Not So Deep Dive: Dollar Tree Stock (Ticker: DLTR)

Don't invest in turnarounds, don't invest in turnarounds, don't invest in turnarounds...

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) History: Dollar Tree’s roots date back to the 1950s when a gentleman named K.R. Perry opened a Ben Franklin variety store in Norfolk, VA. He would later rename this story K&K 5&10. About 2 decades later (1970), Perry and 2 others would expand on this K&K brand by launching a new mall-based concept called K&K Toys. This concept was quite successful eventually reaching 130 stores, and by 1986, they decided to launch a new banner called Only $1.00. They continued to grow both of these banners until 1991 when they sold the K&K stores and decided to focus solely on the dollar stores from there. The name was changed to Dollar Tree in 1993 with the idea that they may someday need to change to a multi-price strategy.

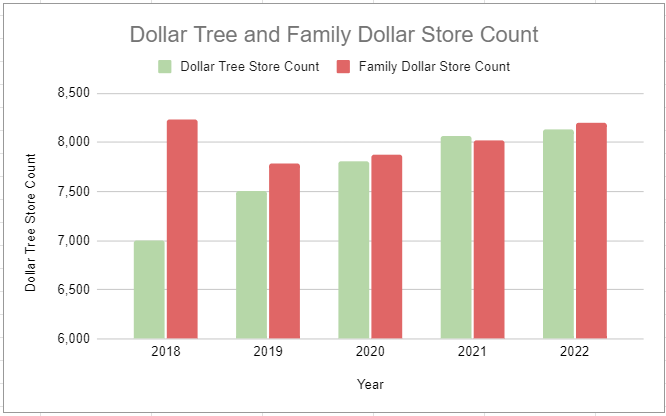

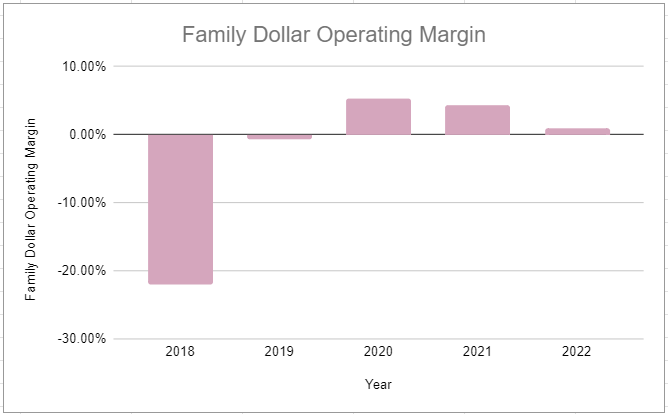

This was the early 1990s. 2 years later (1995), under the Dollar Tree name, the company went public valuing the business at a market cap of $225 million. Once public, Dollar Tree executed a pretty aggressive growth strategy. They were opening 150 stores a year, and acquiring other dollar store concepts typically with debt. Most of these were pretty small deals but by 2008, the company had surpassed 3,000 stores and officially broke into the Fortune 500. At this point, they are quite a large store, but come 2015, they entered into a transformative deal to buy Family Dollar for just over $9 billion in a mix of cash and stock. At the time, FD had 8,200 stores and they also received a higher bid from Dollar General that they rejected. We’ll talk about that store concept in a second, but long story short, they’ve failed to recognize the synergies they originally claimed and they’ve been pretty much unable to get operating margins up for that business.

However, there’s still hope, and a couple of things have happened in the last couple of years that are important to the thesis. For starters, under Mike Wytinsky’s leadership (the previous CEO), DLTR finally made the decision to “break the buck”. Most of the items in their stores used to be $1 and they decided to raise those items to $1.25, which has really opened the door for other high-priced offerings as well. Secondly, they fired Wytinsky and brought in Rick Dreiling, who was previously the CEO of Dollar General and was actually the CEO who was trying to buy Family Dollar.

(Ryan) What they do: DollarTree is one of the largest discount retailers in the US by store count and it’s a combination of 2 banners, DollarTree and Family Dollar. In total, the company has 16.5k stores at about a 50/50 split between banners.

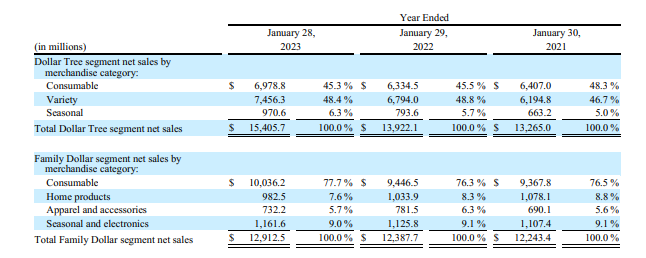

Dollar Tree: Unlike Dollar General, which we looked at last week, Dollar Tree has a more suburban presence and is more focused on the treasure hunt-type experience. More than 50% of items sold at DLTR are discretionary (things like toys, greeting cards, arts and crafts supplies). Their stores are a little larger (8k-10k) square feet and they have ~35% gross margins.

