Not So Deep Dive: Dollar General Stock (Ticker: DG)

Temporary headwinds, or a permanent industry change?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

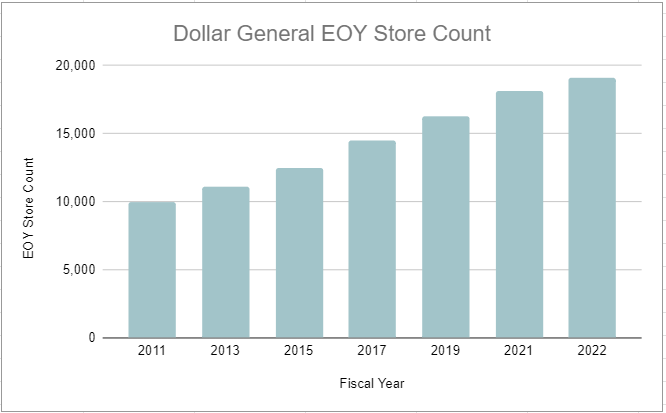

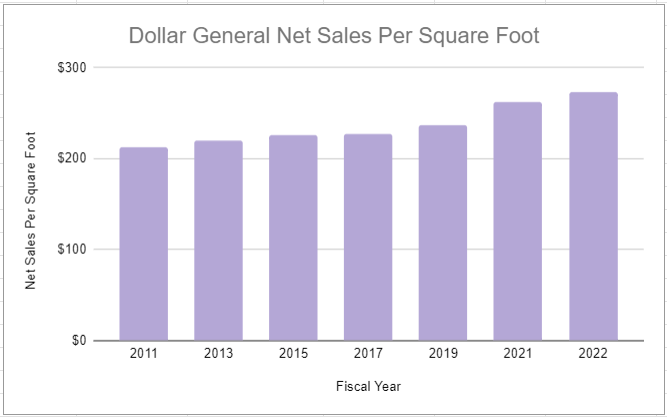

(Ryan) What they do: Dollar General is the largest discount retailer in the US by store count with 19,294 locations scattered across the country. DG’s mission statement/business plan is far more straightforward than most: “Provide a broad base of customers with their basic everyday and household needs, supplemented with a variety of general merchandise items, at everyday low prices in conveniently located, small-box stores.”

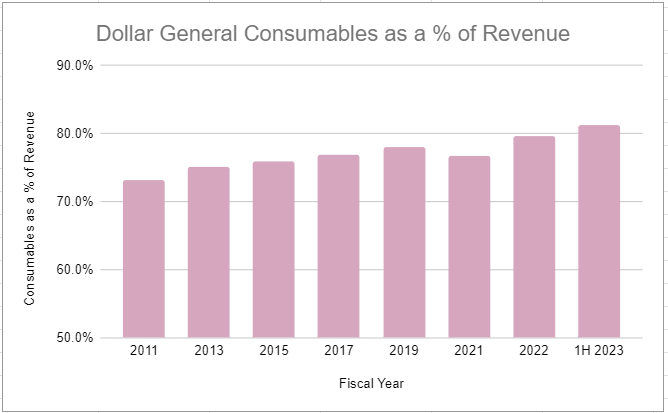

But let’s get a little more into the details. Here’s how a former CEO described the company: “If Walmart and 7-Eleven had a baby, that would be Dollar General”. Basically, DG is a rural grocery store that sells mostly consumable products. These include toilet paper, cereals, milk, frozen foods, candy, and plenty of others. They also sell seasonal stuff, home decor, and apparel. In total, DG carries ~10,000 SKUs. For context, Walmart carries 142k. Here’s the split:

The 7-Eleven part of that reference comes from the store format. With ~20k stores across the country, DG’s average store size is about 8k square feet. For context, that’s smaller than a Trader Joe’s. Additionally, Dollar General targets sparsely populated markets. So ~80% of their stores operate in areas with a population below 20k people. This typically means the average income of their customers is quite low. These are typically hourly workers that make less than $40,000 per year.

