Not So Deep Dive: Block (Ticker: SQ)

Does this fintech disrupter need saving from its own executive team?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: American Express + Nelnet

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: In the words of Jack Dorsey, Block is an “ecosystem of ecosystems”. Or as most people would put it, Block has a number of different products. So let’s walk through each and I’ll try to provide some value beyond the basics of each:

Square: Square is Block’s commerce ecosystem designed for merchants and small-to-medium-sized businesses. This includes hardware and software services that are pretty much self-serve and work right out of the box. This “general purpose stack” works really well for smaller retailers with say 1 to 20 locations. Within these services of course is the actual payments processing functionality, but also a bunch of additional subscriptions that customers can purchase. This includes things like Team Management, Payroll, email marketing tools, loyalty programs, appointments, and pricing is different for each different service.

They’ve recently been seeing success with their “verticals” solution. This includes Square for Restaurants, Square for Retail, and Appointments. Gross Profit from these three grew by 45% in the most recent quarter.

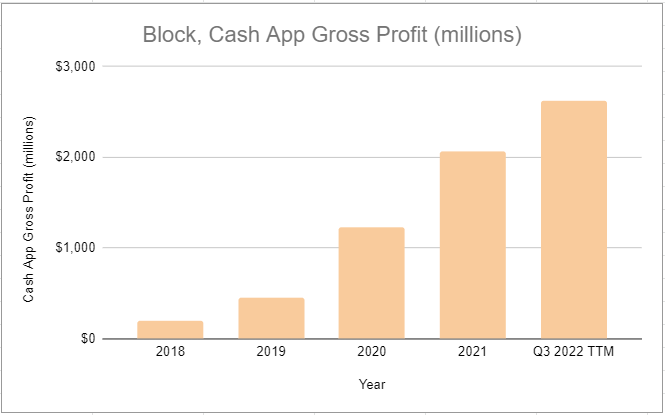

Cash App: This is Block’s all-in-one finance app. Starting with its core peer-to-peer transfer function, Cash App has layered a number of additional products on top that allow the Cash App to function as a true digital banking product.

Today, when a user sets up an account, they are immediately given a routing and account number. Users can receive direct deposits from an employer, transfer money from another bank account, deposit paper money through physical locations, or receive money from friends. Once the money is in a user’s Cash App account, they can hold it or invest it in stocks, ETFs, or crypto. (They are also rolling out a borrowing function)

Finally, when a user wants to pay or send money they can do that in a number of ways as well. They can receive both a physical and digital Cash App Card, link it to their Apple Wallet, use boosts for discounts at tons of different stores, use Cash App Pay to checkout with Square merchants and some other 3rd party sellers, or simply send money to other people.

Afterpay: Block ultimately acquired Afterpay for ~$14 billion. They are a BNPL provider that appears as an option at checkout for many merchants and helps customers discover new merchants that accept Afterpay. This was intended to be sort of the bridge between Block’s Square and Cash App ecosystems, but the rollout has been slow.

Tidal: This is a music streaming platform that Block bought for $297 million in 2021. Functions similarly to other music streaming services. They have a free ad-supported tier, a HiFi tier ($12/month), and a Tidal Hifi Plus tier which apparently has better sound quality and they say “as much as 10% of your subscription is directed to the artists you listen to most. On Apple, they have 78k ratings, whereas Spotify has 25 million.

Bitcoin-related initiatives: I watched their investor day presentation on their “crypto ecosystem” and came away pretty lost. There doesn’t really seem to be one point of focus here, but instead, basically, they can work on whatever they think is best for Bitcoin. This includes a software development kit for wallet developers, decentralized mining systems, and some other things I didn’t understand so I’m going to end there.

(Ryan) History: Many people already know this story, so I’ll be quick. Square was founded in 2009 by Jack Dorsey and Jim McKelvey to help small merchants accept card payments. The initial idea was a simple card reader that merchants could plug into their phone. 4 years later, Square launched a product called Square Cash. This allowed individuals and businesses to set up an account called a Cashtag, and quickly send and receive payments. This was its own separate app and was eventually called the Cash App.

Square joined the public markets in 2015, and at the time it was really just the seller business, Cash App was in its infancy. Around 2017, the Cash App began to allow some users to trade bitcoin. In 2018, they acquired Weebly. In 2021, they acquired Tidal. And in 2022, they acquired Afterpay. Since the IPO, the share count is up by about 85%.

