Not So Deep Dive: Amazon (Ticker: AMZN)

Will this e-commerce, media, and cloud behemoth every achieve sustainable profit margins?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect them to be a polished research report.

Schedule for upcoming weeks: Meta Platforms, Salesforce, and Alphabet!

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Charts

Data is provided by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Amazon breaks its business down into three segments: North America, International, and AWS. However, under each of those hoods, there are several other divisions that function fairly independently of one another and help drive revenue for the business. I’ll go through the seven segments that they explicitly break out at the end of their annual report.

Online Stores: Accounts for 47% of revenue. This is primarily made up of the online marketplace we all know and love. Consumers can buy virtually anything in their store either from Amazon themselves or 3rd-party partners. “Third-party sellers accounted for 58% of all units sold in Q3, the highest percentage ever.” There are also other online stores here as well: Movies sold on Prime Video, E-Books sold on Kindle, Subscriptions purchased on FireTV, etc.

Physical Stores: Accounts for 4% of revenue. This one’s pretty straightforward. It includes all physical stores that they’re operating. So all Whole Foods locations as well as Amazon-branded stores (Amazon Go, Amazon Fresh, and Amazon Style). They do a lot of experimenting here.

Third-Party Seller Services: Accounts for 22% of revenue. 3rd-Party sellers come to Amazon for pretty much two reasons. They have the best distribution capabilities and there’s a massive audience to sell to. There are actually a ton of different revenue streams from here (storage costs, handling fees, shipping fees, professional plans, etc.), but basically, 3P sellers are offered a number of ways to sell on Amazon which include fees and commissions.

Subscription Services: Accounts for 7% of revenue. This is mostly made up of Amazon Prime subscriptions, but also includes audiobooks, music, e-book, and other subscriptions. With Prime, consumers get access to a ton of services for $15/month or $139/year. Since this essentially leverages the costs of other segments, this should be quite profitable.

Advertising Services: Accounts for 7% of revenue. This is one of those sleeping giants under the Amazon umbrella. It’s the 3rd largest advertising business in the world and from what I can tell, it’s incredibly profitable. These include product promotions on Amazon.com, on Kindle, on Amazon music, and across many of their devices.

AWS: Accounts for 13% of revenue. This one needs little introduction. It’s the world’s largest cloud platform. They have data centers across the globe. Customers pay for computing power and storage, and it’s a very high retention business. They were the pioneers in the space and it’s now the primary profit driver for the company.

Other: Accounts for less than 1% of revenue. Right now I’m not totally sure what all is in there. I imagine it’s Project Kuiper, Luna Cloud Gaming, or maybe devices. Basically, when something gets big enough, it becomes its own category.

(Ryan) History: I’m going to go in a different direction with the history here. If you want to read up on the founding story I recommend reading Brad Stone’s two books, The Everything Store and Amazon Unbound. Instead, I’m going to discuss what’s happened in the last 3 years.

In the first quarter of 2020, COVID hit. Unsurprisingly, this spurred tons of demand for online shopping. In fact, in 2020, Amazon’s retail sales grew by 39% off of a $245 billion base (in 2019, they were growing by 18%). Management even said that their fulfillment centers were working as close to 100% capacity as they could. Andy Jassy said in a recent interview, they were forced to either drastically expand capacity or fail to serve many of their customers. They chose to expand. In the following 2 years, they doubled the size of the fulfillment network that they had built over the 25 years prior and developed a transportation network that they were expecting to build over 6 to 10 years. Keep in mind, it takes ~18 months or longer to get an FC up and running. So they had to guess what sales would look like 2 years out and during this period customers were receiving stimulus checks as well which further exacerbated demand.

Well around the end of 2021 to the start of 2022, shopping trends started to revert. People were spending less and shopping more in person. This led to excess capacity across their fulfillment network and at the same time, nearly all their major variable costs were skyrocketing. Ocean freight, air freight, trucking/linehaul, and fuel costs all contributed to a rising cost of revenue. Additionally, they were over-employed in their FCs as they double-hired to fill roles during Omicron. This has all led to diminished income for 2022, especially internationally. However, they’re now in the process of rightsizing that cost structure. Many of those variable supply chain costs that I mentioned have come down significantly, and they’ve pulled back on capital expenditures across their retail businesses. While the full purchases of property and equipment line items might look the same as last year, a larger percentage of that is going toward AWS.

