Not So Deep Dive: Capcom (Ticker: CCOEY

A methodical and longstanding Japanese video game publisher with ambitious future plans

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1WUqceeLwOVbDXITYnTlKbTFhJ_sl_PIa

Reminder: these are show notes that should be read in conjunction with the premium podcast only available to CCM+ subscribers. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Capcom is a Japanese video game developer and publisher. Over the years, they’ve introduced several popular franchises including Monster Hunter, Resident Evil, Street Fighter, and Mega Man. The bulk of Capcom’s game sales come from Monster Hunter and Resident Evil, so I’ll highlight those two games:

Monster Hunter: In this franchise, users play the role of a hunter that goes around trying to trap large monsters. There have been literally dozens of different versions of the game released over the years with the most recent being Monster Hunter Rise. The game itself typically costs $60 on consoles, but users can also upgrade their characters with in-game purchases. Cumulatively, the Monster Hunter franchise has sold 84 million units.

Resident Evil: This is more of a shooter-based horror franchise where the goal is for users to survive in various environments typically filled with zombies. The most recent version of the game is a remake of Resident Evil 3. These games are typically below $50 to purchase and from what I can tell don’t have any microtransactions. Cumulatively, the Resident Evil franchise has sold 127 million units.

Additionally, Capcom generates revenue outside of digital content sales including arcade operations (physical arcades located in various commercial complexes throughout Japan), amusement equipment (physical gaming machines), and other businesses (copyright revenue for movies, TV shows, music, merchandise, esports, etc). Combined, all three of these businesses accounted for 20% of Capcom’s revenue in 2021.

(Ryan) History: Capcom was initially started in Japan in 1979 by Kenzo Tsujimoto who funded the business with what’s now equivalent to $70,000. At the time, the company was called I.R.M Corporation and focused on developing gaming machines. In 1981, I.R.M established a subsidiary called Japan Capsule Computer and in 1983 they developed their first “video game” called Little League. This was really a coin-operated arcade game since it didn’t actually display any video. Capcom continued making these arcade games throughout the first half of the 1980s until they launched their home video game called 1942 on the NES. This marked their shift towards developing games for home consoles, and in 1987, they had their first real hit with Mega Man.

In 1990, the company listed its shares on the OTC markets in Japan as it continued developing both arcade games and home console games. Some of their other successes:

Street Fighter, which was initially started as an arcade game in 1987 and has made tons of sequels over the years. They also developed a Street Fighter movie in 1994.

Resident Evil, which was released for the Playstation in 1996 and also had its own movie. The movie eventually generated more than $100 million in sales worldwide.

Monster Hunter. It was first developed for the PS2 in 2004 and won awards in the gaming industry.

(Brett) Industry/Landscape/Competition:

As we’ve discussed throughout our gaming-themed series, the industry is estimated to have $178 billion in customer spending each year globally

The console and PC gaming markets are around $40 billion each in global spending

Capcom operates internationally with a large presence in East Asia, Europe, and North America with a focus on Console/PC and also has the small Arcade business, which has been surprisingly resilient over the years

One of the big takeaways from studying the gaming industry? Even if a market slows its growth or stagnates, there has been strong durability from some of the older form factors

Competitors: Nintendo, Bandai Namco, Square Enix, EA, Activision Blizzard, and Take-Two Interactive. When consumers look to spend money on a console or PC game, Capcom is competing with its brands vs. all of these companies.

