Not So Deep Dive: Dream Finders Homes (Ticker: DFH)

An aggressive homebuilder with a fantastic track record of growth

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1jlRZMzdWZsdFad40Mg6qaNbYPo0OlYCq

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: DFH employs a similar model to NVR. They are a fast-growing homebuilder currently operating out of 6 markets (Jacksonville, Orlando, DC, Colorado, Texas, and the Carolinas). Like NVR, DFH has an asset-light land financing strategy. So instead of buying the land outright and holding it on their balance sheet while they develop and sell it, DFH enters into finished lot option contracts and land bank option contracts where they put down up to 10% or 15% of the estimated value upfront but can cancel the purchase at the end if needed.

During the time that the land is being developed, DFH is marketing and selling the prospective homes typically to entry-level or first-time move-up buyers. They allow each buyer to add some customization to their home which they then pass along to their construction design team to initiate the building process. Once the lot is finished, and the customer has put down a deposit and received mortgage approval, DFH begins the construction of the home through various subcontractors. DFH states that it typically takes between 75 and 150 days for them to complete the construction of their homes (although it varies depending on customizations and size).

In addition to its core homebuilding operations, DFH offers its homebuyers ancillary products like mortgages and title insurance. They offer the mortgages through Jet Home Loans which is their mortgage banking joint venture that they own 49.9% of, and the title insurance through their wholly owned subsidiary DF Title. The goal of these services is to essentially hold the hands of your buyers and simplify the closing process.

(Ryan) History: Patrick Zalupski has been around the home business for a long time. His mother was a realtor in the Jacksonville area and her husband would buy foreclosed homes and rehab them. In 2005, Patrick wanted to try doing it himself so he bought his own foreclosure and began rehabbing it into what was going to be a 9-unit condo, but he realized quickly that he’d rather be doing single-family detached homes.

However, he said it was nearly impossible to get any available land leading up to the recession because big homebuilders were buying up 500 lots at a time. Once the GFC hit, Patrick saw a lot more opportunities. So Zalupski took out a $200,000 loan from the Clay County Housing Finance Authority in 2008 and was able to build 3 homes with it. At the time, he was able to convince the developer to let them pay for the land after they’d sold the homes. That was basically the inception of their land-option model. They kept repeating that process until 2011 when they were finally able to get a real bank facility and then quickly expanded the operations.

Over the last 10 years, they’ve grown into new markets both organically and through acquisitions of other homebuilders, with the largest being their recent $471 million purchase of MHI which operates in Texas.

(Brett) Industry/Landscape/Competition:

DFH operates in the home building industry, so it has a very similar market opportunity to NVR

IBIS World estimates the homebuilding industry to do $129.3 billion in revenue in 2022

With $2.67 billion in trailing twelve-month sales, DFH has approximately 2% market share based on these numbers

The industry is affected by many macroeconomic factors including interest rates, the current supply of homes, and demographics.

Competitors: Other homebuilders including NVR, Lennar, D.R. Horton, etc.

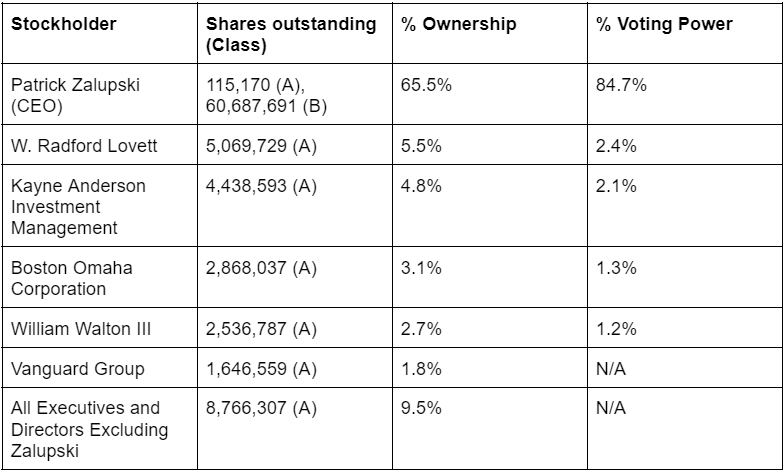

(Brett) Management and Ownership:

DFH was founded and is still run by Patrick Zalupski, who is currently 41 years of age. He has the majority ownership and voting rights of the company so he can run a dictatorship if he wants to

Other important board members include William Walton III and Radford Lovett, both of who have long experience in the real estate industry and own a sizable chunk of stock

Total board of director compensation of $734k in 2021, so an immaterial part of gross profit. However, I would have liked to see both Lovett and Walton (who are uber-rich) waive their salaries

Total executive compensation in 2021: $21 million or 6.7% of gross profit

There were a few red flags:

Executive bonuses are based on adjusted pre-tax income. “When determining actual Adjusted Pre-Tax Income, the committee may decide to exclude one-time items including merger/acquisition costs, litigation expense, restructuring costs, changes in accounting”

Zalupski essentially gifted himself $10.6 million in stock awards last year even though he already owns over half the company. Why does he have to be so greedy?

DF Capital. “The Company has a 49.9% ownership interest in DF Capital, an investment manager focused on investments in land banks and land development joint ventures to deliver finished lots to the Company and other homebuilders for the construction of new homes” The fund has investments from Zalupski, Moran (COO), Fernandez (CFO), and board members, which feels to me like a lot of self-dealing so these people can earn extra returns on lots DFH buys from the fund. Why can’t this all be consolidated under DFH?

(As of 2022 Proxy Statement and using 92,758,939 shares outstanding )

(Ryan) Earnings:

2021:

Just under 5,000 unit closings (up 55%)

$1.9 billion in revenue

And $149 million in pre-tax income

Most Recent Quarter:

Revenues were $791 million, up 118% YoY

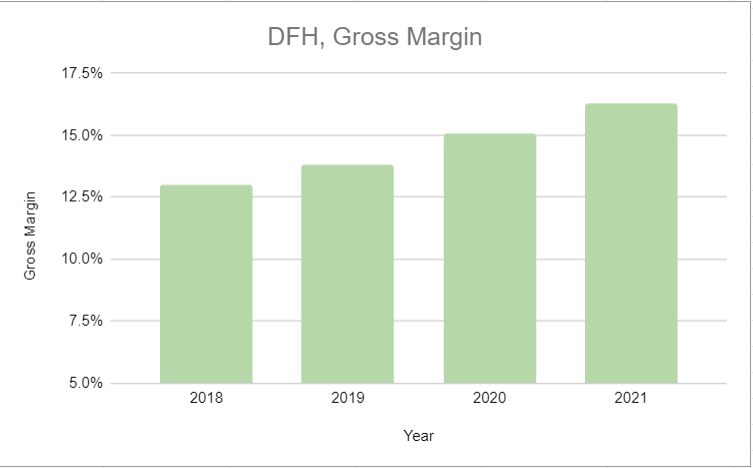

19.7% Gross Margin

1,649 home closings, up 66% YoY

Average sales price $463k, up 29% YoY

Quarter over Quarter: Sales price down 1.4%, backlog of sold homes down 3%, and net new orders down 41%.

Cancellation rate has jumped from 14.4% to 21%.

(Ryan) Balance sheet and liquidity:

Liabilities:

The majority of DFH’s debt is in its revolving credit facility. Frankly, it’s a complicated agreement with a bunch of covenants and contingencies.

As of the latest 10-Q, they had $875 million drawn with an effective interest rate of 4.1%.

The amended credit facility has commitments of up to $1.1 billion, however, there’s an accordion feature that would extend the borrowing base up to $1.6 billion.

The rate on the credit line is variable, and changes each year, depending on a number of factors.

Likely that the rate will rise next year.

Assets/Operating Income:

Only $84 million in straight cash and cash equivalents

But they have $288 million in construction lot deposits, which as we know can partly be called back.

As far as management sees it, they say they have $334 million in available liquidity.

However, DFH also has ~$1.4 billion in inventories. The majority of which is construction in process.

