Not So Deep Dive: Mercadolibre (Ticker: MELI)

How much runway does this e-commerce and fintech platform have in Latin America?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming Schedule for December:

GoDaddy

Squarespace

Adobe

Wix.com

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Charts

Show Notes

(Ryan) What they do: MercadoLibre is the largest internet marketplace in Latin America. They operate in 18 countries with the bulk of revenue coming from Brazil, Argentina, and Mexico, and service more than 88 million unique active users. While Meli has lots of different elements to their business, they break it down into 6 categories:

Marketplace: MercadoLibre’s e-commerce platform gives buyers and sellers a secure place to transact online and it’s on pace to process more than $30 billion worth of merchandise volume this year. This segment is very similar to Amazon retail. They have a large logistics footprint that allows them to deliver most orders within two days and they sell a number of items themselves.

Payments (MercadoPago): This was started initially to help process payments on their own platform but has since grown into a more comprehensive digital wallet. Pago offers a white-label solution that retailers can integrate into their own websites and peer-to-peer functionality so app or website users can transfer money to other users. As of last quarter, MercadoPago has 42 million active users and 22 million of those are wallet payers. For reference, the current estimate for the Cash App is just over 40 million MAUs.

Logistics (Mercado Envios): MercadoLibre offers its sellers access to internal fulfillment and warehousing services. Sellers don’t have to choose this option but it allows them to offer discounts to many of their customers and it can often fulfill orders much faster than other 3rd party solutions.

Ads: Exactly what it sounds like. Merchants or external advertisers can promote their items on MercadoLibre’s various marketplaces. The ad space here includes product searches, banner ads, and suggested products. This is one of those perfect examples of leveraging scale for higher-margin opportunities.

Credit (Mercado Credito): MercadoLibre provides loans to two different stakeholder groups. Its sellers, to help them with their working capital needs, and personal loans to consumers. Initially, these were loans to help them buy items on a MELI marketplace or through other sites with a MercadoPago checkout process, but in 2019 they began extending personal loans to recurring borrowers for off-platform purchases. The outstanding credit portfolio has gone from $284 million in Q3 2020 to $2.8 billion in Q3 2022.

Storefronts (Mercado Shops): Shops allow sellers to easily set up a digital storefront with Mercado Libre as the host. They can easily integrate their stores into other marketplace offerings and it’s zero cost to set up. They instead pay commissions on transactions flowing through their site. This is also where it draws parallels to other companies we’ll be talking about this month like Wix and Squarespace.

(Ryan) History: Mercadolibre was founded in 1999 by Marcos Galperin while he was attending graduate school at Stanford. Two other students, Hernan Kazah and Stelleo Tolda (current COO), helped him launch the business and from everything I’ve read, it was a pretty straightforward path. Initially, with the goal of being a consumer-to-consumer marketplace in Argentina, the idea received plenty of funding including from JPMorgan, Goldman Sachs, GE Capital, and plenty of others. Within two years, eBay – (who Galperin modeled the business after) acquired a ~20% stake in the business. They quickly opened operations throughout different countries in Latin America and raised nearly $300 million in its 2007 IPO. They were actually the first Latin American tech company to be listed on the NASDAQ. Since then they’ve used their cash to continue building out their logistics infrastructure and have ventured into the other operations I mentioned above.

(Brett) Industry/Landscape/Competition:

The e-commerce industry in Latin America is estimated to pass $100 billion (always referencing USD here) in 2022 and is growing rapidly. Projections are for it to hit $160 billion in 2025.

Given the GDP per capita of the nations, delivery infrastructure, and internet penetration, e-commerce is behind the curve compared to the United States, Western Europe, and East Asia

Is there any reason to think Latin America won’t follow the same path as the United States with e-commerce penetration?

Competitors: Offline commerce and delivery infrastructure are some structural competitors. Within e-commerce, Amazon has a decent presence in Mexico and Brazil but only operates in large countries in the region. The main competitor is Shoppee from Sea Limited.