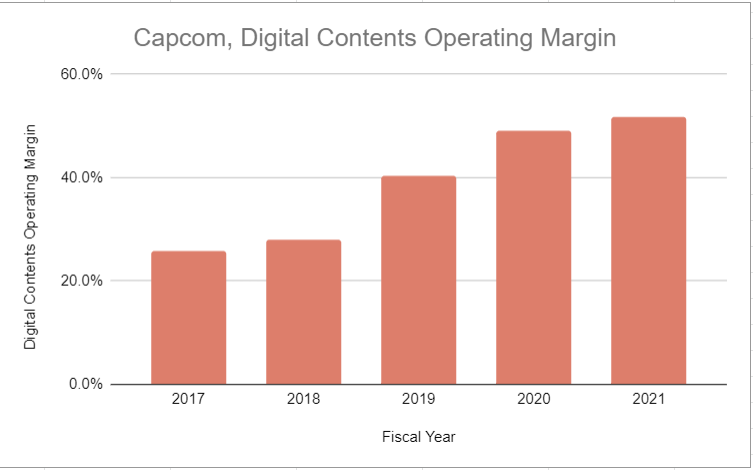

Capcom has invested heavily in a strategy to increase digital and catalog sales to help improve operating margins. This has been an industry-wide trend and is something investors should be tracking when looking at Capcom’s financials

Source: https://www.matthewball.vc/all/audiotech. Up to 2019 annual sales.

(Brett) Management and Ownership:

Capcom was started by current chairman and CEO Kenzo Tsujimoto in 1979, who owns around 4% of the business. He is 81 years old. He explicitly mentions in the annual report he is looking for a successor (likely will be one of his sons)

Haruhiro Tsujimoto is the COO, the founder’s son, and is 58 years old. Has been COO since 2007 and has been with the company since the 1980s. Definitely a candidate to take over the business once Kenzo leaves or passes away.

Ryozo Tsujimoto is the producer of the Monster Hunter series and is also the founder’s son. He is 49 years old and is another candidate to take over the business

The takeaway from looking at management is that this is a family business

Since this is a Japanese company I had trouble finding executive compensation, but given the corporate culture, it is likely not an issue. Also, looking at the shares outstanding chart over the years they are likely not a heavy stock-based compensation company.

Looking at governance, 45% of the Board of Directors are true independent directors. The company explicitly addresses the issue of a family business and says they want board members who are “not intimidated by the company's founder.” I enjoyed seeing this and saw no red flags when looking at the governance of this company.

Capital returns: goal for a 30% payout ratio (current yield: 1.26%) and they have a flexible share repurchase program that has been steadily used over the years.

Important note: they raised employee salaries by a healthy 30% in early 2022. Maybe they were underpaying developers? If so, investors should look for how this impacts margins in 2022

Note: Latest data as of March 2022

(Ryan) Earnings:

Most recent full-year:

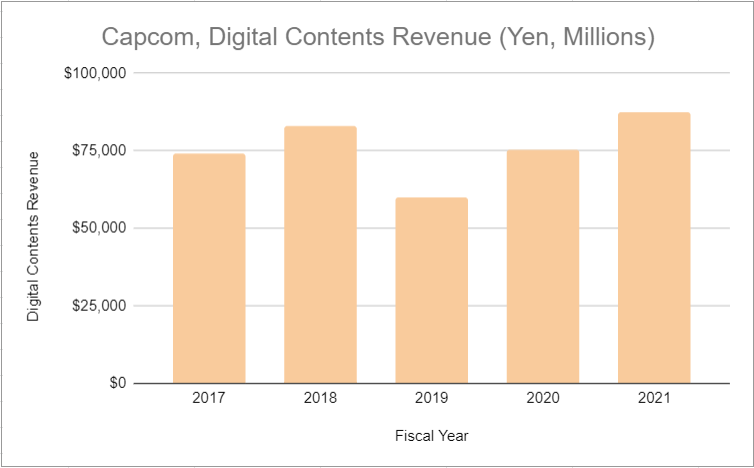

$770 million in revenue, up 15.5% from the 12 months prior

Digital contents revenue grew 16%

Arcade revenue rebounded from Covid

Amusement sales declined

Licensing revenue continues to grow. It’s roughly double from 5 years ago and has 30%+ operating margins.