(From 2016 Investor Day)

Here are a couple of interesting stats I found:

The average DG basket size is $24

The average DG shopper visits a store 32 times a year or once every 11 days.

The average price per unit sold at DG is just over $3

DG has the 2nd highest sales per SKU of all US retailers behind Costco.

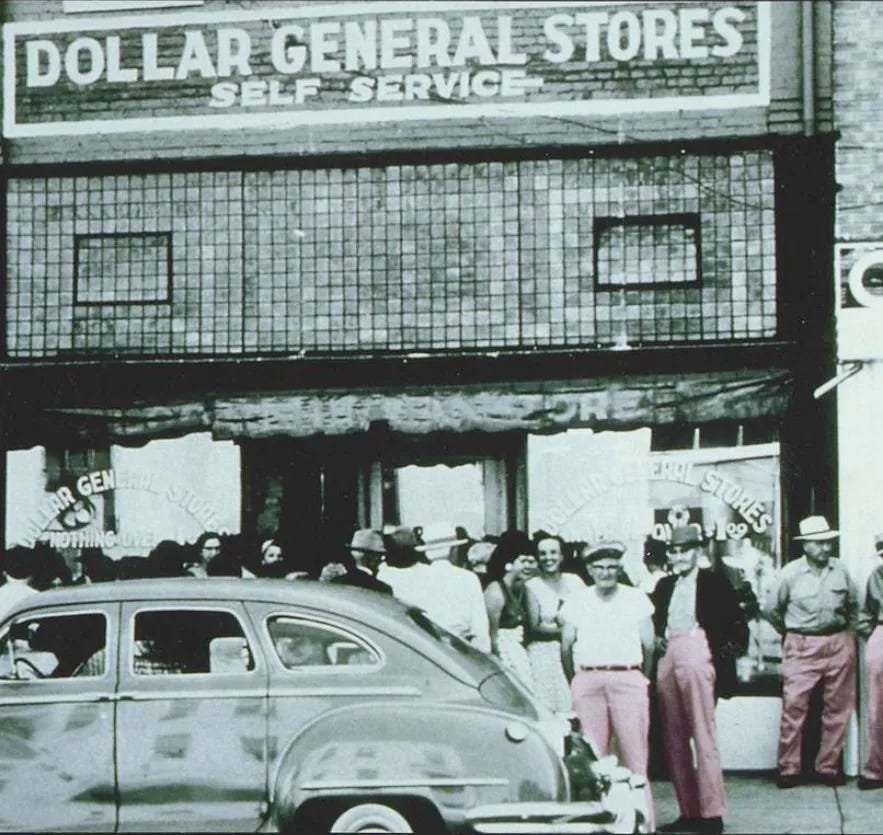

(Ryan) History: Dollar General’s roots date back pretty much all the way to the great depression. A gentleman named JL Turner was trying to find a way to get by during that time and his solution was to buy bankrupt general stores and liquidate their inventory. During this process, his son Cal Turner would accompany him where he gained some pretty good business and sales experience at these closeouts. After having some decent success doing that, JL and Cal decided to open their own store in 1939 each putting in $5,000 of their own money. The shop, which was initially intended to be a wholesaling operation, pivoted to a discount retailer, and by 1950 it had become a real success.

Over the following years, the two of them opened a couple of other stores under random names, but in 1955 they decided to launch the very first Dollar (General Store). The novelty of this concept was that every item in the store had to sell for less than a dollar. As you might imagine, it was successful and they began converting their other stores into DG brands as well. Cal Turner Sr. (the son of JL) was a pretty famous local salesman because he believed he could sell anything. In fact, according to a substack I’ve linked to, he even once said “If the price is right, I can sell pink pants to guys”

Anyways, following the first introduction of this banner in 1955 they expanded rapidly joining the public markets in 1968. Cal Turner Sr. and his son Cal Turner Jr. both ran Dollar General for more than 30 years, then finally handed the reigns over to the first outsider CEO named David Perdue in 2003. Unfortunately, he was pretty unsuccessful as CEO, so in 2007 KKR took the company private and replaced Purdue with Rick Dreiling. Dreiling really had an outstanding impact on the business and many people credit him with being the “architect of the modern dollar general”. Under his leadership, he established the modern DG strategy. The pillars of the strategy are pretty simple: Same-store sales growth (keep prices consistent with inflation), store count growth, and buybacks.