Here is a breakdown of the App Store rankings across important nations for the Mercado Libre, Amazon, and Shoppee competition:

(Brett) Management and Ownership:

Mercado Libre is run by the founder Marcos Galperin, who is 50 years old. He is also the chairman of the board. Galperin graduated from Stanford with an MBA. Dare I say the comparisons to Bezos are apt? Also, not to fall too much in love, but 50 years old seems like the ideal age for a CEO running a maturing business.

Stock ownership of MELI is fairly standard, with no two-class share structure. Growth funds like Baillie Gifford, Capital Research, and Morgan Stanley own shares.

The Galperin family owns 7.74% of the company.

Total BOD compensation of $1.24 million in 2021 so not a concern about overpaying.

Yellow flag: Galperin’s brother is on the board. Still a lot of independent directors. However, the CEO of Brex (26 years old) is on the board. I don’t like to see that.

Executive compensation: $35.2 million in 2021 or less than 1% of 2021 Gross Profit

Galperin pays himself a handsome salary. I don’t necessarily like this but it isn’t a big concern and is based on some solid metrics.

Speaking of which, Mercado Libre has a refreshingly aligned executive compensation structure. It is complicated, but I’ll go through what’s important for investors:

Small base salary each year

Annual cash bonuses based on net revenue, operating income, TPV, shipping time, and Net Promoter Score hurdles Unique hurdles but all of them check out as good incentives

A long-term retention plan (LTRP) paid out over six years is subject to the executive staying employed. It is divided equally over the years, and half of the bonus can get larger or smaller based on where shares are trading. This is a very unique compensation structure but I like it. Again, these are not paid in stock options, but in cash.

My only issue is that Galperin pays himself these bonuses while also owning a lot of stock. They aren’t huge salaries but still, with such a large ownership stake already it feels a bit greedy.

(Source: 2022 Proxy Statement and Whale Wisdom)

(Ryan) Earnings:

Last 12 months:

$9.7 billion in revenue

53% gross margins

$2.1 billion in operating cash flow

17% free cash flow margins

Most recent quarter:

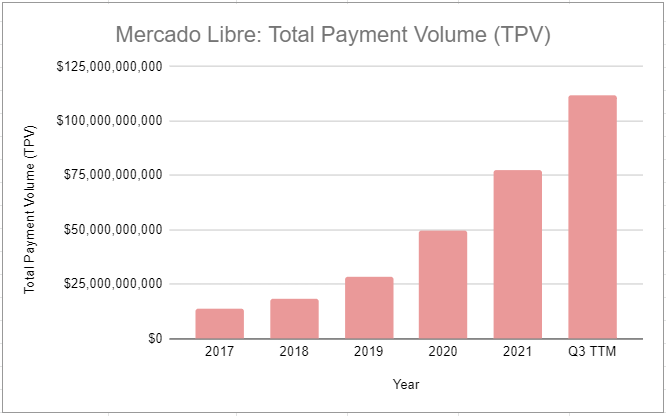

$32 billion in total payment volume, up 76% on a constant currency basis

$2.7 billion in revenue, up 45% (+61% in constant currency)

Fintech is the much faster-growing segment, and Argentina is the quickest-growing geography

88 million unique active customers, up 11.4% YoY

Total payment transactions growing 66% YoY

11% operating margins this quarter

(Ryan) Balance sheet and liquidity:

Probably one of the more complicated balance sheets I’ve looked at due to different borrowings for each company of operation. I’ll try to dissect the parts.

Assets:

$1.5 billion in pure cash and cash equivalents.

$1.9 billion in short-term investments (gov. debt securities)

And an additional $375 million in long-term investments (the majority is still gov. debt securities)

So in total, let’s call it $3.8 billion in cash-like assets.

Liabilities:

$4.7 billion in total loans payable. 42% of it is current. I’ll go through each line item, then talk about the most important ones.