$300 million in operating income, up 27% YoY

39% operating margin vs. 36% a year ago (operating margins have expanded steadily each year from ~15% ten years ago)

Spent ~$210 million on research and development, or 27% of revenue. That’s less than they spent on R&D in 2012. They said they expect that number to be flat moving forward.

Sold 32.6 million software units this year, up 8% YoY.

(Ryan) Balance sheet and liquidity:

Their balance sheet is really simple.

They have $750 million in available cash and $34 million in total borrowings.

So more than $700 million in net cash (However, they hold that cash in Yen, which has collapsed 23% relative to the dollar over the last year)

That’s more than 3 years' worth of research and development expenses.

They strive to payout 30% of their net income in dividends each year

And they buy back shares periodically

(Brett) Valuation: (Based on $3,685 share price)

Valuation sheet: https://docs.google.com/spreadsheets/d/1_TVZVoSCkGpzUwg13iYi5cazR5ichtmIfAy1rRB7iE0/edit#gid=0

$785 billion (Yen) Market Cap

$692 billion (Yen) Enterprise Value

EV/s of 6.3

EV/OI of 16.1

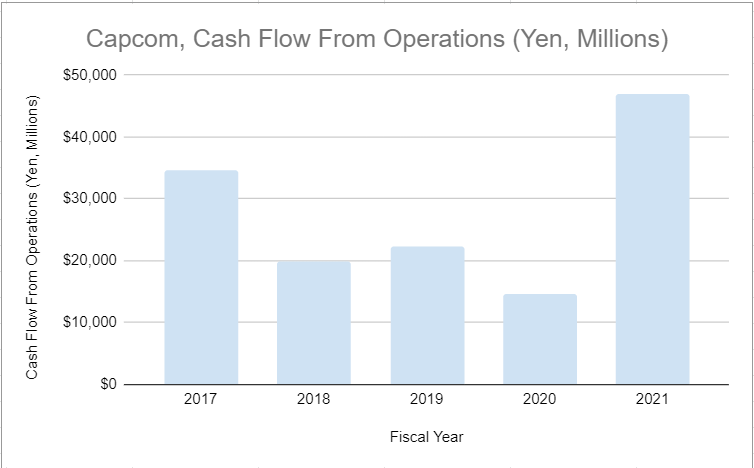

EV/OCF of 14.7

Anecdotal Evidence:

(Ryan) Just based on watching Youtube videos, people really seem to like the Monster Hunter franchise. It seems like Street-Fighter is dwindling, and frankly, the concept just isn’t well suited for modern gaming. The Street-Fighter 30th anniversary collection feels like almost a last hurrah.

(Brett) Resident Evil and Monster Hunter seem to have strong fanbases, but I have no personal experience with the games. The Disney-like strategy of trying to get their IP to as many different entertainment mediums as possible seems smart but harder to do with the more niche IP they have. For example, there’s no way they could open up a theme park as Nintendo did and have it be successful.

Future growth opportunities:

(Ryan) Allocating resources towards mobile development. They’ve done a job implementing their Single Content Multiple Usage strategy over recent years in every segment except mobile. I think it could be worth buying a mobile studio, especially given their sizeable cash pile.

(Brett) New franchises. In order to hit its 100 million software unit goal, Capcom will either need to bring Monster Hunter to the “next level” and make it a global franchise, or it is going to need some new franchises in the mix. Catalog sales can only take you so far. They are releasing a sci-fi shooting game called Exoprimal in 2023 and Pragmata, a dystopian lunar-based game. I have no idea if these will be hits, but Capcom is at least getting some shots on goal. With the size of this business, even one title that does 5 million unit sales a year can be a game changer if it turns into a durable franchise.

Highlights and lowlights:

Ryan’s Highlights:

They have several franchises that have withstood the test of time. Something I’ve grown to look for in gaming companies is how many franchises they have that have been around for more than 10 years, and have those franchises actually grown over time? Capcom has several.

They’ve done a really good job getting lots out of their developers. Development costs haven’t budged over the last 10 years.

