Not So Deep Dive: Dollarama Stock (DOL.TO)

The best kept secret in discount retail? Oh yah, it might be Canadian...

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Dollarama is the largest discount retailer in Canada. Like all of the other discount retailers we’ve looked at this month, the initial Dollarama concept was that they sold everything in the store for $1 or less. But today, they’re simply a multi-price discount retailer.

In terms of SKUs, they are probably most similar to Dollar Tree in the US. Only 44% of their sales come from consumables, with the remainder coming from general merchandise (office supplies, stationary, household items, arts and crafts, etc.) at 41% and seasonal items (holiday decor, summer/winter items, etc) at 15%. And they source these products directly from a number of different markets. 53% comes from overseas – mostly China – and the remaining 47% comes from North America.

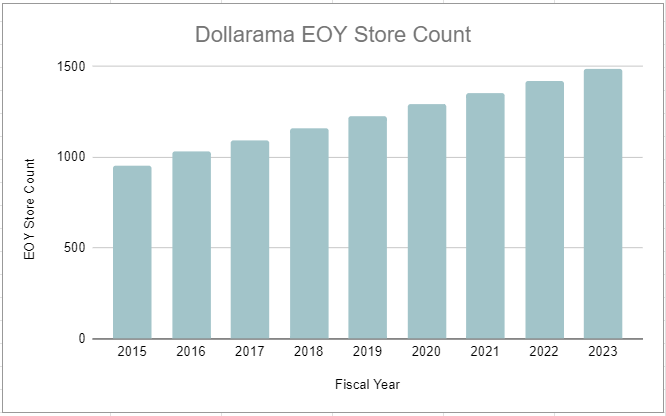

They today operate 1,525 stores across all parts of Canada. The stores average around 10k square feet and they’ve had success in both cities, as well as more rural areas. They use 3rd parties for all of their merchandise transportation, but lease a number of warehouses and distribution centers.

They also own a 50.1% stake in the parent company of Dollarcity. Dollarcity is a discount retailer that’s very similar to Dollarama but operates stores in El Salvador, Guatemala, Colombia, and Peru. Dollarcity has 458 stores across its markets, but it’s growing pretty quickly.

(Ryan) History: Dollarama has really been a family business. Their roots date all the way back to 1910 when Salim Rassy, a Lebanese immigrant, opened a dollar store in Montreal. Over the following 60 years, the family grew the business (called Rossy S. Inc at the time) to 20 locations and just continued to pass the leadership baton down to their kids.

In 1992, the company was being led by Larry Rossy (grandson of the founder) and it had 44 locations in total when they decided to open a new location under a different banner called Dollarama, and it was a hit. Within just 5 years, Dollarama became the major revenue driver for the family, so they decided to either close or rebrand all existing Rossy stores into Dollarama locations.

After seeing the success of this new concept, Bain Capital acquired 80% of the company in 2004 for $850 million and helped supercharge store growth. Dollarama IPO’d in 2009 and that same year, they “broke the buck” and began offering multi-price selection. Over the last two decades, they’ve continued this steady expansion, and in 2013, they initiated their partnership with Dollarcity.

(Brett) Industry/Landscape/Competition:

The Canadian discount retail/dollar store landscape is much cleaner than the United States and comes out looking much more promising for Dollarama

