YouTube

Spotify

Apple Podcasts

This week, we released a podcast with the Wall Street Wildlife guys (check out their podcast, it is fun!) updating Nvidia. Wall Street Wildlife co-host Luke Hallard came on the show in 2022 and pitched Nvidia as an AI play before it was cool. The stock is up around 600% since the episode aired. Not bad.

We had a nice discussion about Nvidia’s culture of innovation, moat, and business prospects. Go listen to the episode for a delightful conversation.

Can we talk about capital expenditures now?

Meta, Microsoft, Alphabet, and Amazon (MAMA?) all reported earnings this week. These are the four horsemen of the artificial intelligence (AI) spending bonanza, and boy did they come through with 2025 guidance. I don’t think Nvidia or TSMC are going to have trouble growing this year.

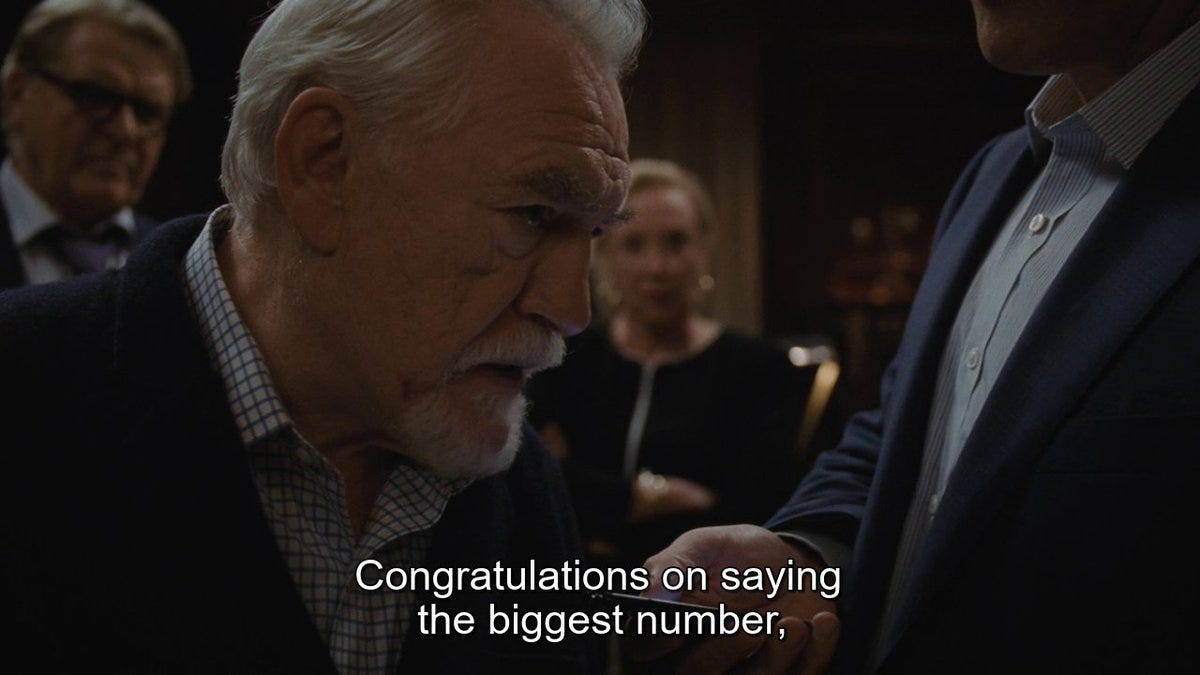

Meta Platforms guided for $65 billion in capital expenditures.

Alphabet guided for $75 billion.

Microsoft guided for $80 billion.

Amazon guided for $100 billion (mainly related to AWS, but let’s say $20 billion goes to e-commerce).

Combined, it looks like MAMA is going to spend $300 billion on capital expenditures related to data centers/cloud/AI in a single calendar year.

A single calendar year!

Let me give you some context on how insane this is. In 2023 (just two years ago) these four companies spent $140 billion on capital expenditures. They are going to more than double this figure two years later.

From 2011 - 2020, these four companies spent a cumulative $379 billion in capital expenditures. They are going to come close to replicating this spending in 2025 alone.

Call me crazy, but I am skeptical that a high ROIC will show up. Eventually, it has to come through in more profits for the cloud end customers (or internal solutions at Meta/Alphabet). $50 billion in new earnings on $300 billion is around a 17% ROIC. Are you certain $50 billion in profits will show up?

Perhaps it will. But it is not a bet I feel comfortable making. The risk/reward is all screwed up with these stocks while they trade at 30x and 40x earnings.

As Mostly Borrowed Ideas recently wrote, big tech’s earnings quality is deteriorating. I don’t know if I would be a seller of big tech stocks right now (I do not hold any today), but the uncertainty around this monstrous spending will keep me from being a buyer.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.