Not So Deep Dive: General Dynamics Stock (Ticker: GD)

Discussing the durability, growth, and margin potential of this U.S. defense contractor

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: General Dynamics is an engineering and manufacturing business that works primarily for the US government. They break their business into 4 segments:

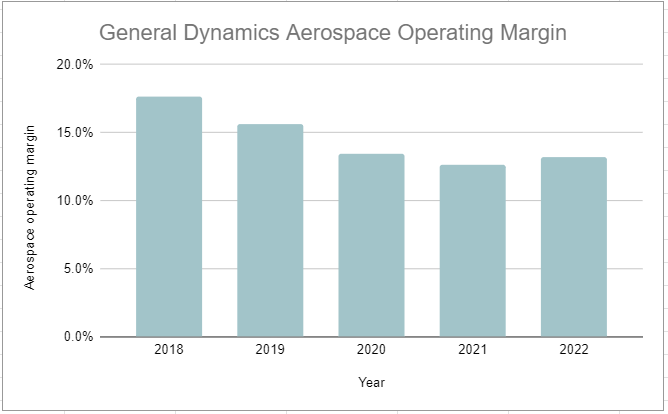

Aerospace: This segment refers to two different businesses, Gulfstream and Jet Aviation. Gulfstream is one of the world’s largest private business jet manufacturers that GD acquired in 1999 for $5.3 billion. Today, Gulfstream sells about 120 jets a year under a variety of different models typically to rich individuals or public and private companies. The Jet Aviation business provides a range of services for existing jet owners. Through their 50+ locations around the globe, Jet Aviation provides things like aircraft maintenance and management and charter services. Aerospace accounts for 22% of revenue.

