This is the first premium post for CCM+ subscribers. If you are subscriber, thank you for supporting the show! One of these posts will be sent to your inbox every Tuesday along with the release of a Not So Deep Dive episode. These are meant to be read as a supplement to what you listened to during the episode.

Now…on to Chipotle

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1iaJeUlgq9oQJeoSE1nS4uztZJPOgIBDM

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Chipotle is a fast-casual Mexican food concept in which all the locations are owned and operated. The model is really quite simple. Chipotle has 53 total ingredients and they give customers a selection of customizable menu items to choose from. Once a customer has chosen what they want, they go through an assembly line ordering process where they can add the various ingredients they would like until they complete their meal. The process is very quick.

As for the supply chain: Chipotle has 25 independently owned and operated regional distribution centers that purchase from a range of local suppliers (they pride themselves on only ordering “responsibly raised” foods). They then ship these ingredients to their ~3,000 US locations based on geographic proximity.

Each Chipotle location averages $2.64 million in revenue a year (46% of sales are digital) and just under $600k in operating profits (that excludes corporate expenses).

(Ryan) History: In the early 1990s, Steve Ells was a chef working in San Francisco. He had aspirations to build his own fine dining restaurant but needed the cash to do it. So at the age of 28, on an $85,000 loan from his father, he opened a burrito shop in Denver, CO. The goal of this place was to be a cash cow that would finance his eventual fine dining restaurant. He figured that if they could sell 100 burritos a day, the business would be economically viable (they eventually sold thousands). The first location got off to a mediocre start, but more and more people kept coming in, and after a few months, they were profitable and Steve was able to pay back his father.

A year and a half later, Ells opened a 2nd location in Denver with cash flow from the original restaurant and by 1996 added a third with a small business loan. Around this time, they began to really professionalize the operation. Ells’s father invested an additional $1.5 million and they also raise some outside capital. In 1998, McDonald’s invested $360 million as growth capital and eventually ended up with 90% ownership of the company. They largely let them run their own operation but they tried to get them into the franchise model briefly.

Fast forward to 2006: With a little over 500 stores, Chipotle went public to much investor excitement and McDonald’s relinquished their stake. Everything went fairly well for them from there until about 2015, when there were E-Coli and Norovirus outbreaks at several of their locations that led to ~1,000 people falling ill. Afterward, same-store sales declined by 30-40% and the stock dropped by as much as 70%, leading to Bill Ackman’s firm Pershing Square taking a 10% activist stake and sparking a lot of change. Ells was replaced by ex-Taco Bell CEO Brian Niccol, they began revamping their supply chain model, and began investing heavily into their digital offering. The stock is a 5-bagger since that timeframe.

(Brett) Industry/Landscape/Competition:

As we’ve discussed with past restaurant concepts like Sweetgreen or Portillo’s, the restaurant industry is easy to understand. People need to eat and all these places are competing for customer spending.

Total restaurant spending in the United States was estimated to be at $799 billion in 2021, down $65 billion from 2019 (source: National Restaurant Association)

Competitors: Panera Bread, Sweetgreen, Panda Express. Listeners will know many others, we don’t have to list them all. However, specifically Chipotle is competing heavily with the lunch crowd, as that has been their bread-and-butter for customers.

(Brad) Management and Ownership:

Brian Niccol CEO

CEO of Taco Bell from 2015-2018 before taking over

President of Yum! Brands and CMO there before that

GM and CMO of Pizza Hut before that

Jack Hartung CFO

CFO of Chipotle since 2002

Curt Garner CTO

There since 2015

CIO at Starbucks for a few years after he spent over a decade climbing that ladder.

There are another 526,000 in future shares issued via options.

Niccol got a $12,000,000 bonus in 2021 along with another $12 million for his team. For example in 2021, Niccot was paid $18 million in compensation with $1.25 million of that being in cash. They use options and stock awards aggressively.

PSUs paid out in direct correlation with cash flow generation – love that. This was $7 million of Niccol’s 2021 compensation.

