Is Sprouts Farmers Market Stock Fairly Valued? (Ticker: SFM)

The stock is up 6.66x since February 2020

YouTube

Spotify

Apple Podcasts

Sprouts Farmers Market crossed over $100 a share today. In February of 2020, the stock dipped to $15 after a disappointing earnings result. So, a 6.66x from February of 2020 to July of 2024. Not bad.

I have been following Sprouts since 2020. It remains a psychological long, but unfortunately I have not fully benefited from the $15 to $100 ride (oof).

We published a podcast on the stock back in early September of 2023:

At the time of recording, Sprouts traded at around $38 a share. It has returned over 100% in less than a year since the publish date. Talk about missed returns. Oy vey.

These were my closing thoughts from the episode:

What keeps me up at night with Sprouts is a concern that inflation is masking stagnate foot traffic. Comp sales have accelerated in recent quarters but are still weaker than other mass merchants such as Kroger. Sprouts sacrificed traffic when Sinclair took over and got rid of low-margin shoppers, but eventually, we need to start seeing foot traffic increase if operating margins are going to expand.

The key metrics I track to see whether the business is deteriorating (the stock price gives us a margin of safety where I still think we make money as long as the business stays in place) are comp sales, operating margin, and operating income per store. They all relate together but I believe are the key drivers of cash flow growth over the long term. If one or all of these took a hit I would be looking to sell Sprouts.

From a valuation perspective, I wouldn’t want to sell Sprouts unless the valuation got extreme. With such a long runway for reinvestment, I think it would be a mistake to sell this because it got to a “market multiple” or some other arbitrary reason.

I think we should make this a significant position if the trailing P/E gets close to the trailing 12x - 13x range. That would make the formula of unit growth/comp sales/margin expansion/buybacks work wonderfully and could lead to a 20%+ stock price CAGR over the next five years, give or take.

These were Ryan’s final thoughts for the episode:

I think comp sales are a bit of a concern for me. Feels like they’re right around the inflation level or maybe even below it. So I share your concern a little bit here, that foot traffic isn’t growing much at all. That worries me that Sinclair may end up reverting back to some of Sprouts old habits of going after low-value customers to boost foot traffic. I don’t see any proof that he would, but it’s something to watch out for and that would show up in the gross margin line.

When would we add? I think it would need to be at a cheaper multiple assuming our estimates for the business don’t change. But if we start to think the business can grow store count at 10% and get maybe closer to 5%-6% comp sales growth, I’d be willing to add more at these prices.

When would we sell? Either a crazy valuation (>25x earnings) or if we notice something fundamentally wrong with the business.

So, we were concerned about meager comparable sales growth in a high-inflation environment and weak foot traffic. The three metrics I was tracking to monitor an improving or declining business were:

