Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

Show Notes

(Ryan) What they do: Diageo is one of the world’s largest alcoholic beverage companies by sales and is the #1 producer of spirits globally. They operate 200+ brands in total and sell through local distributors to both restaurants and retail stores. Diageo is truly a global business:

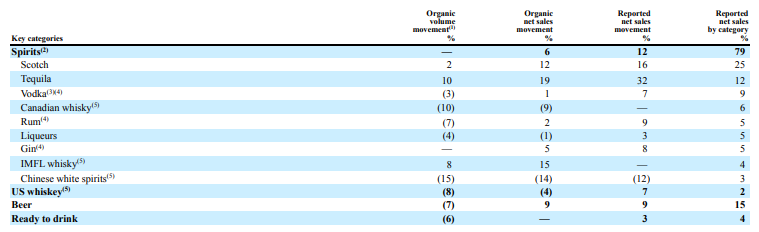

There are a number of ways you can look at Diageo (management looks at them by geography), but I think the easiest way to gain a quick understanding is to look at them by product type.

Spirits: Accounts for 79% of Diageo’s total sales. The biggest drivers here are Scotch, Tequila, and Vodka. They own a number of famous brands including Johnnie Walker, Buchanan’s, Smirnoff, Ciroc, Ketel One, Casamigos, Don Julio, Tanqueray, Bulleit, Crown Royal, Captain Morgan, and more. As a whole, Spirits sales growth has outpaced the overall growth of the alcohol industry.

Beer: Accounts for 15% of Diageo’s revenue. This consists solely of Guinness from all I can tell. Largest beer brand in Europe. Has several variations.

Ready to Drink: Accounts for 4% of revenue. Just derivatives off of their spirits brands. Smirnoff Ice, Ketel One cosmopolitan.

(Ryan) History: Diageo was formed in 1997 through the merger of two companies: Guinness and Grand Metropolitan. Both companies were roughly a £10 billion market cap and were houses to several different brands. In Grand Metropolitan’s case, they also owned Burger King and Pillsbury, which they divested shortly after the merger. But the history of their brands extends back much further.

Haig Club, which is a scotch whiskey brand Diageo started in partnership with David Beckham, has roots that date back to 1627. Guinness was founded in 1759 by Arthur Guinness, when Arthur began brewing at the St. James’ Gate Brewery in Dublin, Ireland. He actually signed a 9,000-year lease on that brewery and that’s still their main production center today. John Walker began brewing whiskey in Scotland in 1820. The list goes on and on. The point is that many of these brands have incredible heritage and mindshare with consumers built over centuries.

As of late, Diageo has been making a push into Tequila, which has been the fastest-growing hard alcohol category over the last decade. In 2015, they acquired Don Julio and in 2017 they acquired Casamigos. They’ve been serial acquirers over the years adding (and also disposing) of brands based on how consumption habits are changing.

(Brett) Industry/Landscape/Competition:

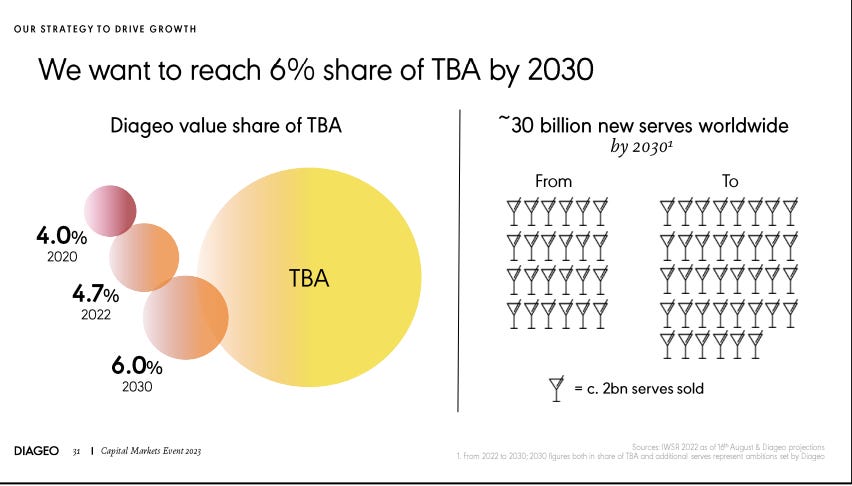

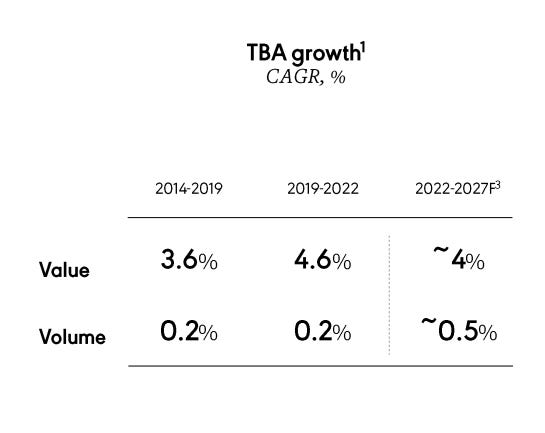

The “Total Beverage Alcohol” category (TBA) is around $1 trillion in global annual spending (graphics below)

Diageo likes to brag that they are “only 4.7% of the TBA market!” and plans to hit 6% market share by 2030

However, that is a bit misleading. They mainly play in international spirits, which is only 22% of the TBA market. Using that number, a 4.7% market share turns into over 20% market share of the spirits category. So, Diageo is the leader in this sector by a longshot

Spirits are taking market share from beer and wine, both on volume and especially in price.

Do we think Diageo achieving 6% TBA market share is achievable? Why or why not?

Other notes: non-alcohol spirit sales are up 13x from 2017. Diageo is investing heavily here.

The “premiumization” narrative shows up in Diageo’s sales data. In developed markets, its premium and super-premium tiers were 71% of sales, up from 53% in 2017. Can this trend continue?

(Brett) Management and Ownership:

Diageo’s management has gone through some major changes this year

Ivan Menezes, CEO since 2013, died earlier this year at the age of 63 from health issues

The CEO job was given to Debra Crew, who was the COO and then before that the president of North America for Diageo. Before Diageo, she worked at a lot of CPG/food companies including Pepsi, Mondelez, and Nestle.

Compensation (shockingly) is base salary, executive cash bonuses, and long-term equity awards

The bonuses are based on net sales growth, operating profit growth, and cash flow conversion

The hurdles are decent for all of them, with the target for sales growth of 6.5%, 7.5% for profit growth, and 100% for cash conversion last fiscal year. These are around the targets they discuss with investors

The long-term equity awards are based on a relative Total shareholder return (TSR) to the peer group. This is a slight concern but the only major thing I found in the management/ownership section

As a large-cap multinational, I don’t think the ownership of the stock is of much worth here. Maybe an activist comes in if they screw up in the next few years, but they have not as of this moment

(Ryan) Earnings:

£17 billion in LTM revenue, up 11% YoY

60% gross margin

£3.7 billion in LTM profits after taxes (net income)

But only £1.8 billion in free cash flow. Big inventory buildup hurting them.

On average, ~85% of net income is converted to free cash flow for Diageo.

Summary: Organic growth has been really solid at Diageo for a while. However, concerns are starting to surface that maybe this won’t last. We’re seeing this particularly in their Latin American markets.

(Ryan) Balance sheet and liquidity:

Liabilities:

£17 billion of gross borrowings. £1.4 billion in cash and equivs. So £15.5 billion in net borrowings.

77% is fixed-rate. It’s termed out. Most are due after 3 years.

Diageo tries to maintain a leverage ratio between 2.5x-3x net debt to EBITDA. Currently sits at around 2.6x.

Assets:

£1.4 billion in cash and equivs, as mentioned above.

Inventories have been rising. £7.7 billion vs. £6 billion two years ago. They’ve also been investing in their “maturing inventories” part of the reason you’ll see a lag in cash flow.

(Brett) Valuation:

EV/profit before taxes of 17

Enterprise value of ~$95 billion (USD)

Anecdotal Evidence:

(Ryan) I’ve tried tons of their brands. Don’t really have loyalty to any of them. Seems like tequila as a spirit of choice has grown.

(Brett) These are good brands. The spirits industry is all about being where the consumer is (stores, restaurants), with a good brand. They definitely have pricing power given how cheap it is vs. unit of consumption (17 drink servings in a 20-dollar bottle of spirits).

Future growth opportunities:

(Ryan) Tequila. Fastest growing category in the Spirits space. Acquired Casamigos and Don Julio so they’re really well positioned. In general, I tend to like their M&A strategy.