Just 2 years after being turned private by KKR, the company was relisted in 2009. Dreiling continued as CEO until 2015, when he passed off the reigns to the COO at the time Todd Vasos, who resigned just last year. Interesting note, Rick Dreiling just took over as the CEO of Dollar General’s largest competitor, Dollar Tree.

(Brett) Industry/Landscape/Competition:

The exact size of the discount retail market would not be too hard to quantify, but the opportunity within Dollar General’s target niche seems to be a bit harder. With 20k stores around the country and a goal of hitting ~30k stores, the size of the TAM may be relevant here.

At the 2016 investor day, management claimed it had a $793 billion addressable market in the United States, including drug stores, mass market chains, grocery, and convenience store chains. The actual addressable market opportunity is definitely much smaller.

In 2016 and still so today, Dollar General has greater than 50% market share within the dollar store channel.

This sector is dominated by three players: Dollar General, Family Dollar, and Dollar Tree

Dollar Tree and Family Dollar are owned by the same company (corporate name is Dollar Tree)

Dollar Tree/Family Dollar did $28 billion in combined 2022 sales vs. $37.8 billion for Dollar General.

However, Family Dollar is the more direct competitor with Dollar General as it has more of a rural focus while Dollar Tree is in more densely populated areas.

Last quarter, Family Dollar comp sales grew 5.8% while Dollar General’s were essentially flat. This is a big concern among investors and is a key metric to track.

Other potential competitors we can discuss:

Wal-Mart?

Amazon?

Temu? (or other online discount retail?)

(Brett) Management and Ownership:

Dollar General has a relatively new CEO, Jeffrey Owen. Owen has been with DG since 1992 and seems to have worked his way up in the company, previously being the COO since 2019.

The CFO is new, joining in 2019 as a VP of finance and becoming CFO in May of 2023

The management incentives are typical compared to other large companies, but with some strange twists

Annual cash bonuses are based on adjusted EBIT targets (earnings before interest and taxes)

What gets “adjusted” out of EBIT? A few things:

Any costs due to a change in control

Disaster-related charges

LIFO adjustments

Any unplanned event that exceeds $30 million in costs

Plus a few other things. All these adjustments seem a bit loose to me

In 2022, the company had a target of $3.648 billion in adjusted EBIT. They generated $3.905 billion in adjusted EBIT. In 2022, its GAAP operating profit was $3.3 billion. Subtract out its interest expense of $211 million and the company had an EBT of $3.1 billion

Management doesn’t get paid unless it hits 90% of its adjusted EBIT target, but this does not seem like a good metric.

But what about long-term PSUs?

The PSUs are based on adjusted EBITDA and adjusted ROIC. I’m not going to go through all the details here but the adjusted ROIC is a bit strange, plus the ranges are very tight (20.23% - 22.23%).

As we all know, incentives are important for maturing businesses that need to find what to do with their capital. This is especially true for a capital-intensive business such as DG.

What would be the best incentive structure for DG? Most of the time I think growth in FCF/share is a great target, but for DG I think that would not be the best option. If I were devising an executive incentive plan here, I think I would use an ROIC using standard IC (no adjustments!) with the “return” being Operating profit minus interest and taxes. If a manager can maintain an average ROIC > 15% for three years, they should get a fat bonus. If not, they get nothing but the base salary.

