Not So Deep Dive: LGI Homes (Ticker: LGIH)

Is any homebuilder immune to broad declines in home prices?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: LGI is a homebuilder that designs, constructs, and sells homes to first-time buyers who are making the switch from renting to homeownership. However, unlike some of the other homebuilders we’ve studied (NVR and Dream Finders Homes) who use options-based purchasing models, LGI typically buys large plots of raw land outright and then converts them into residential communities.

LGI’s land acquisition strategy is somewhat unique as well. They will buy cheap land that’s a ways away from major cities where there is a large base of renters, then they’ll send out flyers with a photo of a new house saying something along the lines of “Tired of paying rent?” And oftentimes, these communities qualify for “rural development” assistance, so the buyers can get help with their down payments.

Since they’re building much cheaper properties, this also means they’re looking for the cheapest land. So LGI operates mostly in markets where the land isn’t a hot commodity. Their two most dominant markets are Central (Texas and Oklahoma) and the Southeast (Georgia, Carolinas, Alabama, and Tennessee). And the homes are designed within a set number of floor plans and have standardized finishes, so rarely is there a whole lot of customization in the process. They also stick to prices, no negotiations.

While it’s hard to pin it down to one thing in particular, LGI has spent years optimizing its processes and now touts industry-leading margins across the board. For reference, last quarter, they had 32% gross margins and 17% net margins.

(Ryan) History: LGI was founded in 2003 in Woodlands, Texas by Thomas Lipar. Lipar, along with a partner, attracted some capital from private equity and began constructing their first community Summerset Estates, which was right outside of Houston. Since then, it’s been a constant refinement of their systems and expansion into new cities that’s driven growth for LGI.

I really can’t do it justice on this podcast, but according to stories from some reporters, they are intensely focused on optimizing this “system” or playbook they have for the construction and sales of homes. Unfortunately, LGI didn’t go public until 2013 so we don’t really have data on how they fared during the financial crisis (but obviously they survived).

(Brett) Industry/Landscape/Competition:

LGI Homes operates in the exact same industry as DFH and NVR (homebuilding), so they have the exact same opportunities

The industry is expected to do around $129 billion in revenue in the United States, giving LGI approximately 2% market share

Remember, the industry can be affected by interest rates, demographics, and other cyclical variables in the economy. This is a highly cyclical business and we are seeing that play out in 2022 with mortgage rates soaring through the roof

Competitors: DR Horton, Lennar, NVR, DFH, and many other homebuilders. The core business is a commodity and can be started up by anyone who has the money to buy a lot of land.

(Brett) Management and Ownership:

CEO: Eric Lipar. He founded LGI Homes and has been running the business in some form since. He is 51 years old and is also the chairman of the board. However, unlike at DFH, Lipar does not have a controlling stake in the business. He owns just under 10% of shares outstanding.

The rest of the executive team has long tenures, with the majority having stuck around at LGI Homes since 2013

The total board of directors compensation was $1.11 million or 0.1% of 2021 gross profit

Total executive compensation was $14 million or 1.7% of 2021 gross profit

Executive compensation is a base salary, incentive bonuses, and long-term stock awards. The annual bonuses are based on 75% pre-tax income and 25% on homes closed

Some of the long-term stock awards are based on three-year cumulative EPS growth

The management and ownership section was pretty boring and straightforward for LGI Homes, which is a good thing.

Yellow flag: Uncle of Lipar is on the board of directors and looks like another family member is on the executive team

Yellow flag: The annual bonuses are based on pre-tax income, which may incentivize management to not care about cash flow.

(Ryan) Earnings:

Last 12 Months:

$2.8 billion in revenue

$541 million in EBIT

Negative cash flow due to growth of inventory

Most Recent Quarter:

2,027 home closings, (-29% YoY)

Part of the reason home closings declined was because LGI stopped selling homes that were more than 60 days away from closing as supply chain disruptions caused LGI to miss some of their closing dates.

They said they would extend this out to 90 days in the back half of this year since they see supply chains normalizing.

Average Sales Price of ~$357k, (+29% YoY)

Total homes revenue was $723 million (-9% YoY)

Cancellation rate was 30.5% vs. 24.4% last year

(Ryan) Balance sheet and liquidity:

Liabilities:

$1.2 billion in notes payable

$300 million in 4% senior notes due in 2029

$1.1 billion credit agreement (not all of it’s being used), that bears interest monthly at SOFR + 1.75% and has a couple of covenants:

Can’t exceed a leverage ratio of greater than 60% (currently at ~43% vs 44% last year)

Liquidity of at least $50 million

A trailing 12-month EBITDA/Interest Expense Ratio of 1.75 to 1

Assets:

$42 million in cash

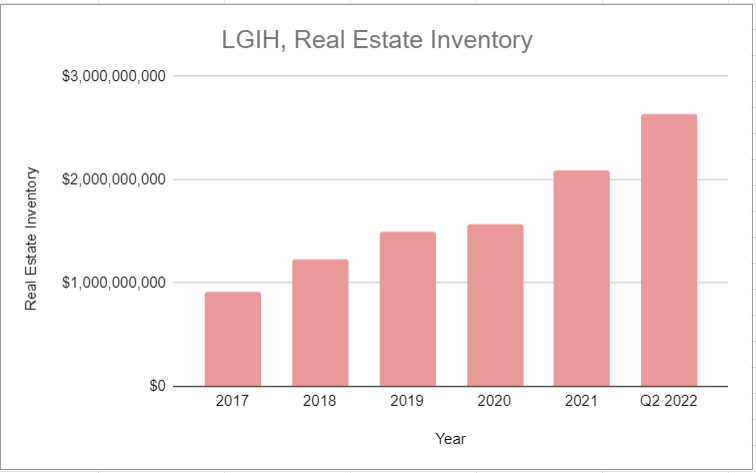

$2.6 billion in real estate inventory, up 52% YoY

67% is raw land, land under development, & finished lots

26% are homes in progress

And 7% are finished homes for sale

Summary: They started a new large land development initiative two years ago and they haven’t had the opportunity to sell through it yet. Assuming they can sustain some reasonable demand, cash flow should accelerate this year.