Family Dollar: FD, on the other hand, is a more direct competitor to Dollar General. These are slightly smaller store formats and they operate in primarily rural and urban areas. Almost 80% of the items sold in their stores are consumables which means they are generating lower gross margins at only 24%. Generally, FD has failed to consistently generate profits. And there’s no promise on items being a dollar, it’s simply cheap goods typically in the $1-$10 range.

So it’s really sort of two different models, but they’re trying to bridge the gap a bit and really change the Family Dollar brand. Here are some of the things they are doing:

Combo stores: They have both banners on them and combine the cheap FD consumables with select DLTR merchandise.

H2 Stores: This is supposed to be the revamped store layout for Family Dollar. Includes more freezer space, higher shelves, and some DLTR items.

Dollar Tree Plus: This is part of that multi-price move-up I mentioned. They’ve taken areas of the Dollar Tree store layout and dedicated them to $3-$5 items instead of the traditional $1.25. This has apparently created a big boost in comp sales and they plan to have DLTR+ in about half of their Dollar Tree locations by the end of this year.

Dual-banner distribution centers: Previously, DCs have been dedicated to one banner or the other. But they are working on a DC in Florida right now that would be designed to distribute to both.

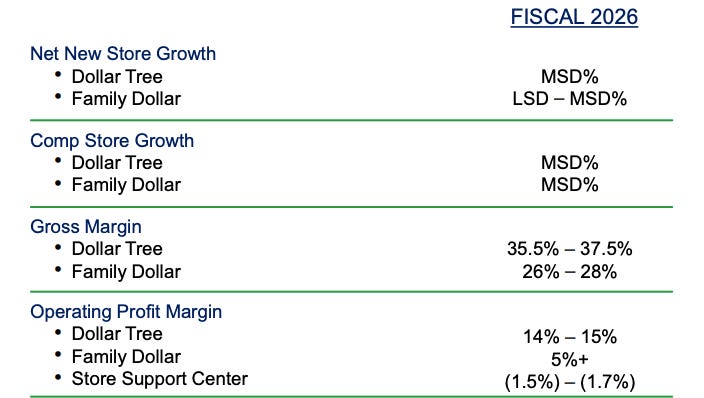

Here are management’s estimates for both businesses:

(Brett) Industry/Landscape/Competition:

Our industry discussion will be similar to last week with Dollar General, but hopefully, we can get a better grip on the dynamics facing the sector at the moment

DT/FD is the second scaled player in the dollar store space, along with Dollar General. As per the last episode, Dollar General claims it has a very large TAM for all of discount retail that could be pushing $1 trillion. However, that includes places like Wal-Mart or CVS or a gas station in the middle of a city that clearly doesn’t overlap with what DT/FD is trying to do.

Dollar Tree/Family Dollar did $28 billion in combined 2022 sales vs. $37.8 billion for Dollar General