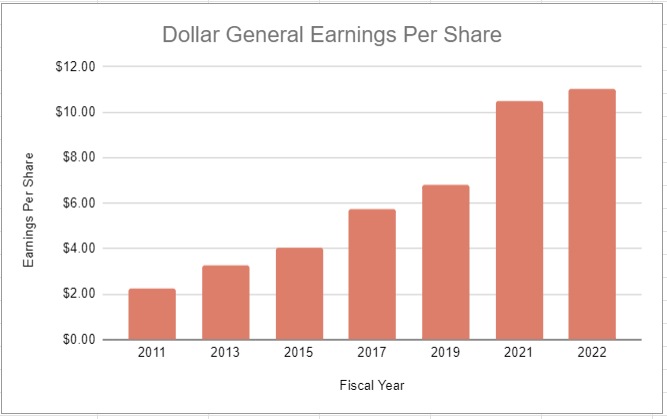

(Ryan) Earnings: This is where it gets interesting.

$39 billion in TTM Revenue

31% gross margin (that’s stayed pretty flat relative to pre-COVID)

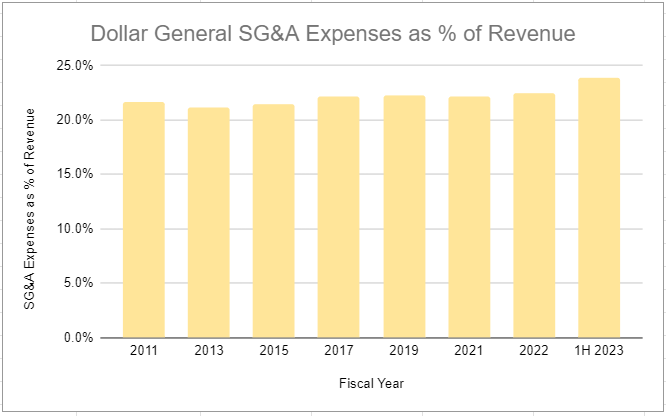

But only 7.99% operating margin over the LTM. That’s the lowest it has been since 2010. Typically they average between 9%-10%.

What’s happening? For starters, same-store sales have now gone negative relative to last year. And this is coming at a time when Walmart Grocery and Family Dollar are both seeing positive comps. Additionally, they’re seeing some margin pressure. Here’s a quote from our friend Alex Morris at the Science of Hitting: “The problems arise as we move down the income statement. Specifically, DG is likely to report 2023 EBIT margins of less than 7% - by far its worst result over the past 15 years. This reflects sustained margin pressures from a number of sources (Consumables mix shift, shrink, product cost inflation), as well as incremental labor investment / SG&A deleverage against lackluster comps; these factors have culminated in a significant hit to profitability. (And on a few variables, like labor, the higher spend is likely to be sustained.)”

A couple questions for us to answer:

How much do you think they can increase store count?

Do you think they can get back to 9%-10% margins?

Do you think the pressure on comp sales will last?

(Ryan) Balance sheet and liquidity:

Assets/Cash Flow:

They keep very little cash on the balance sheet. Just $350M.

$3.9B in TTM EBITDA. Assuming 7% EBIT, that would imply ~$2.75B in expected EBIT for the next 12 months.

Liabilities:

DG has $7.3 billion in total debt. None of which is current.

~70% of the debt matures after 2027, so they’ve got some time.

Almost entirely all fixed-rate debt with a weighted average interest rate of 4.5%.

In total, they’ve got really manageable debt. Their EBIT significantly covers any interest expense and their Net Debt to EBITDA ratio is under 2x.

(Brett) Valuation:

These are varying EV/OIs on different operating margins (trailing twelve-month revenue used here).

Anecdotal Evidence:

(Ryan) Not much here. I don’t think I’m the target customer and I live in a big city so I can’t remember the last time I went to one.

(Brett) We are not living in the target market here. There is a Dollar Tree right next to the grocery store I shop at, so I’ll make sure to check it out before the show. The rural strategy makes a lot of sense and I’m not sure there is much competition there that can run with positive unit economics.