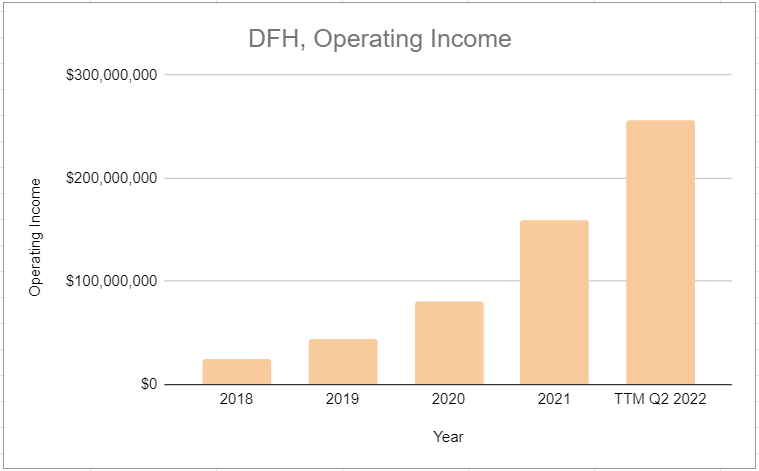

$256 million in LTM operating income

(Brett) Valuation:

https://docs.google.com/spreadsheets/d/1Y2Vq58_Dhpn7pdV5ZtUdC0lUHGVgUBHpGefiQgGDX5U/edit#gid=0

Market cap of $983 million

Enterprise value of $1.78 billion

EV/GP of 3.7

EV/OI of 6.9

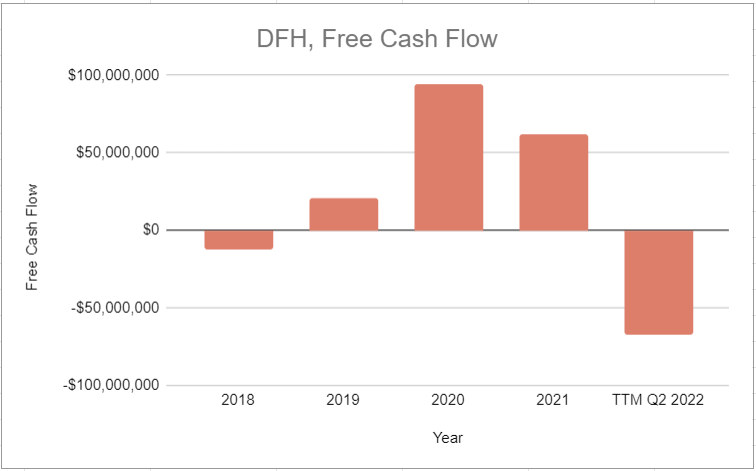

EV/FCF of -26 (not FCF positive over last 12 months)

Anecdotal Evidence:

(Ryan) Zalupski writes a good letter.

(Brett) Reading the shareholder letter, it is clear that management has a great track record of growth. However, I get a bad feeling when I look at how fast they are moving and some of the compensation moves. One word to describe this business: aggressive.

Future growth opportunities:

(Ryan) Build for rent. Build-for-rent homes are simply detached units designed for long-term rentals. “Our build-for-rent platform provides a consistent home deliveries pipeline, which is less susceptible to temporary changes in demand from individual homebuyers.” Built-for-rent homes comprised ~26% of the homes in DFH’s backlog last quarter. Seems nice to have this as an option.

(Brett) Acquisitions. Explicitly stated in the annual letter that acquisitions will be part of the strategy moving forward, as long as they can find a new home builder in a new market. This is a way to accelerate annual volume growth. However, it will likely be fueled by debt, raising preferred stock, or equity raises due to how little cash they are generating at the moment.

Highlights and lowlights:

Ryan’s Highlights

Like NVR, I like the flexibility that the land option strategy gives them in tough times.

Zalupski has been employing leverage since the start of the business, which gives me a better sense that he’ll be able to manage it.

They’ve shown a remarkable ability to grow quickly, which seems like it’d be hard to do in this industry.

