Not So Deep Dive: Boeing Stock (Ticker: BA)

The middling existence of a once dominant aviation and engineering firm.

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Boeing is one of the world’s largest aerospace manufacturers or OEMs. Like other businesses we’ve looked at this month, despite being commonly known for a single product (in this case airplanes), there’s a lot more to the Boeing business than what meets the eye. Here’s how management splits up the business:

Commercial Airplanes (BCA): This is what most people probably think of when they hear the name Boeing. This segment develops and produces a range of different cargo and passenger jet aircraft for commercial customers. Last year they delivered 480 planes in total or about 40 planes a month, with the majority being 737’s (81%) and 787’s (6.5%). Below are the different types of models they have in production today. Today, BCA accounts for 39% of revenue and in the last “normal” year (2018), accounted for 65% of operating income.

Defense, Space & Security (BDS): This is the “defense contractor” side of Boeing. They design and produce a number of vehicles and weapons for the US government and some of its allies. These include fighter jets, helicopters, missile defense systems, and more. The margins are generally thinner in this segment due to the cost-plus nature of many of its contracts. Today, BDS accounts for 35% of revenue and in the last “normal” year (2018), accounted for 13% of operating income.

Global Services (BGS): BGS refers to the aftermarket services that Boeing provides to both its commercial and government customers. These include spare parts, maintenance and modifications, engineering support, pilot training, and really anything customers might need after the delivery of a Boeing product. This is typically the highest margin segment of Boeing’s business. Today, BGS accounts for 26% of revenue and in the last “normal” year (2018), accounted for 21% of operating income.

Boeing Capital( BCC): The main component of this business is to help Boeing customers finance their purchases of Boeing’s products, but it’s also the holistic finance arm for Boeing. Today, BCA accounts for less than 1% of revenue and in the last “normal” year (2018), accounted for 1% of operating income.

To give some context on the sheer size of Boeing’s physical footprint, Boeing has roughly 87 million square feet of floor space, 65 million (or 75%) of which is owned by Boeing. That’s more than 1,500 football fields and it’s more owned space than Amazon. The other important thing here is that Boeing is a very global business. They have suppliers and customers all around the world, and that’s hurt them a bit lately given some of the geopolitical issues around the world.

(Ryan) History: I’ll briefly explain how Boeing was founded, but there are lots of better resources out there on Boeing’s full history, so I’ll try to focus on the last 5 years instead. Just for a little context though, in 1916, an American timber merchant named William Boeing founded the Pacific Aero Products Company in Seattle, WA. They got their start as a government contractor who built “flying boats” for the Navy in World War 1, but they acquired lots of other businesses over the following decades and slowly became the commercial manufacturer they are today.

Entering 2017, the 737 Max 8 was a plane that had a lot of buzz. It was a single-aisle configuration that could seat more than 180 people. Their first delivery came in May of that year and by the 4th quarter of 2018, Boeing was delivering ~40 737 MAXs each month. However, on October 29th, 2018 a Lion Air 737 Max plane crashed in Indonesia, killing 189 people. Roughly 4 months later, another 737 Max crashed this time killing 157 people. 3 days later, the entire 737 MAX fleet is grounded. Less than a month later, officials said they believe the MAX could be grounded for as long as 2 months. Well it wasn’t until 20 months had passed (November of 2020) that the FAA officially lifted its grounding order.

And in the meantime, COVID hit, halting air travel and in turn customer orders. By the 3rd quarter of 2020, Boeing was delivering just 28 commercial planes every 3 months versus 190 two years prior. This led to them burning $20 billion that year.

Question: What do you think was a more pivotal moment for the company’s culture, the McDonnell Douglas acquisition in 1997 or the moving of its headquarters to Chicago in 2001?

(Brett) Industry/Landscape/Competition:

The commercial aircraft market is valued at over $100 billion, and Boeing projects it to grow at 3.8% annually. They project demand for over 40k new planes around the world over the next 20 years. As one of the only manufacturers, a lot of this demand can go to them if they can grow their production rate (they think the cumulative revenue opportunity is in the trillions of dollars)

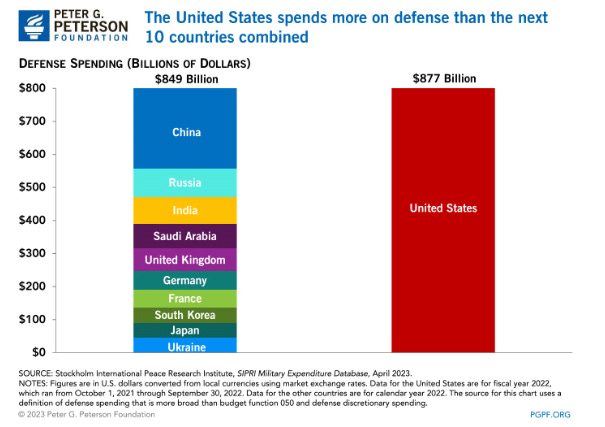

For defense/space, Boeing is selling to the U.S. government and its allies (similar to the General Dynamics episode, if you listened to that). The U.S. DoD budget is over $850 billion a year. I would reference the chart outlining global defense spending below

Competition in aviation: In the 10-K, Boeing says things like “the aviation field is highly competitive” but they only name one competitor: Airbus. They also mention China a few times, which is trying to subsidize its own state-run aircraft maker. Why does this industry have such high barriers to entry?

