Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

Show Notes

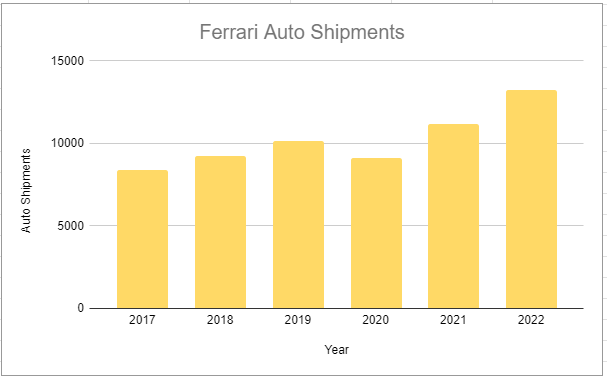

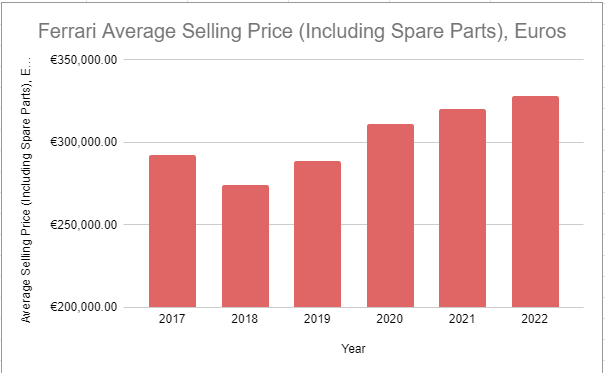

(Ryan) What they do: Ferrari is a luxury brand. They produce high-performance cars, but they bear very little resemblance to the actual auto market. Ferrari is unique in that the company only delivers a little over 10,000 cars a year. For context, Tesla delivers almost 2 million a year. So they really limit supply intentionally. Enzo Ferrari even once said, “Ferrari will always deliver one car less than the market demand”. However, the cars they sell are quite expensive. Depending on the model, the selling prices can range from anywhere between $250k to $3 million (and even more for the one-offs).

Ferrari does all of its production in Italy, primarily through its Maranello plant. And they sell through their network of just under 200 dealerships located all around the globe. However, they aren’t really dealerships in the traditional sense since they don’t hold sellable inventory. The dealerships are merely point-of-sale locations where clients can order or pick up their cars. The current waiting list to buy a Ferrari is around three years.

Beyond selling cars, Ferrari also generates revenue by selling parts to existing car owners. Sometimes these are needed parts and sometimes it's just owners trying to improve their car. They generate advertising revenue as well (get a share from F1), advertise on the side of racecars, sell licenses to some amusement parks, etc. They also have a recurring agreement with Maserati to manufacture engines for them. This has been going on since 2003 and gets renewed every 3-4 years. Lastly, they offer some financing to their customers but most of their customers don’t need loans.

About 20% of the cars they currently sell are hybrid. And that continues to grow.

(Ryan) History: Enzo Ferrari started racing for Alfa Romeo in 1924. In 1929, he formed the Scuderia Ferrari racing team under the Alfa Romeo umbrella. However, in the late 30’s Enzo and Alfa Romeo’s management team had some disagreements so Enzo set out to do his own car manufacturing. He couldn’t have the actual Ferrari name for another 4 years though. WW2 significantly disrupted operations, and Enzo’s facility became a contractor for the Italian govt. for about 4 years. It really wasn’t until after the war that the Ferrari company started to take off. In 1947, Enzo built the first Ferrari-branded car with the dancing horse emblem and instantly began seeing racing success. Their first huge landmark win was the 1949 24-Hour Le Mans. This racing success attracted wealthy people from all over to the brand.

In order to finance the design and manufacturing of the next racecar, Ferrari would also sell cars to wealthy people from all over. However, when people came to visit, he would always tell them that they were going to have to wait a few months to get one. This cycle helped Ferrari continue their racing success throughout the 50’s and 60’s. And in 1960 for the first time, Ferrari went public. However, in the late 60’s they were struggling financially and required outside investment. Fiat took a 50% stake. After Enzo passed away in 1988, Fiat upped its stake to 90%. After that the business was consolidated as a part of Fiat Chrysler, however around 2014, they began exploring a public listing/spin-off.

Sergio Marchionne had become CEO of Ferrari at the time and he encouraged investors during their IPO roadshow to look at the company as a luxury brand. But people constantly just viewed it as a premium car company. Well in 2015, shares of Ferrari were listed, in 2016 they completed the spin-off, and since coming public Ferrari has generated a total return of 620% (or 27% annualized).

