Not So Deep Dive: MarketAxess (Ticker: MKTX)

Is the electronic bond trading market developing into a duopoly?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Block/Square (next week), American Express (week after), and Nelnet (three weeks away)

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: MarketAxess is an electronic trading platform for fixed-income securities. For those that don’t know the lay of the land when it comes to fixed income, it’s quite different than equities and Brett will go through that a bit in a second. But in general, the face value of most bonds is $1,000 which makes it more expensive to get into it. Historically, you’ve had to get in contact with an actual broker who would connect you with other investors looking to sell their bonds. Simply put, MarketAxess is democratizing and digitizing that process. And MarketAxess makes money in 3 ways:

Commissions: MarketAxess earns a mix of distribution fees and variable fees across its platform. Distribution fees are monthly charges that allow users to trade unlimited volume. Variable fees vary depending on the type of bond being traded, the duration of the bond, and the size of the order.

Disclosed Request For Quote (RFQ): This is their traditional protocol or platform that makes up ~60% of their credit trading volume. It allows institutional investors to request bids or offers from their dealer clients. By getting competing bids simultaneously they can pick the best quote or price and save themselves money.

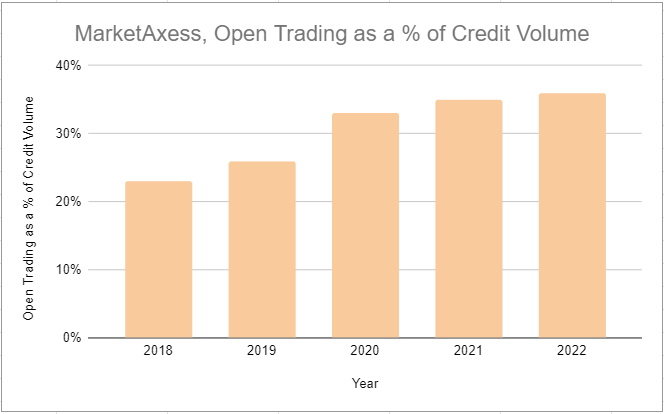

Open Trading: This segment functions much more like an exchange and is accounting for an increasing amount of their credit trading volume (~38%). This allows participants to trade bonds from anyone else on the platform and do so anonymously.

Automated Trading Protocols: Only accounts for about 6% of trading volume, but their automation protocols allow clients to set parameters to trade automatically.

Information Services: There are a number of products here but basically it’s MarketAxess aggregating and selling their platform data to clients for a monthly price. Only accounts for about 5% of revenue.

Post-Trade Services: In Europe, all investment firms are required to submit their transactions to regulators within a day of the sale or purchase. MarketAxess provides those investment firms a reporting solution for multiple different asset classes. Accounts for ~6% of revenue as well.

And there are six different fixed-income asset classes that they offer on their platform. US High-Grade (Rated BBB- or better by S&P), US High Yield (Rated BBB- or lower by S&P), Emerging Market debt (bonds issued by developing countries or corporations in developing countries), Eurobonds (Corporate bonds from companies in Europe), Municipal Bonds (Issued by states, cities, and counties, for public projects), and US government bonds. Aside from US government bonds, most of the bond markets are still not traded electronically.

(Ryan) History: MarketAxess was originally founded in 1999 by Rick McVey. McVey was actually an executive at JPMorgan at the time working in their fixed-income division. At the time JPMorgan had an incubator project called Lab Morgan which backed McVey’s efforts to build a web-based credit platform. They also received funding from Bear Sterns and other prominent financial institutions.

With strong financial and customer backing, MarketAxess got off to a pretty quick start when it began offering newly issued investment-grade corporate bonds to platform customers. In 2004 it went public and since that time they’ve acquired a number of competing platforms to become the massive platform that they are today.

(Brett) Industry/Landscape/Competition:

The fixed-income market has a huge and complex addressable market, which MarketAxess thankfully breaks down for investors

The addressable average daily volume (ADV) for the credit market is $72 billion

The addressable ADV for the U.S. treasury market is $589 billion. Spoiler alert, the U.S. treasury market is huge

Last year, the company did $11.8 billion in ADV (excluding treasuries) and estimates that it has approximately 20% market share across its product categories.

For every 1% market share gain in credit, they estimate that adds $40 million in revenue. So if they double their market share in credit (currently 20%) that is $800 million in new annual revenue

Treasuries are a lot less profitable, with every 1% market share gain equating to $4 million - $5 million in additional revenue. So the real value is in MarketAxess gaining share with credit (which they have been doing).

Competitors: I will outline two main ones. First, is the traditional/analog method of bond selling (phone, e-mail, instant messaging) that the digital platforms have tried to disrupt. Second, is other digital platforms like Tradeweb. The Tradeweb is a slightly different business than MarketAxess but has an ADV for the credit markets of $10 billion. They are the two largest players in electronic bond trading today.

