YouTube

Spotify

Apple Podcasts

Match Group continues to look like a mistake for me. We talked about it on this week’s Power Hour (links above) in detail.

Mr. Market is telling me it is a mistake:

The narrative around the company is quite negative if I am reading the sentiment correctly. If you read the headlines from a place like TechCrunch you would think Tinder is basically dead.

What’s interesting is that Match Group’s financials look alright, when the sentiment would tell you sales are collapsing.

For the full year 2024, management expects $1.1 billion in free cash flow generation. That would be a record high.

Today, management is expecting revenue growth of around 6% for 2024. By my calculations, that is positive revenue growth.

Of course, this is a slowdown from the 20%+ growth of the past. Which is all due to Tinder. Specifically, Tinder is seeing consistent declines in paying users.

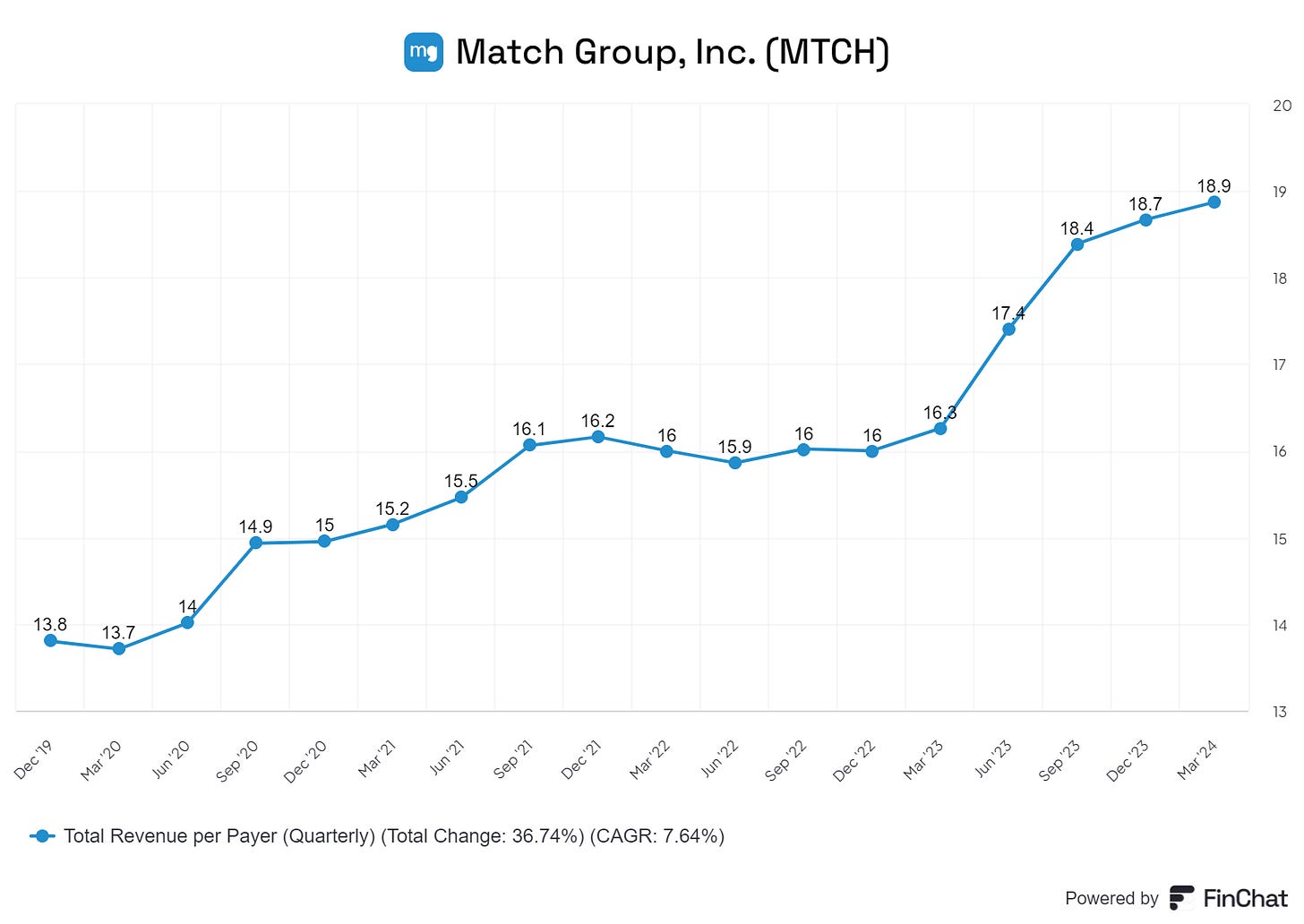

This has been made up through price increases, but obviously, this cannot carry on in perpetuity.

But why are payers declining? There is one main reason: a declining base of active users.