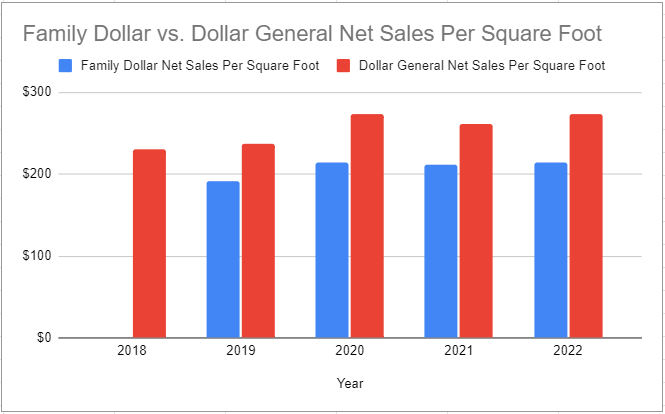

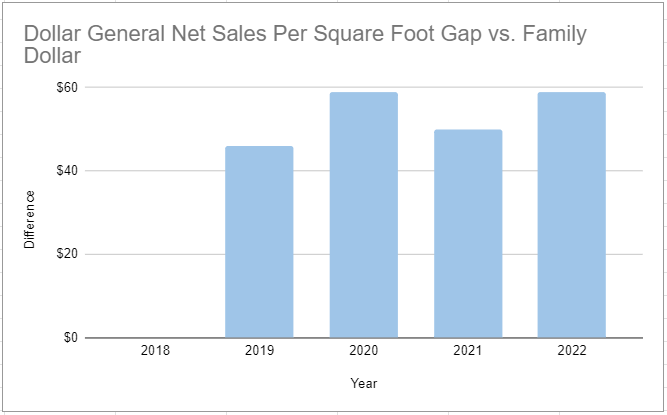

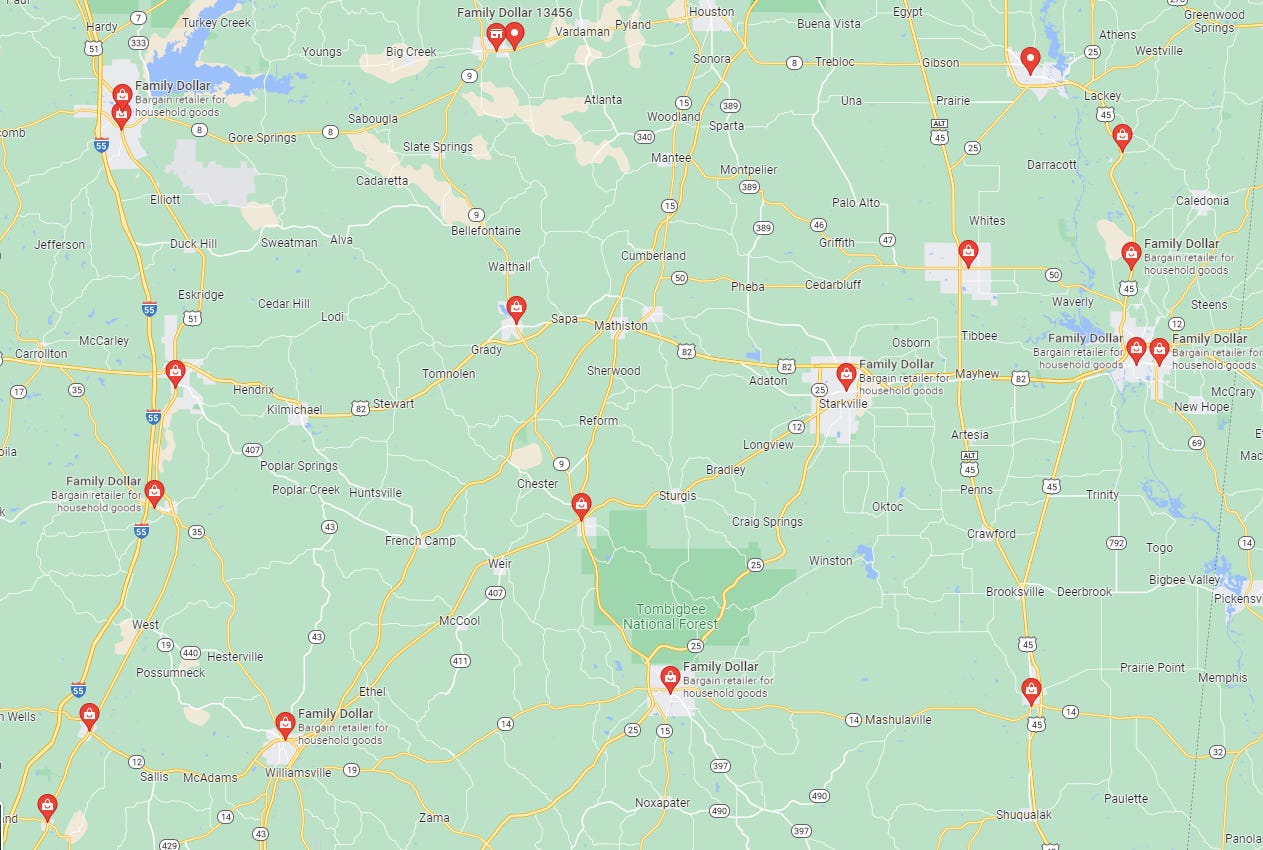

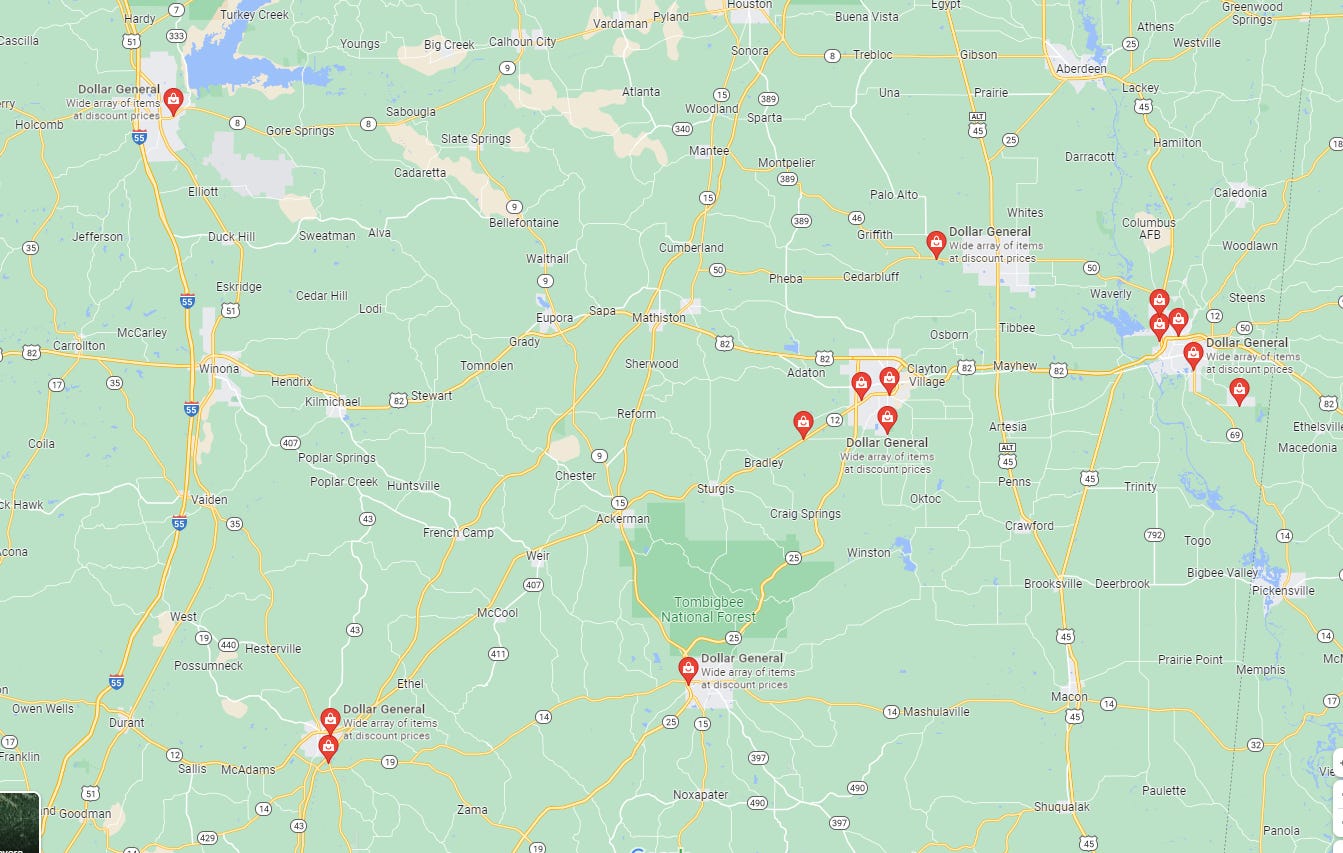

Important note for the competitive landscape: Dollar Tree operates in more suburban areas, Dollar General is almost entirely rural and small cities, while Family Dollar operates a rural and urban focus

Dollar Tree goes for a slightly higher income shopper and has its mix slightly more towards discretionary non-consumable items.

How much do Family Dollar and Dollar General overlap? Definitely in some places, but not entirely. For the smaller towns, it is uneconomical for Family Dollar to say “let’s build a store here” when Dollar General already has a location, and vice-versa.

Below, I have two Google Maps screenshots of the same area of Mississippi. One shows the Family Dollar locations, and one shows the Dollar General locations. While not indicative of the entire country, I think it shows how the competition in this industry can work.

What do we think of the FD competition with DG?

Family Dollar:

Dollar General:

(Brett) Management and Ownership:

Note: taking out the ownership table and only going to talk about any relevant shareholders. No need to list Vanguard/Blackrock that is boring

The CEO of DT/FD is Rick Dreiling. Dreiling was the CEO at DG during its recent heyday from 2008 - 2015, which is why the board at DT/FD wanted him to come over.

Discussion question: How worried are you that Dreiling just benefitted from macro tailwinds since he took over right during a recession?

