Not So Deep Dive: Dassault Systemes (Ticker: DASTY)

A mainstay of the engineering industry is our first stock for our engineering software theme

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

Ryan) What they do: It’s a little difficult to describe all that they offer in a concise manner, so I’ll steal this quote from their annual report, “The purpose of Dassault Systèmes is to provide business and people with 3DEXPERIENCE universes to imagine sustainable innovations capable of harmonizing product, nature and life.” And they do this through a large portfolio of diverse software applications.

They segment each of their products into one of three buckets:

Industrial Innovation: CATIA is the leading global solution for designing and modeling products in 3D, and doing so in the context of its real-life behavior. In talking to my brother, who is a current engineering student, he said the main difference in use cases is that CATIA is better designed to apply certain stresses to a product. Accounts for 53% of overall revenue and also includes ENOVIA (building collaboration), SIMULIA (simulation applications), DELMIA (global ops), GEOVIA (natural resource modeling), NETVIBES (information intelligence), and 3DEXCITE brands (3D marketing experiences).

Life Sciences: Life Sciences is comprised primarily of MEDIDATA. Medidata is an all-in-one life-sciences platform that helps companies like pharmaceutical manufacturers or medical device makers run clinical trials, engage with customers, and leverage swaths of data to help them run more efficiently. From what I understand, this seems like reporting and workflow software for the life sciences industry. Accounts for 22% of overall revenue and is the fastest-growing category.

Mainstream Innovation: Mainstream innovation is primarily comprised of Dassault’s 3D Experience suite, which includes Solidworks. Solidworks is the global leader in the 3D Computer Aided Design industry and helps engineers and designers build new shapes and products. Accounts for 25% of overall revenue.

They serve tons of different end markets including some of the largest manufacturing enterprises in the world, Boeing, Tesla, NASA, Airbus, Proctor & Gamble, and tons of others.

(Ryan) History: Dassault Systemes was created in 1981 to design products in 3D through the spin-off of a team of engineers from Dassault Aviation. They initially launched with their flagship software application CATIA, which they signed a sales and marketing agreement with IBM to resell to their customers. The software took off among most of the large aerospace and automotive manufacturers during that time. In 1996 the company had a successful IPO and a year later used some of the proceeds to acquire Solidworks. While Dassault made several other subsequent acquisitions during the rest of the 1990s and the 2000s, it was iterations to Solidworks and CATIA that really drove the results for the business.

In 2011, like many other software providers, Dassault began making its products available via the cloud after shifting to Amazon’s EC2 (elastic computing). Today, ~80% of their revenue is cloud-based subscriptions. Another big shift came in 2019 when Dassault bought Medidata for $5.8 billion and announced its intent to “extend its focus from things to life”.

(Brett) Industry/Landscape/Competition:

Dassault Systemes has a ton of different products, but it is all focused on software for the engineering and life sciences industries

In its annual report, Dassault Systemes estimates its annual total addressable market (TAM) at $42 billion (U.S. dollars)

For the competition, I’m going to look at manufacturing and life sciences (infrastructure is too small a part of this business)

Manufacturing and engineering: Autodesk (Inventor, Fusion 360, AutoCAD), Siemens, PTC (OnShape), and Ansys (simulation technology). We will be covering most of these companies throughout the engineering software month!

Life sciences: Schrodinger, Benchling, Labware, Thermo Fisher Scientific, and Veeva. However, the market is apparently highly fragmented with the three largest players (including Dassault) having less than 30% market share. This is a big part of the bull case for the Life Sciences division that the general industry tailwind + market share gains can deliver consistent double-digit growth.

(Brett) Management and Ownership:

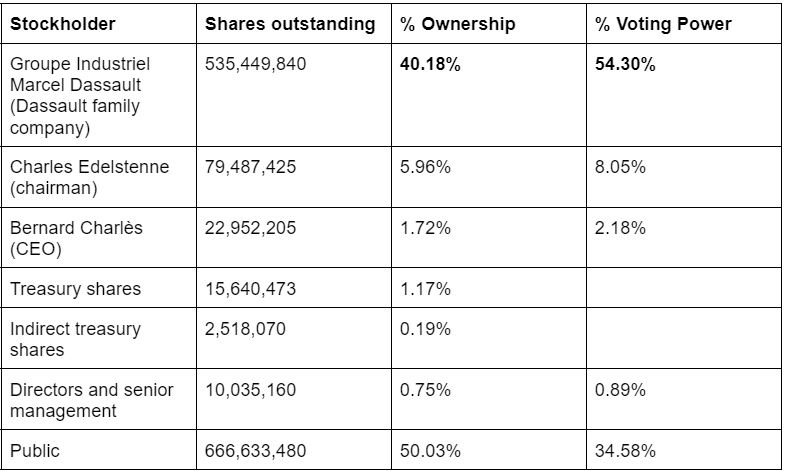

Dassault Systemes is a longstanding family-controlled company

The CEO is Bernard Charles. Charles was essentially one of the founders of Dassault Systemes when it spun out in 1983. In 1988 he was made President of Strategy and R&D.

In 1995, Charles was named the CEO of Dassault Systemes, and in 2016 was named to the BoD. He holds a Ph.D. in mechanical engineering and is in his 60’s. Clearly, the man knows engineering software and has been working in this industry for decades.

Charles Edelstenne is the named founder of the company, chairman of the board, and also the chairman of the Marcel Dassault Group. This is important looking at his voting power, which would likely vote in line with the Marcel Dassault Group. He is 84 years old.

The executive team has generally been at the company for a while: COO (2001) and VP of R&D (30 years) are two examples here.

The board has 12 members, which is likely because a lot of Dassault Group and family members are on the board. The other members have been added to make sure the board has enough independent directors

The company loves ESG. So much so, that they devoted 55 pages to it in the 2021 annual report

Yellow flag: Edelstenne gets paid over 1 million Euros a year as the Chair of the board. A little high for someone that already owns so much stock.

Executive compensation is 50% fixed, 50% variable. The variable compensation is based on a ton of factors including ESG (thankfully only 15%), EPS growth, revenue growth vs. competitors, non-IFRS operating margin, and more. Total compensation of 3.2 million Euros.

(As of EOY 2021)

(Ryan) Earnings:

Last full-year:

$4.9 billion in revenue, up 11% in constant currency

$1 billion in IFRS Operating Income

$1.5 billion in free cash flow (31% free cash flow margin)

The discrepancy is caused primarily by two factors. Billings vs revenue recognition and share-based compensation.

Most recent quarter:

Revenue was $1.4 billion, up 18% YoY (8% in constant currencies)

By category:

Industrial up 6%

Life sciences up 13%

Mainstream up 5%

Non-IFRS Operating Margins were relatively stable at 31.6% (vs. 33.8% last year)

Operating cash flow was up 8% YoY

(Ryan) Balance sheet and liquidity:

Fairly straightforward balance sheet.

They’ve got $2.8 billion in cash and cash equivalents

And $3 billion in total borrowings (95% of which is A- rated bonds)

Here’s the breakdown of the debt:

$900 million at 0% due 2022

$700 million at 0% due 2024

$900 million at 0.125% due 2026

$1.15 billion at 0.375% due 2029

The remainder is in a term loan that bears interest at LIBOR +0.6%

Great balance sheet. Cheap debt and steady cash flow.

(Brett) Valuation:

Market cap of 45 billion Euros

Enterprise value of 45.3 billion Euros

EV/s of 9.3

EV/OCF of 28

Anecdotal Evidence:

(Ryan) Spoke with my brother. He said there’s an entire semester-long required course at his school taught specifically for Solidworks. Then you have to take a class for Abaqus which is another brand they own. This software is engrained in engineering culture and I don’t see how it could be replaced.

(Brett) The moat for Catia/Solidworks is phenomenal. For example, they have been the software provider for Boeing for decades. Imagine trying to dislodge that? On the life sciences front, that one is harder to judge but it feels like the tailwind should be strong over the next few decades.

Future growth opportunities:

(Ryan) Life sciences are sort of the glaring opportunity for them right now. But I think there’s a good chance that this becomes an infrastructure-focused decade. The needed investments in energy production and the reshoring of manufacturing seem like two big tailwinds that they’re well-positioned to benefit from.

(Brett) Life Sciences software. Last quarter, this division grew 14% year-over-year on top of 19% growth in 2021. This has been driven by the execution at Medidata, the large 5.8 billion Euro acquisition it made in 2019. The long-term goal is to make the life sciences industry as virtual as engineering. Here’s a quote from the acquisition: “The virtual world will push the bounds of possibilities to transform not only research and science, but also the entire pharmaceutical and medical device industry and medicine, in general. We made virtual twins of cars and airplanes possible. We will do the same for the human body.”

