Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1tnhV4gNjskgJt2SACNGCA8agny5OsDw_

These are our research notes that should serve as a supplement to this week’s episode. As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Disney is an entertainment company that generates revenue in tons of different ways and at the center of all their monetization sits compelling storytelling and intellectual property that’s loved by people around the world. Here’s how Disney breaks up its business.

Digital Media and Entertainment Distribution (DMED): DMED consists of Linear Networks, Direct-to-Consumer (DTC), and Content Sales/Licensing.

Linear Networks include channels like ABC, Disney, ESPN, FX, National Geographic, and more, and generate revenue primarily through affiliate fees from multichannel distributors like cable providers and advertising.

In its DTC segment, Disney owns several streaming channels that monetize through both premium subscriptions and ad-supported tiers. These include Disney+, ESPN+, Hulu, Disney+ Hotstar, and Star+.

Content Sales/Licensing consists of fees paid by 3rd party services to offer Disney’s film and TV productions to their own customers. However, Disney is slowly removing its library from a lot of 3rd party services as it attempts to bring everything in-house.

DMED also includes theaters paying Disney for distribution, pay-per-view products, licensing to stage plays, and more.

Disney Parks, Experiences, and Products (DPEP): DPEP accounts for all the revenue generated by Disney’s theme parks, resorts, cruise lines, and consumer product sales.

Theme Parks/Resorts: Disney has resorts paired with theme parks located all around the world. These include Disneyworld, Disneyland California, Disneyland Paris, Hong Kong and Shanghai resorts (which are both less than 50% owned), and more. Revenue gets generated at these locations in a few ways. Theme park admissions, merchandise sales, food and beverage sales, room nights at hotels, and a few other smaller ways.

Cruise Lines: Disney operates several cruise ships which monetize in much the same way as its parks and resorts segment.

Consumer Products: This includes the sale of its own merchandise through its own retail stores, various internet sites, and wholesale channels. It also includes royalties from other manufacturers to sell Disney-related consumer goods.

(Ryan) History: In the early 1920s, a film studio in Kansas City that was founded by Walt Disney, created a short film called Alice’s Wonderland. Unfortunately, it didn’t get quite the buzz that they were hoping for so the studio filed for bankruptcy. But the rights to the film were purchased by New York film distributor Margaret Winkler shortly after and the show became a hit. They signed Disney to a contract for six Alice Comedies, so Walt and his brother teamed up to make them in Hollywood under the name Disney Brothers Studios. This was the genesis for the modern Walt Disney Co.

From the 1930s and on, Disney had tons of hit animation films and in 1952, Walt had his idea for what would eventually become Disneyland. The park officially opened in 1955 and at the time, it cost $1 to get into the park and guests would pay for additional rides. 28,000 people showed up on the first day.

In 1966 Walt Disney passed away, and shortly after Roy (Walt’s brother became the first CEO of Disney). After Roy’s death, there have been two really important successors – Michael Eisner and Bob Iger. Eisner assumed the role of CEO in 1984 after his time as President of Paramount Pictures and he was largely responsible for Disney’s into the television industry. Eisner passed the torch onto Iger, and although Iger had some faults, he completed 3 critical deals that have really shaped Disney into what it is today. 1) Acquired Pixar from Steve Jobs in 2006 for $7.4 billion. 2) Acquired full control of Marvel Entertainment for $4 billion in 2009. 3) And acquired LucasFilm for $4 billion in 2012.

(Brett) Industry/Landscape/Competition:

The global entertainment and media industry worldwide is a touch over $2 trillion and is expected to steadily grow this decade

The video streaming market is estimated to be $80.3 billion in 2022 and grow to $139 billion in 2027

The global amusement park industry was estimated to be $73.5 billion in 2019

Competitors: Netflix, HBO Discovery, Amazon, Apple, Universal Studios, Six Flags, Sea World.

(Brad) Management and Ownership:

Interesting to note that 90% of Chapek’s compensation is via performance incentives. ROIC is a key metric for these shares being paid out & we love to see that. While he owns very little of the company outright, he is paid handsomely every year in performance and time-based stock incentives. It’s also important to point out that shares and votes are directly (1-to-1) proportional.

All insiders own 0.20% of the company while institutions own about 65% of the company. This is very common for older companies that have traded leadership teams several times while delivering consistent shareholder success.

Chapek was with Disney for almost 30 years before the promotion. He was a salesperson for Heinz out of college and then started working for Disney.

Christine M. McCarthy is the CFO. She had been climbing the Disney ladder for 20 years before her promotion. McCarthy is a Procter & Gamble Board Member. She was a banking exec at Imperial Bancorp prior to joining the company.

All of the chairmen and most of the executive team spent decades with the company before being promoted.