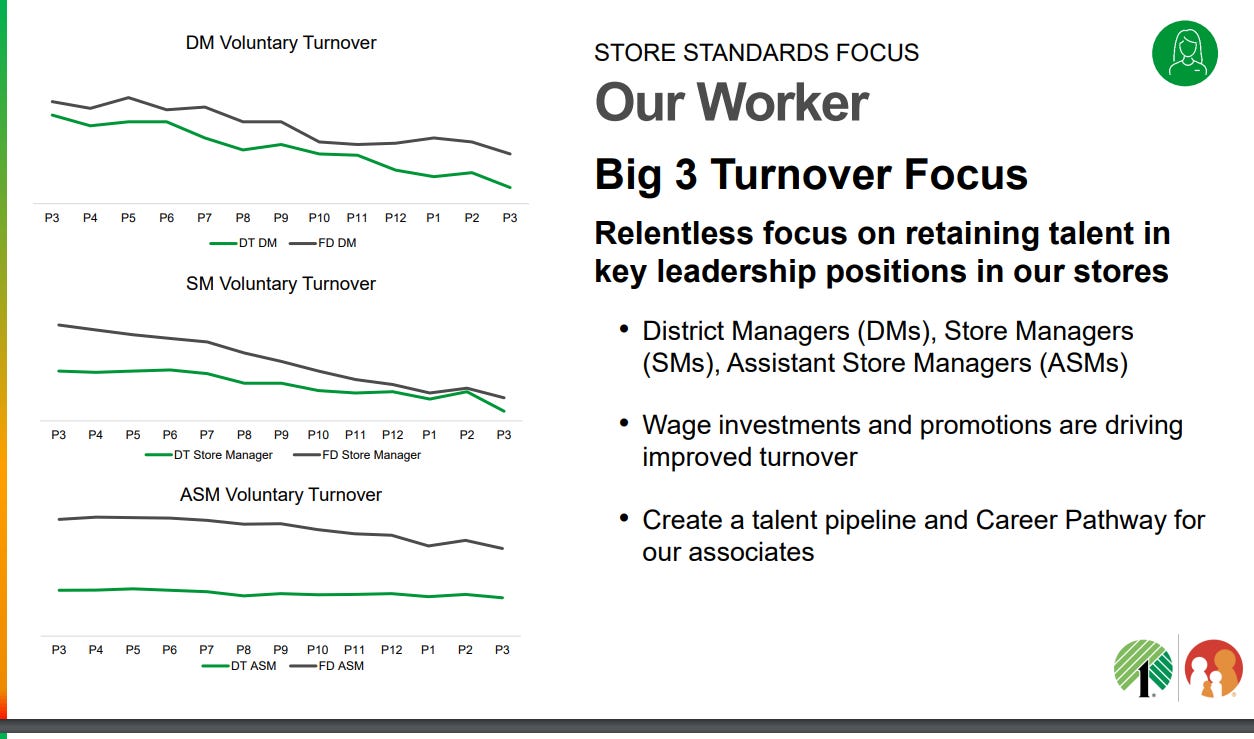

A lot of new executives have come over to DT/FD. The CFO joined in Oct. 2022 from Qurate Retail (concerned about that?). The CIO (information officer) worked with Dreiling at DG, as well as the Merchandising Officer for FD, the supply chain officer, and the merchandising officer for DT.

So, essentially he got the boys back together to fix DT/FD

In the recent proxy, they lay out Dreiling’s executive compensation right in the opening letter for everyone to read:

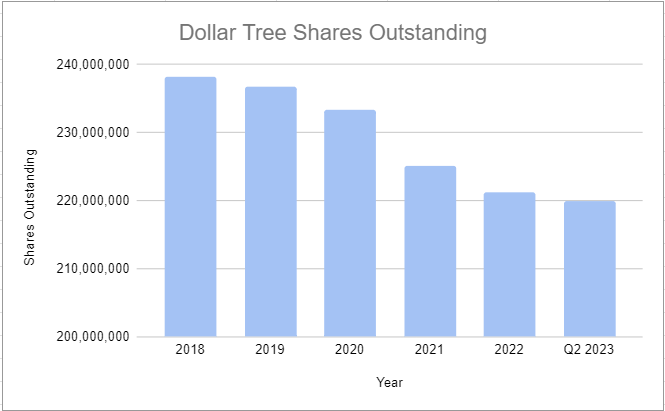

“In order to persuade Rick to take an active operating leadership role and employment with Dollar Tree as Executive Chairman and fully align his interests with the interests of shareholders over the long-term, the Board approved a five-year employment agreement with Rick and granted him an option to purchase 2,252,587 shares of Dollar Tree common stock at an exercise price of $157.17 per share, the closing trading price of Dollar Tree common stock on March 18, 2022. This was at the time the Company’s all-time high closing stock price and we believe already reflected the market’s optimism that Dollar Tree would achieve transformational change and materially enhance long-term shareholder value. The number of shares covered by the award represented 1% of the shares of common stock then outstanding”

“In 2022, the annual cash bonus incentive for executive officers was based 100% on adjusted operating income. For 2023, the Compensation Committee diversified and broadened the metrics, adding total revenue (weighted 40%) to adjusted operating income (weighted 60%), to support the Company’s strategic focus on profitable growth”

What are our thoughts on the incentives for executives here?

