NMI Holdings: 20% Growth, 8x Earnings? (Ticker: NMIH)

An Interview with recurring guest Fabio from Capital Mindset

YouTube

Spotify

Apple Podcasts

For this week’s Wednesday episode of the podcast, we brought back Fabio from Capital Mindset to discuss NMI Holdings.

You might be asking: what the hell is NMI Holdings? We were too, it is a company neither of us had heard of before.

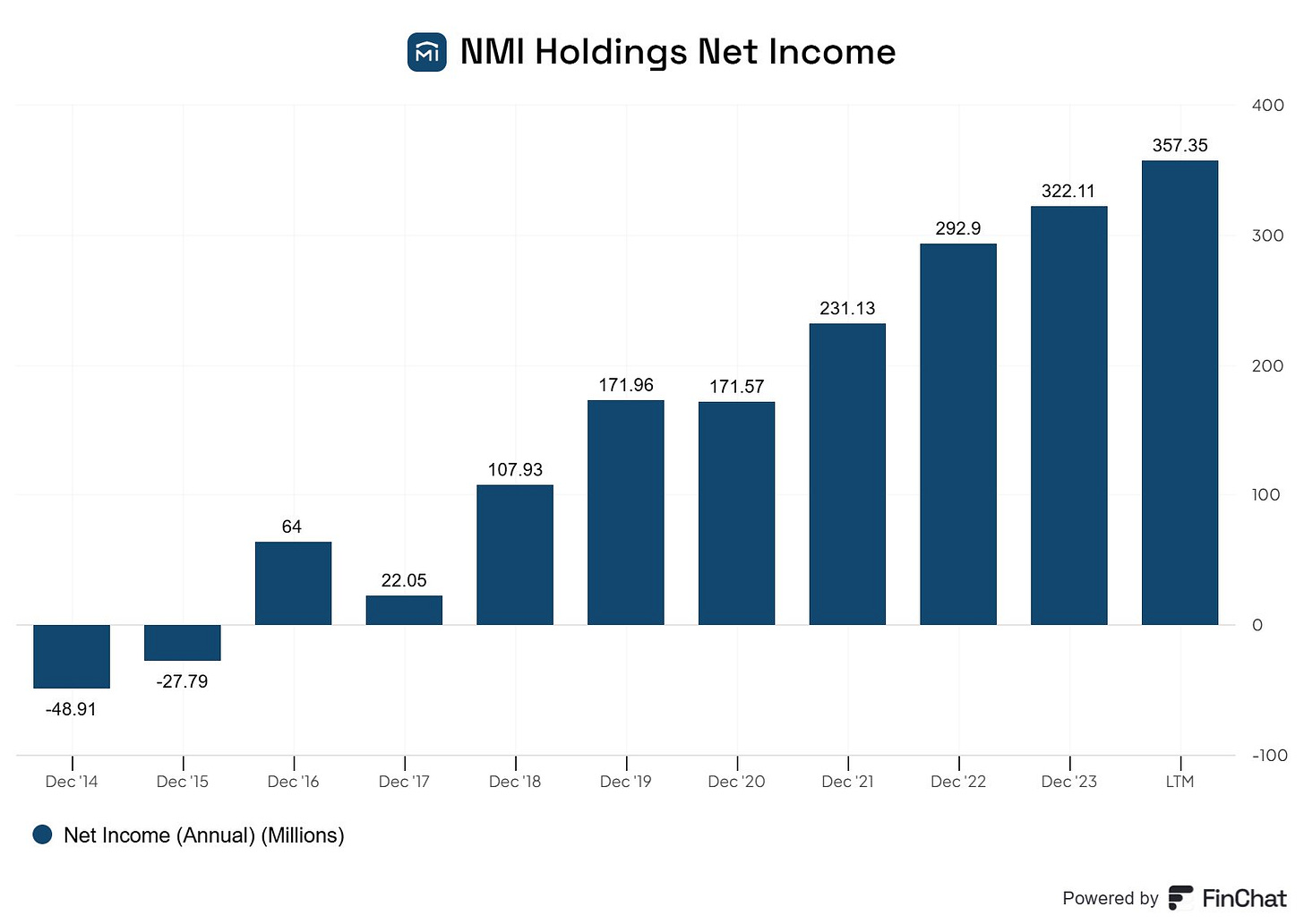

Boy, were we totally missing out on a promising industry. NMI Holdings is an upstart mortgage insurance operator that is taking market share year by year.