Ryan’s Lowlights:

A large chunk of the profit growth that occurred over the last decade was due to game distribution going digital. Now 83% of Capcom’s sales are already digital, so that tailwind has been largely exhausted.

Just an overall lack of sales growth over the last decade.

They’re far too conservative with their cash.

Brett’s Highlights:

The execution of the catalog/digital expansion strategy. These are the two reasons why Capcom’s operating margin has expanded over the last five to ten years.

The execution of the Monster Hunter series over the last few years. Monster Hunter World has hit 21 million unit sales, and Monster Hunter Rise (the Switch and PC game) has hit 11 million unit sales. When the next flagship game comes out, will it be able to make the next step change and sell 30 - 40 million units in the first few years after release? I think it's possible.

Management’s long-term tenures and long-term focus. When reading their shareholder updates in the annual report, I loved their mindset and think they truly understand how to be “stewards” of capital, which few management teams do.

The consistent share repurchase program.

Brett’s Lowlights:

Lack of consistent top-line growth. You can’t juice the catalog and transition to digital sales forever, and they may be coming up against that wall.

The start of Capcom Pictures in Los Angeles. Apparently, they are going to produce their own movies. This feels risky and not the best move compared to just licensing their IP. However, there is definitely some upside here.

A history of letting franchises die. Street Fighter was a great brand that has not captured the same magic as it did back in the 90s. I worry about franchise durability.

Really poor execution on mobile games. They mention this in the annual report and essentially say they don’t have the development DNA to build worthwhile mobile titles. Maybe an acquisition is in the cards?

The balance sheet is too conservative. They have 100 billion Yen and generate cash every year. This is a problem with other Japanese companies as well so I don’t think investors should expect the culture to change.

Bull Case:

(Ryan) Digital sales don’t just replace overall sales, but actually expand the fanbase altogether. Capcom continues to grow unit sales in the high single digits for the next 5 years and an increasing percentage of those sales go digital. This should allow management to hit their medium-term goal of 10%+ annual profit growth.

(Brett) The catalog and digital tailwinds continue over the next five to ten years, driving the baseline of annual unit sales up to the 50 million range and operating margins higher. Then, with the growth of the new Monster Hunter game and/or some of these new titles, the peak range of annual unit sales hits 100 million. Given the operating leverage in the business and the valuation, the stock would likely do extremely well if these targets are hit.

Bear Case:

(Ryan) Capcom is unable to launch any successful new franchises, and their current fanbase stays essentially where it’s at. They are probably close to their ceiling on the percentage of sales that are digital, so operating profits basically stay flat over the next couple of years. And their cash balance loses value during that time.

(Brett) The bear case is simple, and it is the stagnation of the Monster Hunter franchise (Resident Evil is not large enough to move the needle, in my opinion) combined with these new games under development being flops. If this happens, revenue will likely hover in the same range it has over the last five years and without margin expansion, the business will run in place. You probably don’t lose money given catalog sales but hard to see a world where you make money.

More or less interested?

(Ryan) Less interested. It’s hard to look at a business that hasn’t grown sales over the last decade and get excited.

(Brett) More interested. I think this business is durable but I worry about growth. Would be interested if the earnings multiple was lower, I think the stock is a bit expensive right now unless they can get a hit out of the new Monster Hunter game or these new franchises.

Stock for next week? (Rovio Entertainment)

Sources and Further Reading

The Investor Relations page has tons of information but is spread over a lot of different documents and web pages. If you are more interested in the business, we would recommend taking the time to explore the website: https://www.capcom.co.jp/ir/english/

Monster Hunter history: https://en.wikipedia.org/wiki/Monster_Hunter

Resident Evil History: https://en.wikipedia.org/wiki/Resident_Evil

Street Fighter History: https://en.wikipedia.org/wiki/Street_Fighter

Message from CEO, 2021: https://www.capcom.co.jp/ir/english/message/ceo_message.html