My Portillo's Stock Pitch Submission Did Not Win

Which might be a good indicator of its future prospects

I submitted Portillo’s — one of my stock research podcasts from this year — to the Windancer stock pitch competition. Alas, it did not win the competition.

The competition seemed well run (and had a huge prize worth putting in hours of research on), so if they run it again I think I will submit another idea. Any reader should consider submitting too.

The last stock pitch competition submission I had was for Sprouts Farmers Market in 2021. I also didn’t make it to the finals for that one. Since then, Sprouts stock is close to a 10 bagger:

Maybe that means Portillo’s will be a good investment? I kid. Either way, here is the stock pitch. You can read it as a pdf or within this email.

Portillo’s: The Next Chick-fil-A?

If Cava has a chance to be the next Chipotle, then Portillo’s has a chance to be the next Chick-fil-A. Unlike Cava, you can buy Portillo’s stock at a reasonable price today because of its misunderstood unit economics.

At fewer than 100 locations nationwide and best-in-class average unit volumes (AUVs), Portillo’s has a long runway to reinvest at an attractive ROIC and has proven its unit economics outside of its home market. Working with activist investor Engaged Capital, management has levers to pull to further improve cash-on-cash returns for new restaurant openings.

Portillo’s can generate a 23%+ IRR from its current share price of $11.43. Here’s why.

What is Portillo’s?

Portillo’s is a fast-casual chain serving Chicago-style food. The key pitch to customers – and why you would visit over another restaurant chain – are the beef sandwiches and hot dogs in the Chicago style.

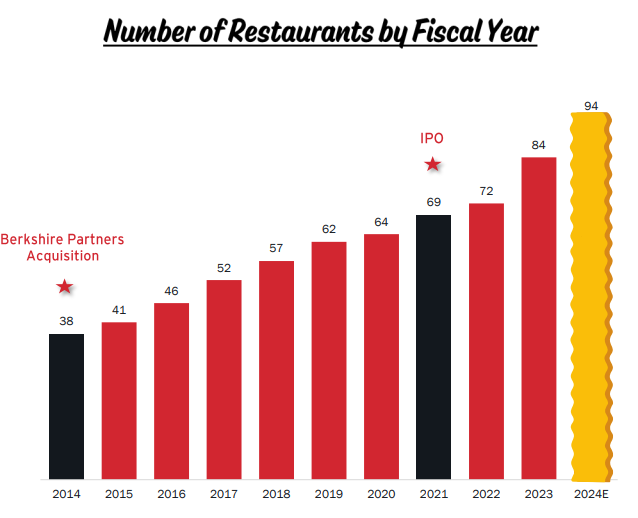

Portillo’s began in 1963 when Dick Portillo opened a hot dog stand in Chicago. For the next few decades, it was a family-run operation in the Chicago area with a loyal following. In 2013, a private equity firm Berkshire Partners bought out Portillo’s and began opening new locations. By 2021 the company had refined its expansion strategy and decided to go public through an IPO.

From 2021 through today, Portillo’s has focused on expanding in the Sun Belt due to population tailwinds and migration of previous customers from the Chicago area. These include cities like Dallas, Houston, Phoenix, Tampa Bay, and Orlando.

Source: Piper Sandler’s Growth Frontiers Conference, September 2024

Understanding the unit economics

At its 2023 Investor Day, Portillo’s disclosed that its Chicago locations have $10.8 million AUVs and 30%+ restaurant-level profit margins. In the Q3 2024 conference call, we got confirmation that AUVs are now over $11 million with flat transaction growth.

For reference, Chipotle does just over $3 million in AUV. Chick-fil-A is rumored to do between $9 million and $10 million at its locations.

There will be few (if any) new locations in Chicago. With the city’s population stagnating, management will get stability from Chicago. Locations generate reliable cash flow. I would expect AUVs to only grow in line with inflation, though.

Sun Belt locations are where new locations will open. But what sort of returns are they getting on these new openings?

Per the latest investor update, Sun Belt locations have $6.6 million AUVs and restaurant-level margins of 20%.

Due to these smaller AUVs and the inefficiencies in the business decades ago, future restaurant sizes will be smaller. Previously, its location formats were 10,000 square feet. New restaurants will now be closer to 6,000 square feet. Importantly, they have worked with managers to make sure they still have the capacity to fulfill a $10 million AUV if the demand is there. New formats cost $5 million - $5.5 million to build vs. $7 million previously.

If a new restaurant maintains a $6 million AUV, cash-on-cash returns are 25% by year three after opening. Remember, Sun Belt AUVs are currently $6.6 million.

This brings us to comparable store sales growth, the largest concern for investors today. Similar to other restaurant stocks, Portillo’s has posted negative comp store sales growth over the last three quarters:

Management is guiding for negative 1% comp growth for 2024. I expect this figure to normalize back to low single digits in 2025 when the restaurant sector normalizes.

Since Portillo’s has existing fans in the Sun Belt (the Chicago diaspora, if you will), Portillo’s locations open with a boom. Sometimes, they begin with a $10 million AUV. In fact, demand has been so strong it has created quality problems at openings. Eventually, demand normalizes back to the $6.6 million Sun Belt AUV. Even though new locations don’t get included in comp sales growth until they have been open for 24 months, this boom-to-normalization cycle presents a headwind for comp sales even if new locations are performing well.