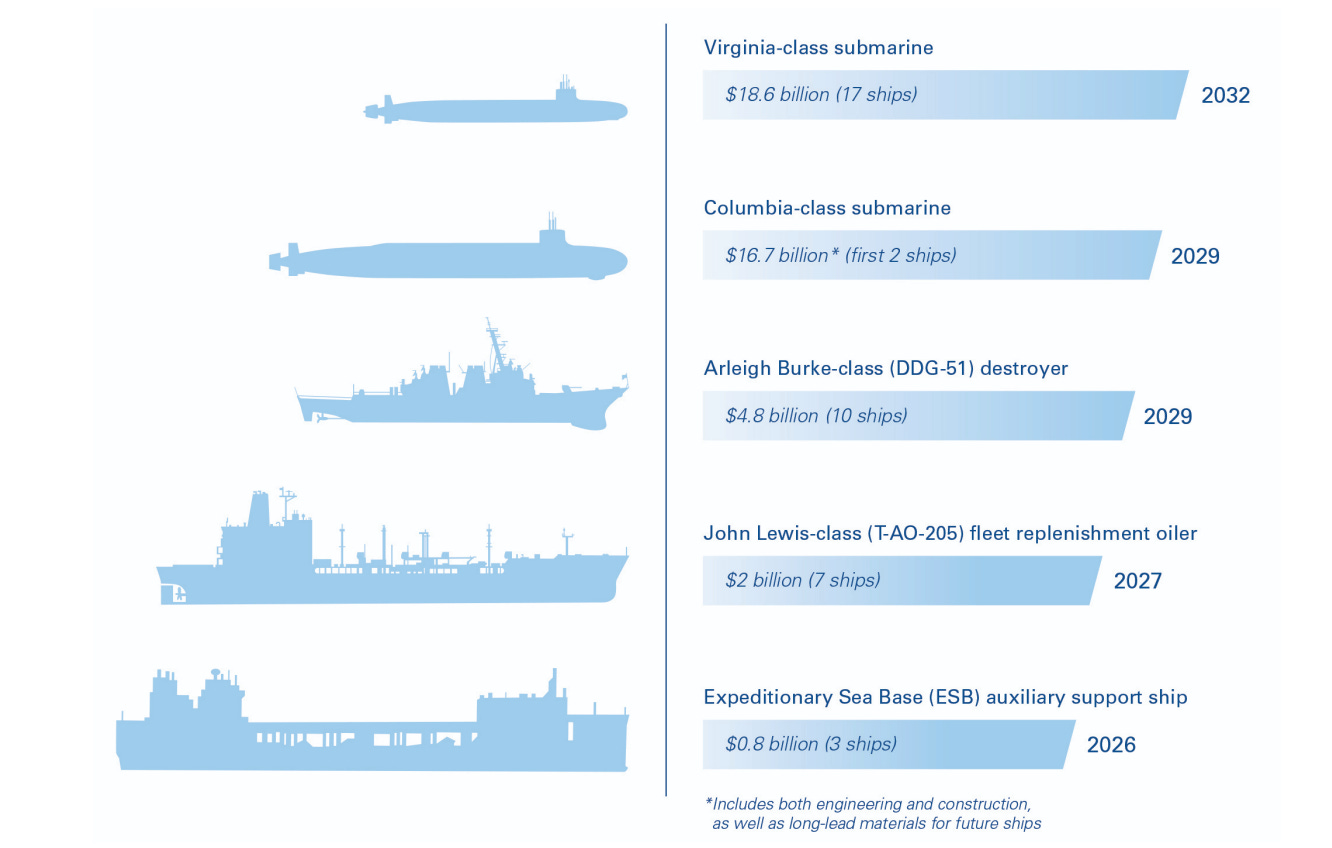

Marine Systems: This is where General Dynamics got its start and it refers to GD’s nuclear-powered submarine production business as well as the manufacturing of some surface ships and sale of after-market services (repair, maintenance, etc). GD builds five different types of ships under this division. For submarines, they’ve long sold Virginia-class submarines and have since been shifting up to a newer style called Columbia-class subs. For surface ships, they sell destroyers and oilers/auxiliary support ships. Almost all of these sales are directly to the US Navy. Marine Systems accounts for 28% of revenue and typically generates 8%-9% operating margins.

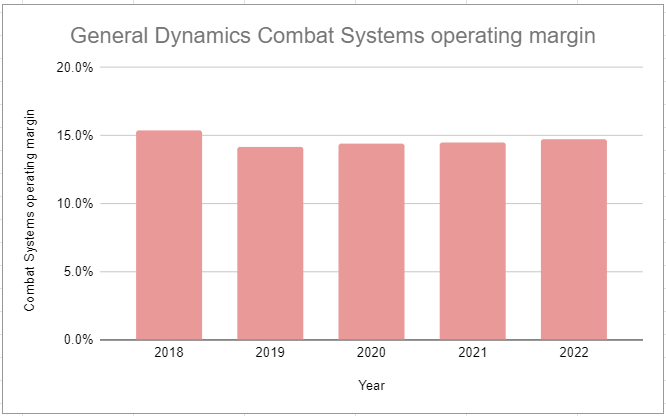

Combat Systems: Combat Systems basically refers to GD’s sales of tanks or as they like to say “land combat solutions”. Under this segment, GD is the sole producer of two important US Army products, the M1A2 Abrams Battle Tank and the Stryker Wheeled Combat Vehicle. In addition to the vehicle offerings, GD produces an array of different highly sophisticated weapon systems, including heavy machine guns and grenade launchers. Combat Systems account for 18% of revenue but have higher operating margins than the Marine segment at 14%-15%.