Competition in defense/space: Many companies. Lockheed Martin, Raytheon, SpaceX, even Rocket Lab. They actually have a partnership with Lockheed Martin in spaceflight called the United Launch Alliance (only mentioned 4 times in the annual report). Boeing’s stake is valued at $587 million on the balance sheet.

(Brett) Management and Ownership:

The CEO of Boeing is David Calhoun. He was appointed in early 2020 after the 737 MAX disasters and the poor execution from the prior executive teams

As a highly technical company, I think it is important to look at the biography of Boeing’s CEO and their technical expertise (or lack thereof). Calhoun graduated college from Virginia Tech with a degree in accounting. He then worked at GE for 26 years, then Nielsen Holdings, then Blackstone. So not a STEM person, a very “MBA executive” if you want to put it that way. I find this to be a negative when evaluating Boeing as a potential investment.

Like almost all large-cap companies, the Boeing Board of Directors each get paid hundreds of thousands of dollars a year and is likely overpaid. But given the size of the company, this is not generally going to be a big deal in determining whether the investment is successful or not.

Executive compensation (say it with me) has a base salary, annual bonus, and long-term equity awards. And you guessed it, they employ a compensation consultant

Prepare your eye rolls in advance: “As was the case in prior years and to better reflect the core operating performance of the Company, the Compensation Committee retained discretion to adjust the results under one or more of these metrics to account for…”

The annual bonuses are a bit complicated but generally go down to each of its segments and are based on earnings power and free cash flow. Combined, the company hit its free cash flow targets but missed its earnings targets, but executives still got over 100% of the annual payouts. Are they just rewarding themselves for depleting inventory?

They have 5 named executive officers, with total executive compensation of $59 million in 2022. It looks like these salaries will be going up in 2023

Is it possible for the cultural problems at Boeing to get fixed?

There is minimal insider ownership but large employee ownership via the Newport Trust Company (I believe)

(Ryan) Earnings:

2022:

$67 billion in revenue, +7% YoY

($3.5) billion in operating income or -5.2% operating margins

($5) billion in earnings before taxes or -7.5% EBT margins

$3.5 billion in operating cash flow

The largest contributors to the difference here are depreciation and amortization (they’ve got $78 billion in aircraft sitting on their books), stock-based compensation, and treasury shares issued for 401k contribution (they issued $1.2 billion worth of treasury shares to fund the company’s portion of 401k contributions), and a build-up of accrued liabilities (mostly forward loss recognition).

Basically, all the cash flow comes from managing their balance sheet.

They are projecting $3-$5 billion in free cash flow for the year and $10 billion in free cash flow by 2026.

Total backlog of $411 billion

(Ryan) Balance sheet and liquidity:

Assets:

$15 billion in cash and short-term investments

$78 billion in inventories vs. $63 billion in 2018

Liabilities:

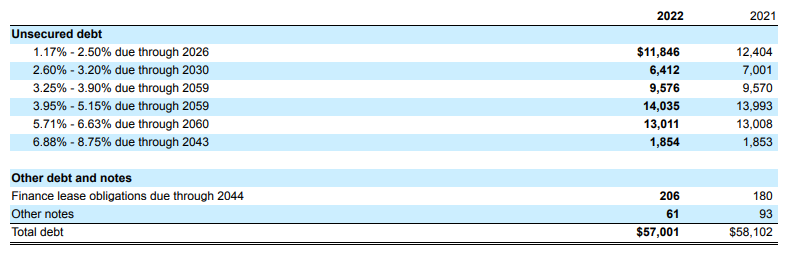

$55 billion in total debt. $7.9 billion is short-term.

Pretty much half of that debt is due in 2059 and 2060 and accrues interest between 4%-6.6%.

Over the last 12 months, they’ve generated $2.6 billion in EBITDA. Right now, that’d imply a Net Debt to EBITDA ratio of 15x.

If you believe they can recover back to 2018 levels of profitability, that’d be ~3x Net Debt to EBITDA.

Overall thoughts: The fact that they were able to borrow 40 years into their future at a fixed 4%-5% interest rate is a testament to their moat. However, if this storm of bad news hit them at any other point in history, they would have been in much bigger trouble.