$4.8 million in SOSARs (stock only stock appreciation right).

(Ryan) Earnings:

1st quarter revenue was $2B, up 16% YoY

Comp sales increased 9%

And they opened 51 new locations

They now have 3,017 total locations, up 7.4% YoY

Restaurant-level operating margin declined from 22.3% last year to 20.7% this year

$1.26B in total last 12-month operating cash flow

$452M in trailing 12-month capital expenditures

$807M in trailing 12-month free cash flow

(Brad) Balance sheet and liquidity:

It has $615 million in cash and equivalents on the balance sheet vs. $815 million last quarter.

Another $240 million in “investments”

$3.3 billion in long-term lease liabilities

$4 billion in retained earnings as it can finance growth with more efficient internal cash flow.

$18,000 in traditional debt (not a typo) and another $500,000 revolve

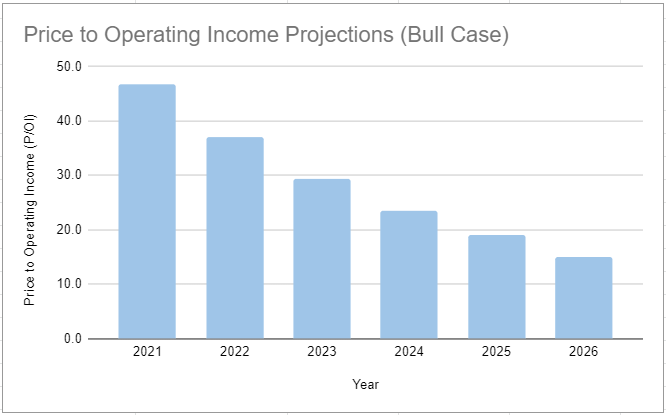

(Brett) Valuation: (stock price: $1,266, 27,962,448 shares outstanding)

Market cap: $35.4 billion

Enterprise Value: $34.2 billion (I am not including operating leases as debt)

EV/OI: 42.5 (2021 numbers)

EV/FCF: 40.7

No major concerns with stock options or SBC. Buybacks have slightly decreased share count in recent quarters, but won’t be meaningful unless the stock falls a ton from here

Anecdotal Evidence:

(Ryan) Love it. Eat there on a regular basis. I feel like the in-person ordering experience has declined though since they started optimizing for online orders.

(Brett) The mobile app is bad but good. The food is good but bad (I can explain).

(Brad) I eat there more than anywhere else. Double chicken and guac but have to get the side of guac because you get way more of that green goodness.

Future growth opportunities:

(Ryan) Chipotlanes. 82% of their new store openings had a chipotlane. Per the last conference call “Chipotlanes also continue to outperform non-Chipotle locations due to the convenience, which is encouraging since digital order pickup is our highest margin transaction.” Locations with chipotlanes also help increase transaction volume.

(Brett) Chippy (just kidding). Getting more customers using digital ordering (this includes the mobile app, website, and delivery services). According to management, around half of customers right now are in-store only, but customers who use digital ordering spend more. This also indicates to me that there is more room to run growing digital rewards members, which are at 28 million members. Lastly, this can help drive AUV growth, which is the key to margin expansion.

(Brad) There is still a long runway for more and more stores globally with the added efficiency levers to pull as well.

Highlights and lowlights:

(Ryan)

Highlights:

Customers know what they’re getting. High-quality ingredients, quick service, and a reasonable price.

Feels like they have pricing power. Could probably charge me 20% more for my order.

Great history of cash flow, even in tough times. And Brian Niccol seems to be a stellar operator.

Lowlights:

They are seeing supply chain pressures across the board right now (beef, freight, wages, construction shortages for new buildings). All these will put pressure on margins.

I worry that they could tarnish the brand with in-store customers (still the majority of sales and increasing since the pandemic) by optimizing too much for the digital orders.

