Not So Deep Dive: Bumble Stock (Ticker: BMBL)

A women first dating app trying to dominate the global marketplace

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Grindr, Spark Networks, and Match Group

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

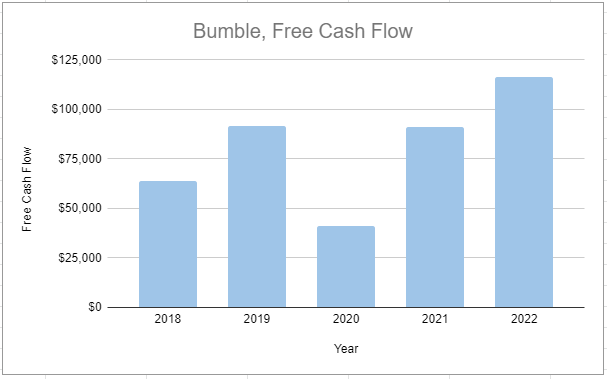

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) History: I think it’s actually best to start with the history for this one because much of the history (and really this company in general), is focused around one individual, Whitney Wolfe-Herd. So right out of college, Whitney apparently met someone named Sean Rad. Rad was running an incubator in LA and invited Whitney to basically help out with all things marketing and sales. After pretty much failing with a product called Cardify, this incubator shifted its resources to work on a sort of side project called Match Box. Match Box eventually became Tinder, and Whitney was basically the pioneer of their college-centric marketing strategy. This worked incredibly well and the company was seeing tons of growth, but after a really ugly breakup with one of the other founders Whitney departed from the company and eventually filed a sexual harassment lawsuit.

In the time that she was out of work (around early 2014), a man named Andrey Andreev apparently reached out to her and said he wanted her to come work for his company. Andreev was the founder of Badoo, which at the time was one of, if not the most popular dating app in the world. Whitney said no, but they stayed in touch, and in the meantime, Whitney was working on ideas for a women-centric app. Initially, it was supposed to be like an affirmation-based social media just for women, but Andreev pushed her to start a women-centric dating app and said that he would help fund it. So in 2014, that’s what she did, and she basically replicated the same exact marketing model that Tinder used and it was a major success around college campuses. From what I understand, the two companies were owned under one technical parent called MagicLab, most of which was owned by Andreev.

However, in 2019, amidst sexual assault allegations of his own, Andreev sold his stake in MagicLab to Blackstone. A year later, MagicLab was renamed Bumble, and Whitney was made CEO. And in February 2021, the company went public. Now at some point along that journey, Bumble (or MagicLab) took out a big chunk of debt.

(Ryan) What they do: Bumble is an online dating business with 3 different brands that operate generally independently of one another but share some of the same technical infrastructure. Each app/brand runs a freemium model, but each has its own unique monetization strategies.

Bumble: This accounts for the majority of the business at 77% of revenue. Bumble’s core differentiator/value prop is that it’s designed with women as the primary focus. For example, after a heterosexual match, women have to message first. Once a match is made, the woman has 24 hours to say something. The app has about 2.2 million paying users and those users on average pay just under $30 a month.

And Bumble provides a number of both subscription and a la carte payment options for its users. Within subscriptions, users can purchase 7-day, 30-day, or 90-day plans which each provide some extra benefits such as Beeline (see who has liked your account), Extend (you can extend the period for her to say something), Rematch (you can pull up old matches that have expired), Travel Mode (change your location), and Incognito (account is hidden unless you’ve liked someone). Within a la carte, users can buy a super like, additional compliments, or spotlight which helps boost how many times your profile is seen.

Bumble also offers matching functionality for other categories called Bumble BFF and Bumble Bizz.

Badoo: Accounts for 23% of revenue. Badoo was at one point one of the largest dating apps globally, predominantly across Europe and Latin America, but it appears that it’s shrinking in relevance. Badoo monetizes in a similar way to Bumble. They have Badoo Premium and Badoo Premium Plus, which just grant payers access to a bunch of the same features I discussed above. Badoo has roughly 1.2 million paying users, but it’s still usually in the top 4 or 5 downloads across a lot of European markets.