Future growth opportunities:

(Ryan) No idea. Mexico maybe.

(Brett) With DG the future growth opportunity might be to get rid of some of the dumb “strategic initiatives” they have now. pOpShelf is likely going to burn capital, the DG Media thing is going to be a waste of expenses, and all this focus on fresh produce, coolers, and stuff like that does not seem to be their core competency. DoorDash partnership is also strange due to the fact that they are in rural areas. I would hope they pull back on some of these things and invest more into store labor in order to maintain or regain the value proposition for consumers. Branching into North Mexico seems smart.

Highlights and lowlights:

Ryan’s Highlights:

Still generate good unit economics in their stores.

I think, for the most part, they are actually pretty insulated from competition. This is a place where people will always come for convenience and value. Walmart isn’t going to start putting 100k square feet of stores in towns with 20k people.

Ryan’s Lowlights:

Feels like they’re getting close to store count saturation.

Rick Dreiling running Dollar Tree. Who would know how to steal share from Dollar General better than him?

The current management team did not seem very convincing. Lots of “we feel very optimistic, we’re very excited about the potential” kind of talk. And not a lot to back it up. They just say they put a team on it for every problem.

Brett Highlights:

The core business in their core geographies likely has a strong moat. It would be very tough for another sizable general store to get into these small communities, incentivizing the competition to stay away.

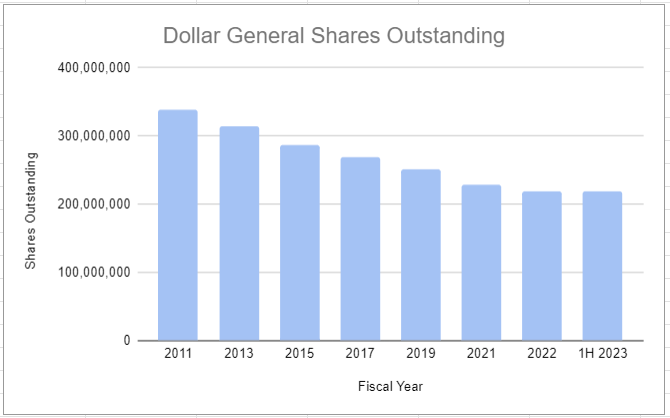

History of buybacks. Shares outstanding are down 31.5% in the last 10 years.

