YouTube

Spotify

Apple Podcasts

We did not talk Nelnet on this week’s Investing Power Hour (links above). I want to discuss it for this weekend’s newsletter.

Nelnet stock rose 6% in the day following the report and has now produced a total return of 167% over the last five years. I still believe it is incredibly undervalued and it remains my largest holding at over 20% of my savings.

Three items were at top of mind this quarter:

The Allo Communications divestiture

Progress on education software/payments profitability + recent acquisition

Transitioning of loan portfolio

Let’s dive in. For a comprehensive look at the business, read our report from earlier this year:

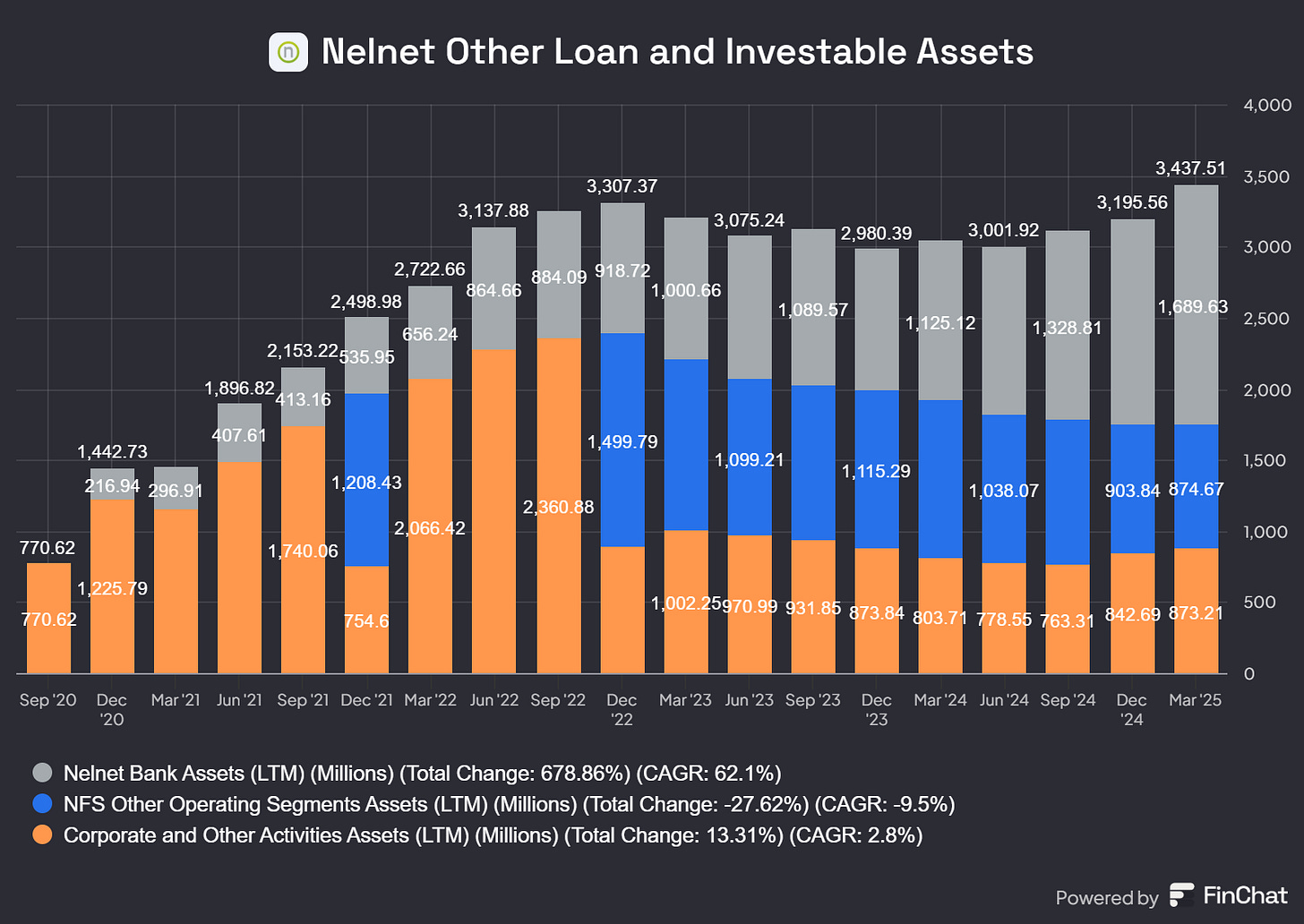

Allo Communications Gain

Subsequent to the end of Q1, Nelnet sold off its entire preferred equity stake in Allo Communications and reduced its ownership of the business from 45% to 26%.