(Brett) India (+ other population tailwinds). At the capital markets day, management talked up the Indian market and the aging up of some of these younger countries. By 2030, around 600 million more legally-aged drinkers will be out there around the world, with a quarter coming from India. Diageo has already invested heavily in the country with its premium spirits strategy. Also, luckily, India is a big whiskey-drinking market, which plays well for them. Overall, money spent on spirits per capita seems to grow as long as per capita GDP grows in a region. So when you have legal population age growing + nice wealth gains, there can be durable growth in spirits consumption for many years.

Highlights and lowlights:

Ryan’s Highlights:

Scale advantages galore. Can acquire smaller brands at steep prices and still earn an attractive ROI thanks to global distribution, can invest more into marketing than smaller peers, can afford to let their inventory age for longer, and have better negotiating leverage with distributors and end-customers.

Hard to replicate the heritage of some of Diageo’s brands. A century or more of marketing has built up significant mind share.

Geographic + aging advantages in certain product lines. Some brands like Cognac and Scotch are constrained and must be manufactured in specific geographies. Some brands also require a certain time to be aged and harvested. Most startups can’t really afford to wait that long.

Premiumization + drinking in moderation is becoming increasingly popular. This means more people are turning to Diageo’s brands.

Alcohol as an institution has been around for a long time and should stay around.

Ryan’s Lowlights:

I’m not sure brand loyalty is what it once was.

New management is unproven and has little background in the alcoholic beverages space. Ivan Menzies seemed like he did a really solid job.

Barriers to entry have come down thanks to modern marketing. We’re seeing this with the growth of celebrity brands. Ryan Reynolds’ Aviation Gin, Dwayne Johnson’s Teremana Tequila, Conor McGregor’s Proper Twelve. It’s just not quite as costly to gain traction as it once was.

Brett Highlights:

When you have longstanding brands that have been out there for over a century, you have an advantage vs. the competition. How many years and how many billions of dollars in marketing would it take to dethrone Johnnie Walker? Or Guinness? I think quite a lot.

It should also be noted that time is literally on the side of some of these brands when you have a product that takes years, sometimes more than 10, for the full production process to finish

Consistent capital returns through both growing the dividend per share payout and buybacks. I see no reason why this can’t continue.

Brett Lowlights:

Are we really going to bet on the growth of historically unstable regions (both economically and politically) in order for Diageo to keep growing? As someone with minimal “boots on the ground” experience in these places, I don’t necessarily have much confidence here.

I’m not sold on the new management team. The capital markets day was uninspiring and robotic, although I wouldn’t disregard them completely just because of that. When a good CEO leaves – especially abruptly – there is always uncertainty.

Bull Case:

(Ryan) 2%-3% volume growth, 2%-3% pricing growth (mix shift to premium), steady margins, and maybe even multiple expansion. I think you’d be getting near a 10% return with some real safety in business quality.

(Brett) Today, you are at 17x profit before taxes, or right around the market average. If the company can grow revenue by 5%+ (around guidance) and steadily expand its margin, the stock will likely do fine. But at this earnings multiple, it is hard to bet on 10%+ stock returns excluding any multiple expansion for a mature business like this.

Bear Case:

(Ryan) Negative volumes for a couple of years. Don’t think this is the end of the world as long as they can keep growing share, but would certainly be a lackluster investment and you’d probably be better off with treasuries.

(Brett) The bear case and worry for me is the company is bet on emerging markets as well as the trend of less alcohol consumption in certain regions over the last few years. Diageo has leaned into this with its “premiumization” strategy, but if the numbers move even slightly on volume/pricing/market share, the company could see stagnate sales growth ex-inflation.

More or less interested?

(Ryan) More interested. Looking back 10 years from now, I don’t think I’d be upset with myself for buying here. I think the floor is high here over the long run.

(Brett) More interested. At the right price – probably 10x pre-tax earnings – I would be all over this stock. These are durable brands in my opinion. But not attracted at these prices.

Stock for next week? (Altria)

Sources and Further Reading

Can Tequila go Global? https://www.wsj.com/business/new-diageo-boss-bets-she-can-make-the-world-love-tequila-b7e05b72?mod=Searchresults_pos1&page=1

Capital Markets Day slides: https://media.diageo.com/diageo-corporate-media/media/34oefpfj/our-strategy-to-drive-growth.pdf

Best Anchor Stocks: Overview of the Spirits Industry