It looks like Mantle Ridge (the activist) still owns around 6% of the stock. Capital World Investors owns 9.2%

(Ryan) Earnings:

$29 billion in trailing 12-month revenue

7.8% comp store sales at DLTR (~10% increase in traffic)

5.8% comp store sales at Family Dollar (blend of traffic & average ticket)

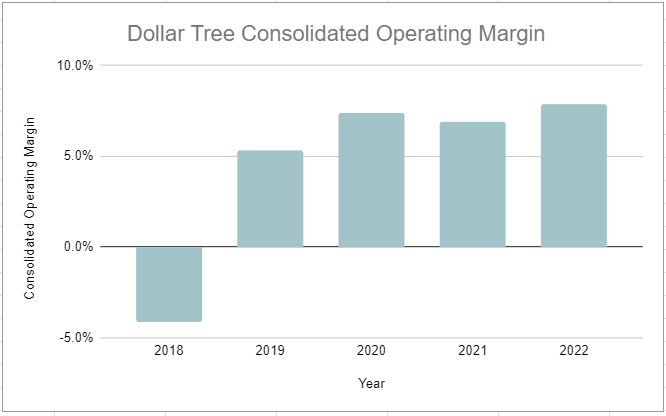

Margins are tightening though. Gross margins decreased by 220bps. Lower markups, mix shifts, elevated shrink, and higher expenses at DCs and freight.

SG&A also increased as a percentage of revenue “due to wage investments in store and field payroll, higher incentive compensation, investments in repairs and maintenance to improve store standards, higher professional fees, elevated general liability insurance claims, and higher utilities expenses related to unseasonably high temperatures”

Trailing 12-month OI is $1.8 billion

TTM Net income $1.2B

(Ryan) Balance sheet and liquidity:

Assets:

$500 million in cash. $1.8B in TTM operating income.

No inventory concerns.

Liabilities:

Pretty simple. $3.4B in long-term debt.

Majority is due after 2028. 3.7% weighted average interest rate.

Net debt to operating income is 1.6x. They have a pretty conservative balance sheet. Lots of cash to invest in fixing Family Dollar.

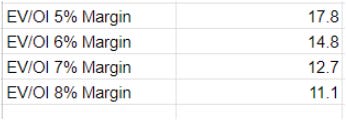

(Brett) Valuation:

Like with Dollar General, I am going to take DT/FD and apply some blended operating margin assumptions to see what the valuation could look like. Going to be an EV/OI multiple

As with DG, the most important factor on whether you think the stock is cheap is where you think margins land

Anecdotal Evidence:

(Ryan) I don’t have much experience with Family Dollar and DLTR is more of a Ben Franklin competitor. But it seems from the outside looking in that they are taking the right steps to improve the business.

(Brett) I don’t have any experience with these brands.

Future growth opportunities:

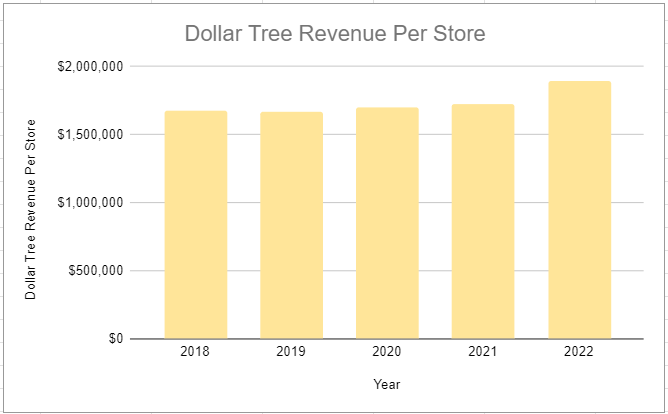

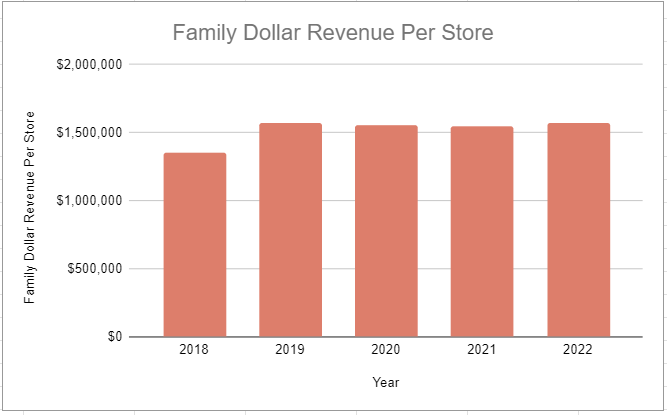

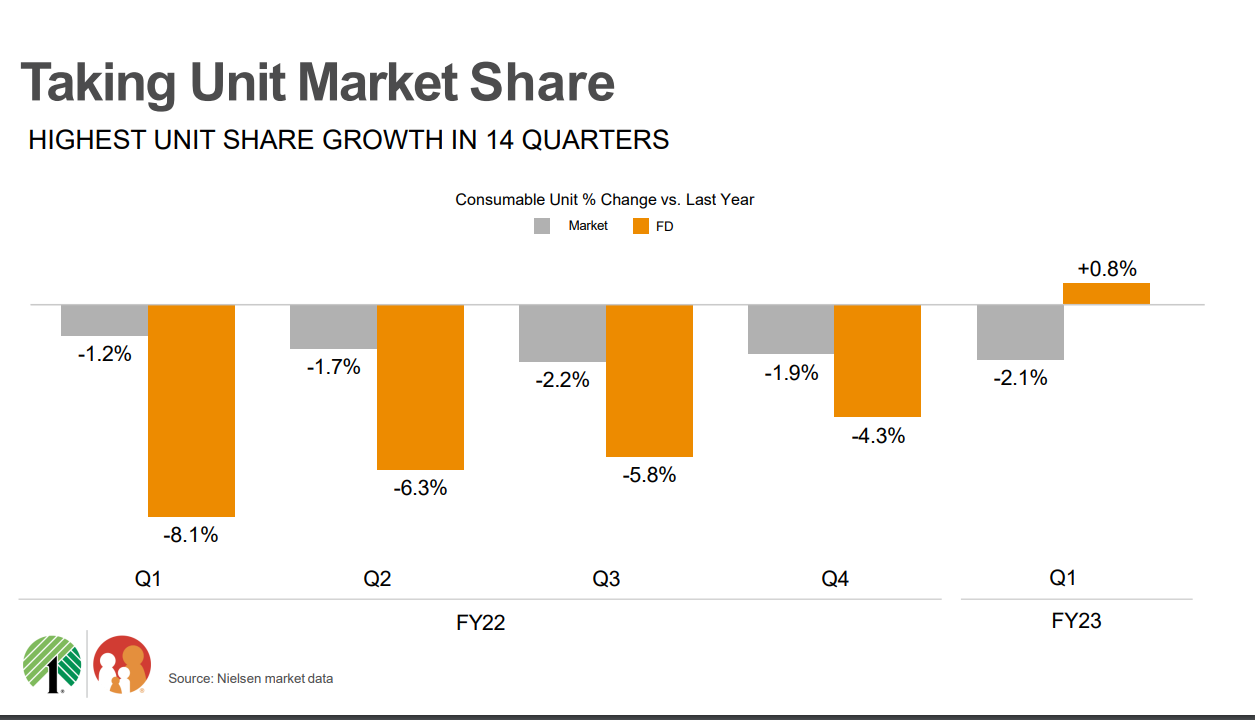

(Ryan) FD closing the gap on sales per square foot with Dollar General. Part of it comes from the new layouts. Supply chain improvements to ensure product quality.