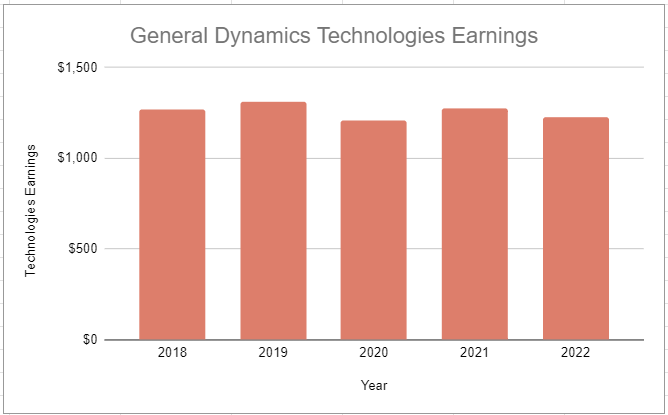

Technologies: General Dynamics groups its technologies division into two subsegments – information technology and mission systems. From the limited transparency they provide on this segment, it seems that their offerings are pretty wide-ranging. They include the production of leading-edge hardware as well as highly specialized software. I’ll steal a quote from their 10-K, “Over the past decade, (The US Govt.) has increasingly prioritized technology solutions as a critical element of their missions… COVID-19, the cyber threat landscape, and demand for advanced warfighter connectivity have accelerated these trends, adding urgency to required technology investments. The result is a significant increase in federal IT modernization and technology spending in recent years and a shift to large-scale, end-to-end, highly engineered solutions that require a broad array of integrated technology services and hardware offerings to meet these customer demands.” This is their largest segment by revenue (32%) and typically generates around 10% operating margin.

As I mentioned above, sales to the US government account for 70% of GD’s billings. And those sales are typically paid for in one of three ways, either fixed price contracts (56%), cost reimbursement contracts (38%), or time and materials (6%). Most of their production contracts are fixed price, which means they agree to perform some specific piece of work and are paid a fixed amount for it.

(Ryan) History: General Dynamics roots date back to the late 1800s. A gentleman named John Holland had developed designs for a submersible ship and developed a company around those designs called the Holland Torpedo Boat Company. In 1899, Isaac Rice bought those designs and renamed the company the Electric Boat Company (still around today). Starting in 1900, the Electric Boat Company began selling their submarines to the US Navy, and as people can probably imagine the next 45ish years were quite lucrative for them. In fact, in World War 2, Electric Boat produced a total of 80 submarines for the Navy.

However, after the war, General Dynamics had a whole bunch of cash and not a lot of orders, so they began looking for acquisition targets. In 1947, they acquired Canadair and as the company grew its aircraft production it didn’t make much sense to maintain the Electric Boat name, so they changed it to General Dynamics in 1952. The year after GD bought Convair and once again leaned further into the aircraft manufacturing business. From that point on, it’s been a long history of new acquisitions and divestitures all around the same theme of contracting on behalf of the US government. In the early 1990s in particular, GD had to divest a big chunk of its businesses due to the downturn in the defense industry.

Since 1994, it’s been pretty much all acquisitions and not a single notable divestiture.

(Brett) Industry/Landscape/Competition:

General Dynamics operates in two markets: defense contracting and private/business aviation

The private aviation market is estimated to be $30 billion and is projected to steadily grow this decade (I wonder how tied this is to the business cycle/stock market?). Gulfstream generated around $8.5 billion in revenue last year so they are one of the leading brands in private aviation

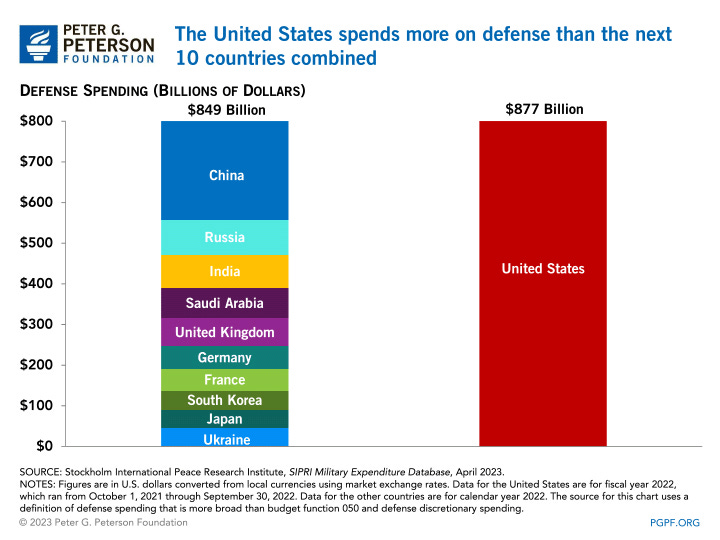

In defense contracting, the “industry” is quite large but obviously very unique. The most important customer is the US government, which is closing in on $1 trillion in annual defense spending. GD is going to also sell products to US allies (for example they are doing a nuclear submarine deal with Australia). So the TAM is actually even large than this.