(Brett) Industry/Landscape/Competition:

When looking at the industry and competition, I am going to separate Amazon into two sections: e-commerce/media and cloud computing (advertising and subscriptions will get bundled into the first category)

As discussed in the Microsoft episode, the cloud computing industry is large and growing quickly, estimated to grow at an average CAGR of 15% through 2030 and hit a size of $1.5 trillion.

AWS is not targeting this entire market, but with a 30%+ market share among the cloud infrastructure providers it has a ginormous market opportunity ahead of it (last quarter, it hit $82 billion in ARR)

Competitors in the cloud: Azure (number one), Google Cloud, Oracle, IBM, Cloudflare, and tons of smaller players

Within e-commerce, the revenue opportunity is even larger. Amazon divides its regions into North America and International.

Just in the United States, the e-commerce market is estimated to be around $900 billion a year (Amazon NA revenue was $300 billion over the last 12 months)

In Europe, the e-commerce market is estimated to be slightly smaller than in the United States

Outside of North America and Europe, Amazon has a few emerging market bets for its e-commerce marketplace that it hopes can grow aggressively this decade. One of these is India, which has an e-commerce market of $75 billion right now but is expected to grow rapidly.

Competitors: Anyone in retail. Or, conversely, anyone that is looking to power online retailers (i.e. Shopify). If I listed everyone it would take a whole page.

(Brett) Management and Ownership:

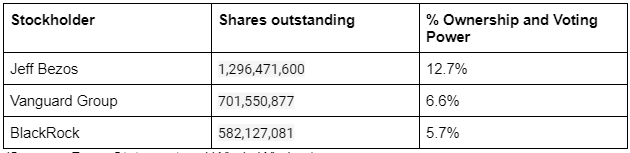

As was well publicized in 2021, founder Jeff Bezos is not running Amazon anymore. He stepped down in 2021 and is now the Chair of the board.

Andy Jassy is now the CEO. He “founded” Amazon Web Services, which he ran until taking over the consolidated CEO role.

There are 11 total members of the board (Bezos and Jassy are both on the board), with all independent directors being random executives from other companies. No red flags there.

The board of directors does not get paid except for discretionary stock-based compensation grants. Last year, two of the 11 members got these grants.

Amazon has a senior leadership team it calls the “S-team.” There are now 28 members of the team across all its divisions. If you look at the list you can see where Amazon’s priorities are: https://www.geekwire.com/2022/amazon-expands-s-team-with-addition-of-four-executives-to-senior-leadership-group/

The executive team gets paid a “simple” (their words) compensation plan

First, they get a modest base salary. And this seriously does mean modest. No executive got paid more than $200k last year.

Second, they get stock awards:

“Periodic grants of time-vested restricted stock units subject to long-term vesting requirements that assume a fixed annual increase in the stock price so that compensation will be negatively impacted if our stock price is flat or declines”

Total executive compensation was stated at $352 million in the last proxy statement. However, this includes the 10-year performance stock plans for executives that got promoted like Jassy. His $212 million estimated “compensation” is the value of all the stock awards he can earn over the next 10 years.

Ownership is very boring outside of Bezos still with 12.7% of the company.

No red flags on the proxy from what I could find. The only small thing was that the company pays for Bezos’s security each year, which I think he should pay himself.

(Sources: Proxy Statement and Whale Wisdom)

(Ryan) Earnings:

Last 12 Months:

$502 billion in revenue, up 9.7% YoY

$305 billion from North America Commerce (61%)

$121 billion from International Commerce (24%)

$76 billion from AWS (15%)

$13 billion in operating income, down 54% YoY

(1%) operating margins in North America

(6%) operating margins in International Commerce

30% operating margins in AWS

Most recent quarter:

$127 billion in revenue, up 15% (19% in CC)

North America sales up 20%

International sales down 5% (Big FX impacts here + recession in Europe. Impacts revenue but not income because they reinvest in their local geographies)

AWS sales up 27%

$2.5 billion in operating income, down 50% YoY

AWS was the only profitable business this quarter.

Most advertising revenue comes from North America too and that saw 30% growth YoY. So that should show just how unprofitable the actual retail segment is right now.