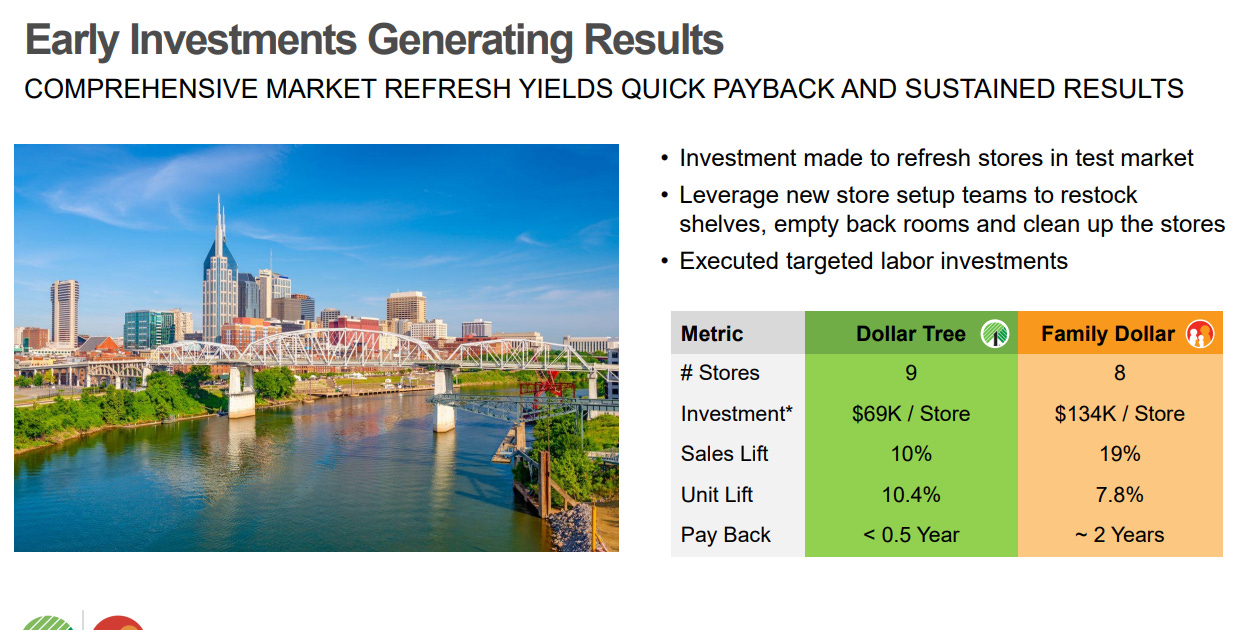

(Brett) Investing in the stores. The bad news is that FD (maybe DT a bit too?) was underinvested for many years. The good news is that the new managers can now reinvest in existing stores and (hopefully!) get solid returns on these investments.

Note: there are a lot of interesting slides from the 100+ page presentation DLTR made back in June. I will try to pull some of the good ones for the newsletter and make some comparisons with DG as best we can

If we look at the IR slide deck, FD/DT plans to invest $6.5 billion in capex over the next three years. But what returns can they get on that investment?

Highlights and lowlights:

Ryan’s Highlights:

Rick Dreiling took over DG when it was in a fairly similar position to what Family Dollar is today.

DLTR looks like a solid business.

I think Family Dollar really is fixable. Why can’t it end up with similar economics to DG?

Ryan’s Lowlights:

I’m still not sure I buy the synergies. The combo stores seem a little weird to me.

Brett Highlights:

This management team makes me much more confident. No surprise that DG fired the CEO we talked about last time, they really seemed to be lost. Dreiling and the people he brought over from DG seem to be on the ball and focused on actually improving things

They have a long reinvestment runway. Over the next ten years, they can easily spend $15 billion growing/renovating stores.

Dollar Tree seems to be insulated from a physical retailer perspective

Brett Lowlights:

I wonder if Dollar Tree and the more urban Family Dollar locations are more susceptible to competition from online and larger places? The rural focus was a big highlight for some of these places as the “moat” can be largely driven by geography

Dollar Tree and the knick-knack dollar store concept seems much more at risk from competition in general. This is something I would like to do more research on.

Bull Case:

(Ryan) $10 EPS by 2026. That’s what they’ve laid out. I think a lot of that is gonna have to come from margin improvement at FD. If you assume a 20x PE, which is below their previous 4-year average, that would get you basically a double over 3 years or a 20%+ IRR.

(Brett) If they drive comp sales growth like they expect they can, this will work out (assuming inflation doesn’t run wild, of course, which means comps need to be better).

Bear Case:

(Ryan) Same as Dollar General actually. Margins are challenged for a sustained period of time.

(Brett) FD is not fixable, and the “returns” in profits from all these investments are poor. Stock doesn’t look too cheap in this scenario.

More or less interested?

(Ryan) More interested. The stock looks cheap if DollarTree has sustainable margins and Family Dollar can turn the corner.

(Brett) More interested, but not at this price. I like the CEO.

Stock for next week? (Dollarama)

Excellent post much like the DG post last week! This has been the most interesting and informative comparison I have read from you guys so far! Thank you!

Also, I agree with Brett's worries about DLTR/FD's competition. As DLTR/FD revamp and raise prices, I feel that e-commerce sites and stores such as Five Below become a bigger threat. Customers already love the scavenger hunt aspect to Five Below's set-up currently.

Lastly, I could see DG and FD slowly encroaching more and more into each other's locations as they grasp for more customers, much like AutoZone and Advance Auto Parts have very close proximities to many of each others locations.

Thank you for this analysis.

Concerning "The bad news is that FD (maybe DT a bit too?) was underinvested for many years. The good news is that the new managers can now reinvest in existing stores and (hopefully!) get solid returns on these investments.". You have published the slide with the metrics on renovation. It shows a pay back period of 0.5y for DT and 2y for FD and it looks like an excellent opportunity if they can keep similar levels.