Competition in a broader sense is all the defense contractors like Lockheed Martin, Raytheon, Northrop Grumman, Boeing, etc. GD is ranked 3rd and gets 5.2% of the defense budget allocated to them (2020)

In a narrower sense, some of GD’s product lines (nuclear subs, Abrams Tanks) have minimal or zero competition. The munitions and technology consulting segments have a wide range of competitors.

(Brett) Management and Ownership:

The CEO and Chairperson of the board is Phebe Novakovic. She has been CEO since 2013 and has been with GD since 2002.

Not that it generally matters for a company of this size, but they have 13 members on the board that all get paid more than $300k a year. I bet they all provide some value to this business, but I don’t like when members of the board get such healthy incomes for doing minimal work.

Generally, I liked how they do executive compensation and incentives. Annual bonuses are based on a mix of EPS, FCF, and operating margin targets. If you really care about this stuff, I would check the changes in hurdles they give themselves each year, but otherwise, I think these are good incentives.

They do long-term stock awards, some of which are based on TSR and ROIC hurdles. The current ROIC hurdle is 12.6%, which I think is fair.

Overall, the executive compensation is healthy, but not crazy for a company of this size. Novakovic got $21 million last year, the CFO got $6.9 million, and the division leads all got a few million dollars.

Since this is an old company, the insiders only own 1.5% of the stock, a large chunk that comes from Novakovic.

Unlike some of the other large caps we’ve covered, they actually have a decent chunk of the stock owned by what looks like active managers like Long View Capital Management, Newport Trust Company, and Wellington Management. I don’t know whether that means anything though.

(Ryan) Earnings:

2022:

$39 billion in revenue

$4.2 billion in operating income or 11% operating margin

$4.6 billion in operating cash flow - $1.1 billion in capex = $3.5 billion in free cash flow

Most recent quarter:

$9.9 billion in revenue, up 5.2% YoY

$880 million in earnings before taxes, up 3.7% YoY

$1.46 billion in operating cash flow (they benefit from customer advances).

The amount of customer backlog that’s been funded in advance is up substantially over the last 2 years.

Book-to-bill ratio (the ratio of orders received to units shipped and billed for) was at 0.9, down from 1.1 in Q3 of last year.

(Ryan) Balance sheet and liquidity:

$2 billion in cash

$10.5 billion in total debt (~90% is long-term)

The weighted-average interest rate is 3.18% and pretty much all the debt is fixed.

Net debt of $8.5 billion, so net debt to OI of 2x.

(Brett) Valuation:

Market Cap: $58 billion

Enterprise Value: $67 billion

EV/Operating Earnings = 15.5

Anecdotal Evidence:

(Ryan) I’ve got zero experience with any of their products. But as for gut reactions to the business, I feel like the incumbents are so advantaged here. There are so many regulatory hoops, hurdles, and clearances needed to produce weapons like this that it seems pretty unrealistic to me that anyone would be able to step in and take their place.

(Brett) I have never ridden in one, but it seems like Gulfstream is the top brand in private jets. That will hopefully give them durability in customer demand and loyalty over the next few decades and beyond.

Future growth opportunities:

(Ryan) New federal budget. Around July of last year, the House voted to pass a bill that boosted the national security budget to $850 billion a year, up $72 billion or 9% relative to last year. Apparently, this was well above Biden’s initial proposal too as lawmakers cited inflation, the Ukraine invasion, and concerns about China as the primary reasons to up the spending. Though it’s kind of a depressing growth opportunity, the defense budget increase is a major tailwind for General Dynamics.