Ryan’s Lowlights

The big jump in cancellation rates is concerning.

It feels a bit like Zalupski is trying to time the market. “During the first month of the quarter, the Company delayed the sale of homes until later stages in the construction cycle. Later in June, demand tightened in response to the rapid rise in mortgage rates coupled with continued home price appreciation.”

I get a weary feeling whenever a public company establishes a limited partnership under its umbrella. Thanks, Enron.

Does their net debt position hinder the benefits of the land option model? If you have to pay down that debt on an annual basis, you’re not going to be as inclined to exercise your right to say “no, we’ll wait”.

Brett Highlights

The land option model clearly works, as we saw when studying NVR. DFH is using this model again and it has helped them grow quickly without having to raise a ton of capital.

Moving into Texas through the MHI acquisition. The big markets in that state are growing quickly and seem to be set to have tons of homes built over the next decade.

Brett Lowlights

Management integrity. There are a few things I saw in the proxy filing that worried me, which are listed in the above section.

Using adjusted income as an incentive measure for management. This can incentivize them to pursue acquisitions and run the business towards a metric that does not actually create shareholder value.

What creates true shareholder value is free cash flow available to shareholders. DFH has struggled to generate cash recently and has some expenses hidden on the cash flow statement that may make “free cash flow” look high when in reality it is not available to be returned to shareholders.

Macroeconomic uncertainty. How far will housing prices drop? What will materials costs look like? We don’t know how bad it will get over the next few quarters for residential real estate, which adds risk to DFH.

The interest rate on its credit facility is variable and tied to Fed Funds/LIBOR. With the Fed raising rates, DFH will have higher costs on its debt, which has grown to a large amount with the MHI acquisition.

Bull Case:

(Ryan) Pretty simple bull case. Over the next 3 years, let’s say the average selling price remains near where it’s at ($460k), home closings increase by 10% a year (9,317 homes in 2025), and operating margins remain steady at 9% to 10%. You’ll have just under $430 million in operating income in 2025. Slap a 7x multiple on it, you’ve got a $3B market cap versus today’s EV of $1.8B.

(Brett) The aggressive growth strategy works wonders, with DFH getting to economies of scale and hitting 10%+ operating margins that consistently generate cash flow because of the asset-light model. At the current EV below $1.8 billion and $255 million in trailing operating income, it would be hard to lose money owning this stock if the business gets much larger from here.

Bear Case:

(Ryan) With the amended credit agreement, it feels like they’re getting really aggressive heading right into a downturn. If that happens, and cancellations jump, they’ll have to forfeit deposits, margins will contract, and servicing that debt will get much tougher.

(Brett) Margin pressure due to home price drops, the strange expenses that keep showing up, and executives running this business for themselves instead of together for themselves and minority shareholders all feel like bear cases to me. Also, being aggressive can put up great growth numbers but it multiplies the potential severity of a mistake if you make it. What happens if this immature homebuilder with tons of debt is making some sort of mistake as we head into a brutal housing downturn? I don’t know what it could be but it does scare me.

More or less interested?

(Ryan) Less Interested. Feels like a good model and I could see this having plenty of upside, but they’re flying too close to the sun with their leverage strategy.

(Brett) Less interested. Management is too aggressive and self-dealing for my liking, especially in a cyclical industry.

Stock for next week? (LGI Homes)

Sources and Further Reading

2021 Shareholder Letter: https://d1io3yog0oux5.cloudfront.net/_277abe3e7863d80a9329cbed54f65382/dreamfindershomes/db/2987/27053/pdf/Dream+Finders+Home+2021+Annual+Letter.pdf

2021 Annual Report: https://investors.dreamfindershomes.com/sec-filings/annual-reports/content/0001140361-22-009752/0001140361-22-009752.pdf

2022 Proxy Statement: https://investors.dreamfindershomes.com/sec-filings/all-sec-filings/content/0001140361-22-016582/0001140361-22-016582.pdf

Redfin October macroeconomic housing update: https://investors.redfin.com/news-events/press-releases/detail/813/redfin-reports-economic-woes-exacerbate-slowdown-as-rates