Not So Deep Dive: Bentley Systems (Ticker: BSY)

A steady software business that has grown through acquisitions. But do the founders care about shareholders?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

November Engineering Software Schedule:

Out now: Dassault Systemes, Ansys

11/22: Procore

11/29: PTC

End of the Month: Autodesk

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Bentley Systems is a leading global provider of infrastructure software. They service fields like civil and structural engineers, geo professionals, plant engineering practitioners, and the owners of the infrastructure asset. Their products span the lifecycle of these assets from design to construction and ultimately even asset management. They have a number of products though, so they divide them into 3 categories:

Public Works/Utilities: On the Public Works side, Bentley’s solutions target end markets such as roads, railways, airports, or wastewater networks. And on the utilities, they cover electricity, gas, water, and even communications.

Industrial/Resources: End markets here include power generation, water treatment plants, as well as oil and gas, mining, and offshore projects. (Think, if you’re modeling an offshore wind farm, you need to analyze and simulate the structural performance of that project. That includes looking at the subsurface conditions, simulating water pressure, and eventually monitoring the energy production from that site.)

Commercial/Facilities: These include more of your commercial buildings, “office buildings, hospitals, and campuses”.

They sell their products in a couple of ways. They have term licenses (lots of duration projects), perpetual licenses, and then what they call E365. With E365, subscribers get unrestricted access to Bentley’s software portfolio but are charged based on daily usage.

(Ryan) History: There is not a lot of history on the business since its been privately held for so long. The Bentley brothers (there are 5 of them) founded the company in 1984 – well one brother came along later – and they all had skills that really complemented each other. Three of them had different engineering degrees and they had enough software development skills to get started. Initially, the business was simply CAD software and it was marketed through the Intergraph corp name, but over time it became their own.

They steadily grew throughout the 90s and 2000s and it wasn’t until 2020 that they actually came public. Prior to coming public, competitor Siemens actually took a big stake in the business and it was rumored that they may even bid to acquire them. Evidently, that never ended up going through but the stock is still up from its IPO.

(Brett) Industry/Landscape/Competition:

Bentley focuses mainly on infrastructure (civil engineering projects) but also has products for digital twins and basic construction, which all overlap with general engineering software.

What do they not have much exposure to? Simulation and manufacturing, which are dominated by Dassault Systemes and Ansys, who we covered previously.

It is hard to get an addressable market estimate for their specific products, but the global engineering software market is expected to grow by around 10% a year for the foreseeable future and digital twins are expected to grow by 40% a year. Again, always do a “common sense” analysis of these estimates, but I think these projections make sense directionally.

Competitors: Autodesk in civil engineering and construction management (this is the main competitor), Hexagon, Trimble, Dassault Systemes (some of their products), and even Oracle. Bentley has a ton of different software products but the main competitor is going to be Autodesk in infrastructure design and management.

(Brett) Management and Ownership:

Bentley Systems was founded by the Bentley brothers and is still a family-run and controlled business today. Through its dual-class share structure, the Bentley brothers have full control of this business and can do whatever they want, essentially.

CEO: Greg Bentley. One of the brothers who wasn’t a founder but joined them in 1991. He is also the chairperson of the board.

CTO: Kieth Bentley. He is a founder and a “principal architect” for the company’s software. He is running the technology strategy for the business. There is a good podcast interview where he goes over what he does as the CTO of Bentley Link:

Four of the seven board members are Bentley family members, making this an even tighter voting control than other dual-class companies like Meta Platforms.

Executive compensation in 2021 was $37.9 million or 5% of gross profit. This is on the high end of what we might call a “reasonable” range, even for executive teams in America.

The Board of directors’ compensation was less than $1 million in total so inconsequential.

There were multiple yellow flags when looking at Bentley’s 2021 proxy statement:

A complicated “bonus pool” compensation scheme where executives can get paid up to 20% of adjusted operating income each year. This is especially concerning considering that many executives already own a huge chunk of Bentley stock. Why even take a salary at all?

The other executives who are not a part of this “bonus pool” can get performance stock units based on adjusted EBITDA targets. The use of adjusted EBITDA is a concern here.

Executives get reimbursed $12,500 a year for fitness memberships and $25,000 a year for family members to accompany them on business trips. This one is self-explanatory.

There are almost 10 million “phantom shares” of stock held by executives that can be converted to “real” shares under its deferred compensation structure. This is unnecessarily complicated and can be used to mislead shareholders if they wanted to.

Siemens also owns a large chunk of stock through a strategic partnership the businesses signed. I don’t think this is meaningful but is interesting to note since they are somewhat competitors.

