Not So Deep Dive: Ansys (Ticker: ANSS)

The simulation software behind many of the world's technological innovations

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

November Engineering Software theme:

11/1: Dassault Systemes (Ticker: DASTY)

Today: Ansys (Ticker: ANSS)

Next week: Bentley Systems (Ticker: BSY)

11/22: Procore (Ticker: PCOR)

11/29: PTC (Ticker: PTC)

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Ansys develops and sells engineering simulation software to a variety of industries. Their products help engineers “explore and predict how products will work – or won’t work – in the real world.” So with Ansys, users can test designs or products by seeing how they would react when applied to different temperatures, pressures, fluid flows, or other changing real-world environments. To highlight a good use case, I’ll use the example that Ansys’ CEO talked about on the last conference call.

In September, NASA launched an unmanned spacecraft that collided with an asteroid and altered its orbit. This was a huge moment in human history and in preparing for this launch the Johns Hopkins Applied Physics Lab used one of Ansys’ products to test the flight. Here’s a quote from the CEO, “The Johns Hopkins Applied Physics Lab extensively used Ansys STK throughout the mission planning process from formulating DART’s trajectory through the asteroid system as well as to visualize relevant vectors and altitudes. The thermal team used STK’s full mission environment when checking the location of the sun relative to the satellite during critical maneuvers.”

That’s one specific example, but Ansys has tons of different products (93 in total) intended to meet various testing needs. And they use both a direct salesforce and distribution partners in their go-to-market strategy. Additionally, Ansys generates revenue in two ways, the initial software license (~50%) as well as maintenance and services revenue (these include software license updates and product support fees and account for the other half of the top line).

(Ryan) History: The idea for Ansys first came about thanks to an engineer named John Swanson. Around the mid-1960s, Swanson had graduated from Cornell with a master’s in mechanical engineering and was working at Westinghouse Astronuclear Laboratory and was responsible for stress analysis. At the time, all engineers were doing finite element analysis by hand and John had the idea to automate the process through software. Westinghouse apparently rejected the idea so in 1969 John left the company to start it on his own. It’s reported that he founded the company “Swanson Analysis Systems” out of his farmhouse in Pittsburgh.

The initial software was developed on punchcards and required Swanson to rent a mainframe computer by the hour. This slowly turned into a bit of a success and by 1991 Ansys – it was called SASI at the time – had 153 employees and $29 million in annual revenue. A year later, SASI acquired a fluid dynamics analysis software company called Compuflo and that really began their streak of acquisitions. Ansys went public in 1996 and since that point has made ~30 different acquisitions.

(Brett) Industry/Landscape/Competition:

Within engineering software, Ansys has a focus on simulation, which is going to be the majority of its addressable market whether it is for fluids, heat, or electronics

Always take these with a grain of salt, but there is a research report published that the simulation software market will pass $40 billion in 2030, growing at around 12% a year

For reference, Ansys does around $2 billion in revenue and is the leader in the space, meaning there should be a fantastic tailwind for its products over the next decade and beyond

Competitors: Solidworks Simulation, Inventor and Fusion 360, and a few other general simulation products. There are a ton of smaller niche software programs for very specific simulations that Ansys consistently acquires

For example its most recent acquisition of C&R Technologies, which does thermal simulation for space systems

(Brett) Management and Ownership:

CEO: Ajei Gopal. He has many years of experience working in technology/software, starting at IBM in 1991. Interestingly, he was on the board of Ansys before taking the CEO role in 2017.

The ownership and share structure is boilerplate. Big index fund ownership, single class share structure, and one big growth fund owning more than 5% of shares.

Compensation:

Total board of directors pay in 2021 of $2.7 million or 0.16% of 2021 Gross Profit

Total executive compensation of $39.9 million or 2.4% of 2021 gross profit

The majority of compensation is in the form of stock awards

Executives get paid performance stock units (PSUs) based on ACV, non-GAAP operating cash flow, and total shareholder return (TSR) hurdles

Annual cash bonuses are based on non-GAAP revenue and non-GAAP operating income hurdles

Yellow flag: the hurdles for bonuses seem a bit conservative and really easy for the executive team to hit. Why is this a problem for outside shareholders? Then management is incentivized to not grow as much as they could while also getting paid some handsome salaries

I would also worry about the incentive to grow through acquisitions, although the TSR metric can help mitigate this a bit

(87,026,055 shares as of 2022 Proxy)

(Ryan) Earnings:

Last full-year:

$1.87 billion in Annual Contract Value, up 16%. (Ansys uses ACV due to the upfront revenue recognition model on perpetual licenses. Over the long-term, ACV and Revenue are equal, but they may lag one another depending on the year)

$1.91 billion in revenue, up 13%.