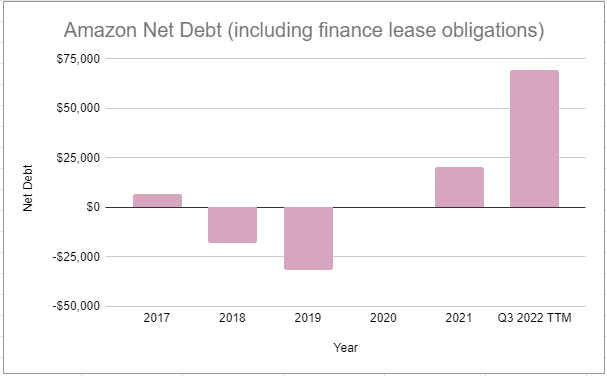

LTM Free Cash flow is -$20 billion. However, in Q3 they had elevated inventory due to supply chain issues in Asia which hurt their working capital.

They spent about $60 billion in capital expenditures over the last 12 months. Most going towards AWS.

LTM FCF minus principal repayment of finance leases & financing obligations was -$28.5 billion. (Amazon pays for a lot of its equipment through finance leases, meaning they buy assets over time instead of upfront, so ignoring the finance leases can make FCF look better than it really is)

We were talking about Azure last time around and I wanted to make sure I talked about the depreciation on cloud servers. Right now, Amazon depreciates its cloud servers based on a 5-year useful life, but I would think that actually extends over time. In Q4 last year CFO Brian Olsavsky said “We've been operating at scale for over 15 years, but we continue to refine our software to run more efficiently on the hardware. This then lowers stress on the hardware and extends the useful life”. This would ultimately lead to improving cash flow at AWS.

(Ryan) Balance sheet and liquidity:

Cash:

$59 billion in cash.

They invest the cash in a number of things, but it’s mostly money market funds and AAA corporate debt.

The only unfortunate thing here is that 36% of the debt securities they own are longer than 12 months. So they won’t benefit quite as much from rising rates this year.

For reference, this quarter they only earned about 0.5% on their cash or 2% annualized.

Liabilities:

Total debt of $63.5 billion

90% of the debt was issued in the last 5 years.

Average remaining life on the notes is 14 years. Meaning the average maturity is around 2036, but some maturities extend all the way to 2060.

The effective interest rates vary as well depending on the duration. But the highest issued over the last 5 years is 4.3%. So I’m guessing the average rate is around 3%.

Interest expense as a % of total debt is about 3.9% right now (annualized last Q’s). However, they’re still paying back some of their older, more expensive debt.

They also have operating and finance leases. For the purpose of calculating the enterprise value, I’m going to include both which is another ~$70B in debt.

So ~$130B in total debt. Minus the $59B in cash, they’ve got about $70B in net debt. So for calculating multiples, I would just add $70B to the market cap. But Brett will go through all that.

(Brett) Valuation:

Market cap of $1 trillion

Enterprise value of $1.07 trillion

EV/OI of 83

EV/AWS OI of 46.7

EV/FCF of -40.7

Anecdotal Evidence:

(Ryan) I’m a customer for them across a number of categories. Not really a ton to say here, but I think when we ask which of the big tech companies will be a better business in 5 years (wider moat), Amazon is probably number one.

(Brett) There’s no way I’m leaving Amazon as a customer unless they materially make the experience worse. I start my buying experience for everything except food and sometimes clothing on Amazon. The moat is so large, they even have a dedicated package delivery set up in my apartment building.

Future growth opportunities:

(Ryan) Buy with Prime. Amazon launched this in April of 2022 and it has only been available to merchants on an invite-only basis. This allows US-based prime members to use the Amazon checkout and delivery process through other merchants’ sites. So someone who sells shoes and uses Wix as their CMS, could easily embed the Buy with Prime checkout option and offer it to their customers. According to internal Amazon data, sellers who offered this saw an average 25% increase in shopper conversion. On Jan. 31, they’re rolling it out to all eligible US Merchants.

(Brett) As with all these big tech companies, there was a lot to choose from here. And in reality, the key driver for the next five years will be growth at AWS while maintaining profit margins. But I am going to choose advertising revenue. Ads revenue includes sponsored, display, and video advertisements across Amazon properties, mainly the e-commerce website. Since breaking out this segment, we’ve learned that advertising revenue has grown at 46% annually since 2019 and now makes up 7.1% of overall sales. At high margins, advertising revenue can help with consolidated operating margin expansion over the next 3 - 5 years.

Highlights and lowlights:

Ryan’s Highlights:

Infrastructure as a moat. The physical footprint and logistics network enable Amazon to offer prices and services that others simply can’t compete with. I don’t see how anyone can replicate them in retail.

They’ve done a great job adding margin-accretive business lines. That’s enabled them to invest more in the customer experience, which I think deepens their moat.

