Not So Deep Dive: Lowe's Stock (Ticker: LOW)

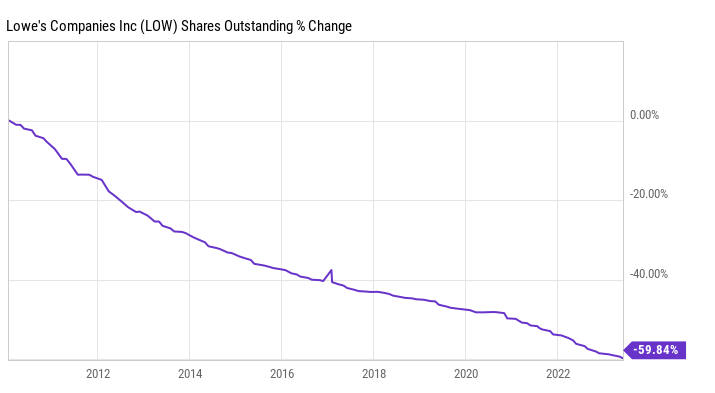

Shares outstanding have declined at a 6.4% annual rate since 2010

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

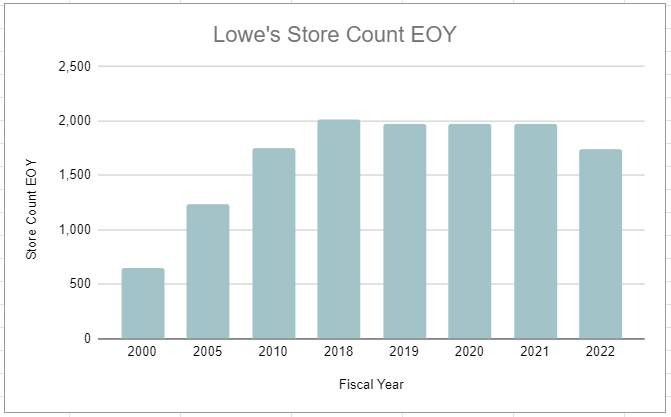

(Ryan) What they do: Lowe’s is the world’s 2nd largest home improvement retailer behind Home Depot. They have ~1,700 stores throughout the US with each one averaging about 144,000 square feet if you include their gardening section (that’s about the same size as a Home Depot store). Lowe’s sales come from lots of different categories. The 4 largest are Appliances, Lumber, Outdoor living products, and Lawn & Garden. Combined, those make up a little over 40% of their revenue. But they also sell Kitchen & Bath products, Paint, Tools, Rough Plumbing products, and plenty more.

Now Lowe’s sells to pretty much 3 different customer types: DIY, Pros, and DIFM.

DIY: DIY customer makes up the majority of the business at around 75% of sales. This is your typical homeowner that’s renovating their house or making some kind of improvement, and it’s been a growing market for them as the number of housing units in the US has grown about 1%-2% a year for a long time.

Pros: This is the second biggest segment for Lowe’s at around 25% of sales. And it’s selling to Tradespeople (Painters, Plumbers, Electricians), repair and remodelers, and property managers. This segment requires a lot of its own customized tools including separate checkout and support, online dashboard, bulk discounts, loading assistance, and membership rewards.

DIFM: This is a small business for them, but Lowe’s offers installation services to customers through a network of independent contractors. This means customers can have flooring put in, bathroom or big kitchen appliances installed, and lots of other services.

The focus really for Lowe’s over the last decade or so has been this Total Home Strategy which includes 5 pillars. 1) Drive Pro Penetration. 2) Accelerate the online business. 3) Expand Installation Services. 4) Drive localization. 5) Elevate Assortment.

(Ryan) History: The origins of Lowe’s started in 1921, when Lucius Lowe opened a hardware store in North Wilkesboro, North Carolina. That store was moderately successful, but Lucius never really wanted to expand the business. Lucius Lowe passed away in 1940 and the business was inherited by his sister who then sold it to her brother (a little weird). Her brother and her husband, Carl Buchan, then ran the business together as partners from then on. Buchan is really credited as sort of the founder of Lowe’s despite not being in the family because in 1943 he apparently anticipated the post-WWII construction boom and had the store reposition its focus to specifically hardware and building materials.

After success with that hardware/building materials focus, they began to expand into other locations throughout North Carolina. Around that time Buchan became the sole owner of the hard goods business and Jim Lowe (the brother) instead started the Lowes Foods grocery chain. The 50s marked a period of steady expansion for Lowe’s and really an overall professionalization of the operations. They went public in 1961 and from there began to expand nationally. Interestingly, at the time, Lowe’s was really focused on selling to professional builders. It wasn’t until about 1978 that they really began to market themselves to the DIY demographic. From that point forward the Lowe’s story has really been an expansion of that model. However, since 2010 it has been a little different. They really began slowing their store count growth around that time (except for one big acquisition in 2014) and started to prioritize more of the sales per square foot. It was also around that time that Lowe’s began a consistent buyback program. Here’s what share count looks like since 2010.

