Nintendo Stock: The Road To $30 (Ticker: NTDOY)

Did you really think Miyamoto would let us down?

YouTube

Spotify

Apple Podcasts

On this week’s Power Hour (links above) a listener asked if I could go through the math that takes Nintendo stock to $30 by the end of this year. Here is that analysis.

My bold prediction for 2025 was Nintendo finishing above $30 a share (the US-listed ADR). It started the year at $15 and is currently flirting with $20.

Nintendo has 1,164,244,142 shares outstanding. Taking that number multiplied by the Nintendo stock price in Japan, convert to US dollars, and we have a market cap of around $90 billion.

A $30 ADR price is a 50% gain from $20, meaning we need a market cap of around $135 billion for the $30 bet to cash. Or, an enterprise value of $115 billion when you subtract out the net cash and investments on the balance sheet.

Is that a reasonable price for the profit inflection coming from the Switch 2?

I think so. Pre-order demand indicates this will be the biggest game hardware launch ever:

Management knew there was a lot of pent-up demand for the Switch 2. They still underestimated how many people would try to order the device.

2.2 million people entered the pre-order lottery in Japan. That is around 2% of the country’s population!

The next 12 months will be a blockbuster fiscal year for Nintendo. Let’s try to quantify these numbers and see what sort of profit will fall to the bottom-line.

$500 gets you the Switch 2 + Mario Kart bundle. Even though the price is cheaper in other countries, I believe the average Switch 2 purchase will generate at least $500 in revenue over the next 12 months when you add in-game purchases, Nintendo Switch Online, and purchases of updated games from the original Switch.

With this surge in pre-orders, 25 million hardware units sold now seems reasonable. Perhaps 30 million if they can get enough supply to market.

25 million x $500 = $12.5 billion in revenue just from Switch 2 hardware upgrades.

Nintendo’s record for consolidated revenue is $16 billion. That was during the pandemic boom for video games and with a much stronger Japanese Yen.

Nintendo can easily clear $20 billion in total revenue this fiscal year if it sells 25 million Switch 2 units.

Why? Because the hardware purchase + one game and the Nintendo Switch Online subscription do not tell the whole story.

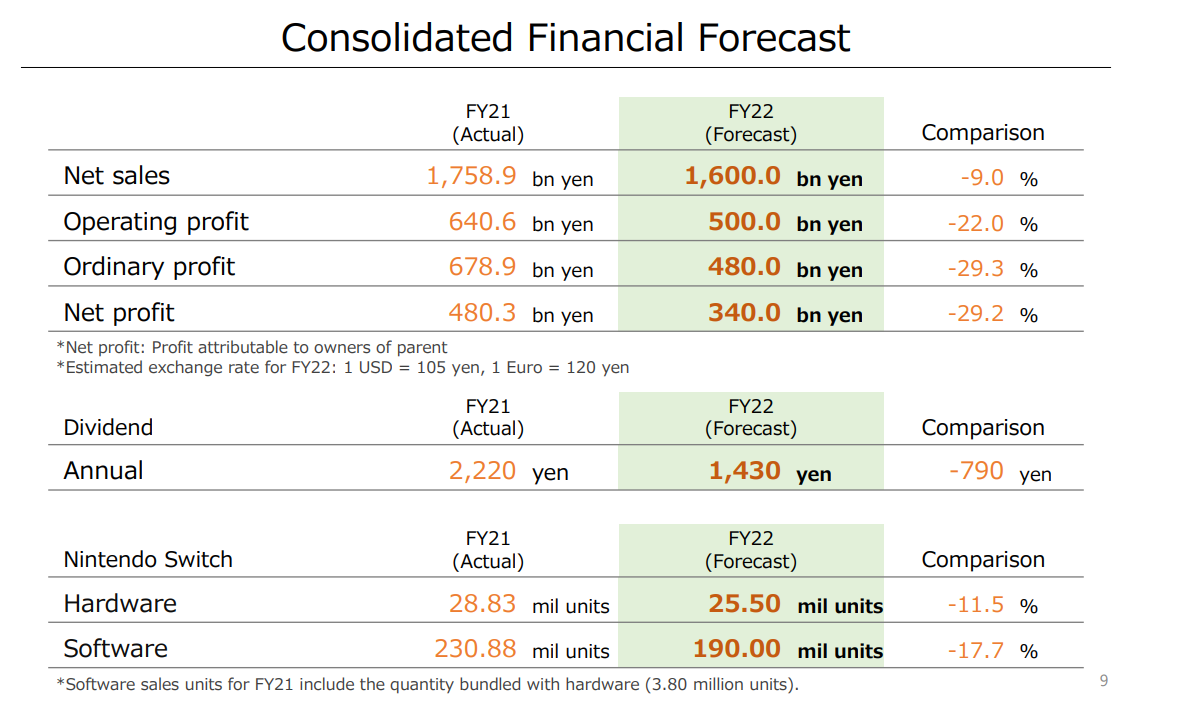

In fiscal year 2021, Nintendo sold 28.33 million Switch units. That led to 231 million software unit sales (games, subscriptions, add-ons, etc.). Not 28 million Switch sales and 28 million software units. Over 200 million game sales.

25 million Switch 2 units sold likely pushes the company above this record level of software sales because of the existing 100 million+ active Switch users who will still purchase games, add-ons, and Nintendo Switch Online (NSO). If you were wondering, NSO has 34 million members.

Including the non-gaming IP, movie, and theme park segment, revenue can eclipse $20 billion in fiscal year 2026.

As you can see from the above chart, Nintendo’s business has a lot of operating leverage. There are fixed costs to game hardware and software development. Selling the incremental Mario Kart game doesn’t cost much.

If 25 million units are sold in fiscal year 2026, Nintendo’s operating margin can reach 40%. That is $8 billion in annual earnings.

As demand normalizes for Switch 2 hardware, I think revenue will drop to around $15 billion with a 30%-35 % margin at the minimum. That is $5 billion or so in annual earnings.

Or, perhaps cumulative operating earnings of $35 billion - $40 billion over the next five years.

Does that deserve an enterprise value of $115 billion by the end of this calendar year? For a high-quality business like Nintendo, sure, that’s fine for me.

That is the path to $30 by the end of 2025. All we need to do is follow how many Switch 2 units get purchased. The rest will fall into place.

-Brett