Highlights and lowlights:

Ryan’s Highlights:

Catia and Solidworks look like they’re in the “stuck with it for life” software bucket.

Loads of pricing power which feels a little easier to implement now that they’re cloud-based.

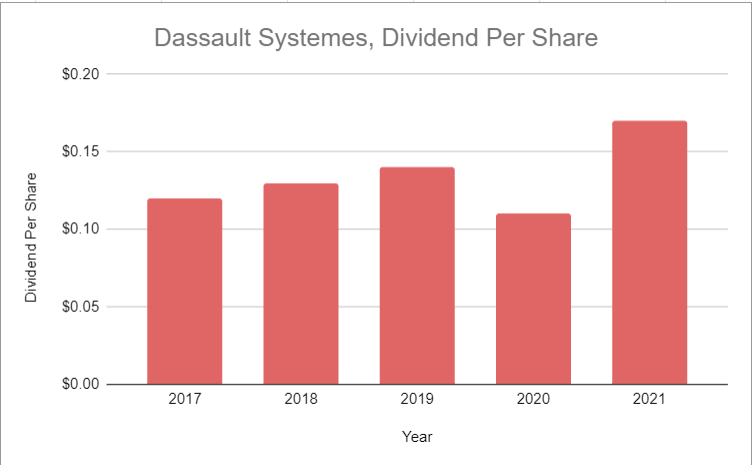

Clear track record of growing free cash flow per share at a healthy rate.

Ryan’s Lowlights:

Management seems keen on limiting its margins.

I don’t know the competitive landscape that well for the majority of its end markets.

Brett’s Highlights:

The switching costs of Solidworks, Catia, and other manufacturing design software. At enterprises of all sizes, it would be extremely tough to switch to an equivalent product without losing a ton of productivity. There is also a strong moat for education institutions, similar to Adobe, Revit, etc. For reference, they are at 80% of the top engineering schools around the world.

The bundling of products through the 3Ds Experiences brand. This is tough to understand because of all the various names that they apply to all of these products, but selling all of the software an engineering company would need as a bundle can keep out smaller companies from winning contracts.

The lead Medidata seems to have within Life Sciences and pharmaceuticals. The top 20 pharmaceutical companies by revenue all use Medidata. Similar to how Catia/Solidworks grew with Boeing and other manufacturers over the last few decades, Medidata and Dassault’s other software products should be able to grow with its large customers as well.

The long-term tenure of the management team

Brett’s Lowlights:

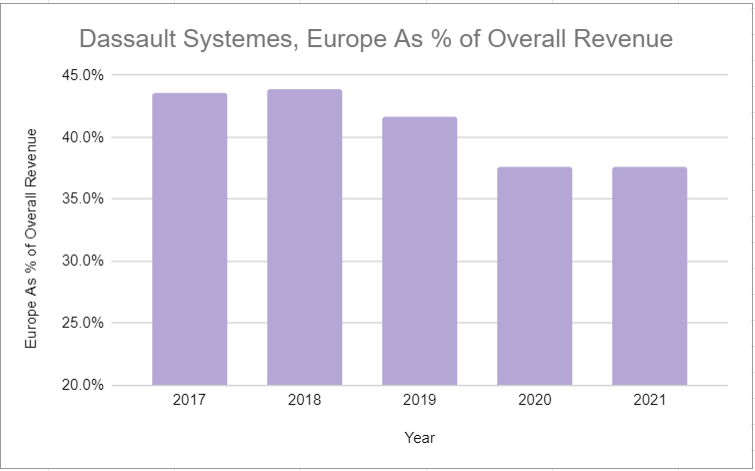

Lack of margin expansion. Since 2017, the operating margin has hovered around 20%. Now, one may argue that this is because of its subscription transition and its heavy investment into Life Sciences as of late, but I think this business should be able to achieve 30% or even 40% operating margins. Why hasn’t it yet?

The need for growth through acquisitions. Dassault Systemes has acquired a ton of companies over the years. I worry about too much diversification and a lack of a coherent strategy, plus the bloat of trying to run all these verticals in a centralized manner.

Competition from Autodesk’s Fusion 360 product is trying to displace Solidworks and is showing some good signs of gaining market share.

Bull Case:

(Ryan) At 28x operating cash flow, I think there has to be a combination of margin expansion and near 10% top-line growth for the returns to look as good as some of the other opportunities out there. Both seem doable, but management’s seemed reluctant to expand margins too far.

