions. Go with the Netflix model guys, it is the healthiest way to build a business over the long term. You will always have people complaining about these issues with a subscription model, but you need to take care of your existing customers. KPIs will look worse for a bit, but it will be worth it I think.

Would you buy the stock today? Yes or no, and why?

I am not buying the stock today due to concerns over management integrity and caring about shareholders. I think the stock looks cheap and has potential for moat expansion, but I need a management team I can trust.

Premortem and conclusions from this episode

Listen to find out!

"For all extents and purposes"

Are the show notes transcribed by AI? In the video, Brady says, as one might expect, "For all intents and purposes."