As Fabio details in the episode, this is a promising sector to be in given the regulatory landscape, locked-in customers, and low loss ratios.

Listen to the full episode for a great primer on a fascinating industry. Just look at these charts (from our friends at Finchat.io):

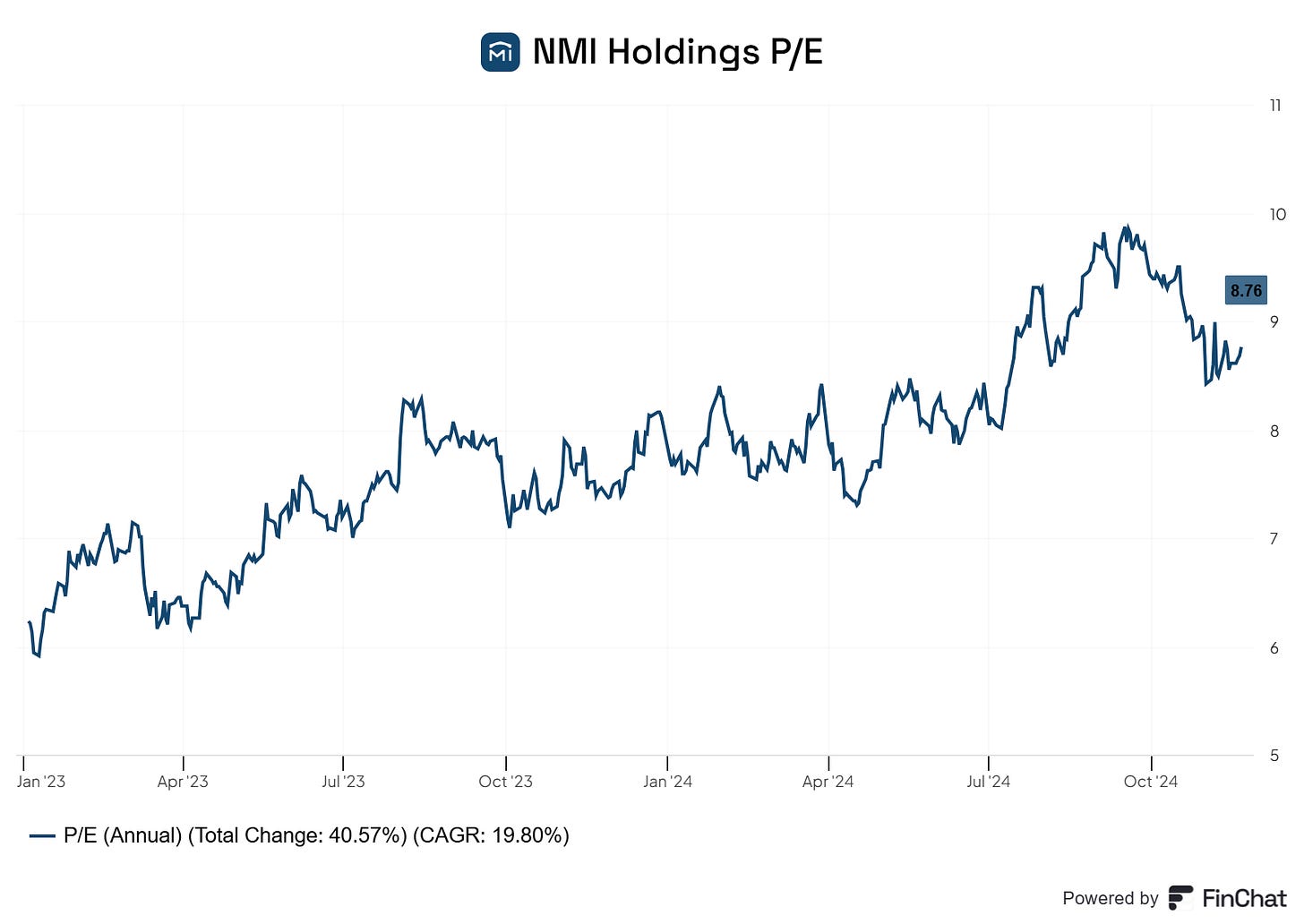

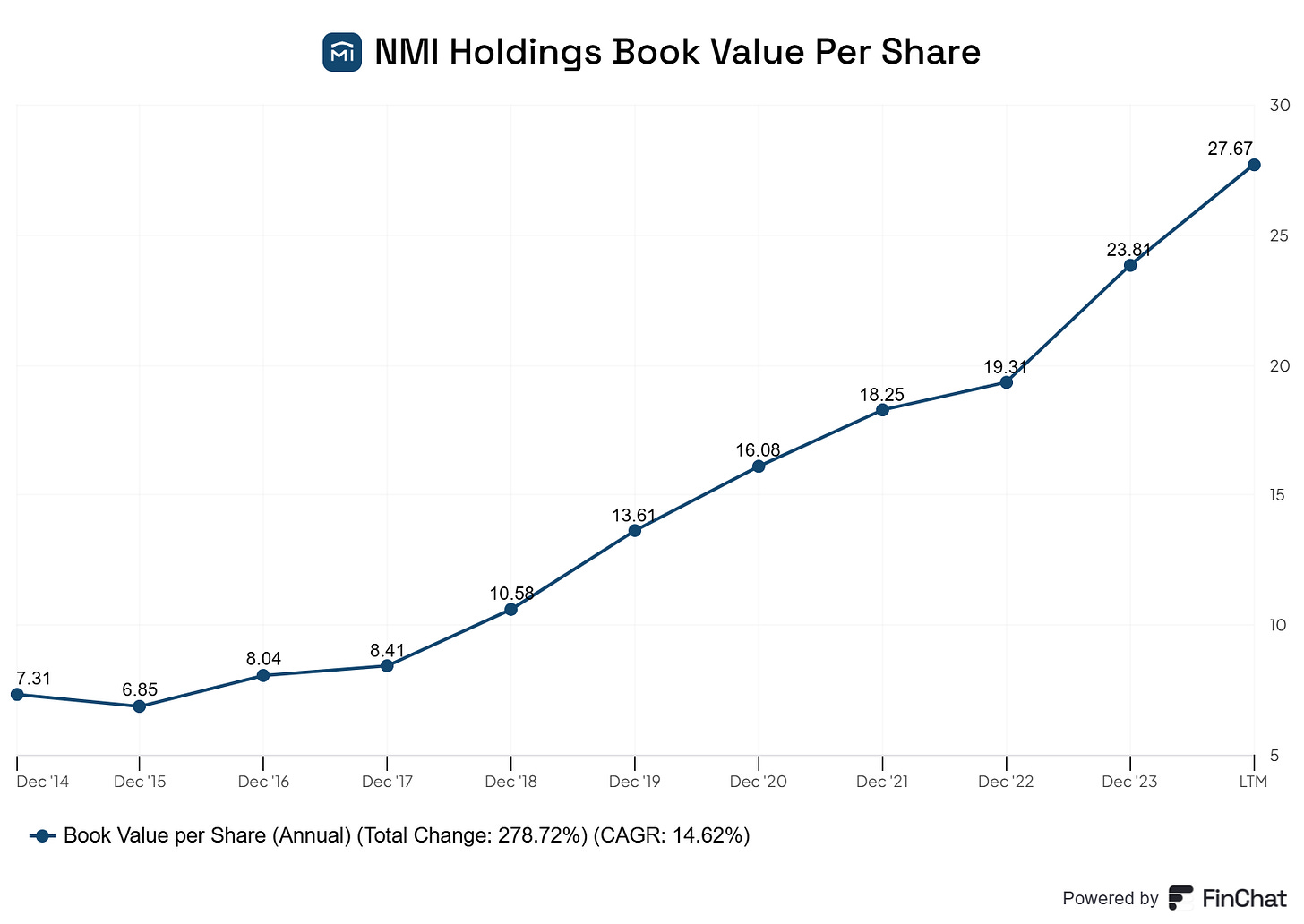

