Not So Deep Dive: American Express (Ticker: AXP)

Are investors underrating this Dow Jones stalwart?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Nelnet (next week) + Dating app companies (month of March)

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: I would describe American Express as a specialty finance company. Unlike most institutions that focus on a particular segment of the financial industry, AmEx operates across nearly the entire transaction lifecycle. So in a typical transaction, someone inserts their card (typically issued by their bank) into a merchant’s point-of-sales terminal. The merchant acquirer (Stripe, Adyen, etc) sends the data to the card networks (Mastercard/Visa) who then queries the cardholder’s issuing bank (Chase, Bank of America, etc) for authorization. Once it’s authorized, it’ll display some sort of a “transaction authorized” message. American Express performs all of those functions (except the point of sales terminal) and they make money basically in three ways:

Discount revenue: These are their merchant transaction fees. On each transaction where a customer uses an American Express card to pay, the merchant is charged a small fee that gets paid out to AmEx, similar to Visa and Mastercard. AmEx charges anywhere from 1.6% + $0.10 to 3.45% + $0.10. It’s estimated that AmEx’s fees are on average 50% higher than Visa and Mastercard. However, in the US today, 99% of merchants accept American Express likely because of the attractiveness of American Express’ cardholder base. Discount revenue accounts for 58% of revenue.

Card fees: This one is pretty unique to American Express. Unlike other card issuers who basically give their cards away for free because they want people to spend on them, AmEx actually charges customers each year in order to use one of their cards. The rates vary depending on the market, but here in the US it costs $695/year for a platinum card and $250/year for the Gold Card. In exchange, users get points back that are redeemable across AmEx’s partners (airlines, hotels, uber, etc). Card fees account for 11% of revenue.

Interest income: This is the more common way credit card companies make money. American Express charges customers an interest rate on carried balances in their accounts, and also originates simple loans to its cardholders (that includes individuals and corporations). Like other businesses, they have interest expenses as well so, in a rising rate environment, they can see their interest income shrink. Interest income accounted for 19% of revenue in 2022.

They also report “service fees and other” revenue which is predominantly made up of travel commissions. So you book trips through American Express, and in exchange, the travel providers kick back a commission to AmEx. They don’t often call this one out, but because of the boom in travel last year, this line item grew by 36%.

Ultimately, the American Express model is what management calls “spend-centric” and it’s really based on their cards and what it signals to be a member.

(Ryan) History: American Express was founded in 1850 as an express mail business in Buffalo, New York. And it was initially founded by the merging of 3 separate express mail businesses started by Henry Wells, William Fargo, and John Butterfield. 7 years later, they got their start in the financial services business when they expanded into the money order business. They also became a real international presence when they introduced the traveler's cheque in the 1890s.

It really wasn’t until 1958 though that American Express began to take its current shape. That’s when they launched their first charge card. Shortly after Warren Buffett bought American Express for the first time in his Buffett Partnership, but sold it at a modest profit. It wasn’t until the 90s that Buffett began to accumulate his now 20% ownership of the business.

They also had a couple of really formative things happen in the last 10 years that I think are important for investors to keep in mind. In 2015, they lost Costco as one of their co-branded credit partners. At the time, 10% of American Express’s cards in circulation were Costco co-branded. There were concerns this would lead to catastrophe for AmEx and the stock fell as much as 35% following the news. Since that time, however, American Express has continued to grow its cardholder base and replace Costco with other partners.

(Brett) Industry/Landscape/Competition:

The credit card market size is hard to exactly pin down as I saw a range of estimates from different sources

However, I would simplify it to them competing in the entire payments market, which is trillions of dollars in volume a year

Card network competitors: Visa (61.6% market share in U.S.), Mastercard (26% market share in the U.S.), and then Discover (2.2% market share). Amex has an estimated 10.5% of total card spending in the U.S., which is down from 15.6% in 2007. Digging deeper, they are competing with the credit card issuers like Capital One, JP Morgan Chase, and other banks that have travel/business cards.

Important note: Amex has a much higher % of volumes from credit cards than Visa or Mastercard, which has been a key reason it has lost market share over the last 20 years or so as debit cards grew faster than credit cards.

Other competitors: Those trying to disrupt the Big 3 card networks like buy-now-pay-later (BNPL), cryptocurrencies, government systems (will link to a source outlining India’s Unified Payments Interface), or really any other digital payments method that does not require you to connect your debit/credit card to the account.

What are the most legitimate threats to the Big 3 card networks?