In the 10-K, they specifically outline that they are worried about information service providers like Bloomberg, ICE, and others starting to offer electronic trading to clients

Here is a quote from a Bloomberg article outlining why electronic trading is growing market share, especially since the start of the COVID-19 pandemic: https://www.tradeweb.com/newsroom/media-center/in-the-news/the-bond-trading-revolution-is-real-this-time/

“Goldman struck a deal in October with MarketAxess in which it committed to become a dedicated market-maker and contribute streaming prices for U.S. investment-grade corporate bonds. The MarketAxess Live Markets order book “gives institutional credit investors and dealers the ability to place resting live orders in the market and engage firm prices provided by dealers and investors with a single click.” In other words, no need to call Goldman every time — just click.

Having Wall Street’s support, instead of long-held opposition, could be the last step to a fixed-income revolution. “It’s almost gone full circle, and now the most sophisticated dealers have learned how to operate very effectively in those electronic markets as well,” McPartland said.

I remember in September 2019, during a conference held at the Federal Reserve Bank of New York, when Scott Minerd at Guggenheim Partners lamented the “archaic method” of calling three dealers to obtain a bond price. “It’s a low-value add. We’re not curing cancer, we’re getting a quote on a bond,” he said.”

(Brett) Management and Ownership:

The founder, CEO, and chairperson of the board is Richard McVey, who has been running this business since the beginning.

However, the company just announced that Chris Concannon, current chief operating officer (COO), will take over the reins as CEO on April 3. McVey will remain as chairperson of the board. Concannon has been with MarketAxess since 2019 and before that was CBOE Global Markets, Virtu Financial, and Nasdaq.

They have 13 members of the board who get paid a total of $2.76 million annually, or 0.4% of revenue

Total executive compensation in 2021 (latest numbers) was $19.6 million, which is 2.7% of 2022 revenue. No concerns there. We try to run these numbers and make sure it is at least in the low single digits, and if not, ask why.

Annual cash bonuses are half based on adjusted operating income targets, the other half on individual goals

The equity compensation is half time-weighted restricted stock units (RSUs) and the other half is performance stock units (PSUs)

The PSUs are based equally on credit market share gains, revenue growth outside of U.S. credit, and operating margin. I like all of these targets.

When looking at the proxy statement, I had trouble finding any red or yellow flags that makes me concerned about the company’s values, which is a good thing.

(Sources: Whale Wisdom and latest Proxy filing)

(Ryan) Earnings:

2022:

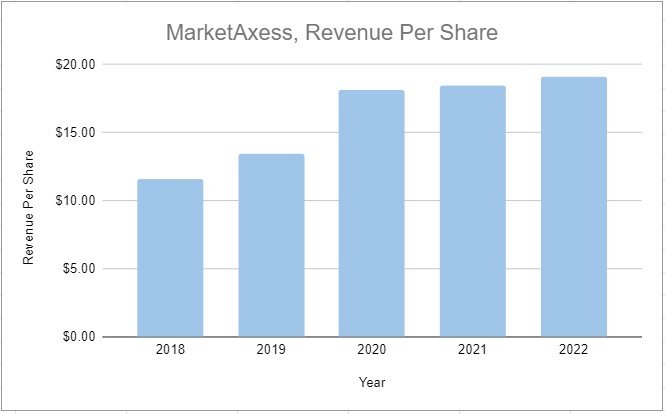

$718 million in revenue, +3%

$327 million in operating income (45% operating margin)

$261 million in free cash flow (36% free cash flow margin)

Most recent quarter:

Growing market share across most products

Revenue was up 8%

24% increase in average daily volume

Reached 2,068 total active firms on the platform, up 10%

But saw a 10% decline in average fee per transaction due to more trading of lower-duration bonds

44% operating margin, still investing and hiring though to support growth in newer markets.

(Ryan) Balance sheet and liquidity:

Really simple balance sheet

No debt

$431 million in cash and $84 million in investments (mostly US treasuries)

So call it $500 million in net cash

(Brett) Valuation:

Market cap of $13.3 billion

Enterprise value of $12.8 billion

EV/OI of 39.2

EV/FCF of 49.1

Anecdotal Evidence:

(Ryan) Zero product experience. I will say, however, it’s very refreshing to see a fast-growing tech company that operates so efficiently. They had 676 employees as of the last 10-K. That’s more than $1M in revenue per employee and they consistently return capital to shareholders.

(Brett) The pitch for why their products need to exist seems sound. Why can’t bond trading become more like equity trading? I think it should. I also like management’s frugality. However, I did not like their discussion on the analyst call that they repurchase shares “to offset share based compensation.” This is the exact wrong way to look at it because you could be repurchasing stock at absurdly high valuations, as they did in 2020 and 2021.

Future growth opportunities:

(Ryan) Acquiring other digital bond marketplaces. Similar to what they did with MuniBrokers in 2021. MuniBrokers in this case was a platform that connected municipal securities brokers to institutional traders. Sounds like the name of the game here is getting as much scale as they can across all sorts of fixed-income segments and the quickest way to do that feels like acquiring platforms for their customers. Their customers don’t just trade one bond type they trade across fixed-income classes. Having strong liquidity across all asset classes must improve the value prop of the platform overall.

