Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Autozone is the leading retailer of auto parts and accessories in the US. These include items ranging from critical parts like batteries and fuel to oil and other maintenance fluids to even items like air fresheners. Here are all the products they sell:

84% of the products that are sold are in the failure or maintenance categories. And there are two groups they sell to, Individuals and Garages (or other commercial customers). They call these two groups DIY and DIFM.

DIY: Sales to DIY customers or individuals account for 71% of Autozone’s revenue. For individuals, Autozone tends to provide more than just the sale of goods. Customers come to Autozone for their specialist knowledge (ie. what do I need for this problem with my car?), Autozone can sell it to them, and then provide the tools for them to install it if needed (Loan-a-tool program).

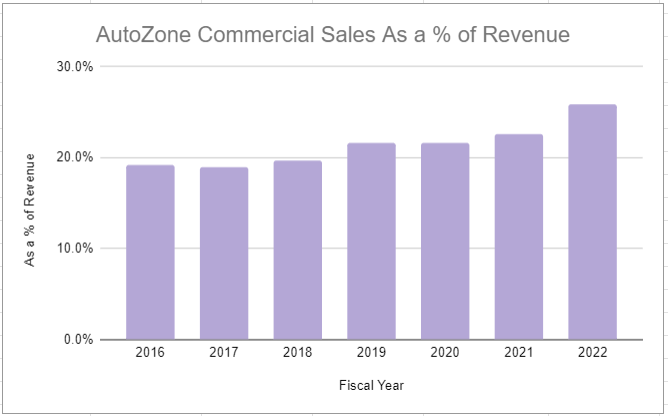

Commercial: Accounts for ~29% of sales but continues to outpace DIY. These are sales to local or even national repair garages, dealers, or other service stations. Commercial customers can order any inventory they need online at autozonepro.com or through the mobile app, and Autozone will deliver it to them from their more than 350 hub and mega hub stores located throughout the US. This segment reminds me of Home Depot’s “Pros” business.

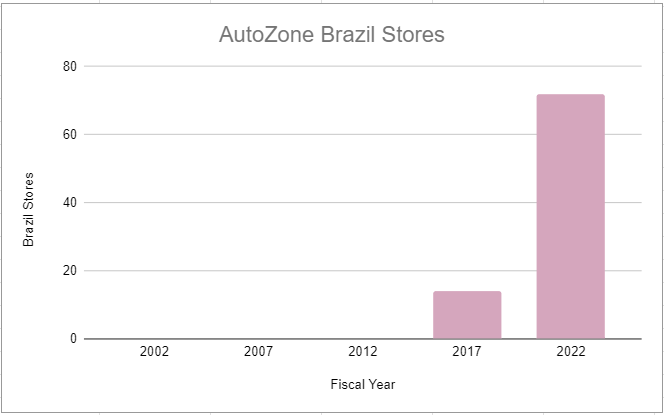

As for their physical footprint. Autozone has just over ~6.2k stores in the US, 700 stores in Mexico, and 83 stores in Brazil. Each of these stores is around 6,500 square feet and they stock the stores with lots of inventory. So unlike other retailers where the motto is usually “stack it high, sell it cheap, sell it often”, Autozone doesn’t turn over its inventory all that often because they have to have a wide assortment to meet anyone’s needs. However, the inventory doesn’t go bad (for the most part) and they have long accounts payable periods to vendors.

(Ryan) History: Kind of an interesting origin story here. Autozone was originally developed out of a wholesale grocery company called Malone & Hyde (M&H). M&H sold all sorts of items and after the original founder’s son Pitt Hyde introduced auto parts to the business in the late 70s, they began to see pretty good success with it. Malone & Hyde was actually publicly traded on the NYSE and after having several acquisitions blocked, Pitt Hyde decided to spin out their own auto parts store to try and diversify the business. So in 1979, they opened their first store in Arkansas called the Auto Shack. This was kind of one of the first self-service auto parts stores.

They started to add stores pretty quick and in 1986 they rolled out their first in-house brand, Duralast. A year later, after some dispute with RadioShack, they changed their name to AutoZone. Around that time, Pitt Hyde decided to take Malone & Hyde private and sell the grocery segment. He did, however, keep the auto parts business which was growing quickly at the time and he retook this public in 1991. Throughout the 90’s, Autozone was in expansion mode. They reached 1,000 stores in 1995 and kept acquiring other companies and reformatting their stores into Autozone stores. In 1997, Pitt Hyde retired, and around the late 1990s was the first time the company instituted its share buyback program. Since the turn of the century, the fully diluted share count is down 86%.

(Brett) Industry/Landscape/Competition:

AutoZone is the largest player in the do-it-yourself (DIY) automotive parts and repair market for the United States

The market is huge, with hundreds of billions of dollars spent on automotive repairs each year

Autozone has a fairly mature business in the United States with over 6k stores as of the end of last quarter.

Important note: The industry is still fragmented. AutoZone was estimated to have a 14% market share, Advanced Auto Parts 6%, and O’Reilly 9% market share. Combined this is only around 30% market share for an industry that lends itself to consolidation (which we can discuss on the episode). Would it be shocking to see these three players hit 50% share within 10 years? I don’t think so.