(287,734,291 shares as of 2022 Proxy Statement)

(Ryan) Earnings:

2021:

$965 million in revenue, +20% YoY

78% gross margin

$93 million in earnings before taxes (EBT) or a 10% EBT margin. (Had a $95 million one-time deferred compensation expense connected to IPO)

In 2020, Bentley had 21% EBT margins.

$288 million in operating cash flow

Most recent quarter:

$268 million in revenue, +6.7%

$984 million in ARR, +14% in constant currency

99% Account Retention Rate

$47 million in EBT (18% EBT margin)

(Ryan) Balance sheet and liquidity:

Liabilities:

$1.8 billion in long-term debt. Here’s how it shakes out:

$540 million in a bank credit facility.

64% of that is in a revolving loan (weighted average interest rate of 4.3%)

36% is in a term loan (Matures in Nov. of 2025 and has a weighted average interest rate of 2.3%)

$678 million in 2026 convertible senior notes (0.125% rate, and a conversion price of $64.13/share – 63% higher than today’s price)

$563 million in 2027 convertible senior notes (0.375% rate, and a conversion price of $83.23/share – double today’s price)

Assets/EBITDA: (Their lenders use Adj. EBITDA to determine creditworthiness)

$73 million in cash

$362 million in LTM Adjusted EBITDA

The credit agreement states that they can’t exceed a net leverage ratio of 3.5 to 1. Right now they have about $1.7 billion in net debt and $362 million in TTM Adj. EBITDA.

Right now their net leverage ratio sits at 4.7x, so I don’t know what to think.

Perhaps there were amendments to the credit agreements that haven’t been mentioned since the last 10-k.

(Brett) Valuation:

Market cap of $12 billion

Enterprise value of $13.7 billion

EV/S of 14.0

EV/GP of 16.2

EV/OCF of 42.9

Anecdotal Evidence:

(Ryan) Their focus seems to be very much on engineers and employees first. In an interview talking about their IPO, Greg Bentley said they made an “extraordinary stock grant” to their employees so that they owned 1/3rd of the company when it went public.

(Brett) The founder who is the CTO seems very dedicated to Bentley’s mission and gives a great pitch for the long-term growth of digital twins.

Future growth opportunities:

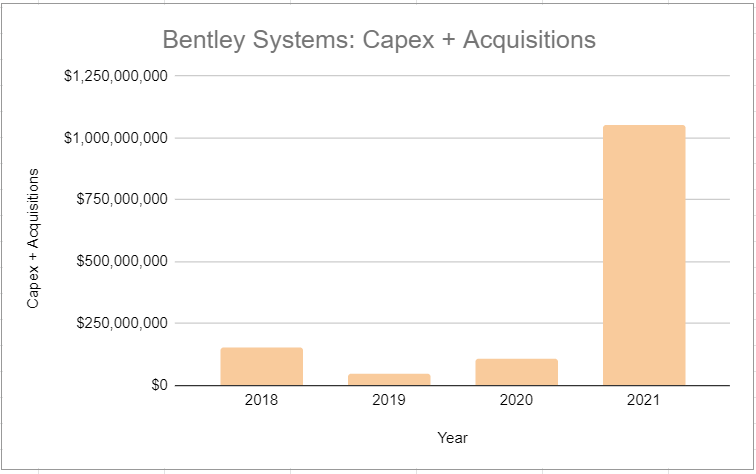

(Ryan) Recent acquisitions. They explicitly state that they want this to be a part of their strategy. “Since our founding, we have purposefully pursued a strategy of regularly acquiring and integrating specialized infrastructure engineering software businesses.” So much so in fact, that they’ve bought 33 companies in the last 5 years. But really there have been two big ones – Seequent ($1.05B) and Power Line Systems ($700M). I’ll touch on Seequent. Seequent is the global leader in 3D modeling software for geosciences. This apparently added 10% to Bentley’s ARR, so looks like they paid 10x sales.

(Brett) Infrastructure digital twins. Keith Bentley thinks that digital twins are the next big revolution that Bentley Systems is working on since the original computer-aided design boom in the 1980s. A digital twin is a digital representation of a real physical asset, which can be analyzed and managed in real-time through the connection of IoT sensors and computer chips. Bentley Systems is investing heavily in this industry with its iTwin platform it wants to lay on top of its existing design and management software. The company also has a $100 million venture fund specifically earmarked to invest in digital twins. Confused? Read more on Bentley’s website: https://www.bentley.com/software/digital-twins/

Highlights and lowlights:

Ryan’s Highlights:

Market-leading software in most of their end markets. Serves a critical function that customers have to pay for. This seems to be reflected in the account retention and DBNRR figures (99% and 110% most recent quarter).