As of late, Ferrari has actually been boosting production. Now this is not that common for them. However, it seems like thanks to the rise of popularity in Formula 1 and the rise of wealthy clients coming from Asia, Ferrari has felt like the demand had grown so much that they needed to start increasing production.

(Brett) Industry/Landscape/Competition:

We are all aware that Ferrari is a luxury sportscar brand. To understand its target market, let’s start with the broader automotive market and move down to Ferrari’s target customer base

There are around 70 million cars sold around the world every year

Narrowing down to sports cars, there are around 1 million sold around the world each year

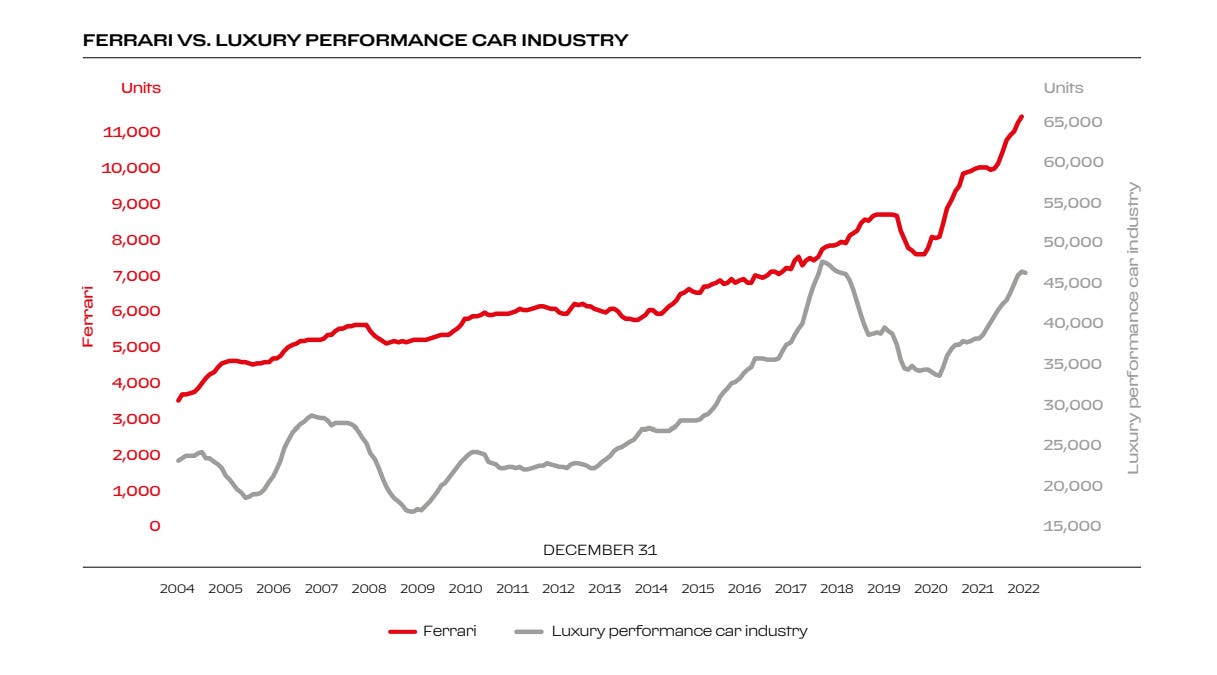

According to Ferarri’s definition, there are around 50,000 “luxury sports cars” sold around the world every year (graphic below). Ferrari sells just over 10k vehicles a year but is growing its market share and production

From a “luxury strategy” perspective, Ferrari looks well positioned. There are a billion people (perhaps billions?) that recognize it is a luxury brand, or believe it is a luxury brand. Ferrari estimates there are 26 million “high net worth” individuals who can afford a Ferrari (remember, a lot of customers purchase more than one vehicle). It sells just over 10k cars every year, meaning it is likely well undersupplying customer demand every year. This is a good thing.

Side note: The global fashion industry has over $1 trillion spent every year. Ferrari has entered this market and it remains a call option for the company. How much confidence do we have they can succeed in fashion apparel and goods?

Competitors, according to Ferrari’s own annual report:

“Lamborghini, McLaren, Aston Martin, Rolls-Royce and Bentley, as well as Porsche, Mercedes and Audi in certain segments of the market”

Should any of these competitors worry Ferrari investors?

(Brett) Management and Ownership:

The CEO of Ferrari is Bendetto Vigna. He came over to Ferarri in September 2021 from a microelectronics and sensors company. He had worked within that industry since 1995.