AutoZone has two international markets: Mexico and Brazil. Mexico has 713 stores and Brazil has 83 stores. Management mentioned that Brazil currently has a negative ROIC while Mexico actually has a higher ROIC than the United States business. Is the company primed for the potential “decade of Mexico” in the 2020s?

The automotive repair market has steadily grown due to the rising age of vehicles on the road (peep graphic below). As the age of vehicles grows, and more and more people in Mexico and Brazil own vehicles, the more demand there will be for Autozone’s products and services

AutoZone is also investing heavily to serve the commercial market (i.e. repair shops), which they have much less market share in. There has been a slow trend from DIY to do-it-for-me (DFIM, as they describe it) in automotive repairs, so it will be important for them to serve this section of the industry if they are going to retain/grow overall share.

So to sum it up you have a growing industry, the ability to take share, nascent opportunities in Mexico/Brazil, and Commercial. Not as “mature” of an industry as you might think at first glance.

(Brett) Management and Ownership:

If we wanted to ever do a mount rushmore or top 5 best proxy statements I’ve ever researched for the show, this may now take the top spot, it was that flawless

AutoZone has been led by William Rhodes since 2005, who has been with the company since 1994

In the proxy statement, the company brags about executives never leaving AutoZone for other companies, only leaving their positions when they retire

In fact, Rhodes is doing just that next year, with the VP of merchandise, marketing, and supply chain taking over for him. The CEO transition is perhaps the biggest risk facing AutoZone over the next few years and is the final “test” to establish Rhodes as one of the best CEOs ever in my opinion.

AutoZone has a standard executive compensation with bonuses and stock options but does so in a way that actually aligns executives and shareholders.

Annual bonuses are based on a matrix of EBIT and ROIC performance and are not one-foot hurdles like other companies we look at. Quote from Proxy:

“As discussed above, the Compensation Committee used its discretion to adjust annual targets upwards after the first half of the fiscal year. As such, the revised targets reduced management payout from 297.5% to 191.5%”

Stock options are paid out on 10-year time frames and therefore are actually for the long-term:

They treat shareholders like partners, one such example:

“Senior executives may periodically use AutoZone’s private aircraft for personal travel pursuant to an agreement with the Company. Under the agreement, the Company must be reimbursed for the direct, incremental cost to the Company arising from the personal use of the aircraft. These expenses include the cost of fuel, aircraft maintenance plan costs related to the trip, ramp fees, pilot expenses (if contract pilots are used on the trip), any special insurance for the trip, and other direct costs to the Company”

Overall, no concerns with the executive team or culture of this business. They think long-term and about all their stakeholders (there were plenty of strong employee benefits discussed in the proxy as well) and return excess cash to shareholders consistently and rationally.

*Based on shares outstanding as of latest proxy filing

(Ryan) Earnings:

Last decade:

Store count has increased by ~3% a year

Same-store sales have grown at ~4% a year

Operating margins have expanded slightly

Share count has decreased by more than 6% a year

Last 12 months:

$17 billion in revenue, +8% YoY

51% gross margin

~$3.4 billion in EBIT

~$2.4 billion in free cash flow

I think I’ll leave it there. I’m not sure it would help to get too granular with this business since it’s so consistent.

(Ryan) Balance sheet and liquidity:

Assets:

Just under $300 million in cash, so not a lot. Basically just a buffer to use when they need it.

Lots of inventory $5.7B. Growing quickly too due to inflation.

And $10B in property and equipment. They own basically half their stores and lease the other half.

Liabilities:

Accounts payable is 127% of inventory. So despite being a retailer that turns their inventory pretty slowly, they can still maintain that working capital advantage.

$7.3 billion in long-term debt. Weighted-average interest rate of 4%, almost all of it fixed-rate. And more than 50% of it matures after 2027.

With over $3B in EBITDA, they have just over 2x leverage. The debt isn’t a concern at all and I like that they’ve used it given how predictable the returns are for them on their investments.

(Brett) Valuation:

More charts to check out covering numbers in the newsletter

Market cap of $45.9 billion

EV of $53 billion

EV/OI of 15.8

P/FCF of 18.4

Using EV/OI to show how much in pre-tax income shareholders are earning compared to the size of the enterprise

Using P/FCF to evaluate how much firepower management has to continue repurchasing shares

Anecdotal Evidence:

(Ryan) I went there a couple of weeks ago because my girlfriend was having problems with her car. We went in, told them what car she had and what the problem was, they looked up the model and make in their proprietary catalog (Z-net) and told us the specific fluids we needed. I honestly wouldn’t have known what to get if it weren’t for them and they were really helpful. Also, the car wasn’t working, so I’m not really that keen to haggle over price. She needed her car, and the price seemed somewhat reasonable, so we bought it.

(Brett) Clearly a good brand with a competitive advantage. Management seems to me like the biggest positive. When listening to the conference call, they were open, respectful, and honest, while also confident about their long-term strategy. Rhodes leaving seems like the biggest risk to me.