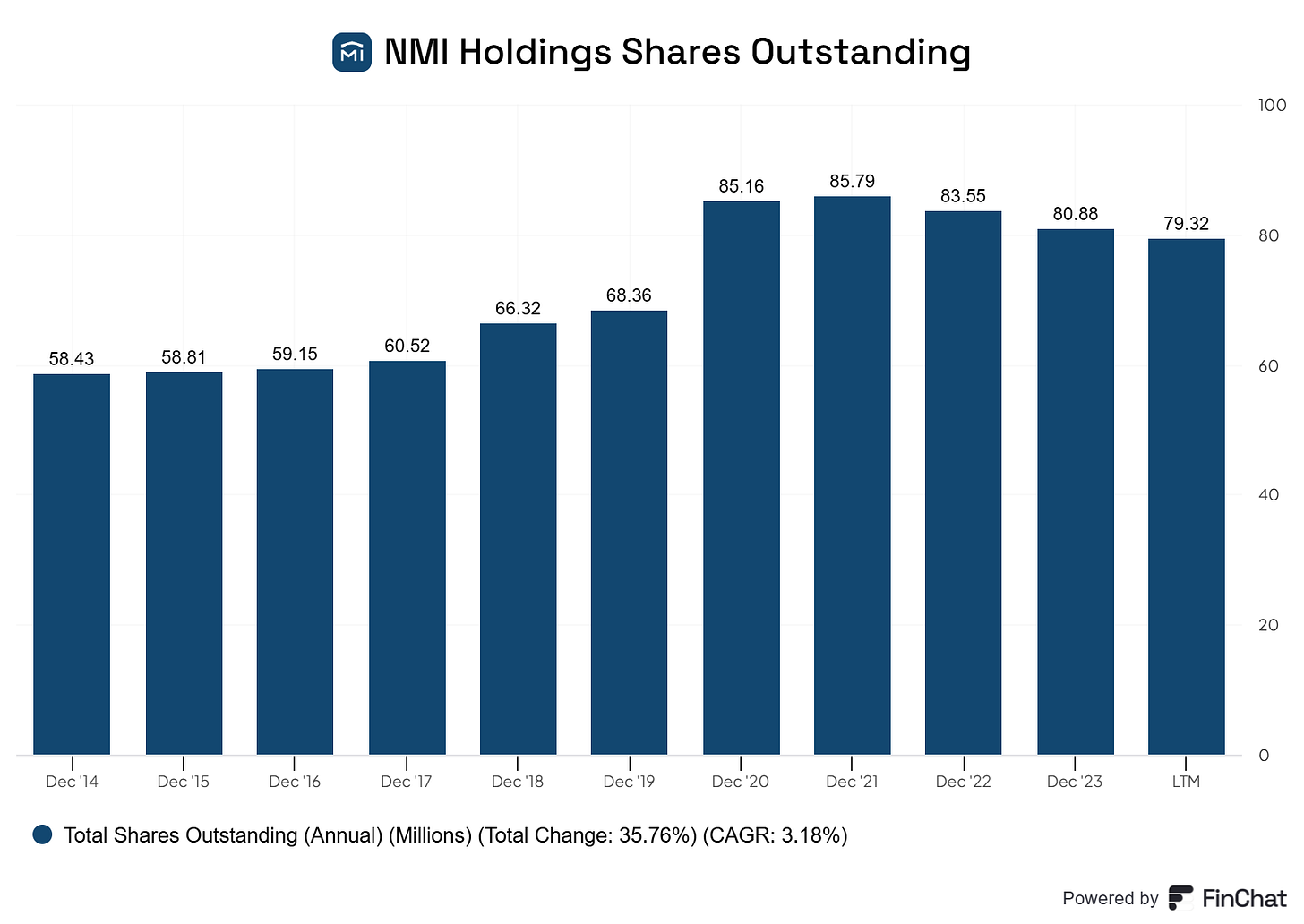

Low P/E, history of strong book value per share growth, and lowering its share count. Yummy.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.