Fruitz: Fruitz is kind of unique and it’s really popular in France. On Fruitz, along with setting up your profile, users are required to select either a cherry (serious relationship), grape (looking to date), watermelon (nothing serious), or peach (only casual) to indicate their dating intentions. So far it provides little financial contribution, but Bumble acquired them a little over a year ago and I think they’ve only really launched in France. Here’s what Whitney Wolfe-Herd said about them “We bought Fruitz because we’ve looked at over 90 dating businesses and the majority of them are inorganic growth. So they’re propped up on spend and you know, they’re not really network effect businesses. Fruitz was very organic. It was in the zeitgeist. Gen Z loves this product in France and they’re definitely one of the most talented teams I’ve met in the space.

(Brett) Industry/Landscape/Competition:

If you look at third-party estimates they vary widely for the size of the online dating market. This is a bit shocking as we can just add up the revenue numbers for the big three dating players, which gets us to a global spend of around $4.3 billion. Of course, there are some other players, so maybe we can round this number up to $5 billion a year

How much larger is this number 10 years from now? How much could the “online connections” market Bumble management touts add to this addressable market?

Competition: very easy to understand. You have Match Group (owner of Tinder and Hinge), and Grindr. That’s essentially it for Bumble competitions around the world. Yes, you could include something like Raya, but that app is not really competing for all daters and I would not think is eating up much of – if any – of the online dating oxygen from Bumble.

(Brett) Management and Ownership:

Bumble has some interesting management and ownership quirks that I’ll address in this section (as an aside, none of it has to do with the founder/CEO being a woman)

The founder/CEO of Bumble is Whitney Wolfe-Herd, who started the company after leaving Tinder around 10 years ago. She is 33 years old.

Executive compensation size was not a huge concern (although watch out for periodic equity grants). However, the annual bonuses are based on an equal mix of revenue growth, adjusted EBITDA growth, MAU targets, and culture (?) which are all not good targets in my opinion.

After doing a private equity deal with Bumble years ago, Blackstone still owns a large stake in this business.

From a voting perspective, both Blackstone and Herd have a tight grip on the voting power through the separate stock units (call them Class B for all intents and purposes). We won’t go through the full numbers on the pod but look at our ownership table to get the full shares outstanding.

There are a few things that get me concerned with this proxy statement:

Full control by Blackstone/Herd of this stock through the Class B Units. They can screw over outside shareholders and there is nothing we can do.

Herd gets childcare benefits and full-time security paid for by the company when she is worth hundreds of millions of dollars. In my opinion, this shows a lack of frugality and integrity.

Herd is only 33 years old. I generally get nervous when a CEO/founder is less than 40 years old. However, she has almost 10 years now working running this business successfully so this is only a minor concern.

There is a clause talked about in the proxy/annual report that states that the Bumble holding company you are buying a stake in with this stock is going to be forced to pay 85% of the tax incentives earned by the company to Blackstone/Herd and other Class B shareholders. While purposefully written to be extremely confusing – and thus it is possible I am missing something – this feels like selfish self-dealing that I would be concerned about continuing going forward. (The balance sheet currently has over $350 million in accrued liabilities to be paid out to these people).

A few years ago, Herd took out a loan from the company. In a vacuum, this actually benefited the business because Herd paid interest back to the company (the loan is now repaid in full). However, this still feels icky to me.

In a similar vein to the voting control, I worry that Blackstone may want to “take under” Bumble. Why wouldn’t they at these prices? Who is going to object? Herd could still maintain an ownership position if she wanted.

