[PODCAST] Is Bill Ackman a Good Investor?

The famous investor loves to create controversy. Sometimes, it backfires

YouTube

Spotify

Apple Podcasts

We discussed Bill Ackman on the podcast this week. It was published on Wednesday morning but I delayed sending this email because of the election.

The episode was a dive into his hedge fund, investing history, and case studies of his biggest wins and losses.

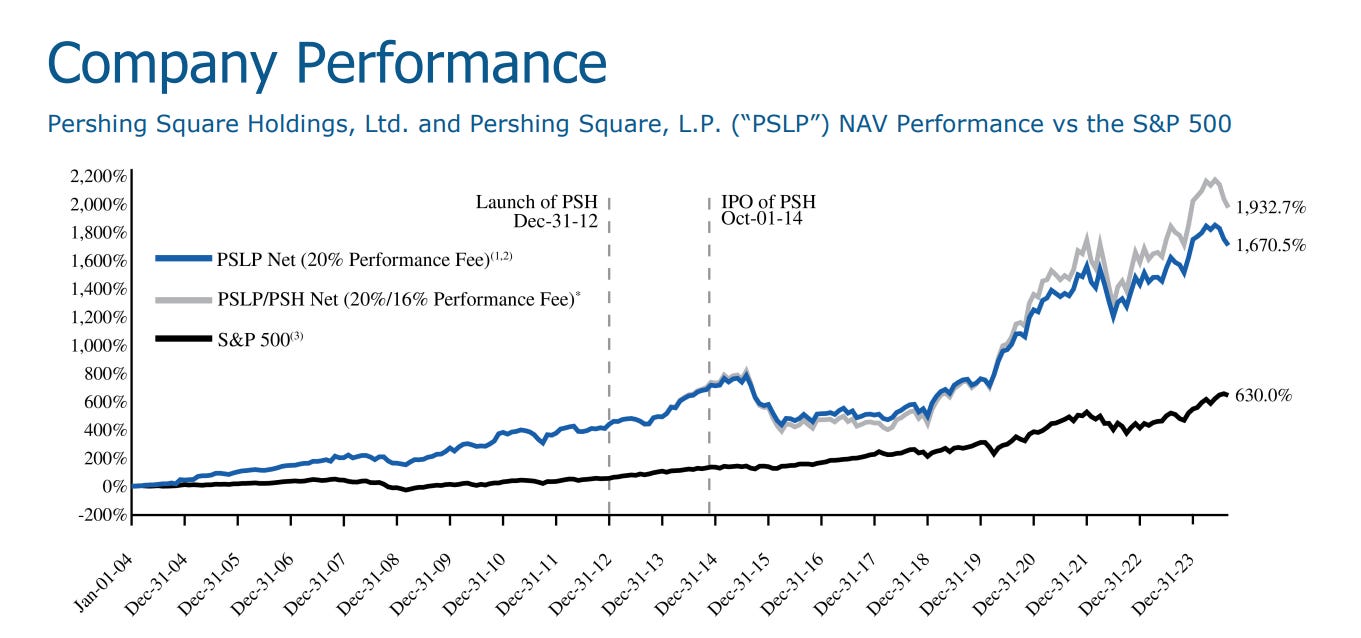

It ended up being a debate on whether Ackman is truly a good investor. If someone were to argue Ackman has skill, they might claim Pershing Square’s performance has beaten the market over 20 years. Which is true:

There is no denying this fact. However, if someone were to argue against Ackman’s investing acumen, they might say:

His previous hedge fund Gotham Partners shut down due to conflicting investments (Ryan dug up some good information on this for the show)

The Herbalife and Valeant debacles

Pershing Square has trailed the market for the last 10 years

As Ryan says on the show, I’m curious to what his full professional lifetime returns are if you combine Gotham Partners and Pershing Square.

It is not just about analyzing stocks. It is also about managing a portfolio and managing your emotions (which go hand in hand).

Like him or hate him, you cannot deny that you are interested in Bill Ackman. I am curious what the fund’s next 10 years look like.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.