What matters above all else is AUV. On a consolidated basis, Portillo’s did $8.9 million AUVs and 23.5% restaurant-level margins over the last twelve months. As the Chicago area becomes less important, both of these figures will keep decreasing until they normalize with the Sun Belt region. Even though the consolidated numbers will trend lower, ROIC will remain acceptable, and restaurant-level cash flow will be positive.

Long reinvestment runway

At the end of 2024, Portillo’s expects to have 94 restaurants open. Management believes there is room across the United States for at least 500 locations, if not more.

At a $5.5 million build-out cost, Portillo’s has room to lay out $2.75 billion in capital and earn a 25% ROIC. This is the most attractive part of the thesis. As long as you believe in the unit economics (I do), the runway for reinvestment is salivating.

The plan is to grow unit count by around 12%+ a year indefinitely. That would bring unit count to 515 by 2039. In other words, there is over a decade left on this reinvestment runway.

Management + activist engagement

At Portillo’s, I want to track whether management understands what increases shareholder value. From reading interviews and conference call transcripts, I believe they do.

The CEO is Michael Osanloo, who previously ran P.F. Changs. The CFO is Michelle Hook, who was previously a VP at Domino’s Pizza. Both brands have more locations than Portillo’s, so I have no concerns with these two executives dealing with increasing scale.

Both understand that maintaining high throughput without sacrificing product quality is the key to success. This means getting the right store managers, optimizing the restaurant size, and taking care of customers.

Here are a few examples. Portillo’s offers everyday reasonable prices and does not default to tips (most chains do now). It does not discount through meal deals, price gouge, or implement shrinkflation (portions are consistently large). The brand has an NPS score similar to Chick-fil-A and In-N-Out for a reason. Of course, the AUVs in Chicago speak for themselves. People clearly like the experience.

Here is CFO Michelle Hook in a recent interview with CFO.com:

“Right now, the consumer is looking for value. So you see several brands out there offering value menus and shouting “value” at the consumer. The challenge is getting traffic into your restaurants.

At Portillo’s, we don’t discount or go on sale. Our challenge is how to get traffic without that. And so, one focus is on throughput in our drive-thru. If we could get more people there, it would create more transactions.

And it’s just about focusing on consistently running world-class operations and giving guests a good experience, whether that’s the price point, the quality of the food, the service, the cleanliness of the restaurant. If all those things come together, you’re more likely than not to come back.”

What about the activist? Engaged Capital has built up a 10% stake in Portillo’s and wants to engage (get it?) with management on ways to improve operations. According to CNBC reporting, Engaged Capital is not looking to replace management and believes there would be private equity interest if the stock keeps underperforming. There is concern about a take-under, but any buyout interest provides some semblance of downside protection for investors.

Engaged Capital doesn’t want Portillo’s to own or develop real estate. This would make the business more capital-light, but would perhaps be short-sighted. As management likes to say, it has a restaurant in Chicago where it fully owns the real estate. That location generates $3 million in cash flow a year.

Overall, management seems lukewarm to the idea of switching up its real estate strategy but said it would explore options if it made sense to improve the growth return profile. I think this is reasonable and shows they are a professional group.

So far, I think the activism has been a good thing for Portillo’s. If need be, they will keep management in line in order to protect shareholders.

Why the stock is cheap

Portillo’s trades at a market cap of $843.5 million. Netting out its debt and including the tax receivable agreement (TRA), its enterprise value jumps to $1.45 billion. About half of this is from debt and half from the TRA.

My estimates for Portillo’s through 2030:

12% unit count growth

Consolidated AUV shrinks to $7.3 million (Chicago effect)

Restaurant-level margin contracts to around 20% then starts re-expanding (Chicago effect)

Consolidated operating margin steadily increases from 8% to 11.6% (leverage comes from marketing and G&A expense)

In 2030, Portillo’s will generate $147.9 million in operating income per these estimates. To simplify my model, I assume that all debt + TRA expenses are paid in cash as well as stock-based compensation (all SBC offset by share repurchases). Even with these conservative assumptions, Portillo’s will generate positive free cash flow every year through 2030.

There is a clear path for Portillo’s to find operating leverage, self-fund 12% annual unit growth, and perhaps even return some capital to shareholders through repurchases/debt repayments. Long story short, there is a runway to consistently increase value.

Portillo’s will still have strong growth prospects in 2030, and I think it would deserve to trade at a P/OI of 20, if not higher. That is a market cap of $2.96 billion, or 3.2x its current market cap. Over the next six years, that roughly equates to a 23.3% IRR.

Portillo’s will not be done growing in 2030. Under my estimates, operating income will be above $300 million in 2035 and over $1 billion a decade after that if it reaches 1,000 locations. Of course, 1,000 locations in 20 years is a home-run scenario. Even with the low chance of this happening, it greatly increases the expected value of the investment.

Given the reinvestment runway, Portillo’s has a chance to be a steady 10-bagger (or better) as long as the unit economics remain consistent. I think they will.

-Brett

Interesting idea, thank you. A couple notes/questions:

Why has share count doubled since 2020?

Why use P/OI? OI is agnostic to capital structure, but market cap is not - you need to match the two. So the right metric would be EV/OI (aka EV/EBIT) - or if you don't want to be capital structure-agnostic, good old P/E.