(Ryan) Earnings:

Last 12 Months:

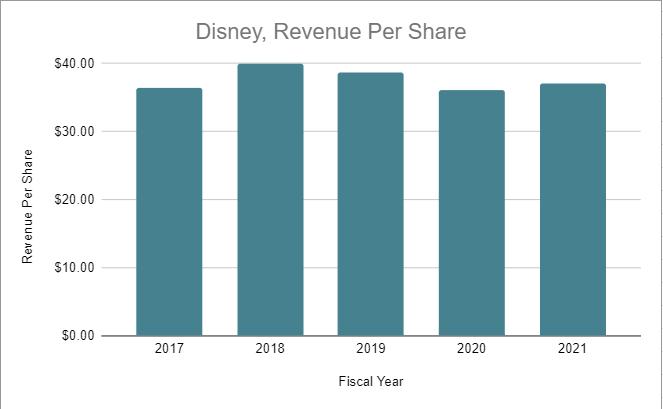

$81 billion in revenue, up 27.5% from the 12 months prior

34% gross margins

And just under 10% operating margins

Most Recent Quarter:

$21.5 billion in total revenue, up 26% YoY

Parks/Resorts generated $7.4B, up 70%.

Media & Entertainment generated $14.1B, up 11%.

$3.6 billion in operating income, up 50% (16.6% operating margin).

Parks has 30% operating margins

Media has ~10% operating margins

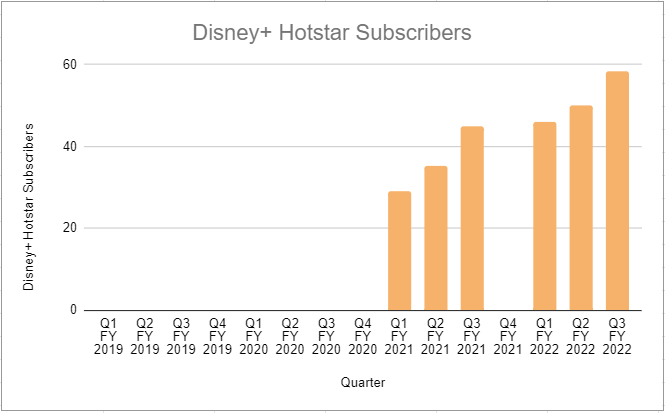

As for direct-to-consumer, here’s the breakdown in subscribers & ARPU:

Disney+ (includes Hotstar): 152 million subscribers (+31%), $4.35 global ARPU (+5%)

ESPN+: 22.8 million subscribers (+53%), $4.55 global ARPU (+2%)

Hulu: 46.2 million subscribers (+8%), $12.92 ex-live TV ARPU (-2%)

(Brad) Balance sheet and liquidity:

It has $13 billion in cash and equivalents.

$5.58B in current debt

Another $40 billion in total debt

(Brett) Valuation: (Based on a stock price of $121.84)

Dynamic valuation: https://docs.google.com/spreadsheets/d/1JsMxJSlNnX_BWKCfGMjxFOK7tSxMF_s23fGmP7N6JCg/edit#gid=344186698

Enterprise value of $255.7 billion

EV/OI of 49.2

EV/FCF of 207

Potentially dilutive securities as % of shares outstanding have hung out at around 2% for the past five years

Anecdotal Evidence:

(Ryan) The parks really do seem to have unlimited pricing power. I love Pixar, Marvel, and Star Wars. I’d also be willing to pay $20/month purely for ESPN+.

(Brett) I am on the edge of my seat waiting for She-Hulk: Attorney At Law.

(Brad) Disney Channel had some great shows. Suite Life, Hannah Montana. Classics.

Future growth opportunities:

(Ryan) I’ve got two. Either launch sports betting app within the ESPN brand or some sort of related partnership, or acquire a video game studio. I’ve always thought Disney and EA (or Nintendo) would make a lot of sense, given they already work well together. And on the sports betting front, here’s management’s commentary on the recent conference call, “We have found that basically our sports fans that are under 30 absolutely require this type of utility in the overall portfolio of what ESPN offers. So we think it's important. We're working hard on it and we hope to have something to announce in the future in terms of a partnership there that will allow us to access that revenue stream.”

(Brett) Bringing sports to streaming. They are in pole position with the growth of ESPN+, which is at 22.8 million subscribers. At a $15 monthly ARPU (this would include ads) with 75 million subs that is $17 billion in annual revenue, before ancillary products. Feels very doable and revenue would likely be above content costs (so generating positive cash)

(Brad) Go buy some content. We’re in a land grab right now in terms of building subscriber bases and they can outcompete everyone else trying to do so. It has the cash and the firepower to remain acquisitive with companies or lucrative media rights. It has the most compelling balance sheet within legacy media (not including mega-cap tech). Go spend. Also, they really should make the 1800000th Avengers movie. What’s taking so long?

Highlights and lowlights:

(Ryan) Highlights

The Disney bundle is the best overall value in streaming thanks to the diversity of the offering and the sheer size of the catalog.

Parks are idiosyncratic. So unique, so nostalgic, and turns people into lifetime Disney fans.

(Ryan) Lowlights

Costs to acquire attention continue to rise as more and more competition presents itself. Not just in the streaming universe, but through other forms of media as well. It’s not nearly the same as it was when linear was just getting started.

I don’t know what the mature state economics look like for streaming and that’s clearly where they’re allocating lots of their resources.