“Upon closing, Nelnet expects to receive aggregate cash proceeds of approximately $410 million from ALLO for these redemptions and recognize a pre-tax gain of approximately $175 million”

We have $410 million in cash heading to the balance sheet this month. Nelnet still owns 26% of Allo Communications that is worth hundreds of millions (?) of dollars.

The stock has a market cap of $4.1 billion as of this writing. Not bad to see 10% of the market cap coming to the balance sheet in cash from a single transaction!

And this is only a small part of the Nelnet operation.

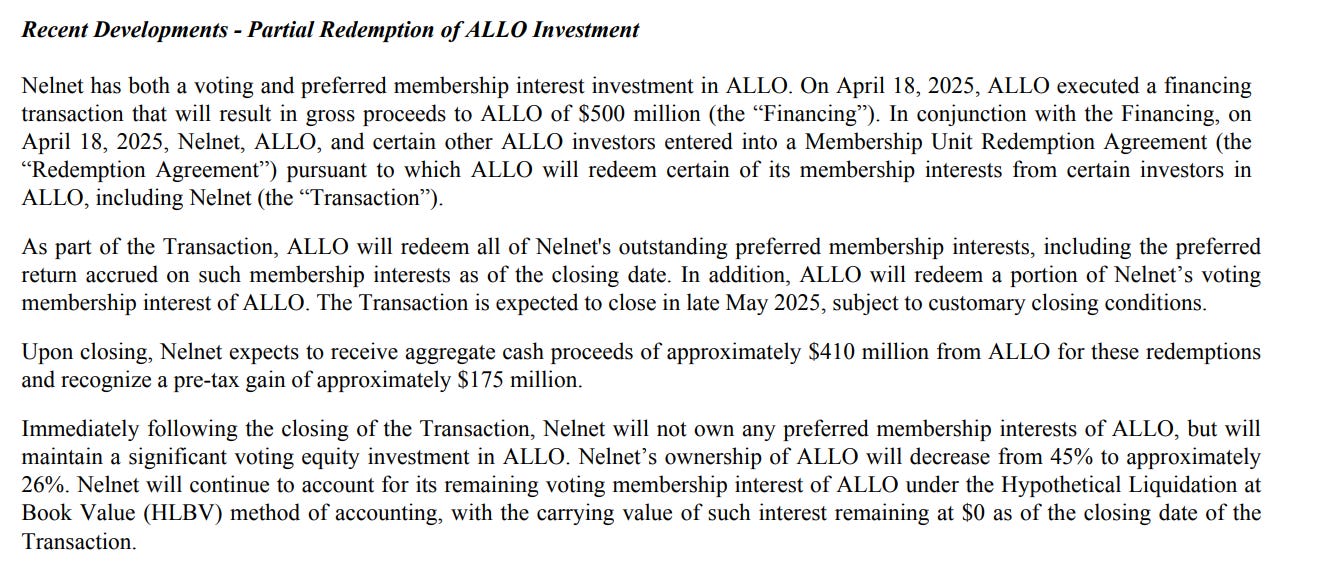

Stalling growth in software and payments

Nelnet’s division that sells software and payments solutions to educational institutions is its most lucrative business, and perhaps the easiest to understand. It is generally software for administration buildings and payment processing for private institutions. Simple.

Both revenue and EBIT growth for this division have slowed in recent quarters. Not a huge concern, but obviously I would like the double-digit growth to resume at some point. Still, a software business generating $117 million in EBIT with (I think) strong cash flow conversion is worth at least $2 billion even if it is slow growth.

These are cash generating businesses.

Management may have just found an inorganic path to growth with the acquisition of Next Gen Web Solutions, which serves the higher education market. Nelnet’s software is mainly for private K-12 education.

We have no financials for the acquisition, but I am confident management stayed disciplined on its hurdle rate. What we do know is that Next Gen Web Solutions serves 20 million students, so I’m guessing this is a sizable company.

The next 12 months will tell us how impactful the acquisition will be to revenue/earnings for the segment.

Screenshot of the full press release:

Transitioning loan portfolio

Nelnet’s student loan portfolio continues to wind down, although it did pick up some residuals this quarter:

This loan portfolio still has $1 billion in undiscounted cash flow coming to the balance sheet, and 25% of it coming this year.