Quote from the proxy statement on the tax agreement. Try reading this without twisting your brain into a pretzel:

“We expect that as a result of the size of Bumble’s allocable share of existing tax basis acquired in our IPO (including such existing tax basis acquired from the Blocker Companies pursuant to the Blocker Restructuring), the increase in Bumble’s allocable share of existing tax basis and the anticipated tax basis adjustment of the tangible and intangible assets of Bumble Holdings upon the purchase or exchange of Common Units (including Common Units issued upon conversion of vested Incentive Units) for shares of Class A common stock and our possible utilization of certain tax attributes, the payments that we may make under the tax receivable agreement will be substantial. We estimate the amount of existing tax basis with respect to which our pre-IPO owners will be entitled to receive payments under the tax receivable agreement (assuming all pre-IPO owners that hold Common Units following the Reclassification (the “Pre-IPO Common Unitholders”) exchanged their Common Units for shares of Class A common stock on the date of the IPO, and assuming all vested Incentive Units were converted to Common Units and subsequently exchanged for shares of Class A common stock at the IPO price of $43.00 per share of Class A common stock) is approximately $2,603.7 million, which includes Bumble’s allocable share of existing tax basis acquired in the IPO, which we have determined to be approximately $1,728.1 million. In determining Bumble’s allocable share of existing tax basis acquired in the IPO, we have given retrospective effect to certain exchanges of Common Units for Class A shares that occurred following the IPO that were contemplated to have occurred pursuant to the Blocker Restructuring.”

(Ryan) 2022 Earnings:

$903.5 million in revenue, up 19% YoY

72% gross margins

($114) million in net income

$133 million in operating cash flow

Discrepancy is due to $111 million in SBC and a $145 million impairment charge to Badoo because of their exit of Russia and Ukraine

3.2 million paying users, up 10% (Bumble is growing 34%, Badoo is decreasing 11%)

Total average revenue per paying user (ARPPU) of $23.03, up 7%

(Ryan) Balance sheet and liquidity:

Assets:

$403 million in cash and cash equivalents.

More than $100 million in annual operating cash flow.

Liabilities:

$625 million in total debt, almost all of it is long-term. It’s all in variable rate 2027 term loan. The expense as a percentage of overall debt was ~4%.

To offset the variable rate risk, they have a large book of interest rate swaps. During this year they booked a $10.5 million increase in net gain on interest rate swaps during the year. This offset about half of their interest expense.

Accounting for their interest rate swaps, every 1% increase in rates is an additional $2.8 million in annual interest expense.

S0, net debt of ~$225 million, versus $133 million in annual operating cash flow, and the business continues to grow. I think the balance sheet is fine here, especially with the interest rate swaps in place.

(Brett) Valuation:

Market cap of $3.95 billion

Enterprise value of $4.55 billion (including tax payouts)

EV/GP of 7

EV/FCF of -44.3

EV/OI of 39

EV/Bumble App Revenue of 6.55

As a side note, the company now has 28.1 million total potentially dilutive securities (not all including the Class B Common units I think, although it is incredibly confusing), up from 11.7 million at the end of 2021.

Anecdotal Evidence:

(Ryan) Certainly one of the big 3 in the US and the world broadly. Frankly, though, I don’t think the user experience is actually that different between Bumble and Tinder (at least in the US). Despite all the talk of completely inverting the dating market.

(Brett) The Bumble app is good. One of the big 3 apps around the world. I worry about Badoo being a zero and Hinge crowding out some of Bumble’s greenfield opportunities in non-English speaking markets.

Future growth opportunities:

(Ryan) Hard to say since the formula for growth is so straightforward here. Launch in new markets, market some, and let the network effect take care of the rest. Beyond that, I don’t necessarily see a problem in them acquiring more smaller players. Wolfe-Herd said they aren’t trying to be a “House of Brands”, but if they’ve got the marketing chops and resources to scale niche concepts, I say do it. Responsibly, obviously.

(Brett) I am going to take the Fruitz acquisition. The deal was for $70 million (could be more if there are contingent payout clauses). Fruitz is a popular dating app in France that came up with an innovative way for daters to state their intentions by classifying themselves as a “fruit” within the app. Your choice of fruit puts you in a category on a range of casual to more serious dater. It is currently the 5th top-grossing app on the French App Store (Tinder is #1 and Bumble is #2). Can Bumble scale the app across more countries? That seems to be their intention.