Comparable sales growth

Operating margin

Operating income per store

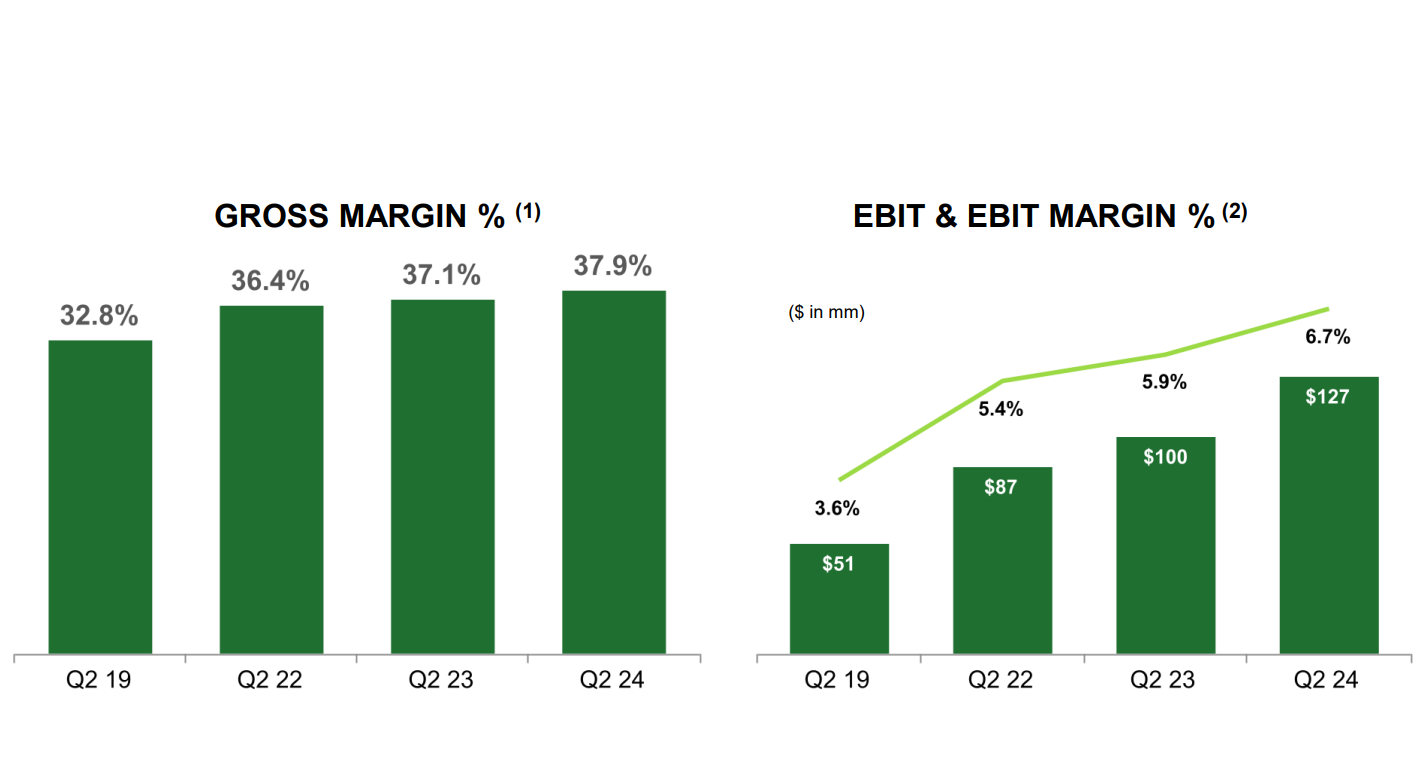

Sprouts laid all these concerns to rest in Q2 2024. Comp sales growth was 6.7% and GAAP operating margin expanded to 6.7%.

Here is an illustrative slide deck from the Q2 earnings result:

The business looks healthy. Really healthy. Everything is moving in the right direction. The stock is up over 100% in less than a year because most people believed the opposite, that Sprouts Farmers Market was a poor business and just a COVID winner that would continue to struggle.

For multiple reasons we don’t need to get into today (that we do hit in the episode, though), we believed the business was much better than the stock price implied.

So far, the results show we were correct. Return on invested capital (ROIC) has steadily improved since the pandemic hangover:

At just above 400 stores, there is room for the brand to more than double its unit count over the next decade:

Improving reinvestment runway and an improving ROIC? Sign me up! Oh wait, I am still sucking my thumb on the sidelines.

Alright, enough self-loathing. The only thing I can do is take the lesson for future investments and let winning stocks run when they tell me I deserve to let them run.

Some charts from our friends at Finchat.io:

But the big question is: does Sprouts Farmers Market now trade at fair value?

At $100 a share, Sprouts trades at a market cap of around $10 billion. They are guiding for at least $3.29 in EPS for the full year. That is a forward P/E of 30.

If revenue keeps growing at 10% - 12%, margins slightly expand, and shares outstanding come down at a small amount each year, I think EPS can grow at around 15% annually this decade. This may be optimistic, but I think it is doable and there is no reason to believe the concept is anywhere close to maturity. Call it my base case.

Five years of 15% EPS growth off of 2024 will bring the figure to $6.62. So, you can buy shares at 15x 2029 earnings.

This feels like fair value to me.

Would I buy shares of Sprouts Farmers Market here? Not a chance. I do not like buying stocks where EPS has to grow double-digits or else the stock will fall. Expectations baby.

But should long-term shareholders sell? I don’t think so either. We have entered no man’s land with this one.

There is a chance Sprouts Farmers Market is a 100-bagger from February 2020 over the next two decades. No reason to give that up because the stock looks slightly expensive today.

Brett

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

"Would I buy shares of Sprouts Farmers Market here? Not a chance. I do not like buying stocks where EPS has to grow double-digits or else the stock will fall." - Great perspective Brett.