I like the management team. In watching interviews with Jassy, you can tell he’s a clear and rational thinker. The CFO does a good job explaining the important points on the calls. And they strike me as honest.

Ryan’s Lowlights:

Their obsession with devices (and maybe just moonshots in general). I was on the fence about it for a long time, but after learning that Alexa burns about $10 billion a year, I can clearly say it’s a waste. They’re also buying iRobot for $1.7 billion. They also invested heavily in the Fire phone and it was a flop. I just don’t see why they’re so eager to get into hardware.

Brett Highlights:

The corporate philosophy and culture are fantastic for setting up incentives to drive long-term value creation for all stakeholders (including shareholders). This was the best proxy statement I’ve read for these shows so far.

With the growth of higher margins services (3P sellers, ads, subscriptions) going from 23.4% of sales in 2017 to 36% over the last twelve months, Amazon should now have the (theoretical) room to expand its consolidated margins.

AWS is an obvious highlight I’m sure we’ll discuss throughout the episode.

Brett Lowlights:

The media/content division. I’m not sure that, other than some locked-in super fans for various sports, the content spending is driving better long-term economics for the Prime business. Inverting the situation, how many people would churn from Prime if the media products disappeared overnight?

The only other lowlight I have, and this is a big one, is the wasteful spending across so many R&D projects. Now, I’m sure executives would argue these projects will create value over the long term, but why do they need to do so many all at once? Here is a list of all the projects they are working on outside of the core businesses (I’m sure I’m missing something too):

Fire TV and Wifi devices

Alexa and Alexa-connected devices

Kindle and reading devices

Ring and other home security products

Consumer robotics like the Astro Robot (they are acquiring iRobot too)

Just Walk Out Technology and Amazon Go/Fresh Stores

Whole Foods

Prime Air drone deliveries

Amazon Music, including podcasts (acquired Wondery) and a live audio service

Acquiring MGM Studios

Amazon Care (acquiring One Medical)

Project Kuiper (satellite internet similar to Starlink)

Luna Cloud Gaming Service

Amazon Games video game production company

Amazon Style physical fashion/apparel store

Amazon Pharmacy

Electric vehicles (Rivian commitment and investment)

Self-driving vehicles

These are all just from the past two years. What needs to go, and what needs to stay?

Bull Case:

(Ryan) Utilization/Productivity rates go up across their fulfillment network, this probably requires a combination of increasing unit volume and rightsizing the actual capacity itself, but if it happens over the next couple of years, I think we could see operating margins reach close to 10%. And, as fulfillment Capex comes down, the overall Capex line item is going to be dependent on AWS demand. (Plus, the short-term catalyst would be energy costs coming down.)

(Brett) The bull case is very simple, and it is just a recovery in margins back to slightly above 2019 levels, which is very doable given that AWS, ads, subscriptions, and 3P sellers are a larger part of the business today. At 10% operating margins on a $600 billion revenue base (which is doable in a few years), that is $60 billion in annual operating income. At the current EV slightly below $1 trillion, that does not look like an expensive stock whatsoever.

Bear Case:

(Ryan) I think a big concern is short-term. I could see it taking a while to get retail profitable again, especially if we face any sort of consumer slowdown.

(Brett) My largest concern with Amazon – perhaps my only concern – is that they are so ambitious and have gotten so large and sprawling across the globe and different product offerings that it will be impossible to reign in spending. Was this a “one-way door” as Bezos likes to say? Maybe.

More or less interested?

(Ryan) More interested. Great moat, widening moat, and AWS is a wonderful business. And it is not too expensive.

(Brett) More interested. There are three things we look for in investments: predictable cash flow, high-integrity management, and an attractive price. Amazon looks potentially (key word is potentially!) promising on all three.

Stock for next week? (Meta Platforms)

Sources and Further Reading

2021 Shareholder Letter: https://s2.q4cdn.com/299287126/files/doc_financials/2022/ar/2021-Shareholder-Letter.pdf

Books by Brad Stone: https://www.amazon.com/stores/Brad-Stone/author/B001H6L5IM?ref=ap_rdr&store_ref=ap_rdr&isDramIntegrated=true&shoppingPortalEnabled=true

Invent and Wander: The Collective Writings of Jeff Bezos: https://www.amazon.com/Invent-Wander-Collected-Writings-Introduction-ebook/dp/B08BCCT6MW

Andy Jassy at Code 2022 Conference:

Great stuff guys. Lookin' forward to that Salesforce deep dive!