(Brett) The new Columbia Class Submarine that is going to replace the aging nuclear submarines in the US Navy arsenal. Electric Boat is going to run around 78% of the construction for these projects and has essentially locked down production through at least 2042 (and likely much longer). As one of the only shipyards in the world that can build these, there really isn’t much of a choice for who the US Navy is going to choose. I ran a very simple analysis and projected that – due to the growth of the Columbia submarine production and operating leverage after manufacturing ramp-up – GD will grow its Marine Systems operating income by 5% a year from now through 2042. That would lead to $32 billion in cumulative operating income from now until then. How much is that worth today? Why am I so confident in making these projections? Because this submarine class looks to be the number one priority for the entire US Navy:

“As the Navy’s top priority, the Columbia-class program will remain funded even at the expense of funding other Navy programs”

Highlights and lowlights:

Ryan’s Highlights:

Highly predictable revenue streams and their largest customer has a clear interest in making sure GD is well-compensated.

Capital returns to shareholders have been great over the last decade. Share count has come in by ~22% and dividends have more than doubled.

Given that the US govt. has had success with contracting to General Dynamics in the past, I imagine it bodes well for future contracts. I.e. the government knows and trusts General Dynamics.

I like that they’ve diversified somewhat into the commercial sector. Might provide some buffer if defense budgets contract at any point.

Ryan’s Lowlights:

Lackluster earnings growth. EBIT is up 6.7% over the last 5 years.

Bookings are still largely tied to defense budgets.

Brett Highlights:

I like the Gulfstream business. The brand is solid, margins look strong, and they are coming up with some new innovative products. I wonder what the growth will be though.

The Marine systems segment is top-notch. It is highly predictable and a monopoly. What more could you ask for?

Given the brand and relationships within the DoD and other government agencies, I think it is likely they will keep winning deals for the technology consultant segment.

The capital returns strategy has been consistent and sound. They have grown the dividend payout by 12% a year since 1991.

Brett Lowlights:

Over half of the business is on fixed-cost contracts. Unlike the much-maligned “cost-plus contracts” these provide more risk to the defense contractor as they only get a fixed payment from the government and have to eke out the profit margin themselves.

I believe it would be tough to identify any deterioration in technological capabilities or the potential of losing a government contract (outside of the nuclear subs). There is a big narrative right now around new defense contractors like Anduril that keep getting lots of funding. Will they be able to step on GD’s toes? I don’t know.

Bull Case:

(Ryan) The geopolitical concerns persist or worsen over the next 5+ years and defense budgets continue to rise. This should provide a nice tailwind for new bookings/contracts. Assuming operating margins stay between the 10%-13% range and you get 5%+ bookings growth a year, General Dynamics should have plenty of room to continue growing that dividend.

(Brett) At a little over 15x operating earnings (remember this excludes taxes and some corporate costs), I think you need to be confident that three things will happen: steady 5%+ revenue growth, steady margin expansion, and consistent repurchases/dividends (I believe in the above sections we outline why this could occur). If this happens, the stock likely does well over the next two decades.

Bear Case:

(Ryan) Seems unlikely to happen since our defense budget as a percentage of GDP is near an all-time low, but if we got some contraction there it’d be a big headwind. If you go back and look at the defense budget contractions of the late 1980’s it really hurt a lot of these defense contractors. I think the downside is still limited here though. Most likely you’ll get the dividend + meager growth.

(Brett) I struggle to think how one loses money here. However, given the low earnings yield vs. its historical average, I think there is the cliched risk of multiple compression combined with low growth due to losing customer contracts outside of its monopoly-like businesses. I do not know how durable the revenue is from its munitions or technologies segment.

Sources and Further Reading

Defense contractors spending: https://dsm.forecastinternational.com/wordpress/2021/02/02/top-100-defense-contractors-2020/

Columbia Class Submarine:

Exploring the Resiliency of the Defense Industry: https://fortunefinancialadvisors.com/blog/exploring-the-surprising-resilience-of-the-defense-industry/