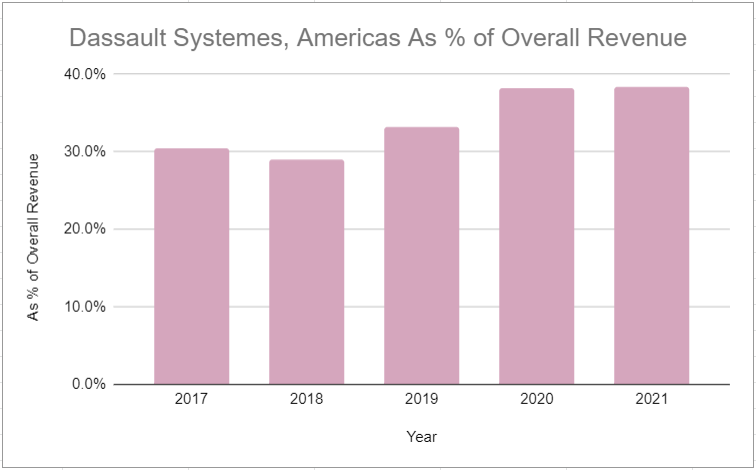

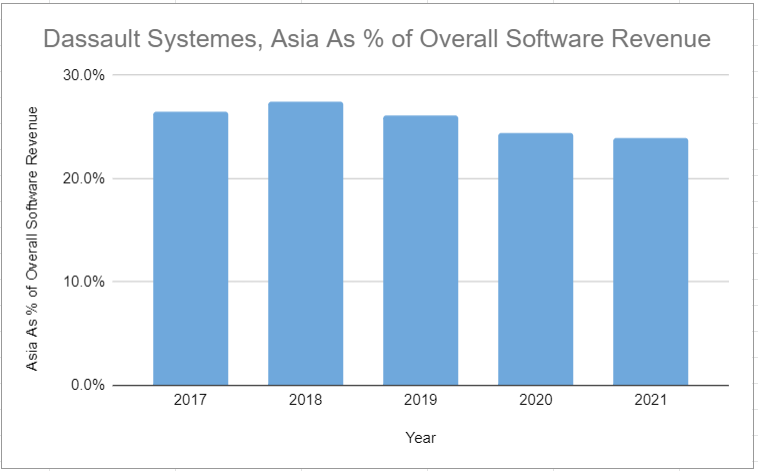

(Brett) With investors understanding that Dassault Systemes is a high-quality business (EV/OCF still way above the market’s average earnings multiple) I think you need to be very optimistic about future growth and margin expansion for this to do well over the next three to five years. If this happens and annual cash flow reaches $4 - $5 billion, you’ll likely do quite well as an investor. I think this is possible considering all the growth factors we outlined earlier. And this is not including the tailwind from manufacturing reshoring in North America and the new Outscale cybersecurity/cloud division.

Bear Case:

(Ryan) The competitive landscape heats up in life sciences and Dassault only grows the top line by a mid-single-digit percentage each year. The industrial and mainstream channels seem pretty bulletproof, but there seem to be some high expectations baked in right now.

(Brett) It sounds simple but mine is slowing revenue growth, due to a variety of factors. This could be from market share losses to Fusion 360, less growth in the life sciences area than investors are thinking, or macroeconomic factors. With a high starting valuation, things could get disappointing if growth stalls. I’m not worried about much else.

More or less interested?

(Ryan) Less interested. I think the next decade has a high likelihood of looking like the last (132% free cash flow per share growth over the last 10 years), which wouldn’t warrant the current valuation.

(Brett) More interested. I love the moat/competitive position of the engineering software part of this business. Today, I am not interested because I am worried about slower growth in conjunction with a high starting multiple.

Stock for next week? (Ansys)

Sources and Further Reading

Catia vs. Solidworks: https://www.buildercentral.com/catia-vs-solidworks/#:~:text=CATIA%20and%20Solidworks%20are%20owned,3D%20parts%20and%20assembly%20modeling

300+ page 2021 Annual Report: https://investor.3ds.com/system/files-encrypted/nasdaq_kms/assets/2022/04/01/4-08-51/3DS_2021_URD_31032022.pdf

Overview of Medidata: https://www.medidata.com/wp-content/uploads/2022/05/MEDIDATA-CORPORATE-FACT-SHEET-2022-4.27.22.pdf