Not So Deep Dive: British American Tobacco (Ticker: BTI)

Can the company successfully transition nicotine consumers away from cigarettes?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: In short, British American Tobacco (BTI) is the 2nd largest tobacco company in the world (excluding China). There are a couple of ways to break down BTI, but the easiest is probably by product category. BTI operates three different segments: Combustibles, New Categories, and Traditional Oral.

Combustibles: This is predominantly their cigarettes business which accounts for ~82% of their overall revenue. Unlike Altria & Phillip Morris which have split geographies, BTI sells their brands globally. A couple of the recognizable brands include Camel, Newport, Lucky Strike, American Spirit, etc. About half of BTI’s combustibles business comes from the United States, where BTI has an estimated 35% market share.

The brands in this space cover various parts of the market in terms of price. But in general, the business is experiencing volume declines. From 2009 to 2022, British American’s cigarette shipments fell 16%. However, those declines have been accelerating in recent years.

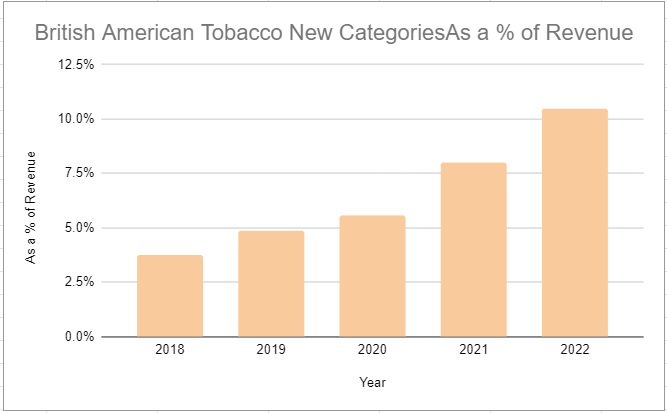

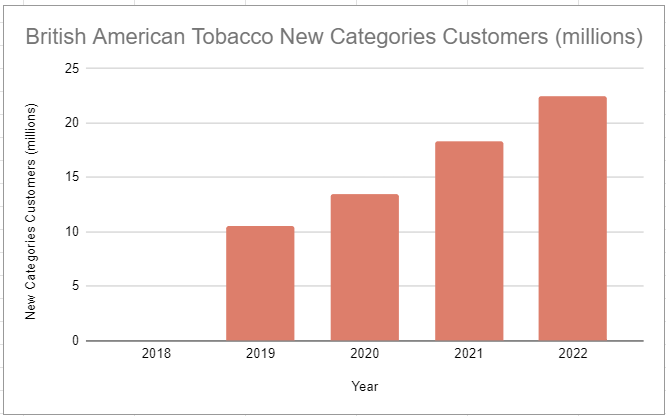

New Categories: This consists of 3 banners that span 3 different product categories: Vapour, Heated Tobacco, and Modern Oral (aka Nicotine Pouches). In total, these 3 brands account for 12% of overall revenue, but it’s rising quickly.

Let’s start with Vuse. Vuse is the #1 vaping brand globally, having now surpassed Juul. Vuse got its start as a refillable vaping product, but they’ve recently launched Vuse Go in 24 different markets which is a disposable product. The disposables market has been growing quite quickly. Most of the revenue for Vuse comes from the US and overall Vapour revenue grew 44% for BTI.

The second big brand here is Glo. Glo is a heated tobacco product. It competes with Phillip Morris’ IQOS brand and is in 2nd place in terms of market share. For a quick explainer, the technology heats a cigarette equivalent (heat stick) instead of burning it, which apparently reduces the harmful chemicals that are present in smoking. This has not been launched in the US yet, so all their revenue is currently coming from Europe, Asia Pacific, and the Middle East. Revenue for this segment grew 24% last year.

The last brand to talk about is Velo. This is what they call their modern oral category. Similar to Zyn. Velo is the market share leader for nicotine pouches in Europe, but it’s much smaller here in the US. Revenue in Europe was up 31% last year driven entirely by volume growth. This really isn’t much of a revenue driver for the business yet, but they’re trying to get clearance to launch their European Velo product here in the US.

Traditional Oral: Mostly chewing tobacco and moist snuff. The biggest brand is Grizzly, but they also have Camel Snus (which may have been discontinued). Pretty small part of the business at 4% of revenue. Volumes are also declining quite quickly here, but I believe it’s pretty profitable for them.

Discussion Questions: Do we think heated tobacco would be popular in the US? If Velo gets clearance to have its European product here, do we think it can effectively compete with Zyn?

(Ryan) History: The company’s roots date back to 1902. The UK’s Imperial Tobacco Company and the American Tobacco Company (god I miss old corporate names) formed a joint venture to cross-sell each other’s cigarettes in their respective markets. Buck Duke became the company’s first chairman and he was highly focused on mechanizing production and trying to become the low-cost provider. This worked pretty well and they began expanding globally. However, in 1912, during Roosevelt’s trust-busting initiatives, the American Tobacco Company was forced to divest its stake in the joint venture.