86.5% Gross Margins

$526 million in free cash flow (28% free cash flow margins)

Most recent quarter:

$409.3 million in ACV, up 12% YoY (20% in constant currency)

$127.2 million in operating cash flow (down slightly due to timing on some investments)

$1.1 billion in deferred revenue & backlog

Basically offset SBC with buybacks

(Ryan) Balance sheet and liquidity:

$633 million in cash and cash equivalents

And $500+ million in annual free cash flow

$753 million in long-term debt

All the debt comes from two variable-rate term loan facilities and they accrue interest at the Eurodollar Rate plus some margin. It appears they used this funding to help finance some of their previous acquisitions.

Pretty much all the debt is due in 2024, and last year their interest payments amounted to $12.4 million on $755 million in debt. So 1.6%. However, it’s been rising this year.

Additionally, Ansys has access to a $500 million revolving credit facility that it’s not currently using.

More than enough liquidity to service its debt.

(Brett) Valuation:

Market Cap of $18.6 billion

EV of $18.75 billion

EV/s of 9.3

EV/GP of 10.7

EV/OCF of 31

Anecdotal Evidence:

(Ryan) My only product experience is through watching product tutorials. When I watch them I can’t help but think there are a lot of barriers to entry here. Not just in the sheer complexity it would require to build a portfolio as they have, but reputationally.

(Brett) They not only have the best simulation technology portfolio but are definitely the best brand within the industry. All you hear online or from anecdotes is that “Ansys software is the best” which means they have great mindshare among R&D departments. I think this gives them a competitive advantage and likely additional pricing power (can’t go with a lower price and risk ruining your reputation).

Future growth opportunities:

(Ryan) Two recent acquisitions, AGI and LSTC. Both of these were acquired since 2019 for more than $700 million apiece in a mix of cash and stock. AGI or Analytical Graphics Inc. provides analysis software for aerospace, defense, and intelligence applications. AGI can track orbiting satellites and their connections to ground stations. The 2nd one, LSTC or Livermore Software Technology Corporation, is the gold standard for predicting a vehicle’s behavior and the effects on occupants during a collision. And it works great with the specificities involved with electric vehicles. When I look at those two acquisitions, both are in industries where spending should continue to trend upwards.

(Brett) Expanding its partnership with AWS. They recently announced Ansys Gateway which allows customers to access Ansys simulations through the cloud. Simulations take a ton of processing (similar to a video game). This will not only help improve the customer experience but expand the potential customers who can use Ansys simulation. Here are some interesting quotes from the press release:

“Customers can manage and control computer-aided design (CAD) / computer-aided engineering (CAE) cloud consumption and costs on AWS while taking advantage of the scalable hardware and compute capacity”

“With Ansys Gateway powered by AWS, customers gain instant, intuitive access to Ansys applications. In addition to reducing time to market, customers can reduce costs by paying for cloud resources only when they are being used”

Highlights and lowlights:

Ryan’s Highlights:

Feels like there are very high barriers to entry here for several reasons. (1) Technical complexity, (2) Industry standard gives them a reputational advantage and (3) Breadth of offering likely deters competitors and provides better value to customers than peers.

The shift to the cloud should bring about higher margins in the long run.

Pricing power. Ansys provides the best simulation software which for most customers is mission-critical. Have to imagine customers are willing to pay more for that.

Ryan’s Lowlights:

Not a fan of the variable rate debt. Why couldn’t they have issued fixed-rate bonds in 2019/2020?

I question a company’s moat when they have to constantly acquire competitors.

Brett’s Highlights:

The lack of competition. Sure the basic simulation tools are the same as Solidworks or Fusion 360, but nobody has been able to match the technological capabilities unless they focus on a hyper-specific niche (which Ansys typically acquires).

The breadth of simulation software that Ansys can offer as a part of its multiphysics platform. Multiphysics means the ability to simulate multiple properties at once (think stress load, heat, and electricity all at the same time). Ansys has this on steroids which makes it extremely hard for someone to replicate.

Tailwinds in multiple industries. There are electric circuit boards/semiconductors, the space economy, autonomous vehicles, 5G, and others.