(Brett) Valuation:

Market cap of $1.9 billion

Enterprise value of $3 billion

EV/GP of 3.8

EV/OI of 5.7

EV/FCF of -7.9 (negative over TTM)

Anecdotal Evidence:

(Ryan) It still feels like there’s a home shortage. Rental supply feels tight, which makes me think that homes in this affordability bracket will always be in demand.

(Brett) Hard to find any anecdotal evidence as a consumer. However, looking at LGI’s topline growth, it is clear they have been efficient in using a debt strategy to grow the size of this business and have been smart on what areas to grow in.

Future growth opportunities:

(Ryan) Not pouring money back into land and instead returning capital to shareholders. At least for a little while. They just took a big swing on land and they’ve got 70% undeveloped. LGI trades at a historically low multiple. I think it’d be better right now to let the inventory drop while they repurchase.

(Brett) Counterintuitively, in the short run it could be beneficial for LGI Homes to slow down its sales and land acquisitions. Why? Because of all the uncertainty around mortgage rates at the moment. If mortgage rates stay high for many years, then LGI Homes is likely overpaying for land. However, if it runs through its $2.6 billion in inventory and gets more cautious, it could mitigate any of this potential risk. Management has a good track record of being aggressive when everyone else is cautious and cautious when everyone else is aggressive. I would hope they do the same today.

Highlights and lowlights:

Ryan’s Highlights

Since 2020, they’ve repurchased about 12% of their common stock.

Their margins vs. peers validate to me that they really are optimized operationally, and this “system” they implement works.

Since LGI sells starter homes, I feel like they’re better positioned in an “affordability crisis”. If it gets tough to afford homes, people could trade down.

Ryan’s Lowlights

The cash flow always ends up back in physical assets.

They seem to have taken a pretty big bet on land at a pretty unfortunate time.

Cancellation rates are jumping. Maybe I’m wrong about how they’d fare if affordability is a problem.

Brett Highlights:

Track record of growth with a sound strategy in a commodity industry. I like that they go for the cheaper areas around the big cities. With the rise of remote work that spreads cities out this could be a specific tailwind for LGI that does not have exposure close to downtowns.

Management’s long tenures (CEO and the rest of the executive team) make me think they have a strong culture.

Brett Lowlights:

Growth has been fueled by debt. This is a wonderful strategy when interest rates are low, but gets more difficult when interest rates are high.

The business has struggled mightily to convert operating income into cash flow. Yes, these are just working capital adjustments, but it makes it lower quality in my opinion.

The industry is highly cyclical and can make this business perform terribly even if management executes flawlessly with its strategy.

Bull Case:

(Ryan) Let’s draw it out. 3 years from now, they’ve developed most of the raw land that they have on their balance sheet, they’ve sold 11,000 homes a year on average, and the sales price remains flat. If they maintain 25%-28% gross margins, ~13% operating margins seem achievable which would result in more than $500 million in annual operating income. That puts them at an EV/OI of 5.7x. Over the last 10 years, they’ve averaged an EV/EBIT of 10.5x.

(Brett) At 5.5x operating income and a large portion of its enterprise value in real estate inventory, you don’t need much from LGI Homes in order for this to be a good investment. I would need to answer two questions with confidence before investing: one, how far will margins go down as interest rates rise? And two, can the business start generating consistent cash flow?

Bear Case:

(Ryan) They can’t sell through the homes they finish. This feels like a realistic scenario. This leaves them with homes simply sitting on their balance sheet and debt they have to repay. Essentially, the whole bear/bull case hinges on whether or not there’s enough buyer demand over the coming years. I’m not certain there is.

(Brett) The housing market in the United States goes into a major downturn over the next few years, debt costs rise due to rising interest rates (double whammy on home prices too), and the company continues to struggle to generate positive cash flow. I could see this business look like it is generating solid “profits” but never generate much true cash that is available to be returned to shareholders.

More or less interested?

(Ryan) Less interested. I worry about cyclicality and the company’s struggles to generate cash flow.

(Brett) Less interested. I liked the management and culture, but this is a bad business operating in a tough industry.

Stock for next week? (Dassault Systems)

Sources and Further Reading

2nd Quarter Investor Presentation: https://investor.lgihomes.com/static-files/0e7f3179-0794-445d-9715-23ac4492f0f0

Article on their unique operating model: https://www.probuilder.com/2016-builder-year-lgi

2022 VIC Write-up: https://www.valueinvestorsclub.com/idea/LGI_HOMES_INC/512821894

Redfin October 2022 Update: https://investors.redfin.com/news-events/press-releases/detail/818/redfin-reports-sellers-time-on-market-doubles-from