That same year, they were listed on the London Stock Exchange and became solely a UK operation (although they had operations in several international markets). To enter new markets they would typically just acquire the local player. In fact, by 1927 they had 120 different subsidiaries. While this might all sound somewhat irrelevant, they established local distribution networks in all these areas that served as the groundwork for parts of their modern-day distribution system. Generated about $5 million pounds each year throughout the great depression, but those profits collapsed to just $3 million pounds during WW2. Post war though, BTI (not sure that’s what it was technically called at the time) would begin growing again and become the 3rd largest company across British, French, and German companies by profits. 1960 and beyond, BTI began acquiring operations that really had nothing to do with tobacco (paper, cosmetics, food, etc.) and these acquisitions continued for ~20 years even getting into the financial services space.

Fast forward to 1994, and BTI acquired the American Tobacco Company, adding the Lucky Strike brand to the portfolio. The only other big events worth mentioning. In 2016, they finalized a deal to acquire the remaining stake of Reynolds American which added quite a lot of debt to the balance sheet.

(Brett) Industry/Landscape/Competition:

Note: I am going to link to a great data report on the cigarette industry

In order to understand the industry, we should look at cigarettes and then “everything else”

First, cigarettes. This is a bifurcated market on a global basis. In North America and Western Europe, volumes have continued steady declines for reasons we are all aware of

However, in lower and middle-income countries, cigarette consumption is on the rise. Generally, the market share of volumes is increasing in Africa, Middle East, and Asia and conversely falling everywhere else

“Between 2006 and 2020, cigarette sales in the Asia Pacific region increased 7.5% to 235 billion sticks. For the Middle East and Africa region, sales increased 15.3% to 65.5 billion sticks for the same period”

This all adds up to globally declining volumes but rising retail sales due to pricing power: “Between 2006 and 2020, global cigarette volume sales decreased by 3.5% while real retail values increased by 24.3%”

With the “new categories” or “risk-reduced products” (we may refer to them as either), there is a lot more uncertainty but also a lot more potential for growth.

There are varying projections, numbers, and estimates for these categories, but I think of it like this. The potential is the entire global population who is currently consuming nicotine (mainly cigarettes). Exclude the just under $300 billion coming from China and the industry is around $300 billion - $400 billion.

So, there is clearly a ton of potential for new-age nicotine products

(Brett) Management and Ownership:

Note: As with a lot of European companies, I struggle to figure out the exact figures for stock ownership. I don’t think it is very important here, though.

BTI is run by Taddeu Marocco. He was appointed CEO in May of this year and has climbed the ladder at the business since joining in 1992. So a real insider hire here. He was previously the CFO from 2019 until his promotion.

Why did he get the job in May? Well, it would be quite a coincidence to have the old CEO “retire” when news came out about the company violating sanctions and selling into North Korea. They are paying a $600 million fine for this. It looks to me like they fired the old CEO and brought on Marocco.

However, wasn’t Marocco almost assuredly aware of these payments as CFO?

Executive bonuses are based on a lot of metrics, including: group volume share, new categories revenue, new categories contribution profit, group adjusted operating profit

The long-term stock options are based on three-year hurdles for comparative TSR, EPS, group revenue, and cash flow conversion

From an executive comp perspective, the only glaring red flag is the relative TSR. Who cares about relative returns.

Should we have any confidence in this management team and culture?

Even though the company has generated a boatload in profits, the actual TSR has been flat over the last 10 years

(Ryan) Earnings: (I hate European reporting btw)

Ok, let’s start with the big picture.

$28 billion pounds in last 12-month revenue

Gross margins are really high at ~80%

35% free cash flow margin

Moving to the recent H1 Report:

Total revenue was up 4.4% (they are helped by FX, it was 2.6% in constant currency)

Combustibles revenue was up 2% on 6% volume declines

New Category revenue was up 29% (vapour volumes were the weakest)

Traditional oral revenue was down 9% on sharp volume declines.

Adj. EPS grew 3.6% in constant currency (weird comp because of shutting down Russia business)

Trailing 12-month net income is $8.8 billion pounds

They aim to payout ~65% of their Adj. EPS in dividends. Currently, that’s at $0.71 a quarter, which comes out to just over a 9% dividend yield.

(Ryan) Balance sheet and liquidity:

Assets/Cash Flow:

~$4 billion pounds in cash/investments

They generated ~$14B pounds in EBITDA last 12 months.

BTI also owns a ~30% stake in the India Tobacco Company (ITC). ITC has a market cap of almost $50 billion which would value BTI’s stake at ~$15B. However, they’ve said they aren’t planning to sell it. They do however collect dividends and ITC I believe does spin-offs which allow BTI to sell some shares.