(Brett) Valuation:

Market cap of $121 billion

EV of $160 billion

EV/FCF (2023 target) of 32

EV/FCF (2025/6 target) of 16

Anecdotal Evidence:

(Ryan) I agree with what Brett says. I think they also have a solid reputation for taking care of their employees, which has encouraged a lot of people to stay there for a while.

(Brett) Good engineers still want to work at Boeing. I think the problems likely start and begin with the fact the company executives have been detached (by distance and philosophy) from the boots on the ground designing and building the airplanes. I do not like how they moved the headquarters to Virginia, although that is a better location for a defense/aviation researcher than Chicago.

Future growth opportunities:

(Ryan) I guess the answer is pretty simple, they have to increase production. I think they have to do that before they start investing in other initiatives. If they can get the production really going again and establish some stability in earnings, then I think they can really turn this into the Boeing of old.

(Brett) Fully embracing space flight as the next avenue for growth. Looking at the United Launch Alliance, it looks like they are not taking this seriously as the future of the aerospace industry. It was only mentioned 4 times in the annual report, and only in passing for why the investment portfolio was written down. If I am a shareholder of Boeing I want the company to stop talking about free cash flow and talk about investing in cutting-edge aerospace and space flight technology to compete with SpaceX, Rocket Lab, etc. They have clearly built up technical debt over the last 20 years. It would be a hugely positive indicator if they said something along the lines of “We are not going to lose money, but we are going to take a ton of our cash flow from aviation, services, etc., and double our research into the future of our end markets.”

Highlights and lowlights:

Ryan’s Highlights:

It’s clearly a difficult business to replicate. The capital, the expertise, and the talent required to run a business of this size seems like it’d be pretty much impossible to assemble. Even governments struggle to do it (China/Europe as examples).

End market growth. Historically, air traffic has grown at 2x GDP. It’s lumpy but this should serve as a lasting tailwind for aircraft demand.

This is not a business the government wants to let die.

Ryan’s Lowlights:

If they have another crash, or another scenario that mirrors what they saw in 2019, their debt load will be extremely difficult to service. You kind of have to picture the ideal scenario for this to result in good shareholder returns.

The proxy adjustments disgust me.

Brett Highlights:

Huge barriers to entry and minimal competition.

Growing end markets (especially aviation)

Brett Lowlights:

Unpredictable cash flow. The huge barriers to entry are due to low margins, a tough overall industry operating environment, and cyclicality from customer demand. Also, inventory build has been and likely will continue to be a problem. All of this makes the cash flow less predictable even if earnings are strong.

They haven’t shown signs of ramping up R&D for a new product since the 787. Lead times for a new plane will likely be over a decade, and there is the need to constantly reinvest. The R&D spend looks solid but I wish it was higher given the nature of the two industries it operates in.

Dropping the ball over the last 20 years when it comes to product development. Yes, the 787 is a great product but was way behind schedule and is the only big product they have released in the last 20 years. How is it possible they were crushed by a start-up like SpaceX in spaceflight? It might not be hyperbole to say this was the premier engineering institution (excluding government agencies/labs) in the world for the 2nd half of the 20th century. Can they regain the former glory? I think they need to drastically up their R&D spending to make it happen.

I don’t trust an MBA-type to head up this company. Maybe that is biased, but I just don’t. They should have an experienced engineer running this company. It needs to be R&D first.

Bull Case:

(Ryan) I’m just going to lay out their guidance. At their investor conference, they stated that their objectives are 800 annual commercial aircraft deliveries by 2026, mid-single-digit growth for services, and low single-digit growth for defense. These together would get Boeing to $100 billion in revenue and they are striving to reach 10% operating margins, so $10B in annual operating income. Between 2010 and 2019, they traded at an average EV to EBIT multiple of 13x. It was more in the 15x-20x range when they were really humming. Let’s assume it trades at 20x. That would be a $200 billion market cap vs. an enterprise value of ~$160 billion today. I think you really have to assume they are going to grow without a hiccup over the next 5 years for this to be a really high-performing investment.

(Brett) If they hit $10 billion in free cash flow a year, the stock will be fine. The question is though: What is the quality of that free cash flow?

Bear Case:

(Ryan) Continued difficulty expanding production. Or worse, trying so hard to meet your production goals that you make a catastrophic error somewhere in the process. The downside here seems quite big to be honest.

(Brett) Production and quality issues continue. If they have happened regularly for the last 5 years, why should we all expect anything different for the next five? They are in a prove-it mode.

More or less interested?

(Ryan)

(Brett) No. I don’t trust management. At the right price and with the right management team focused on the right things, this is a great buy as the U.S. is not going to let it fail. But that is not what I see today.

Sources and Further Reading

Boeing Investor Conference: https://s2.q4cdn.com/661678649/files/doc_presentations/2022/11/2022-Investor-Conference-Combined.pdf

Netflix documentary: https://www.netflix.com/title/81272421