(Brett) Industry/Landscape/Competition:

The industry opportunity for both Cash App and Square is large. At the 2022 investor day, management estimated that Cash App had a $70 billion gross profit TAM and Square had a $120 billion gross profit TAM. For reference, over the last 12 months gross profit at Block was $5.5 billion.

Competitors to Square: Shopify, Clover, Wix, Toast, Olo. Essentially, any company that is trying to help SMBs facilitate payments and manage the back office busywork.

Competitors to Cash App: Venmo/PayPal and Zelle are the two largest in the United States. As of recording, Cash App is the #1 most downloaded app in the United States in the finance category.

Competitors to Afterpay: Affirm, Klarna, PayPal, + many more. Apple also is rumored to be launching a BNPL product. Is BNPL just a commodity service that anyone can launch?

(Brett) Management and Ownership:

Block is a bit of an enigma. There are some things I really love about its management/governance philosophy and some things I really dislike.

The founder, chairperson of the board, and current CEO is Jack Dorsey. Dorsey started the company from scratch a little over a decade ago and has turned it into the behemoth it is today.

On the 2022 Proxy filing, there was an interesting proposal to change the dual-class voting power (Class B shareholders get 10x voting power) to one share one vote. The reasoning? Shareholders dislike Square changing its name to Block. Dorsey and his co-founder have over 50% voting power with their dual-class shares, according to the latest proxy filing.

Executive compensation at Block is simple. They pay base salaries and give out a lot of stock options to executives. Dorsey gets a $2.75 salary (no typo) and no stock awards or other personal benefits (explicitly stated in the Proxy).

However, for some reason, the board of directors still thinks it is reasonable to hire a compensation consultant. What these consultants do, I do not know.

Total executive compensation in 2021 was $38.2 million, which is not bad compared to the sizable gross profit generated each year.

There were quite a few related party transactions on the proxy. All seemed to be “fine” but it always rubs me the wrong way seeing this type of stuff. For example, it looks like they signed a software deal with the CFO’s husband when there were probably quite a few other vendors they could have chosen.

(Sources: Whale Wisdom and 2022 Proxy Statement)

(Ryan) Earnings:

Last 12 months:

$17 billion in revenue

$5.5 billion in Gross Profit (33% Gross Margin)

51.7% Square Ecosystem

47.5% Cash App

0.8% Bitcoin

$306 million in free cash flow

Most recent quarter:

$1.6 billion in gross profit, up 38% YoY

Excluding the Afterpay acquisition, Square GP grew by 17% and Cash App GP grew by 37%.

($21) million in free cash flow

Cash App continues to grow quickly. 49 million monthly transacting users, +20%. And gross profit per transacting user continues to grow.

Square ecosystem is seeing strong demand as well. They’re having success with verticals and GPV mix continues to move towards larger business. ~40% of GPV came from businesses with more than $500k in annualized GPV.

They report $327 million in adjusted EBITDA

(Ryan) Balance sheet and liquidity:

Assets:

$5.4 billion in cash and short-term investments + another $800 million in long-term debt securities.

$3 billion in customer funds

They also hold a little over $500 million in bitcoin. It appears some of this is meant for customers trading, but they are also taking some risk by holding it there.

Liabilities:

$4.9 billion in customers payable (vs. $3 billion in customer funds)

$4.6 billion in total debt. 10% is due in the next 12 months

The debt is a mix of fixed-rate Senior Notes ($2B) and Convertibles ($2.6B).

The senior notes aren’t due until 2026 and 2031, and have rates of 2.75% and 3.5%.

But here are the convertibles:

2023: $461 million remaining, 0.5% interest, matures on May 15th, and has a strike price of $77.85. $400 million has already been converted.

2025: $1 billion, 0.125% interest, maturing on March 1st, 2025, and has a strike of $121.01/share.

2026: $575 million, zero interest, maturing on May 1st, 2026, and has a strike of $299.13/share.

2027: $575 million, 0.25% interest, maturing on Nov. 1st, 2027, and has a strike of $299.13/share.

And they have a warehouse funding facility.

So in terms of net debt, I’d say they have $9.2 billion in cash, investments, and customer funds. Subtract the $4.9 billion in customers payable, subtract the $4.6 billion in total debt, and they’ve got $300 million in net debt.