Liabilities:

BTI has lots of debt, much of which was acquired through the 2017 acquisition of Reynolds. $42 billion pounds in total borrowings, so ~$38 billion in net debt.

Average maturity on the debt is about 9.5 years.

Average cost of debt has increased to 4.3%.

Most of the debt is fixed. 14% is floating rate.

They are trying to delever right now because of the higher interest rates. They aim to keep their leverage (net debt to adjusted EBITDA) ratio between 2x-3x.

(Brett) Valuation:

Notes on the Google Sheet

I am getting an EV/OI of approximately 8

Math: 2022 operating income, putting value on dividend payments from ITC, add back net debt, keeping everything in GBP (assuming currency movements will remain unpredictable)

Why use operating income? Because it shows how much capacity BTI will have to pay down debt, taxes, and dividends in the coming years.

Does an EV/OI of 8 feel right for BTI?

Anecdotal Evidence:

(Ryan) It seems like aside from Zyn, the “new categories” space in the US is a crapshoot.

(Brett) The modern European oral market seems attractive. I like that the new categories are getting to profitability, which I think investors may be underrating. Was the Reynolds acquisition a mistake?

Future growth opportunities:

(Ryan) Leaning into the disposable vaping category through the Vuse brand. An increasing percentage of the vaping category is moving to disposables in the US, and that seems to be eating away at Vuse’s business. Vuse has popularity and some brand recognition in the States, so I think the shift to disposables could work for them.

(Brett) The introduction of the “good Velo” to the United States. The company is still waiting for regulatory approval for its new nicotine pouch formula in the United States, which has done quite well in Europe. The U.S. nicotine pouch market is large, growing quickly, and has the best unit economics in the sector. Do we think it is too little too late if they get this approved? Could they really dethrone Zyn?

Highlights and lowlights:

Ryan’s Highlights:

I like that they have a global revenue mix. Especially given what the environment looks like for combustibles in the US.

I think they are fairly well positioned with their “New Categories” products. Or they at least look better off than Altria.

If they have real success with new categories, it should be margin accretive over time.

Forward earnings multiple is roughly half of what it has been over the last decade.

CEO being fired by the board. Probably a good thing here

Ryan’s Lowlights:

I don’t have too much belief in their “New Categories”.

Lack of shareholder returns over the last decade.

Brett Highlights:

Globally diversified and category-diversified revenue mix. They are in most geographies and most nicotine categories. Essentially, whatever way the wind blows with the sector (which I still think is fairly uncertain) they should do fine.

New categories growth looks solid and should have an underappreciated profit inflection. They already have distribution globally which is a huge advantage

Brett Lowlights:

Management

Management

Management

Regulators sitting around doing nothing.

Foreign exchange unpredictable

Bull Case:

(Ryan) I’m going to throw out some questions and let’s assess whether they seem reasonable. Can BTI’s cigarette volumes decline by 2% a year or lower over the next 5 years? Can BTI raise prices on its cigarettes by 5% a year or more over the next 5 years? Can BTI grow its New Categories’ revenue by 10%+ a year for the next 5? And can margins stay where they’re at? If you think the answer is yes (I do), then this should easily generate 10%+ returns.

(Brett) If you believe that operating earnings can stay flat or even grow, you will make out like a bandit as long as management doesn’t shoot themselves in the foot. I think earnings will probably grow in USD terms unless Fx continues to be a major headwind.

Bear Case:

(Ryan) Cigarette volumes declined faster than expected, and BTI’s share in the new categories space declines. If that happens, I think the floor is still high but you would underperform treasuries.

(Brett) Management continues to make mistakes. This is my only concern. I have a lot of confidence this stock is undervalued. But that may not matter.

More or less interested?

(Ryan) More interested. I would have no problem owning BTI in a tax-free account. I would collect the dividend and reinvest it elsewhere.

(Brett) More interested. At the right dividend yield, this makes a lot of sense. But we need to heavily discount the management team here.

Final question: PMI or BTI? (Then we can add in Altria at end of month)

Stock for next week? (MGM Resorts)

Sources and Further Reading

Invariant 1H 2023 Update:

Acquisition of Reynolds American: https://www.reuters.com/article/us-reynolds-amricn-m-a-brit-am-tobacco/bat-agrees-to-buy-reynolds-for-49-billion-idUSKBN1510LW

Report in global cigarette market: https://assets.tobaccofreekids.org/global/pdfs/en/Global_Cigarette_Industry_pdf.pdf

Gripes with FDA: https://www.bat.com/group/sites/UK__CRHJSY.nsf/vwPagesWebLive/DOCWJLYQ

Why use a dollar sign prefix on the seven instances of a number that is followed by "pounds"? On the other instances where the $ figure is *not* followed by "pounds" do they represent dollars?

Enjoyed listening to your discussion. Thanks for the shout-out!