Brett’s Lowlights:

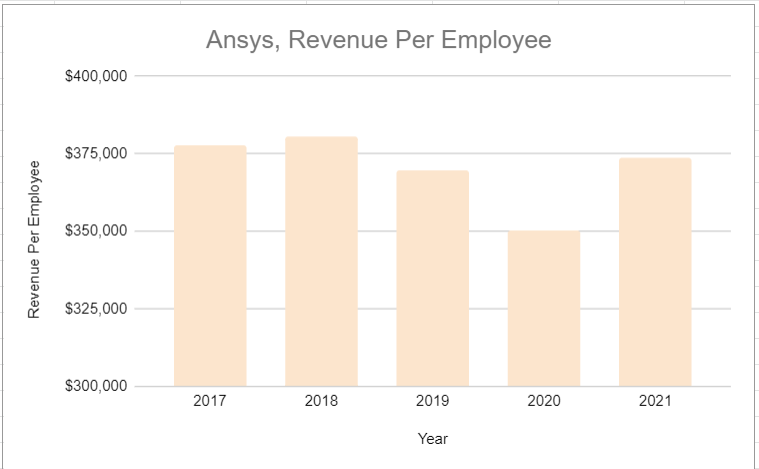

Operating cash flow margin deterioration over the past 5 years. This has led to OCF per share only growing by 5% over that timeframe. Is this temporary? Maybe. But I don’t like it in conjunction with the suspect compensation strategy for the executive team.

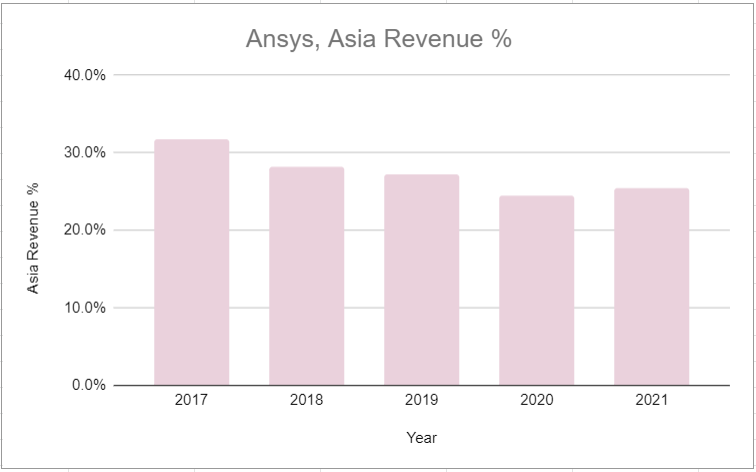

There are a lot of geopolitical risks here that could be underrated. Ansys’s technology is so good it could be deemed a security risk. 5% of revenue is in China and there is major exposure to Korea (Samsung + automakers), Japan (automakers), and Taiwan (semiconductors + electronics) that I have a slight worry about.

What sort of multiples are they paying for these acquisitions? Revenue per employee has not grown (and with margins declining).

Bull Case:

(Ryan) At 32x OCF, I think investors today need double-digit ACV growth and gradual margin expansion. As long as the multiple doesn’t compress too far, that should lead to outperformance.

(Brett) As with the majority of these engineering software companies, I’m going to have a simple bull case. Revenue grows at 10%+ in constant currency for the next decade and the operating cash flow margin returns to 40%. If this happens, it would be tough to lose money in the stock. This may not be a hypergrowth company, but it certainly has put up durable growth.

Bear Case:

(Ryan) From 2012 to 2019, Ansys’ average EV/EBIT multiple was about 22x. Today it sits at 33.8x. Now the argument could be made that earnings are slightly depressed and it’s a higher quality business now, but if Ansys trends back to previous multiples there’s going to be some downside. I really don’t question their ability to grow ACV at a healthy rate over the next decade though.

(Brett) The competitive position seems extremely hard to beat, so I think the bear case has to be valuation (30x “earnings” multiple when looking at OCF) and macroeconomic/political risks.

Sources and Further Reading

Ansys products page: https://www.ansys.com/products#t=ProductsTab&sort=relevancy&layout=card

Ansys Gateway Powered by AWS: https://investors.ansys.com/news-releases/news-release-details/ansys-announces-launch-ansys-gateway-powered-aws

Ansys Achieves Certification With Taiwan Semiconductor: https://investors.ansys.com/news-releases/news-release-details/ansys-multiphysics-solutions-achieve-certification-tsmc-n4

Q3 2022 Prepared Remarks: https://investors.ansys.com/static-files/725940d5-3380-4a77-ab14-52e5db30f233

2021 Annual Report: https://investors.ansys.com/static-files/02936325-1b83-455b-a693-ee6bba7b15ae