(Brett) Valuation:

Market cap of $44.9 billion

Enterprise value of $45.6 billion

EV/GP of 8.3

EV/FCF of 309

Anecdotal Evidence:

(Ryan) I don’t use the Cash App much anymore. But I redownloaded it and was impressed by all the functionality. I still think they’ll have a tough time integrating discovery, but the rest of the app is great. Tidal looks cool but it’s simply too far behind.

(Brett) I recently quit using the Cash App. I used to love it because they would give some 10% off “boosts” for free when spending with the card. I guess these were unsustainable because they stopped offering them and then I didn’t find any uses for the Cash App so I stopped keeping money in my account. Looking at the Cash App numbers though, it looks like I am an exception here.

Future growth opportunities:

(Ryan) Cash App Pay + Cash App Card. For starters, the cash card continues to grow. 36% of Cash App users are now monthly card users (vs. 29% last year), and those that have a Cash Card drive 5x as much gross profit as a non-card user. Beyond the Cash Card, Cash App Pay allows users to pay at any square merchant, both online and in person (QR Code) directly using the money in their cash app account. They’re trialing this with some other non-Square merchants as well. From the CC: “60% of Cash App pay volumes are now from customers who aren't active in Cash App card”.

(Brett) There are plenty of growth opportunities that management has outlined for shareholders that I could choose here, but I am going to choose one that I think is very important for future growth + moat expansion. It is upselling Square business customers to more of its products. There is a nice slide from the investor day showing that gross profit from customers who use 4+ products is 40%, up from less than 10% in 2015. This will not only be a growth driver but drive gross retention for these businesses.

Highlights and lowlights:

Ryan’s Highlights:

Pretty simple here. The unit economics are exceptional for Cash App users. They say it costs $10 to acquire active Cash App customers and within 3 years, they contribute $60 in gross profit on average.

Execution and product rollout has been great at Square as well. The move up market and the number of customers using multiple products should make the service much stickier.

Ryan’s Lowlights:

Bitcoin. Of course, I have a hard time measuring the value of their actual bitcoin initiatives, but it’s not just that. Dorsey seems fixated on making Bitcoin a centerpiece of Block’s other services as well, like with Bitcoin Boosts on the Cash App.

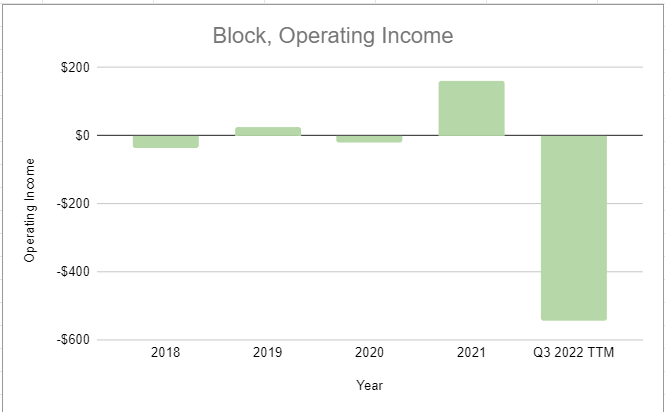

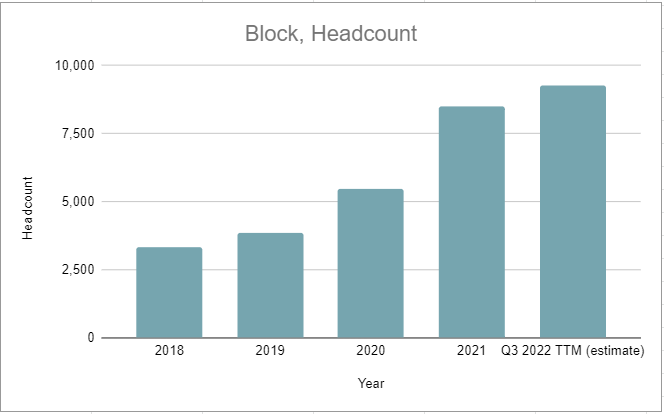

Some of their financial reporting feels dishonest. “We delivered strong profitability during the quarter with adjusted EBITDA of $327 million.” But over the last year, stock-based compensation has grown by 60%, they have real depreciation costs, and they backed out $23 million in acquisition integration costs? Oh, and they backed out “Bitcoin Impairment Losses”. Either this is intentionally misleading, or potentially even more concerning, management genuinely doesn’t understand what matters.