Bundling potential makes them harder to disrupt. Within E365, customers get discounted bundling of products.

Increased spending going toward infrastructure around the world right now. That’s a great tailwind for Bentley.

Ryan’s Lowlights:

Loads of debt. And a big chunk of it is variable rate.

I generally don’t like when companies have acquisitions as a part of their stated strategy. Makes it seem like they’re forcing themselves to acquire, which probably means they’re paying more than they should.

How much money has been given to investment banks in the form of fees throughout their history? (Consistently amending credit agreements, paying investment banks on acquisitions, raising convertibles, etc.)

Brett’s Highlights:

The durability and focus of the family-led business for multiple decades is highly impressive. From what I can read into, they are mostly non-frivolous and really just want to build the best software they can for their infrastructure customers.

Digital Twins, and for a few reasons. First, these new products give them new revenue opportunities. Second, it widens the moat by increasing the switching costs of leaving Bentley Systems. Third, they are able to ride the technological innovations of other companies that make digital twins more viable (cloud, mobile devices, semiconductor advances with IoT devices)

Government infrastructure bills around the world, specifically in the United States. This should give infrastructure, construction, and manufacturing firms the freedom to spend more money on software solutions to bring their systems into the modern age. Bentley Systems should benefit from this.

Brett’s Lowlights:

There are two things that concerned me the most when looking at Bentley Systems. First, is the scattered acquisition strategy which I worry does not have a great ROIC framework and is focused solely on grabbing the technology they want.

Second, is the greedy compensation plans for people who already have huge ownership stakes in this business. And, on top of this, the bonuses are all based on “adjusted” metrics, which could incentivize growth through acquisitions.

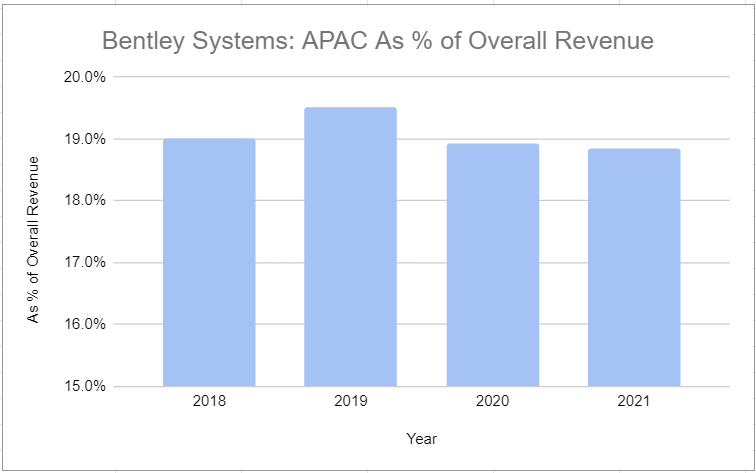

Exposure to China. This is explicitly mentioned in the last conference call (and other places) as a negative on the business right now. 19% of its revenue is from APAC, and China is likely a large piece. On the last conference call, they did mention a pick-up from India that was balancing out some of these losses.

Bull Case:

(Ryan) It’s a pretty crazy valuation frankly, so to get 10%+ returns from here I think a lot needs to go right. I’d argue they need a teens percentage annual growth rate over the next 5 years and some margin expansion.

(Brett) At a premium valuation and with the heavy acquisition strategy (which should be handicapped when looking at historical revenue growth), I think you need to expect durable 10% growth for the next decade driven by the government infrastructure plans and the successful commercialization of digital twins.

Bear Case:

(Ryan) Multiple compression, overpaying for acquisitions, increasing debt payments (will they have to roll their debt in a higher rate environment?), and an overall lack of focus on outside shareholders. I think the business is sound, but that doesn’t mean shareholders will benefit.

(Brett) The big bear case for me is a combination of a high starting earnings multiple and an ownership/management structure that does not care about generating cash for shareholders.

More or less interested?

(Ryan) More interested. Feels like 7%+ growth is highly likely for this business over the next decade. Just not interested in it at this price.

(Brett) More interested. This is a durable business with an excellent track record of growth. However, the current earnings multiple scares me.

Sources and Further Reading

Keith Bentley interview:

Introduction to Bentley Systems Slides: https://www.bentley.com/wp-content/uploads/bsy-introduction-to-bentley-11-2022.pd