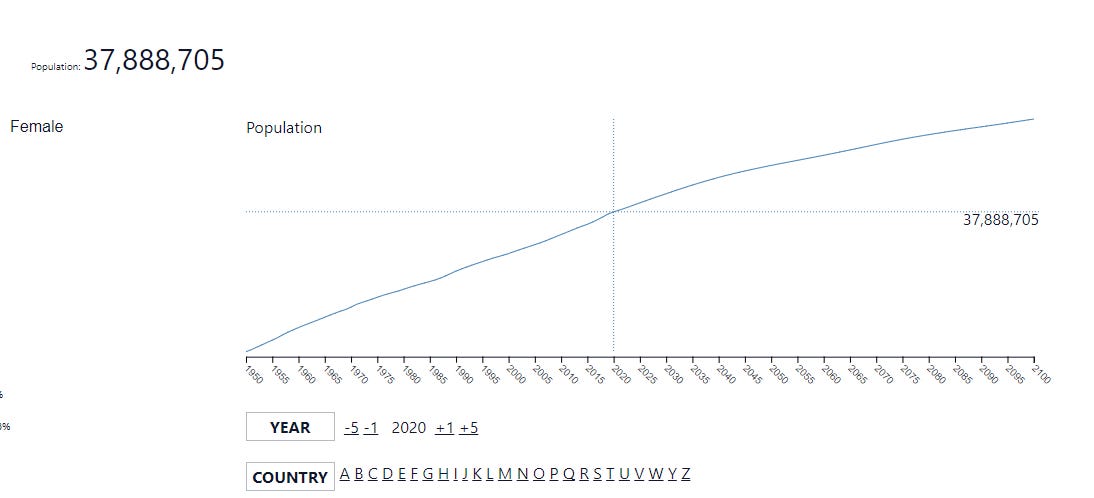

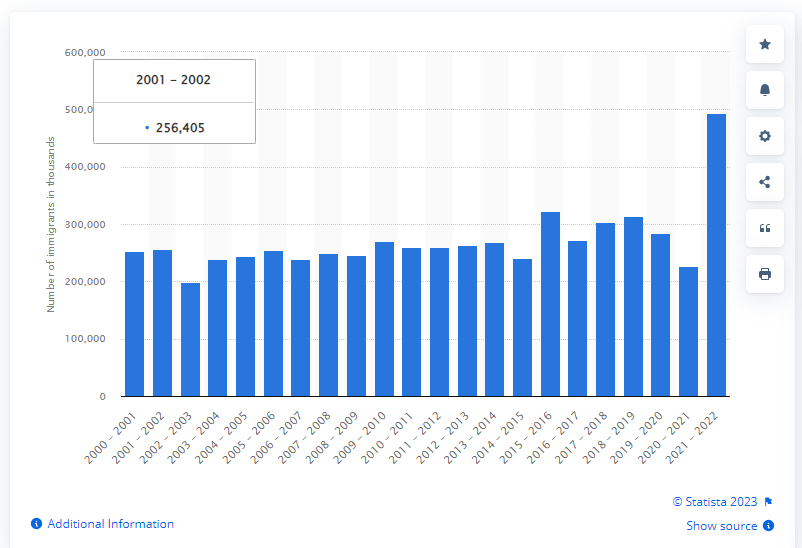

First, Canada has a great population tailwind. The current population is at just under 40 million and is expected to steadily grow. Immigration tailwinds look nice for them too (charts below)

“Canada's population grew by over a million people for the first time ever last year, the government has said.”

Dollarama also has no scaled competitor in the country:

“Dollarama doesn’t face those same competitive pressures. Its 50% market share among general discount stores in Canada is more than twice what Dollar General and Dollar Tree together have in the US. And Dollarama’s C$4.5 billion in annual revenue exceeds that of its next ten largest local competitors combined”

Dollarama thinks it can hit 2k stores by 2030-ish

Dollar Tree Canada is something to watch

I think this looks like an ideal industry environment (growing consumer demand, minimal competition, greenfield growth opportunities). Do you agree?

(Brett) Management and Ownership:

Dollarama is helmed by Neil Rossy, who has been CEO since 2016 and was CMO since 2010. He has been with the company since 1992. He is the son of the founder of Dollarama and is the “fourth generation” Rossy retail leader. He is 53.

The Rossy family owns warehouses that are leased to the company. Is this a red flag? Full quote from AR:

“As at January 29, 2023, the outstanding balance of lease liabilities owed to entities controlled by the Rossy family totalled $26.7 million. Rental expenses charged by entities controlled by the Rossy family but not included in lease liabilities totalled $7.4 million for Fiscal 2023”

Using a compensation consultant, the company has the trifecta of base salary, annual bonuses, and long-term equity compensation (shocking!)

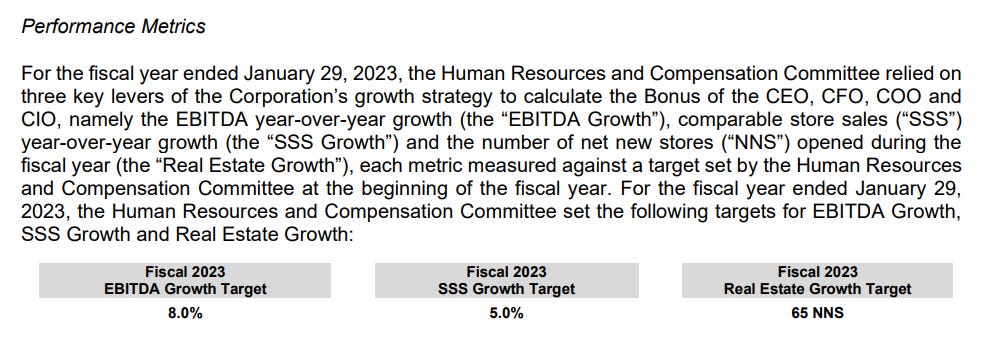

Annual bonuses seem solid, are based on EBITDA growth, Same-store sales growth, and store count growth. These all seem like sold metrics to me. They say these targets are “ambitious but not out of reach” which I think is fair. Full graphic describing bonus metrics for last year below

Long-term PSUs based on EPS targets. I think that is fine.

Neil Rossy owns 3% of the company. Are we annoyed that the Rossy family gets paid so much when they already have skin in the game? Would Berkshire/Costco do this?