Highlights and lowlights:

Ryan’s Highlights:

Monetization. I think Bumble does a better job than its peers at providing different payment offerings and incentives.

Proven track record of growth + operating leverage. Bumble has proven that it can successfully enter new markets and grow, likely because many people in those markets already know about the brand. The larger the platform, the less marketing is required to attract new users, which means better margins for Bumble.

Industry tailwind. We’ve all seen the chart and probably seen real-life examples but online dating is growing.

The upside in margins if app store fees come down in any way.

Ryan’s Lowlights:

Governance. On top of the weird complexity, it just doesn’t feel like there’s much of a focus on optimizing for minority shareholders. Wolfe-Herd is clearly an exceptional marketer, but I’m yet to see anything that shows me she’s a great capital allocator.

Badoo’s declining relevance is a concern, but some of the numbers from this year are attributable to the Russia/Ukraine exit. However, in general, it looks like Hinge is quickly replacing Badoo on the top-grossing charts in pretty much every European market it has entered.

Brett Highlights:

The payer growth at Bumble has been steady and seems to have a lot of runway to grow. If they become one of the big 3 dating apps globally I see no reason why they cannot have 10 million payers on the platform eventually.

The unit economics for these dating apps are so strong, with 70% gross margins even with huge fees paid to the mobile application stores.

There are major network effects (will be talked about on every episode for this month’s theme) that give these apps long-term competitive advantages if nurtured correctly. Each person that joins Bumble makes the platform that much more valuable for everyone else in that geographical area. There’s a reason I use Tinder and Bumble no matter where I am in the world and not the thid rate app ranked 50th in the lifestyle category on IOS.

Brett Lowlights:

I have two major lowlights that are going to keep me away from this stock. One is the decline of Badoo, which I think is on a course for complete irrelevancy in five years. The app is terrible and will get crushed by Tinder, Hinge, and (ironically) Bumble due to a lack of investment.

The governance issues talked about above. I do not trust Blackstone to act fairly for me as a minority shareholder with the majority voting power in this company.

Bull Case:

(Ryan) I’ll walk through some of the numbers. My assumptions are that Bumble continues to grow and Badoo slowly declines but they run it for cash. Over the next 4 years, if Bumble grows revenue at 15% annually (optimistic, but doable for a business of this quality) and has 30% operating margins at maturity, it’ll be generating $364 million in operating income in 2026. If Badoo’s revenue shrinks by 2% each year and they have 15% operating margins, it’ll be generating ~$29 million in annual OI. So together they’d be doing about $400 million in annual operating income, valued at 17x you’ve got a $6.8 billion market cap or 60% higher than the current price. Plus the upside of Fruitz if that ends up being anything.

(Brett) We’re at an EV/GP of 7 at today’s prices (including the tax liabilities). If Bumble can eventually reach 30% operating margins like Match Group (Tinder reportedly has operating margins of 50%), that would put the current multiple to operating income at 17x. Even if the company faces headwinds from interest payments and share dilution, the stock will still likely do well over the next five years if Bumble can grow its revenue at 15% a year.

Bear Case:

(Ryan) I think at this point investors mostly only care about Bumble. If Bumble’s user growth begins to slow, investors would get hurt. Hard to see why that would happen, but it’s always possible. Or cash never gets returned to shareholders.

(Brett) My bear case is Blackstone.

More or less interested?

(Ryan)

(Brett)

Stock for next week? Grindr

Sources and Further Reading

2022 Annual Report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001830043/daf20544-dbea-4e53-8dc3-8a619728c249.pdf

2022 Proxy: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001830043/c5a5f32b-0d83-4c89-b361-fdfff733d86b.pdf

History of Bumble: https://www.businessinsider.com/bumble-dating-app-company-history-2021-ipo-2020-9