Not So Deep Dive: Hawaiian Airlines (Ticker: HA)

Losing money with intense competition, but could be trading at a dirt-cheap price

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Hawaiian Holdings is technically speaking the parent company of Hawaiian Airlines, but they don’t own anything else so we’ll only really be discussing Hawaiian Airlines. Hawaiian Air is the 11th largest US airline based on revenue passenger miles. They own 61 aircraft (comprised of 3 different airplane types) and use those planes to conduct flights across 216 different routes. Those routes include island-to-island flights, Hawaii to the US, and Hawaii to different international destinations across Asia and the South Pacific. Of their passenger revenue, 89% comes from domestic flights. Prior to COVID, that number was just 74%.

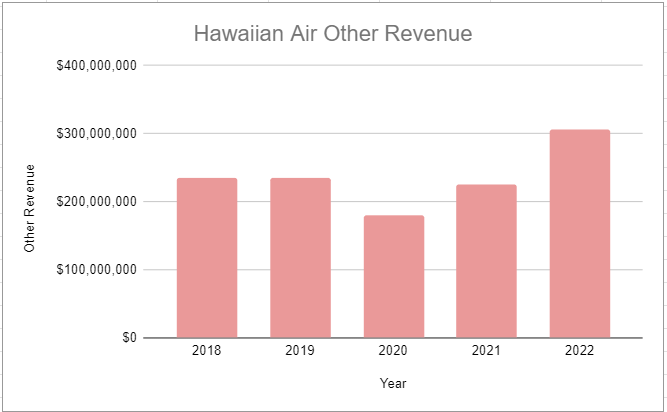

Unlike Ryanair, which we discussed two weeks ago, Hawaiian isn’t trying to be the low-cost provider. They are on the more expensive side as Brett will talk about, but they really try to focus on their service and building customer loyalty. They have 11.7 million “HawaiianMiles” members that account for 40% of all their passenger revenue, and they have card partnerships with lots of organizations as a way to encourage flying more with Hawaiian. Hawaiian also earns ~12% of its revenue by flying cargo and through some of that loyalty revenue.

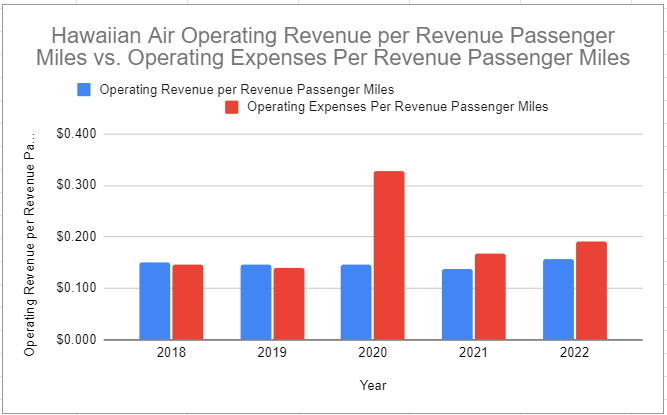

Hawaiian’s major costs are Wages and benefits (29%), Fuel (29%), Aircraft rent and maintenance (12%), and then everything else (depreciation, agent commissions, airport fees, etc.) are all below 10%. In total, in 2022, Hawaiian Air spent about $2.9 billion on just $2.6 billion in revenue.

(Ryan) History: Hawaiian Airlines was founded in 1929 (30 years before it officially became a US state). At the time it was called Inter-Island Airways and was actually a subsidiary of the Inter-Island Steam Navigation Company (man I miss old company names). But it only flew island-to-island routes for pretty much the first 50 years of its existence.

It wasn’t until 1985 that Hawaiian Airlines (the name change happened in 1941) decided it needed to venture outside of its inter-island routes due to intense pressure from other airlines. Their first venture was charter services to the South Pacific and that very same year they launched their very first route to mainland US. For the first time ever, this meant Hawaiian was competing with the big carriers. From there, they continued to add more and more routes across both mainland US and APAC. However, a lot of these new routes proved unprofitable for them, and in 1993 they filed Chapter 11 for the first time. Then ten years later, due to unsustainable union agreements, they filed for bankruptcy again and reorganized.

They’ve since emerged from bankruptcy protection and flew profitably (for the most part) since 2005. That was until COVID hit.

(Brett) Industry/Landscape/Competition:

Hawaiian Air operates three commercial segments: Inter-island (between the Hawaiian Islands), Domestic to island (ex. LA to Honolulu), and International to the islands (ex. Tokyo to Honolulu)

Within the domestic-to-island market, they compete with the big 4 (Southwest, United, American, Delta) and Alaska Air. However, the largest competitor here is Alaska

Within the inter-island market, Hawaiian used to have a big advantage with minimal competition. However, now Southwest has flooded the market with very cheap inter-island routes, which Hawaiian has had to stoop down to.

Internationally, they have less competition as opposed to “partners” (flight map at links below)

The Hawaiian tourist market in the United States has recovered to pre-COVID levels (chart below). However, international markets such as Japan have not yet. Japan is the most important non-U.S. country for Hawaiian Air

Hawaiian positions itself as the premium airline for travel to and from the islands (we can discuss the perks and viability of this strategy later). For example, a flight over the holidays from Seattle to Honolulu would cost $730 on Alaska but $930 on Hawaiian

Southwest:

Alaska:

(Brett) Management and Ownership:

Hawaiian Air’s CEO is Peter Ingram, who has been CEO since 2018 and has been with the company since 2005

Note: The Board of Directors is 13 strong and each get paid around $200k per year. Total pay for the BoD is $2.5 million. Peak net income for the company is $300 million, so this is not nothing

Executive compensation:

Metrics getting changed for compensation all the time. Tough to track

In 2022, annual comp was changed to EBITDA from cash flow

Long-term awards are based on EBITDA, TSR, and “strategic goals”

Last year, they got paid for generating negative adjusted EBITDA

The ownership table is interesting. The JETS ETF owns an estimated 13% of the stock, and its AUM is going down. I wouldn’t be surprised if these flows have an effect on the stock price.