(Ryan) Earnings:

Over the last decade:

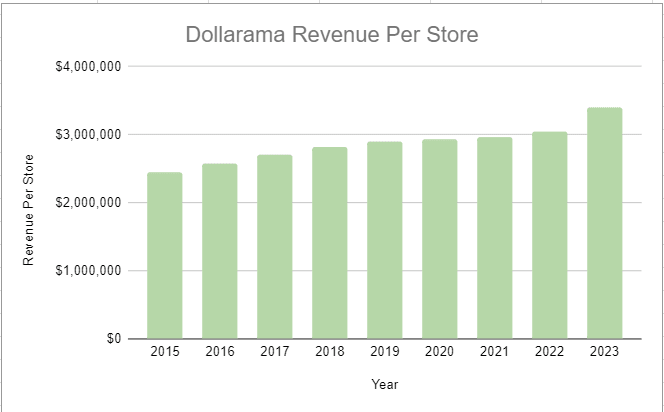

Total revenue has grown at an 11% CAGR

Stores have gone from 785 to 1,525 (6.5% CAGR)

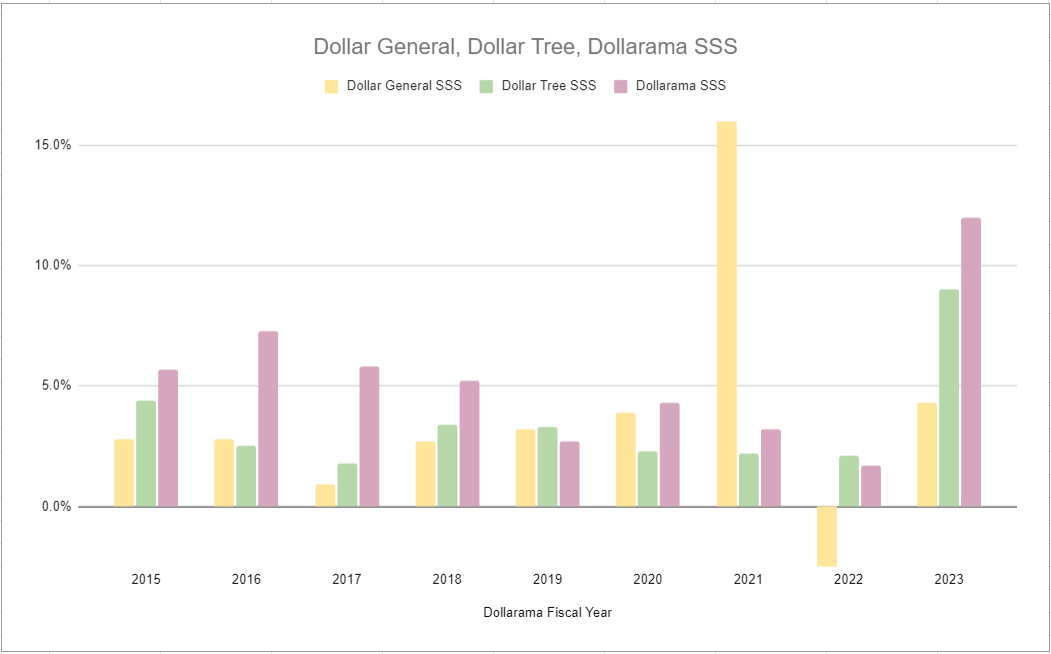

Comp store sales have grown at 6.3% on average

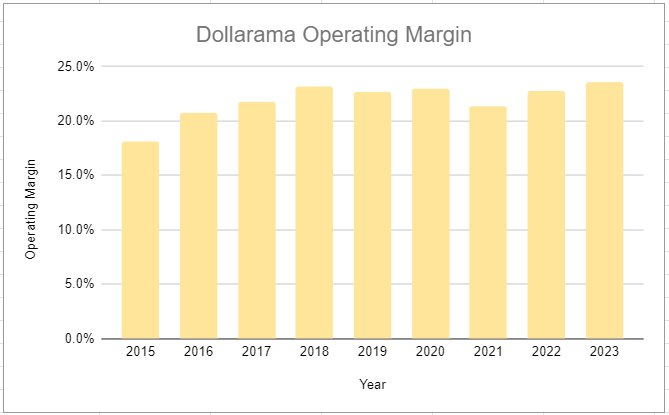

Operating margins have gone from 17.2% to 23.1%

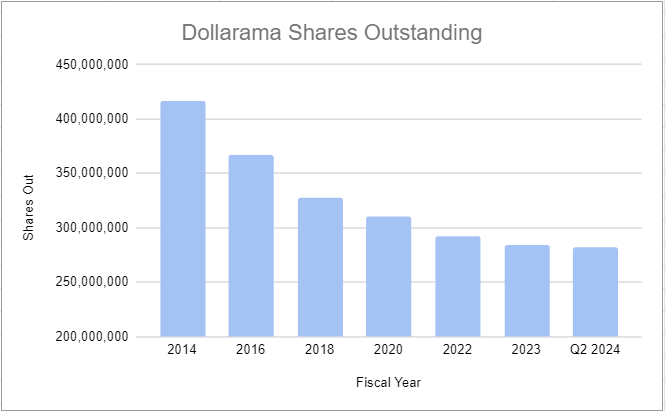

Shares outstanding have declined by 33% in the last 10 years

EPS have compounded at 19% annually

Most recent quarter:

15.5% increase in comparable store sales

(Ryan) Balance sheet and liquidity:

From 2014 to 2019, they really pushed their leverage. Since then they’ve pretty much maintained a leverage ratio in the 2x-3x range.

$2.2 billion in debt.

All senior unsecured notes, mostly due after 2025.

Weighted-average interest rate of 3.3%.

$252M in cash. They lease their locations, so no real estate value.

Earn >$1 billion in EBITDA each year. So a really manageable debt load.

(Brett) Valuation:

Market cap of $26.9 billion

Enterprise value of $28.9 billion

EV/OI of 21.8

Anecdotal Evidence:

(Ryan) Seems well run. The management team seems to care about the long term at least in the way they speak. On the recent CC, someone asked about what the target is for the percentage of merchandise that’ll be at the $5 price point and Neil Rossy said “There’s no target just to clarify the situation. There never was a target, and there won’t be a target with regards to how many SKUs are in any given price point. It’s fluid and it really is dependent on the offering. So if the next 6 months produces a fantastic, let’s say, offering of $2 or $2.50 items, then that’s the price point range that will grow.”

(Brett) Never been to any of the concepts, since I live in the United States. But reading management commentary, my feeling is that they “get it,” like some of the old DG execs. Not sure I have any facts about why but that’s what I believe after studying them.

Future growth opportunities:

(Ryan) DollarCity. Seem to be adding about 10 new locations a quarter (a little under 10% store growth annually). I know little about the markets, but I imagine they’re a lot further away from saturation than Dollarama’s Canadian business.

(Brett) Very hard to pinpoint outside of the new store growth + Dollarcity. I think an important point is the growth of the Canadian population, which is outpacing a lot of other markets, as well as the minimal competition. However, I actually get slightly concerned about the Canadian reinvestment runway here given the valuation.

Highlights and lowlights:

Ryan’s Highlights:

I like the way the management team speaks to investors. They’re very candid and kind of sarcastic sometimes when analysts ask spreadsheet questions.

Seems to have a strong brand in Canada. They’ve had a good balance of store growth and positive comp sales.

Well positioned for a difficult consumer environment. Said a lot of people are trading down.

Ryan’s Lowlights:

Get rid of the related party transactions. They lease warehouses from companies owned by the Rossy family.

Brett Highlights:

Management is rock solid. Yes, there is some nepotism here, but there seems to be a great culture of just “getting it”

Minimal competition in the Canadian market.

It has a unique position (similar to Five Below) that keeps big-box competition insulated. Over the long-term, I worry about e-commerce but they seem to be doing just fine being a great counterweight to the grocery run or big box retailer, while competing less with them like a Family Dollar or Dollar General does.

Brett Lowlights:

Related party transactions as well.

Worried about reinvestment runway and the potential of margin compression if the operating environment ever gets a bit suboptimal. I remember reading that they “love” paying their labor minimum wage.

Bull Case:

(Ryan) They target 2k stores by 2031, that’s a 25% increase over 8 years. They’ve beaten their targets in the past, but suffice it to say we should expect slow unit growth. So let’s say they grow store count by 3% a year (might be optimistic), comp sales by 6% a year, operating margins stay flat, and they reduce share count by 3% annually. That’s a 12% return keeping all else equal.

(Brett) At an EV/OI above 20, I think you need to expect continued fantastic comp sales growth even with store count saturation increasing. If that occurs and margins stay steady (yes, I know comp sales and margins are heavily tied together) the stock probably does well from here. Expectations are fairly high though.

Bear Case:

(Ryan) Margin compression or closer to store saturation than the valuation implies. Feels like there’s also room for some competition.

(Brett) My two big concerns are margin compression and low ROICs in Latam. I would want to get a bigger investigation into the Latin American market because that could become a meaningful part of the business over the long term.

More or less interested?

(Ryan) More interested. Seems really well run, but I worry they are overearning right now. I’d be more interested at 10x-15x like the US discount retailers.

(Brett) More interested. However, I don’t like retailers unless they trade at dirt-cheap multiples. Physical retail is hard and rife with competition/disruption.

Stock for next week? (Silicon Motion, maybe)

Sources and Further Reading

Historical financial results: https://www.dollarama.com/en-CA/corp/financial-reporting