Brett Highlights:

The execution of customer products over at the Cash App. When we looked at them 3 - 4 years ago, the thesis was that they would take the peer-to-peer payments service and add on more monetizable features. This occurred, and they now have reached a point where they are a send, payments (Cash Card and Cash App Pay), and savings (direct deposits, stocks, etc.) application. Now, they are trying to add on Shopping with the Discover tab and the assets brought over from Afterpay.

The durability of the Square business. This segment has faced tons of competition over the years but continues to grow and I think can widen its moat by building out more and more tools that SMBs need.

Young (in executive terms I mean 50 or below) management team that has proven to think with agility and act quickly. I have some lowlights from this but it comes with its benefits.

International growth has been phenomenal with a gigantic opportunity ahead.

Brett Lowlights:

Purchase of Tidal. They haven’t done anything with Tidal. It is still in the 30s on the audio app store charts (Spotify, YT Music, and Amazon Music populate the top 5). This is going to be a hole in its pocket for years and with Jay Z on the board (and a friend of Dorsey) it feels unlikely they will sell it. The purchase price was $300 million but could end up being over $1 billion in losses over time.

The Bitcoin investment and these new things are called Spiral and “TBD.” I am not going to explain what they are trying to do but it is useless and will destroy shareholder capital, so obviously not good if you are an investor.

The young management team seems to get caught up in a lot of new projects and makes a lot of irrational decisions sometimes. Was the Afterpay acquisition a good fit for them? Yes. Was it way overpriced? Yes. Was Tidal a dumb move that should have been contemplated longer and given scrutiny by the BOD? Yes. Was all this crypto stuff a bit too much? Yes.

Bull Case:

(Ryan) A change to the share structure. If that actually happened, and votes went one-to-one, I’d be ecstatic. But if the same management stays in place, it needs to reign in some costs. Let’s just put some numbers in for context: If over the next 5 years, gross profit grows by 10% annually and 20% of every gross profit dollar turns into free cash flow (currently how much they generate in Adj. EBITDA), Block would be generating $1.8 billion in annual free cash flow. The EV is currently $50B and you could probably expect some dilution. It’d take some really impressive top-line growth to make this investment work.

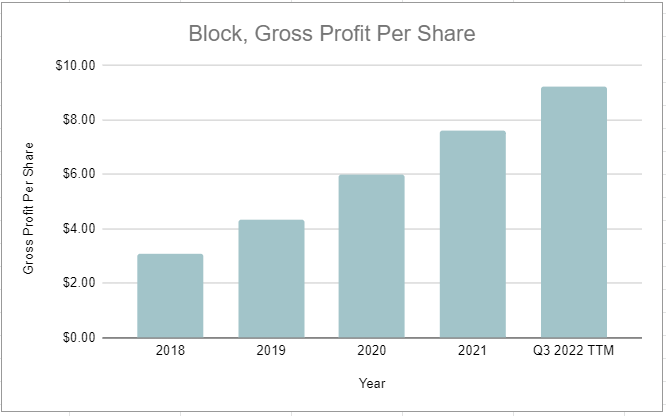

(Brett) If expenses/headcount gets rationalized and gross profit per share continues to compound at a high rate (34% CAGR since 2018) it will be hard to lose money at an EV/GP below 9 over the long term.

Bear Case:

(Ryan) Poor capital allocation, plain and simple. I worry this is just one of those businesses that never truly generates cash. If Dorsey is a true believer in free markets and meritocracies, shouldn’t he give every share equal voting power? So he can be CEO because he truly deserves it?

(Brett) Expense mismanagement, more poor acquisitions, and further “investments” into Bitcoin and Bitcoin-related products. These have occurred for the last five years, so why should investors expect things to change over the next five? So what if gross profit grows at a fast pace (which management uses to defend itself in the proxy statement) if it never gets turned into cash flow. Dorsey is one of the executives I fear only cares about size and not optimizing for shareholder returns.

Sources and Further Reading

2022 Investor Day Page: https://investors.block.xyz/Investor-Day-2022/#

2022 Proxy filing and 2021 annual report: https://s29.q4cdn.com/628966176/files/doc_financials/2022/ar/Block-Annual-Report-2022.pdf