(Brett) Open Trading. MarketAxess’s Open Trading product allows clients to trade directly with each other anonymously, among other things. This seems to be the next step in bringing bond trading to the digital age and making them more like equities and actually making MarketAxess more like an exchange. Open Trading has gone from 23% of volumes in 2018 to 36% last year, so it is growing steadily. I think this has a great chance to widen MarketAxess’s moat over the next decade as it provides better liquidity to clients and saves them tons of cash. In 2022, they saved an estimated $945 million on pricing through Open Trading.

Highlights and lowlights:

Ryan’s Highlights:

Network Effect. The more brokers that are on the platform, the better prices being quoted to traders, which means theoretically more money saved. The more traders that are on the platform, the more likely the brokers are to get bids for their bonds being sold.

Still benefiting from a gradual switch to electronic trading. I’ve seen some skeptics mention that it will never go all digital, but from what I can tell, and what management says it seems like on a long enough time frame bond trading will go increasingly digital. US high yield, municipal bonds, and emerging market debt all have less than 25% of bonds traded digitally.

Possibility of sustained high rates. This should draw more trader interest over time and be a general growth driver for them.

Ryan’s Lowlights:

Market share stagnating in US High-Grade bonds. This is where most of their fees come from.

Don’t seem to be getting that great of adoption on their distribution fee model which makes me question their competitive position. With variable fees still growing faster, are investors just using multiple platforms and seeing where they can get the best price?

Brett Highlights:

This is a classic network effect. The more clients that join the platform, the more valuable they are to each other, which increases the value MarketAxess can provide to all of them.

Expansion into emerging markets and new credit products is obviously smart. Like a stock brokerage, MarketAxess can provide the most value to its customers the more offerings it has on its platform. This also can widen its moat.

I think there is likely a regulatory moat here. For example, look at this proposal from MarketAxess, Tradeweb, and Bloomberg for the Euro market: https://www.thetradenews.com/bloomberg-marketaxess-and-tradeweb-take-the-wheel-in-european-fixed-income-tape-plans/

“Major fixed income execution platforms Bloomberg, Tradeweb, and MarketAxess have confirmed they will be collaborating on how to push through plans for a consolidated tape for fixed income in Europe.

The three entities have set out plans to apply to become the consolidated tape provider through the public procurement process organised by ESMA. As part of this process, Tradeweb, Bloomberg and MarketAxess are now preparing a competitive request for information process to begin reviewing independent third-party partners that have the potential to offer the consolidated tape service.”

They are inflation-protected, at least over the long term.

Brett Lowlights:

Management transition. I love that MarketAxess has essentially been founder-led forever, but McVey is now passing the torch off to his successor. No matter how smart/qualified the successor is, executive change brings uncertainty to a stock.

The competitive stance vs. Tradeweb and any of these newer electronic trading platforms are unclear. Why do clients choose Tradeweb over MarketAxess or vice versa? Can/do they use both, and does that mean there is no pricing power? Will these two companies form a duopoly that has rational pricing? Can other financial technology companies like Bloomberg, ICE, etc. use their distribution to cut in on some of this market share? I am just a little unclear on what MarketAxess’s market share will be a decade from now, although I think it can be much higher.

Bull Case:

(Ryan) For starters, I think you have to believe that rates are going to stay high and that trading volume on the platform is going to grow by at least 15% per year over the next 5 years. And their take-rate or fees per million is going to stay relatively flat during that time period. If those things happen, and operating margins stay around 48%, they’d be generating about $700 million in operating income in 5 years. If you value it at 25x operating income, you’ll have a market cap of ~$18B. That’s a low single-digit CAGR.

(Brett) At an EV/OI of 40 with already high-profit margins, I think you need to expect a few things from MarketAxess in order to make money here. First, you need to believe they are under-earning due to what has happened in the credit markets in the last two years + foreign exchange headwinds. Second, you need to believe operating margins still have room to expand. Third, you need to believe the steady market share gains continue this decade. If all three of these things are true, I think you can make money buying today over the long term.

Bear Case:

(Ryan) Multiple compresses, take rate compresses, and margins don’t expand. If that happens, there’s really no way you’re getting a double-digit CAGR. Unless rates go to like 12%.

(Brett) Multiple compression. The company has grown its revenue at a 12% - 14% CAGR over the last decade. If that slows down to 5% - 10%, there is no question the multiple rerates lower, which at an EV/OI of 40 would be bad news for shareholders.

Sources and Further Reading

Corporate Timeline: https://www.marketaxess.com/timeline_milestone

2019 VIC Short Report: https://www.valueinvestorsclub.com/idea/MARKETAXESS_HOLDINGS_INC/1477010560

Q4 earnings presentation: https://s201.q4cdn.com/767283836/files/doc_financials/2022/q4/4Q_FY-2022-Earnings-Deck-FINAL.pdf

Q4 earnings release: https://s201.q4cdn.com/767283836/files/doc_financials/2022/q4/4Q_FY-2022-Earnings-Release_v10-FINAL.pdf

October 2022 Investor Presentation: https://s201.q4cdn.com/767283836/files/doc_presentation/2022/10/Investor-Presentation-3Q-2022.pdf

Any way I can access past reports? Not able to subscribe to premium for some reason