(Brett) Industry/Landscape/Competition:

When you look at Lowe’s it clearly has a huge addressable market. It operates in the home improvement/building space, which management estimates have annual spending of $1 trillion

This can be divided (generally) in half between professional customers and DIY individuals. However, Lowe’s has 75% share in DIY and only 25% share in Pro. They want to expand their presence in Pro over the next decade

Management also says there are three macro factors that affect this business: personal incomes, age of the housing stock, and home price appreciation

Competition: Tons. You can probably divide them into three categories

One: Home Depot. The leader in the space, larger than Lowe’s, and the only “direct” competitor with the national brand

Two: Regional/local competitors. These are the SMBs and smaller brands that compete as broader home improvement stores. For example, in our small college town, there was no Home Depot or Lowe’s but a smaller “Town Building Supply” that provided tools for DIYers and farmers in the area.

Three: Niche offerings from brands. This could be a Sherwin-Williams store, Ace Hardware, or Floor and Decor.

With $96 billion in revenue, Lowe’s is closing in on a 10% market share for the entire home improvement category

(Brett) Management and Ownership:

Lowe’s is led by Marvin Ellison, someone who has been around the retail business for years. He was appointed CEO in 2018 after getting appointed to turn around J.C. Penny (don’t think we can fault him for that company's failure)

Previously, he worked at Target and Home Depot. The Home Depot experience is quite interesting:

“He has extensive experience in the home improvement industry, having spent 12 years in senior-level operations roles with The Home Depot. Most notably he served as Executive Vice President of U.S. stores from 2008 to 2014, dramatically improving customer service and efficiency across the organization, as he oversaw U.S. sales, operations, installation services, tool rental and pro strategic initiatives.”

The company uses the standard trifecta of base salary, annual bonuses, and stock awards

Annual bonuses are mainly based on sales/operating income targets with a tiny amount focused on Pro Sales growth and inventory turnover. These are solid targets for management.

The performance stock units are based on ROIC hurdles and TSR relative to the S&P 500. I think this is fine as well and should incentivize them to continue buying back stock

Nothing special about insider ownership or funds that own this thing. Basically all just the investment banks and passive. Super boring. However, it should give them endless firepower to repurchase more shares.

*Based on 585,980,783 shares outstanding as of the latest filing

(Ryan) Earnings:

Last 12 months:

$96B in revenue (has declined slightly due to weakness in the DIY category)

$12.2B in operating income

$9B in EBT

Last 10 years:

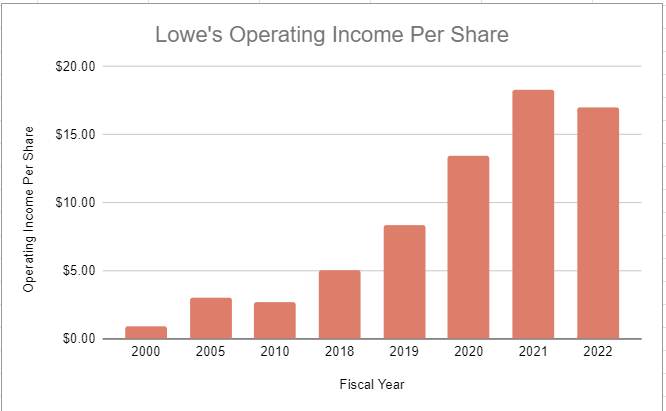

Revenue has grown at 6.5% annually

Operating margins have gone from 8% to 13%

EPS is up 18.5% annually (god bless that buyback)

(Ryan) Balance sheet and liquidity:

Assets:

$3 billion of cash and equivalents

$20 billion of inventory

$17 billion of property value

Liabilities:

$36B in LT debt

70% of it is due after 2027

Weighted-average interest rate of 3.8%

Net debt to EBITDA is ~3x

This has been an exceptional levered buyback strategy and I don’t see any reason why it can’t continue. Maybe a greater % of the buybacks will come from FCF with rates where they’re at.

(Brett) Valuation:

Market cap of $127.5 billion

EV of $160.6 billion

EV/OI of 15.8

P/FCF of 21.8

Anecdotal Evidence:

(Ryan) I’ve been in them, and I don’t really notice the biggest difference between them and HD, but I’m not really a recurring customer. I like Marvin Ellison though. He seems to have a really solid grasp on the business.

(Brett) I don’t think I’ve ever been to a Lowe’s. For some reason I’m a Home Depot guy but I don’t know why, and I’m also not a meaningful customer of the business. I think the way they’ve changed the Pros business could be underrated by investors.

Future growth opportunities:

(Ryan) Growing Pro penetration. Despite having its roots largely in the contractor business, Lowe’s has been behind the ball when it comes to properly serving this group. About 5 years ago, they interviewed Pros that left them to see why, and here’s what they said “1) You’re always out of stock. 2) Associate training consistency is all over the place. 3) Can’t count on you to have loading assistance. 4) You can’t distinguish me from anyone else. 5) You don’t have the national brands.” They say they’ve been working on all of that and it’s starting to bear fruit. 600bps Pro Penetration improvement since that point.