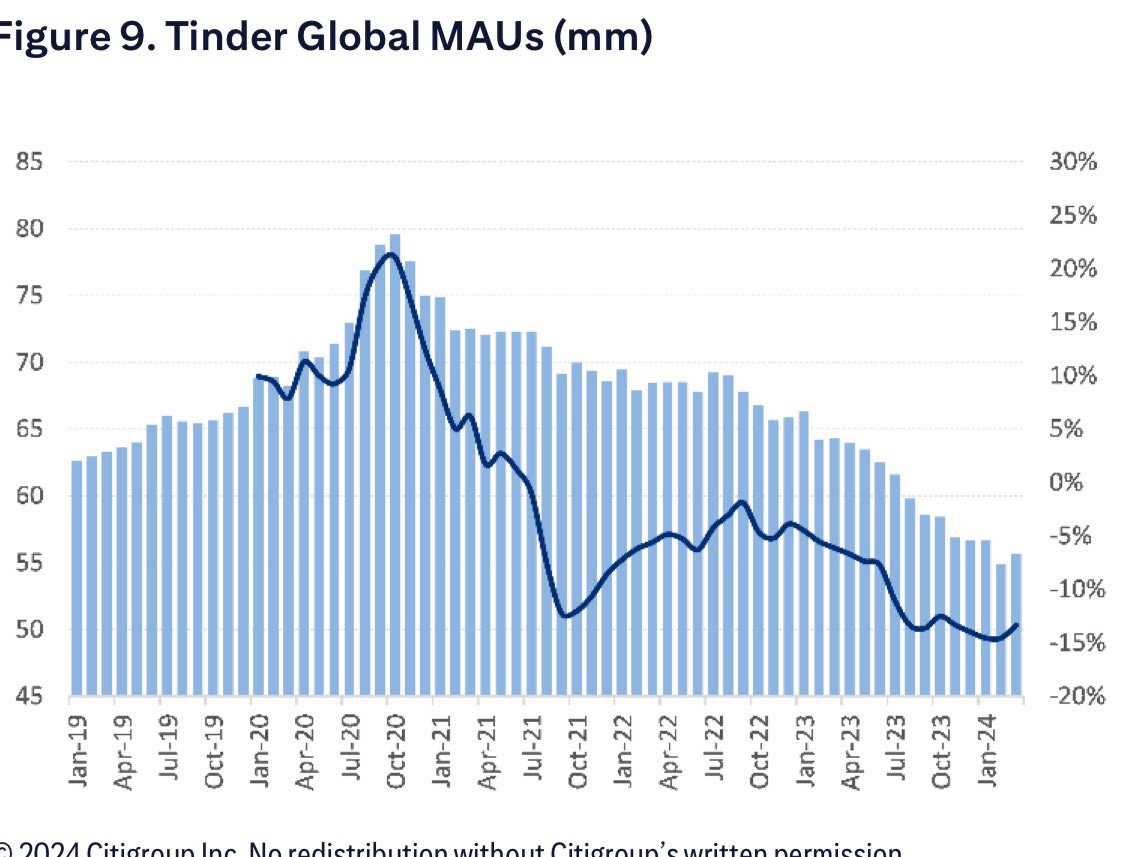

Active users (not payers, but total active users) have declined from around 80 million to 50 million in the last few years. Here is a chart of an alternative data estimate (management doesn’t disclose a specific KPI every quarter):

Some of this decline is due to management getting more aggressive with bots, malicious accounts, and other “unhealthy” users for the platform.

Management says they will not see much of a future headwind to users from these initiatives. However, they are also implementing more stringent rules such as requiring face photos. This will be a headwind to growing users BUT should make the dating marketplace more healthy (who wants to message with a faceless user?).

So, to solve the number of payers, eventually, Tinder needs to stabilize or grow its total active users. Can they do that with the new product initiatives? I don’t know. But I think the stock is pricing in a continual decline in MAUs.

Hinge is on track to hit $1 billion in revenue, and likely much more over the next five years. With healthy margins.

The stock is at a market cap of $8 billion, so less than 8x 2024 free cash flow. Management is buying back a lot of stock and the business should continue to generate positive cash flow.

Was it a mistake to buy Match Group at twice the current stock price? Yes.

Am I adding to my position today? No. I don’t see it as a bet with minimal downside (which is when I want to size up a position).

But do I think it is a good risk/reward at this price? Absolutely.

If Tinder MAUs simply stabilize after this new management team “ripped the bandaid off” after years of stagnation from the prior executives, this stock has 10-bagger potential. It will definitely be higher if this happens. It is likely a $5 billion revenue business within a few years from just Tinder and Hinge which translates to $1.5 billion in free cash flow, give or take.

Management can also reduce share count at around 10% per year at these prices.

Of course, there is still downside potential. I am not buying, but I’m not selling after this earnings report either.

(These KPI charts come from our friends @finchat.io! Use our LINK and get 15% OFF any premium plan.)

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

“Was it a mistake to buy Match Group at twice the current stock price? Yes.

Am I adding to my position today? No. I don’t see it as a bet with minimal downside (which is when I want to size up a position).

But do I think it is a good risk/reward at this price? Absolutely”.

If you liked it at $65 and don’t you like it at $31, why hold it? This was a good piece, I think listening to sentiment is such a waste of time unless you are planning to use sentiment to your favour.