Do you have any worries that Vigna has no experience running a luxury company?

For Ferrari, I think it is important to also look at the marketing lead, given how delicate the advertising biz can be for a luxury company. The chief marketing officer has been in that position since 2010, which I think is a great thing

The board of directors is also likely a bit more important here, and Ferrari has a great board:

Chairman: CEO of Exor (also chairman of Stellantis, Ferrari’s old parent company)

Son of Enzo Ferrari, Pierro Ferrari

Delphine Arnault (daughter of Bernard Arnault and head of Dior)

CEO of Yves St. Laurent

Apple senior VP of Services

COO of Chanel

There are two meaningful ownership stakes: Exor and Pierro Ferrari

Exor has a ~25% economic stake in the business. Pierro has a ~10% economic stake

However, due to a strange voting mechanism (details unimportant), Exor has a ~36% voting power and Pierro has a ~15% voting power.

Combined, they have 51.7% voting power in this business. With shares outstanding coming down, this may increase

Executive compensation: Bonuses based on relative TSR and EBITDA targets. Not great.

Yellow flag: Too much focus on EBITDA. EBITDAm is not relevant for a company spending so much on capex and overstates Ferarri’s earnings power

(Ryan) Earnings:

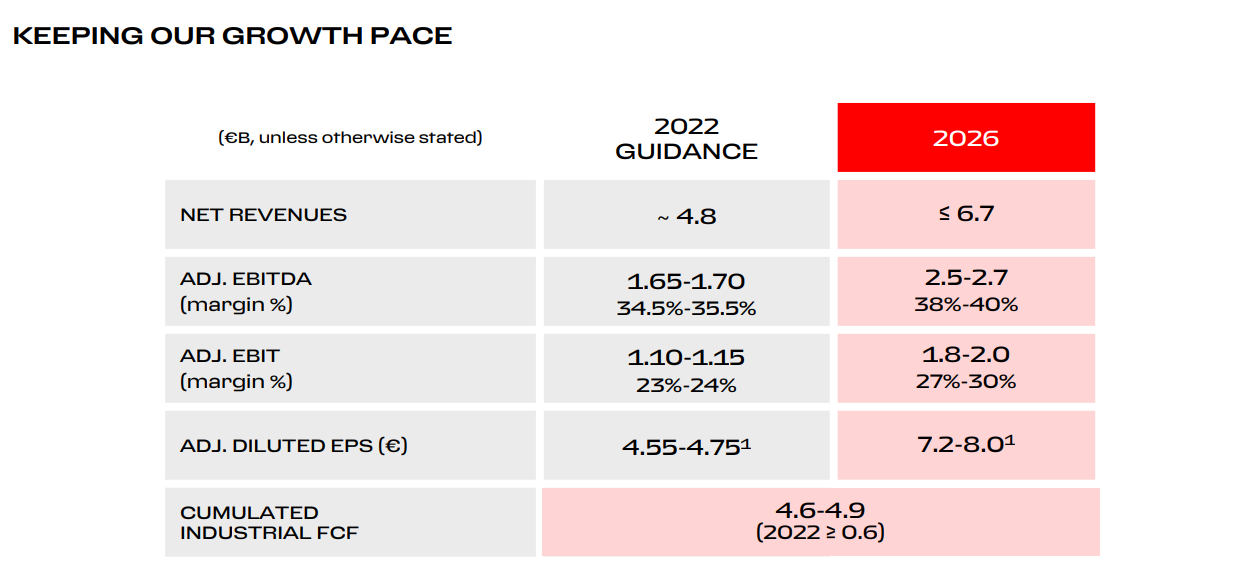

€5.8B in LTM revenue

Most recent quarterly revenue grew by 23.5%, well above their historical rev growth rate

~50% gross margin

27% operating margin

Free cash flow often lags, especially right now as they have added some production. Before the launch of a new model, they’ll have a big inventory buildup as well.

Most important thing here: Ferrari has earned ~€1.5B in EBT over the last 12 months.

(Ryan) Balance sheet and liquidity:

Not super important here, but we can talk about it anyway.

Ferrari reports €2.8 billion in total debt

But €1.1 billion of that is what they call “asset-backed financing”. I believe this is the loans made to customers and the collateral is the Ferrari vehicle.

Basically, you can strip that out. And just look at real debt which they call “industrial debt”.

Ferrari has a little over €1 billion in “industrial debt” with €1 billion in cash to match it. So basically close to zero net debt.