(Brett) Management and Ownership:

The Chairman and CEO is Stephen Squeri, who was named to this role in February 2018

Squeri is a lifer at Amex, joining the company in 1985.

The board of directors is fairly standard for what I might categorize as a “Dow Jones Company” with plenty of independent directors from a variety of industries, a lot of seats, and pay of a few hundred thousand dollars each year.

With the size of the company, board pay is not a concern at all

Executive compensation has three criteria: base salary, annual cash bonuses, and long-term performance stock awards

Total exec comp was $77.5 million in 2021 which is less than 1% of 2022 pre-tax income

The annual bonuses are based on a wide variety of metrics like revenue growth, earnings per share, net promoter score, and “fire up the core engine” (?)

For anyone concerned about the strange incentives, 50% of the weighting goes to the financial metrics

The long-term stock awards are based on three-year average ROE and total shareholder return (TSR) vs. peer group companies

“The program requires top-quartile relative Return On Equity (ROE) for Performance Restricted Stock Units to pay out at target, and above-target payouts are contingent on Total Shareholder Return (TSR) performance being in the top third of our peer group regardless of our ROE performance. Median relative ROE performance results in an 80% payout”

(Ryan) Earnings:

2022:

$51 billion in total revenue, +25% YoY

58% is from discount revenue

19% is from net interest income

12% is from net card fees

8% is from service fees and other revenue

3% is from processed revenue

$41 billion in total expenses with the largest being card member rewards

$10 billion in pre-tax income (or 20% pre-tax income margin which is pretty close to the average since the 90’s)

Paid out $5 billion through repurchases and dividends or pretty much 70% of their net income.

133 million total cards in force (3% CAGR over the last 10 years)

$1.6 trillion in annual network volume (6% CAGR over the last 10 years)

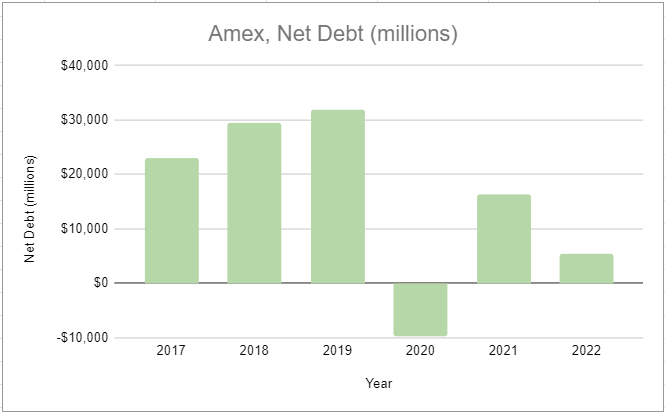

(Ryan) Balance sheet and liquidity:

Assets:

$33.6 billion in cash and interest-bearing deposits.

$57 billion in cardmember receivables

Net write-offs on the receivables jumped from 0.2% in 2021 to 0.8% in 2022.

$108 billion in loans to cardmembers.

The percentage of loans that are 30 days past due are at 1% vs. 0.7% last year.

Though the increase in rates has hurt them on the margins, their delinquency rates are still significantly better than peers.

Liabilities:

$42.6 billion in long-term debt outstanding

$34 billion is in fixed-rate senior notes, with rates between 2.8%-4% and have maturities dating out to 2042.

The rest is a mix of debt across their subsidiaries with some of it being floating rate. Nothing too crazy.

(Brett) Valuation:

Market cap of $129 billion

Enterprise value of $134.4 billiojn

EV/E of 18

Earnings yield of 5.6%

Anecdotal Evidence:

(Ryan) Feels like most people think of it as a “flex” or a way to signal wealth. Certainly regarded as a premium brand.

(Brett) They definitely have a good brand. People think of it as a luxury.

Future growth opportunities:

(Ryan) Converting more cardholders to American Express bank accounts. This was discussed at some length by the CFO during a recent Bank of America Conference. “There is significant overlap (between those who have a card and those who have a high-yield savings account), but not complete overlap. One of the things we probably under-executed for many years was mining both ways, the power of the overlap.” The more customer funds they can keep on the platform, the more they can lend. They said they wanted to increase their lending growth, and this seems like a great low-cost of funds for that effort.

(Brett) We have a soft rule of not using “international expansion” as a future growth opportunity. But with Amex, I am going to use a specific international growth opportunity that can be the core driver of getting them to merchant parity with Visa or Mastercard, which is simply investing in their sales outreach in more international countries. When this new management team took over, they decided to target a few international markets, and over the next 10 years I think they can eventually expand to all relevant countries outside the U.S. This will increase the value proposition for people domestically in those countries but also the “world traveler” customer that Amex targets in wealthy countries.