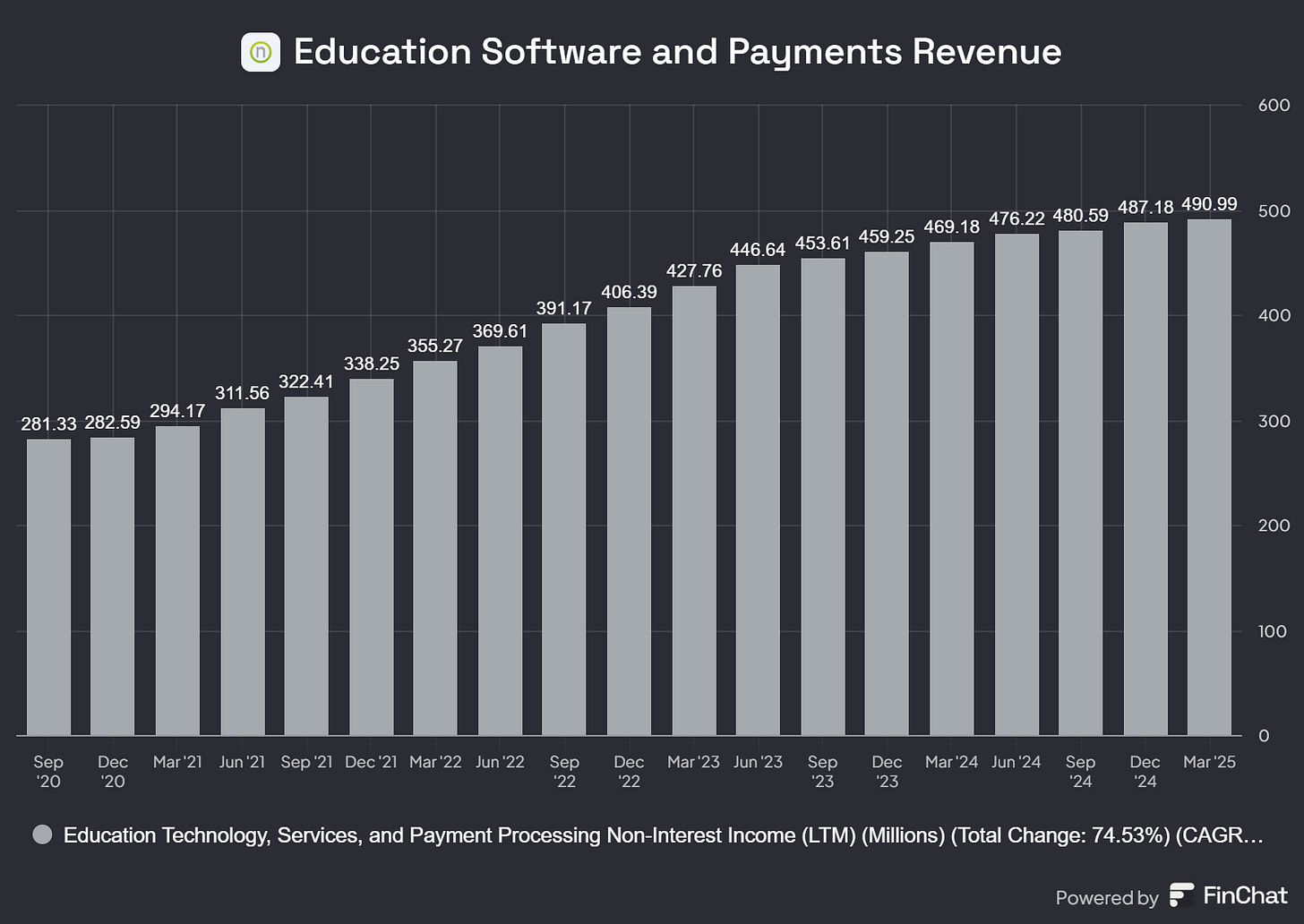

However, Nelnet is replacing its loan portfolio in other methods with unsecured lending on its own balance sheet and building up Nelnet Bank.

We should hopefully see more growth in assets held outside of the AGM segment (I know, confusing) in the years to come.

Nelnet Bank keeps growing its deposits and loan portfolio. Net interest income after loan losses has risen to $25 million over the past twelve months. This is one of the most important KPIs to track over the next few years.

We didn’t talk about every part of the Nelnet thesis, and I bet there are still some hidden gems on the balance sheet management might surprise us with. But this illustrates the continued progression of the Nelnet conglomerate and why it still remains severely undervalued at a market cap of $4.1 billion.

I continue to hold and will buy more at the right price.

-Brett