(Brett) Earnings Multiple:

In USD, Ferrari has a market cap of $67 billion

Over the last twelve months, it has generated $1.27 billion in net income

This gives it a trailing P/E of 53. I think net income is a fine earnings metric to use for Ferrari, free cash flow can get a bit wonky

What I think investors should consistently track: EBITDA, free cash flow, and net income, as well as the conversion of EBITDA to free cash flow and conversion of net income to free cash flow

Anecdotal Evidence:

(Ryan) I’ve spoken with someone who went to one of the Ferrari events in Italy or maybe it was somewhere else, and what he described sounds like just a really powerful business model. Everyone was so eager to be there. People were buying cars before they ever got in them. It’s a status thing and it’s actually a beautiful engineering thing as well.

(Brett) Clearly, a great brand and the F1 aspect is a competitive advantage in marketing that I don’t think can be replaced. They do a lot of the “little things” right to make them seem elite, exclusive, etc. For example, I don’t think that it is a coincidence that both Ferrari drivers are from Southern Europe and very attractive. They are basically models for the Ferrari brand.

Future growth opportunities:

(Ryan) I think they have room to keep increasing production. Not too much but at the same 5%-6% rate they’ve been growing at over the last decade. Seems like demand really is significantly larger than their supply here. Not only are there a lot of buyers but many of the buyers are repeat customers. I think the runway for growth is quite large here. Also, maybe chill on the buybacks for a bit.

(Brett) Let’s spend some time here discussing the expansion into Ferrari as a fashion/apparel brand. They now sell four-figure clothing items, watches, and other items that are not strictly for automotive. Its “sponsorship, commercial, and brand” line item is now 10% of revenue (not all of which is from fashion apparel). How likely is it that in 10 years Ferrari is doing $1 billion in revenue from luxury goods outside of automotive? Does it matter?

Highlights and lowlights:

Ryan’s Highlights:

Wonderful business. Their clients are happy to hand over $1M to stay in the “club”.

Their brand is really built on their long history of racing success. That’s pretty much impossible to replicate.

Being a leader in Formula 1 is one of the purest and most effective marketing strategies.

Recession-proof (for the most part).

Ryan’s Lowlights:

Growth of business in Asia, and in particular, mainland China.

Brett Highlights:

I think it is the best luxury brand in the world with multiple competitive advantages. It has the heritage in racing, the top marketing with F1, and the expertise in making the top sports cars out there

They are definitely undersupplying demand. They can consistently raise supply and prices, especially with the fact that the after-market is still such an advantage (something we can discuss).

They are definitely in the right wheelhouse of using a proper “luxury strategy.” Billions are aware of Ferrari, tens of millions can afford one, but only ten thousand (maybe 20,000 in 2030) can buy one each year.

Brett Lowlights:

The capital allocation looks poor. Focusing on EBITDA as a target metric, hiding R&D in Capex, and repurchasing stock when the earnings ratio is above 50x. They are also disadvantaged vs. a brand like LV where there is a true need for innovation, R&D, and the like making its vehicles. They are a work of engineering, not just “art” as its fans might say.

The transition to electric vehicles presents some complications for them. From the recent CC:

“A few other luxury premium car makers have noted that at the very top end of their product ranges, the customers, particularly in China, have a strong preference for internal combustion engines as similar to a watch. They believe the mechanical elements have a higher level of craftsmanship and value compared to electric and digital offerings”

Bull Case:

(Ryan) It’s gonna take a lot for this to really make sense from here. Let’s just run some numbers. 15% annual revenue growth for the next 5 years and they get to 32% EBIT margins in year 5. That’s ~€3.3 billion in annual EBIT. Let’s say the market values them at 30x EBIT in 2028 (this is the bull case remember), that’d be a $99B market cap or 48% return over 5 years. That’s pretty rough.

(Brett) If you add up everything in our show, it is clear that Ferrari can grow revenue by 10% a year into perpetuity if they just keep doing what they are doing today. So, at 50x earnings, I think you are betting the stock stays at 50x earnings. You will not see hypergrowth in earnings here, I don’t think profit margins are going to explode higher due to high R&D spending.

Bear Case:

(Ryan) I think the most realistic bear case is that we see production stay relatively flat over the next several years. Hard to support the valuation here with flat production.

(Brett) If they slip up even at all with the growth formula, the stock will likely retrace to a much lower earnings multiple.

More or less interested?

(Ryan) More interested. It’s such a wonderful business. There’s just no world where I would pay 50x earnings for this.

(Brett) More interested. Clearly, an incredible business. I would want to buy at around 30x earnings. Don’t ask me why this is my number.

Stock for next week? (Hermes)

Sources and Further Reading

Capital Markets Day 2022: https://www.ferrari.com/en-EN/corporate/capital-markets-day-2022