Future growth opportunities:

(Ryan) I know international is frowned upon, but I’m going to take it here because Bill Rhodes said some interesting things about the Mexican market on the most recent CC. When asked about the opportunity there and the return profile of those stores here were his comments “In Mexico, our returns are better than they are in the US. It’s been a very good performing market for us for 25 years now. And the most exciting part is as we get further and further in the growth spectrum, we see more and more growth in front of us in Mexico.” They are planning to open a little over 40 stores a year down there for the next few years.

(Brett) The commercial opportunity. This is a large and growing part of the automotive parts and repair market, and AutoZone is explicitly trying to serve this market more along with its traditional DIY customer. The company has much less market share within this segment, which can be spun as a positive giving it a long runway to reinvest for growth. Over the last 12 months, the commercial segment has generated $4.5 billion in revenue compared to $2.15 billion in the same trailing twelve-month period in 2018. That is 109% growth. Consolidated revenue is “only” up 50% in the last five years.

Highlights and lowlights:

Ryan’s Highlights:

I like Bill Rhodes. Seems like he got this very southern, nice guy charisma, and he loves the business. In general, people at Autozone tend to have pretty long tenures.

Economies of scale. Better prices from vendors thanks to their share of the market. Less time is spent on fulfillment the more DCs they add.

Two big tailwinds. The number of cars in the US continues to go up by about 1% each year and the average age of those cars continues to rise.

Because customer visits are often time-sensitive and critical, I think the market will be pretty immune to online competition.

It’s a simple model that generates attractive ROIC.

Ryan’s Lowlights:

The only real big one for me is EVs. I have a hard time getting comfortable with this. Most of the products Autozone sells, EVs don’t need. It’ll take some time before this really hurts Autozone but I have a hard time getting comfortable with this.

Brett Highlights:

Management. Already gushed over them in the above section, but worth reiterating how many positive qualities I think they have.

Consistent share repurchases. Instead of wasting money on acquisitions, money-losing new initiatives, or whatever you’d want to describe it the company consistently repurchases stock, returning capital to shareholders while also increasing per-share value for remaining shareholders.

I think the growth in commercial and Mexico may be underrated.

The fragmented industry should lead to even more consolidation in the coming years due to AutoZone’s growing competitive advantage.

Competitive moat due to economies of scale and need for tons of “nodes” in geographical areas. Expertise needs from workers make them immune to competition from broad-based retailers. Ask yourself: would you ever go to Amazon for automotive parts? No chance in hell.

Brett Lowlights:

Rhodes is leaving the company. Can’t understate how nervous a CEO transition makes me, especially one with such a great long-term track record. Hopefully, the culture has permeated the entire business and this new guy keeps things mostly the same (philosophically). However, there are always major risks when a new person takes the lead.

Growth of electric vehicles (and maybe autonomous vehicles?). EVs apparently require less maintenance or have fewer parts overall, which could lead to less of a need for a retailer such as AutoZone. Obviously, if self-driving goes mainstream and fewer crashes happen and fewer people drive, the market for parts and repairs will go down.

I’m worried that operating margins may revert to the downside. They got a nice boost during COVID but could see pressure from wage inflation in the coming years, especially if workers at places such as UPS are getting huge raises.

Bull Case:

(Ryan) Grow store count by 2% a year, increase same-store sales by 4% annually, and maintain their 20% EBIT margins. If they do that and continue to buy back 5%+ of their shares each year, EBIT/share would grow by 14%. Assuming no change in the multiple that’s what you’re going to get. I think this is pretty realistic.

(Brett) Bottom-line margins stay stable and/or rise, inflation+ industry growth and market share gains lead to 7%+ revenue growth, continue to return capital to shareholders through buybacks

Bear Case:

(Ryan) Serviceable vehicles start declining slowly as EVs begin to make up a larger percentage of the US fleet. I think that’ll take a while though.

(Brett) (A good indication a business has a margin of safety and low downside is when I can’t think of a good bear case) My bear case would involve the new management team, just some uncertainty there. Also, the EV and AV case makes sense but won’t materialize for at least a decade (new purchases have to flow into the used market). My real bear case would be margin compression + low inflation (they do better with high inflation imo) + compression of earnings multiple. Returns probably are low for the next five years under this scenario but it would likely present a great buying opportunity in year 5.

More or less interested?

(Ryan) More interested. I have a hard time getting comfortable with the EV risk, but this checks every other box for me.

(Brett) Yes more interested. It is pretty clear to me that I can trust AutoZone management and that it has a predictable business due to its competitive advantages. I would be interested in buying shares at the right price.

Stock for next week? (Lowe’s)

Sources and Further Reading

Business Breakdowns on AutoZone: https://www.joincolossus.com/onboarding

Push into commercial business, 2019: https://www.vehicleservicepros.com/service-repair/the-garage/article/21177447/autozone-autozone-renews-its-focus-on-commercial-sales

Insightful analysis. Thank you for sharing your insights and for making the show notes available as well🙏👍

I’ve featured a link to this post in my latest Friday Roundup:

https://open.substack.com/pub/rhinoinsight/p/the-friday-roundup-752?r=2587ts&utm_campaign=post&utm_medium=web