*Based on shares outstanding as of latest filing

(Ryan) Earnings:

In the most recent quarter, passenger revenue grew by 4.5%

They still reported -2% earnings before tax margins

Load factor, which is total revenue passenger miles/available seat miles (basically occupancy on their flights), was 86.7%.

One of their big costs right now is that they have planes just sitting idle. They are operating at just 70% of their 2019 capacity. For the last couple of months, they’ve had 2 or 3 of their 18 A321s sitting out of service because they needed an engine change from a certain supplier.

Now, I want to use this for reference. It seems like they still have lots of increased costs that are out of their control, but here’s what the operating margins looked like from 2014 to 2019.

(Ryan) Balance sheet and liquidity:

$1.3 billion in cash and short-term investments

$1.6 billion in long-term debt, $1.7B if you include finance leases.

80% of the debt is “loyalty program financing”. Has a fixed interest rate of 5.75% and their quarterly payments are only the interest. The $1.2 billion (principal) isn’t due until Q1 of 2026.

For the next 2 years, they only have $70M in debt due.

Very manageable balance sheet. Especially if they can get back to positive operating margins.

(Brett) Valuation:

EV/E with 4% margin of 6.1

EV/E with 6% margin of 4

EV/E with 8% margin of 3

EV/E with 10% margin of 2.4

Anecdotal Evidence:

(Ryan) Maybe I’ve used them. Not really sure. I typically just default to Alaska Airlines now to rack up the miles. That seems like a real threat to Hawaiian Airlines by the way.

(Brett) The premium airline is a bit of a conundrum. On the one hand, for a longer flight to Hawaii, I’d definitely pay up a bit if they have good seats, free food, and free good wifi (which Hawaiian is going to get). On the other hand, I don’t know how much and whether it will be worth it for Hawaiian.

Future growth opportunities:

(Ryan) Getting back to full capacity. This really isn’t in their control, but it’s the difference between them being profitable or not right now. I wouldn’t know what to do if I were them, but it sounds like it’s going to take at least another two quarters (which is corporate speak for a year) to get their fleet back to full.

(Brett) The return of Japanese travelers. Japan has been the slowest country in Hawaiian’s regions to get back to international travel post the pandemic. This has brought down Hawaiian’s international revenue by a lot in their second most important corridor. However, this summer growth has been solid coming out of Japan which could mean the recovery is finally happening. On the other hand, the Japanese Yen has weakened a lot which is making travel to Hawaii very expensive.

Highlights and lowlights:

Ryan’s Highlights:

They’ve got a big frequent flyer base that is going to consistently come back to them.

Can’t remember where I saw the statistic, but I believe tourism to Hawaii continues to grow.

Good balance sheet and they’ve shown that they can be profitable.

Ryan’s Lowlights:

Same as what I had with Ryanair. Tons of moving parts, most of which are out of their control. We’re seeing this with the Pratt and Whitney engine delays right now, the Boeing 787 delays, and the lack of travel demand from Japan.

Increasing competition on their routes from the other larger carriers.

They’re struggling to be profitable at a time when leisure demand is rock solid. What happens if that slips while they have these capacity delays?

Brett Highlights:

A well-known brand in the space that travelers are going to associate with travel to and from Hawaii. They have a ton of experience flying these routes compared to the broad-based carriers

The growth of the credit card program and freight revenue from Amazon should diversify this business away from the cyclical commercial air travel market.

Over $1 billion in cash on the balance sheet to weather any more slowdown + all the headwinds (talked about below)

Brett Lowlights:

The cyclical nature of the airline industry, plus the choppy cash flow

They are facing a ton of headwinds right now: Pratt engine troubles leaving some planes grounded, slow deliveries of 787s by Boeing, competition from Southwest on inter-island routes, foreign exchange making it harder for international travel, the Hawaiian fires (might not have an effect), fuel prices going up. These will all hurt their ability to get back to positive profitability, which worries me.

Bull Case:

(Ryan) Leisure demand stays strong. The delays dissipate from both Boeing and Pratt & Whitney and they get back to 5%-10% operating margins. Let’s be optimistic and say they actually do that, they’d be generating probably around 30% of their enterprise value in cash each year.

(Brett) They are getting pretty close to profitability despite all these headwinds. Once they get some of these 787s back up, international market back, fuel prices (maybe?) stop going up, they can get their revenue per seat mile compared to operating expenses back on the right track. This may still be late 2024 into 2025 timeline though.

Bear Case:

(Ryan) Takes a year or maybe even two to get back to full capacity and in the meantime, the economy and the leisure demand worsen. If that happens, they could be losing a lot more money than what they’re currently doing. Bankruptcy would certainly be on the table.

(Brett) They never get back to pre-COVID profit numbers and are bogged down by cost-conscious competition from Southwest and Alaska. With all the variability in its costs, it is hard to predict whether they are going to generate positive earnings.

More or less interested?

(Ryan) More interested. Clear upside if they can get back to anywhere near 2017 margins. But it feels like there are constantly “short-term’ headwinds prohibiting them from operating at their best.

(Brett) More interested. This stock is dirt cheap if you believe they can get back to profitability. It might be too risky for my tastes, but I can see a thesis where at these prices the risk/reward makes sense even if bankruptcy is on the table.

Stock for next week? (Arch Capital: Adyen)

Sources and Further Reading

Reviews on best airlines to fly to Hawaii: https://nextvacay.com/best-airline-to-fly-to-hawaii