Highlights and lowlights:

Ryan’s Highlights:

Diverse revenue streams. This exposes them to lower credit risk than other financial institutions. With rising rates, Amex’s provisions for credit losses have jumped but because net interest income only accounts for ~19% of the business, they aren’t nearly as exposed.

The Premium Brand. Whether it’s the luxury lounges, the known costs required to be a member, or the fancier-looking card, AmEx attracts a more affluent customer base. This customer base carries less risk credit-wise and should be more resilient in financial downturns.

Benefits from inflation across most of its business. Although interest rate hikes increase their interest expense, higher interest rates also imply inflation. If inflation causes an increase in the cost of goods for most consumers, their revenue will increase directly because of that.

Ryan’s Lowlights:

Honestly, very few lowlights for me. The lack of international distribution is one that Brett will touch on, but other than that I can’t think of one. I maybe would’ve said that they’ve pressed their advantage too far on the merchant fees and card fees, but merchant acceptance has ballooned in recent years and the cardholder base continues to grow.

Brett Highlights:

Amex has reached virtual distribution parity with Visa and Mastercard in the United States. I think this means the industry has achieved oligopoly status where all of the players will act more rationally (this is on the payment network side, they still face more competition as an issuer of credit cards).

The international expansion strategy seems rational and achievable. They are working through the most important cities to their customers (Tokyo, Singapore, Sydney, etc.) before moving to all relevant regions eventually. What I like about this is they can invest a lot into this expansion and will likely get durable returns for many years. I think it also means they will have a wider moat five years from now (a key indicator/question Buffett likes to ask)

The cards-in-force additions have been strong post the ending of the Costco partnership and when the new executive team started its strategy. Plus, it has skewed toward Gen Z and millennial customers with high lifetime values.

The capital allocation strategy is rational and consistent. Shares outstanding have declined by almost 3% a year since 2017.

Brett Lowlights:

Amex has an inherent distribution disadvantage vs. Visa and Mastercard. They are working hard to fix this through international partnerships and sales teams pushing to get merchants on their network, but it is possible they can never catch up to the more open ecosystems of their main competitors.

Reliance on large partners, specifically Delta Airlines, to drive volumes and customer acquisition.

Bull Case:

(Ryan) Interest expenses as a percentage of interest revenue come back down, resulting in higher net interest income. If interest income normalizes, the cardholder base continues to grow at 3% per year, card fees continue to gradually increase, and they increase global merchant acceptance, I think ~10% growth is reasonable.

(Brett) Today, Amex trades at an EV/E of 18. At those prices, it indicates you need durable topline growth in order to achieve annual returns of 10% or more on the stock. Management is guiding for 10%+ revenue growth from 2024 onwards which will lead to higher bottom-line growth through margin expansion and share repurchases. I think if you believe Amex will grow its topline by 10% – maybe even a little less – the stock can work well going forward.

Bear Case:

(Ryan) Even though they’d likely fare better in a recessionary environment, spending could still slow for them. And their new cardmember acquisitions would probably hurt relative to the other card networks due to the higher fees. I think it’d be tough to get enough earnings growth in that environment to make this a 10%+ return over the next 5 years.

(Brett) The bear case comes down to two things: increased customer acquisition costs due to the proliferation of Visa and Mastercard-backed cards from new entrants plus lower volume growth as we got a one-time bump in spending last year that will not hold up in 2023. For reference, look at the changes to the U.S. consumer savings rate over the last few years

Sources and Further Reading

Digital Payments system from Indian central bank: https://www.imf.org/en/News/Articles/2022/10/26/cf-how-indias-central-bank-helped-spur-a-digital-payments-boom

Card brand market share in the United States, 2007 - 2021: https://www.statista.com/statistics/279469/market-share-of-credit-card-companies-in-the-united-states-by-purchase-volume/

Reaction to losing the Costco partnership: https://www.fool.com/investing/2016/06/22/how-bad-management-led-to-american-express-costco.aspx#:~:text=On%20Feb.,sending%20the%20stock%20down%206%25.

American Express launches checking account: https://techcrunch.com/2022/02/08/american-express-launches-its-first-all-digital-consumer-checking-account/

2022 Investor Day Presentation: https://s26.q4cdn.com/747928648/files/doc_presentations/2022/2022-Investor-Day-Presentation.pdf

Why Amex Lost the Costco Partnership: https://viewfromthewing.com/an-inside-account-of-how-amex-lost-the-costco-deal-and-what-it-means-going-forward/