Loans from banks, bank overdrafts, secured lines of credit, financial bills, deposit certificates, commercial notes, finance lease obligations, collateralized debt, 2028 notes, 2026 sustainability notes, 2031 notes, and other lines of credit.

$1.2 billion in collateralized debt. (Frankly, I have difficulty understanding what these borrowings are. I read through the description in the 10-K and it looks like a real word salad. “The Company securitizes financial assets associated with its credit cards and loans receivable portfolio.”)

$1.5 billion in their notes (2026 are 2.4%, 2028 are 2% but convertible, and 2031 are at 3.1%).

And $500 million in loans from banks (a combination of fixed + variable rate debt, but it’s a much higher interest rate than their notes).

In total, interest expense this quarter was $92 million. Annualized, that’s a 7.8% interest rate. Some is variable though, so it could rise.

(Brett) Valuation:

Market Cap of $44.3 billion

Enterprise value of $45.6 billion

EV/s of 4.7

EV/OI of 64.4

EV/FCF of 28.5

Anecdotal Evidence:

(Ryan) Nothing. Actually a bit of a lowlight for me, because not living in the markets or not having used any element of the platform, I worry that there are some pain points within the business or the markets they serve that I’m missing.

(Brett) I wish I tried this when I lived in Mexico for two months. However, I did try using Amazon, and it was a pain. Also, shipping/delivery in Mexico is a pain, so I think it is very plausible that Mercado Libre can invest a ton of capital into infrastructure while getting sold ROIs.

Future growth opportunities:

(Ryan) Logistics. Boring, I know but this is the part of the business that I think can most solidify their moat. They spent $630 million in Capex in 2021 or 65% of their operating cash flow. That was higher than most years, but I like that and hope it continues. Also, slowing down the lending business, which they’re doing. I’m not against them offering this, but I get worried any time I see a company’s loan volume grow 10x in 2 years.