(Brett) Highlights

The dominance and durability of the family brands in video and theme park entertainment. With so many decades of established loyalty to these characters, it is an easy bet they will also be profitable a few decades from now.

The superior offering of the theme parks compared to all other offerings. This gives them a ton of pricing power.

With a lock on family offerings + sports, I feel confident in their ability to maintain viewership as we continue to transition to streaming

(Brett) Lowlights

Recent capital allocation decisions. The acquisition of Fox was clearly a bad deal and doesn’t give me confidence the executive team will act rationally for shareholders.

The capital intensity (and labor intensity) of the theme parks make it a notch below perfect.

They have strong pricing power (near infinite it seems at the theme parks), but they like to flex this muscle aggressively. Growth from raising prices, all else equal, is typically the weakest form of growth when taking care of your stakeholders.

The chance of writing down the China business to zero seems high enough to warrant concern.

No company has proven they can consistently generate positive cash flow in streaming video

The encroachment of Amazon and Apple into sports rights.

General bloat concerns of a centralized conglomerate.

(Brad) Highlights:

The leadership team is full of veterans who have been with the company for decades. Love to see it.

Parks are extremely difficult to emulate in terms of matching IP and making the needed upfront investments. That’s a reliable cash cow to feed the streaming segment.

A mountain of IP to continue churning out profitable film after film.

(Brad) Lowlights:

Does not seem like Iger and Chapek get along. He’s even hinted at regretting hiring him.

Does not seem like a cycle of heavy investing will ever slow down for this company. That builds somewhat of a competitive moat vs. companies without the resources to do so. But this is far from an asset-light model.

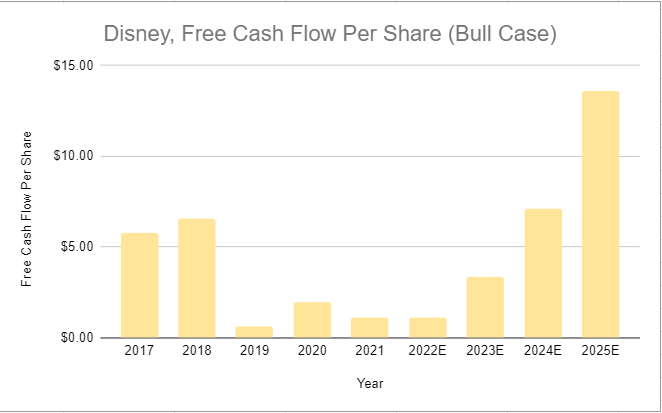

Bull Case:

(Ryan) Disney reaches 400 million or more total subscribers, aggregate ARPU doubles, and all these concerns about streaming economics get put to rest. That, plus high single-digit growth in ticket prices at parks, equates to 15%+ free cash flow margins.

(Brett) At the current enterprise value, you have to see a path to $20 billion in annual free cash flow generation. I think this can be done equally amongst the Parks/Experiences and video/entertainment segments if theme parks go back to normal globally and the company’s streaming ambitions are met.

(Brad) It continues its rapid subscriber growth within streaming and can eventually turn that into a respectably profitable, self-funding business. At that point, the mountains of cash being generated by the other pieces of the business can be used for more aggressive shareholder returns or M&A to expand into new categories.

Bear Case:

(Ryan) Competition for attention increases the costs of content enough that the media and entertainment segment is barely generating cash. Still not a bad investment, but you’re basically buying it for the parks at that point.

(Brett) The China risk, mismanagement of some of the prized assets, and lack of true profitability in streaming video are the big concerns from my seat.

(Brad) Mega cap tech becomes the winner of streaming. Disney + flames out (highly unlikely at this point), and we are left with somewhat of a value trap.

More or less interested?

(Ryan) Less interested. How streaming shakes out seems completely uncertain to me, and that’s a huge element of Disney’s future.

(Brett) On the fence. The theme park business is amazing, but there is a lot of uncertainty in the entertainment business I would not want to pay a premium for the company. Recent capital allocation decisions also scare me.

(Brad) More interested. I see this as having such a high probability of success in streaming and think it can figure out how to turn it into a self-funding business as it did within linear. Its ability to outspend legacy media on sports rights is a major key that could be threatened by mega-cap tech’s entrance into the space. That would be the main thing to keep in mind as a shareholder.

Stock for next month (Brad: Pagaya Technologies)

Sources and Further Reading

Yet Another Value Podcast on Disney, Netlfix, and The Media Space: https://yetanothervalueblog.com/podcast?ppplayer=704b9e5f05450865727a07b7877b9c44&ppepisode=1c99e03d78574cd0e56d950409526a2f

The Science of Hitting, Disney coverage (paywall, various updates): https://substack.com/profile/10489671-the-science-of-hitting

Disney Q3 2022 Conference Call: https://www.fool.com/earnings/call-transcripts/2022/08/10/walt-disney-dis-q3-2022-earnings-call-transcript/

Disney 2021 Annual Report: https://thewaltdisneycompany.com/app/uploads/2022/01/2021-Annual-Report.pdf

Disney Q3 2022 earnings update: https://thewaltdisneycompany.com/app/uploads/2022/08/q3-fy22-earnings.pdf