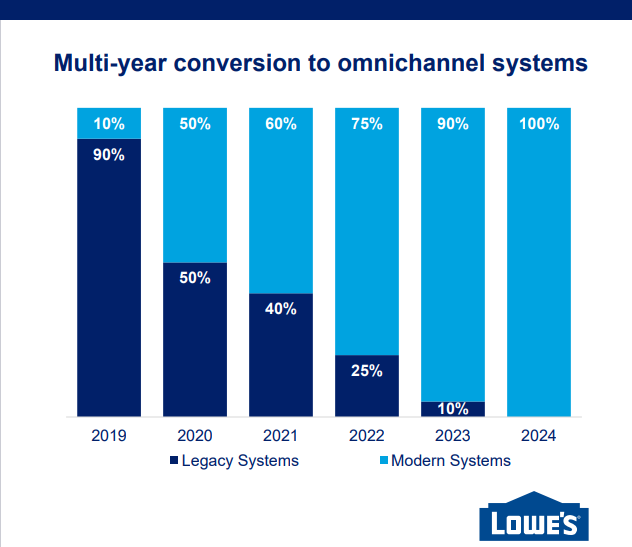

(Brett) Getting off of the legacy software/operating systems. Identifying future growth opportunities for Lowe’s is difficult as they really just want to drive more volume through existing stores and ride U.S. economic growth. One way they are trying to reduce friction (and therefore increase volumes/efficiency) is to get rid of its legacy software systems and upgrade the entire Lowe’s ecosystem to modern software programs to help its omnichannel experience. This will make it easier for stores to serve Pros, individuals, e-commerce, delivery, etc., and hopefully help grow comp sales while not increasing much in costs.

Highlights and lowlights:

Ryan’s Highlights:

Durable business with economies of scale. 2/3rds of sales are non-discretionary according to Ellison and they’re still well positioned to grow share overall against everyone except Home Depot.

I think it’s honestly a positive that they’ve been losing to Home Depot in a number of ways and yet generating such good returns on invested capital. If they start to make up some ground in terms of sales per square foot, I think that provides a lot of upside.

I like that Ackman is involved.

Ryan’s Lowlights:

Home Depot is beating them in the Pros category. Hard to tell what the big advantage is for HD here since both membership programs seem pretty much identical. According to some contractor surveys, HD has better business management tools but everything else is comparable. HD gets ~50% ($78B) of revenue from Pros vs. just 25% ($24B) for Lowe’s.

Brett Highlights:

As with a lot of these share cannibal episodes, there is a lot to like with Lowe’s. They have a duopoly, are doing all the right things to increase their competitive position, treat customers and employees well, and consistently return cash to shareholders through repurchases and dividends.

Brett Lowlights:

I think there is a chance they get knocked around a bit by niche competitors such as Floor & Decor over the long term. But otherwise from a competitive standpoint, it is hard to argue there is a company in a better position in retail, maybe besides Amazon Retail and Costco.

The 2020 and 2021 housing bubble could be worse than we are thinking. Yes, Lowe’s is still going to benefit from rising personal incomes (where do you think the UPS raises are going to flow to?) and aging housing stock, but if home prices stagnate for a while or we actually don’t have an undersupply of housing (I don’t think we do), they could face a bit of a headwind in the next five or so years.

Bull Case:

(Ryan) I think they’re in a pretty good position to generate double-digit returns from here. If they grow sales by their last 10-year average of 6%, margins stay consistent, and they use all of their cash flow to buy back stock. You’re going to get probably 12%-13% EPS growth. If the multiple drops that figure will probably be even higher. Or they could honestly even take on more debt from here.

(Brett) Today, we are trading at a trailing EV/OI of 16. For a giant company trading at slightly below the market average, I think you need to be confident in all three of these things in order for the stock to work over the long term: consistently positive comp sales, steady margin expansion, and consistent dividends/share repurchases.

Bear Case:

(Ryan) Weakness in the real estate market leads to lackluster DIY performance. That would probably result in lower-single-digit revenue growth, which certainly worsens things.

(Brett) At least one or two of the three things that will drive shareholder returns in the bull case turn into headwinds. Comp sales are weak due to deflation or stagnate housing, margins compress because of it, and capital returns strategy changes with new management.

More or less interested?

(Ryan) More interested. Very durable business and should be able to continue buying back stock at its impressive pace.

(Brett) More interested. As with AutoZone, I’d be all over Lowe’s at a trough earnings multiple of 10. That’s the magic target for share cannibals.

Stock for next week? (Discover Financial)

Sources and Further Reading

2022 Investor Presentation: https://corporate.lowes.com/sites/lowes-corp/files/event-qr-code/2022_Analyst_and_Investor_Conference_Presentation.pdf

Pershing Square Writeup: https://assets.pershingsquareholdings.com/2022/10/07155009/2018-Interim-Financial-Statement-Letter-Only.pdf

Short thesis 2023: https://www.valueinvestorsclub.com/idea/LOWES_COS_INC/7429845296#description

Long thesis 2018: https://www.valueinvestorsclub.com/idea/LOWES_COMPANIES_INC/1937248117