(Brett)

Highlights:

It is a very understandable concept that should work well in many regions around the globe. I see no reason this can’t work in Canada and Western Europe, depending on the supply chain. I believe unit growth can continue at a steady pace for 10+ years.

After they went through the E-Coli scare a few years ago and brought the new executive team, they really executed strongly in revamping the brand and getting people, especially young people, to see the company in a positive light. This is important because of how competitive the “lunch decision” is for people.

They have been able to maintain solid operating margins even while significantly bumping their employee salaries and facing high inflation in beef and avocado costs.

Lowlights:

On the flip side of the labor equation, Chipotle has over 100k employees. They treat them well, but if wage inflation continues, this could hurt its ability to get back to 15%+ operating margins.

While the fresh ingredients concept is sound and differentiates Chipotle from other QSR brands, it generally makes operations more difficult to run and could be another reason margins have trouble expanding. Or, conversely, if they expand margins by getting relaxed on food quality, it could tarnish the brand and create long-term damage.

(Brad)

Highlights:

The food rocks and it’s already somewhat expensive. Hints at pricing power while commodities rage that should be somewhat sticky as those prices cool off. There could be a significant near-term opportunity to grab more margin. I love that the CFO has been there since 2002.

Lowlights:

Tastes change. Not like a fashion brand, but still, concepts go in and out of style. Niccol has done a fantastic job keeping them in vogue but they must do so while maintaining the excellent food quality. I’ve seen brown guac a bit more frequently in the past.

Bull Case:

(Brett) I believe everything comes down to margin expansion. Unit growth is easy to forecast, but returns will be dictated by whether operating margins go much higher than 11%. Going one level deeper, what dictates operating margin is how much sales volume you get on your fixed costs (labor, leases, etc.). So the most important metric is growth in AUV, or comp sales growth. Of course, it would also be nice if the valuation would come down and buybacks could help juice EPS and FCF/s by 2% - 3% a year.

(Ryan) They maintain their brand strength in the eyes of consumers. They double their total store count over the next 7 years. Per restaurant revenue doubles over that same time period. And free cash flow margins reach 15% (capital expenditures as a percentage of revenue should decline as they scale). That would result in $4.8 billion in free cash flow. If investors value those cash flows at 20 times, that would be a $96 billion market cap (171% higher than today’s market cap).

(Brad) The company can successfully morph its store portfolio into a fully-omnichannel operation while keeping the brick-and-mortar experience excellent. It can use its pricing power to maintain the recent price hikes as food input prices come down and continue to comfortably compound close to 15%.

Bear Case:

(Ryan) Closer to store maturity in the US than I expect, same restaurant revenue growth slows to mid-single digits, current restaurant-level cost pressures persist and they can only reach low-teens margins long-term. And if the company is valued at more like 15x. If any of those four risks come to fruition, this could be a single-digit return.

(Brett) I’m going to keep things simple for a simple concept. If margins do not expand, shareholders will almost assuredly do poorly over the next 5 - 10 years.

(Brad) More food safety issues like e-coli that have hurt it in the past creep back up. Less likely with the standard operating procedures in place, but still a remote possibility. Competition like Qdoba prevents Chipotle from using commodity volatility to juice long-term margins.

More or less interested?

(Ryan) On the fence. I love the business, but I don’t like the uncertainty that comes with restaurant concepts.

(Brett) More interested. I don’t think the risks we talked about are that likely to impact growth in free cash flow per share. At the right price, this seems like a great risk/reward for shareholders looking to buy and hold for a decade-plus.

(Brad) More interested. Pricing power, excellent brand and leadership. It is just a bit too expensive today.

Stock for next month (Brad: Disney)

Sources and Further Reading

How I Built This Podcast (Steve Ells): https://www.npr.org/2020/12/22/949258959/chipotle-steve-ells-2017

How Chipotle Morphed Into a Lifestyle Brand https://www.qsrmagazine.com/exclusives/how-chipotle-morphed-lifestyle-brand

We Had Lines Out the Door (paywall)

Great work guys - and thanks for the shoutout!