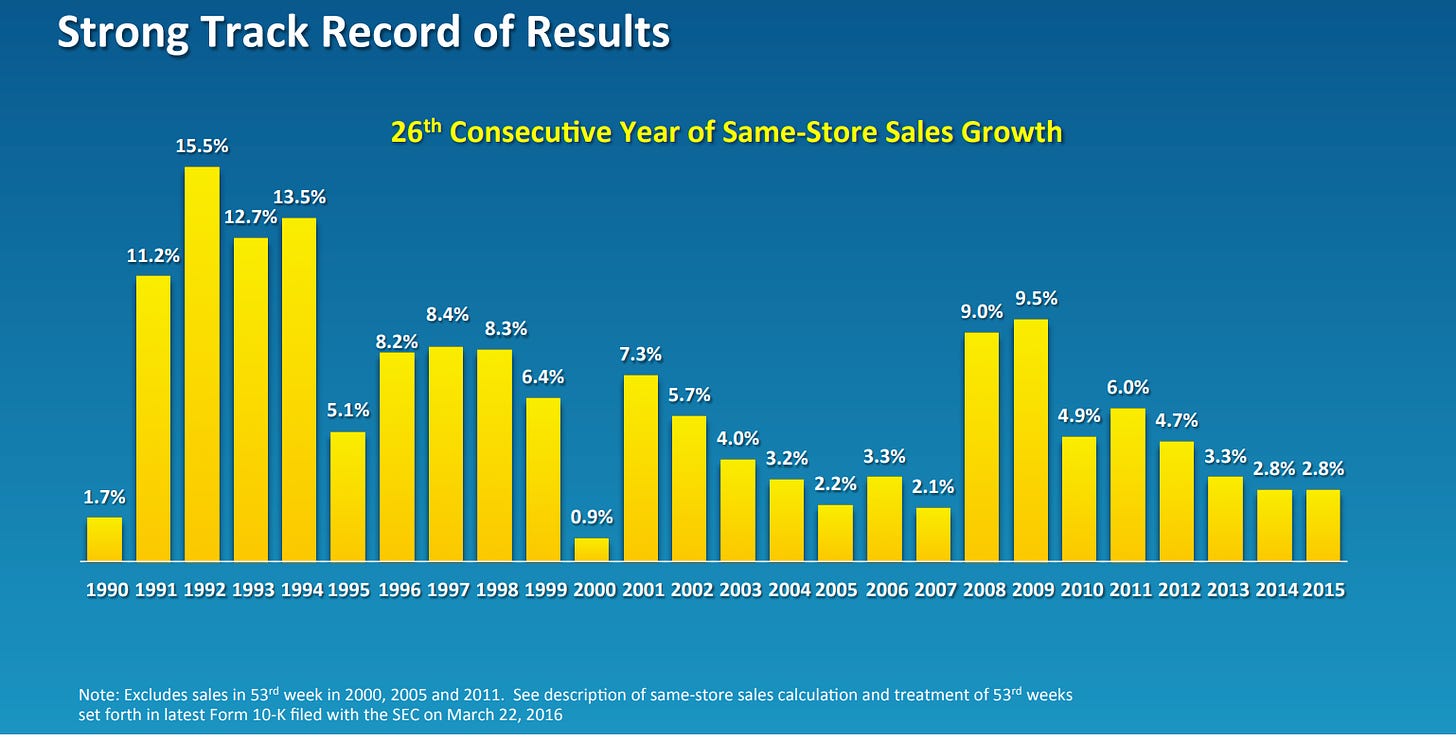

Counter-cyclical. Take a look at this chart from the 2016 Investor Day. Same-store sales growth greatly accelerated in 2008 and 2009, during a deflationary bust. That is because there were a ton of people trading down to DG.

Brett Lowlights:

I don’t trust the new management team and their incentives. They seem to be trying ideas with major uncertainty such as pOpshelf when they should just be reinvesting into the core idea.

Wouldn’t be surprised if margins continue to compress.

Competition from Family Dollar seems to be getting better when historically it was much worse.

Debt costs are going to rise if they try to invest in more growth.

Bull Case:

(Ryan) The current headwinds are overblown. Comp sales return, margins revert, and there’s room for them to keep growing store count by low single-digit percentages each year. I don’t think you really even have to run the numbers here. If that happens, this will pass our hurdle rate.

(Brett) If margins don’t deteriorate down to 5% (check our valuation table again), I don’t think you need much here to get solid returns. With buybacks eventually going to resume, cheap multiple, and revenue growth pretty easily achievable the stock likely does well going forward.

Bear Case:

(Ryan) I think the biggest long-term concern here is from the competition. Probably Dollar Tree more so than anyone else. Lost share for DG likely means margin pressure too. Store saturation + consistently lower margins would put DG in some trouble. But I think you’ll still get some decent returns. Probably similar to treasuries in this scenario.

(Brett) There has been a permanent change in the discount retail landscape. Do we think this is true?

More or less interested?

(Ryan) More interested. The upside is there if they can revert to their historical numbers, but I need to take a look at DollarTree before really considering an investment here.

(Brett) More interested. At the right price, I think the risk/reward adds up here. But I don’t think it is this price.

Stock for next week? (Dollar Tree)

Sources and Further Reading

Dollar General History:

Recent quarterly TSOH Writeup:

Scuttleblurb update:

Hey guys just wanted to let you know you are helping me a ton with a case study. Great insights, officially a subscriber!

Good work guys, and thanks for the shout-out. Looking forward to DLTR!