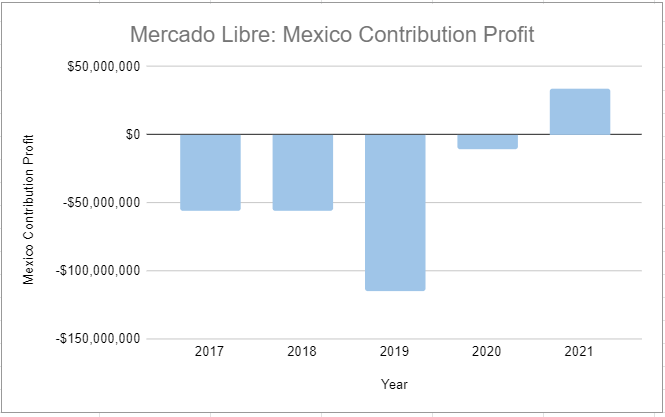

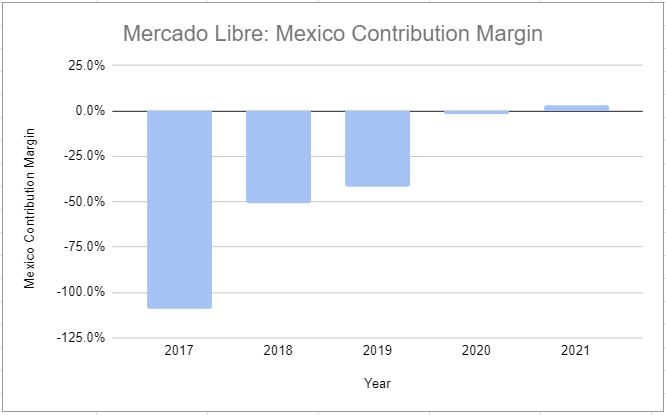

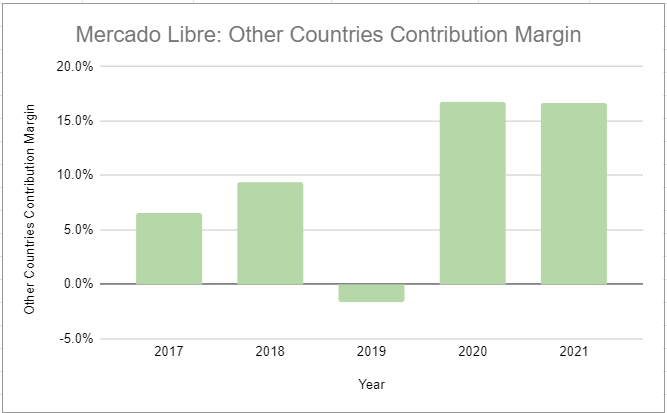

(Brett) Mexico. Looking at the app store rankings, shoppers are flocking to Mercado Libre in the nation, and I could see it gaining market share for many years once it builds out its own delivery infrastructure. With a huge population, strong demographics, and an e-commerce industry ripe for the taking, Mercado Libre could be doing $10 billion in revenue in Mexico five to seven years from now. For reference, through the first nine months of 2017, the Mexico segment did $58.3 million in sales. Through the first nine months of 2022, it did $1.26 billion in sales. Right now, the country has very low-profit margins, but that should change over the next three to five years as expenses start to scale up.

Highlights and lowlights:

Ryan’s Highlights:

Massive opportunity. Internet penetration rates have gone from 35% to 72% over the last decade. And Latin American e-commerce volumes represent only 13% of overall retail sales.

Scale and being early. For an e-commerce marketplace, the scale provides a lot of optionality and ways to increase margins (ads and logistics). This allows them to continue investing in their logistics infrastructure at a faster rate than their peers, further deepening their competitive advantage.

MercadoPago looks like a really solid business. It’s benefitted from the strength of the marketplace and it continues to grow quickly.

Raised convertibles at a great time.

Ryan’s Lowlights:

Mercado Creditos. I have a hard time assessing the quality of a loan portfolio outside of what management communicates to me. We’ve seen companies that lend to small businesses in Brazil get burnt (StoneCo). Loans past due grew by 150% over the last 9 months. “We took a deliberate decision to slow originations as we recognized the risks associated with a weaker lending environment, particularly in Brazil.”

Regulatory/Legal risk. I don’t understand or trust the operating environments in Brazil and Argentina.

Brett’s Highlights:

Execution over the last decade has been phenomenal. They copied a lot of what made Amazon successful, but that is a good thing. And on top of copying Amazon, they are building a legitimate financial technology company through Mercado Pago that could drive the most value for this business over the long term.

Growth of Mercado Ads. Ads are high-margin and can help mitigate margin risk, especially in areas where the existing infrastructure is poor and will need a lot of capital investment. Ads revenue was 1.3% of gross merchandise volume (GMV) in Q3 2022, up from 0.9% a year ago. I think this could easily reach 3% - 4% over the long term and be a strong profit driver for the company.

Building up fulfillment/warehouse infrastructure. I think with so few fast delivery set-ups already in the major Latin American markets, it would be even better for them to invest further into commerce infrastructure instead of credit lending and fintech stuff. This is where the moat comes from and how Mercado Libre can separate itself from competitors like Shoppee.

Brett’s Lowlights:

The number one concern is foreign exchange risk and political risk. Over the last decade, Argentina has steadily moved closer and closer to hyperinflation (the inflation rate is currently 88%). Brazil and other Latin American countries also have recent political track records that make me nervous for business owners…to say the least.

Leaning into financial lending for individuals and small businesses. This is risky, especially in areas with more unstable economies than the United States. Installment payments are now 25%+ of purchases through Mercado Pago, and the company now holds billions in receivables on its balance sheet. What happens if loan delinquencies go up and the economies in Latin America sink? Not saying it will happen, but it could, no matter what its “AI” pricing models determine.

The embracing of cryptocurrency near the top of the bubble was not a good look. It was not a large bet and will have no impact on the business, but I still don’t think it is good for the brand of Mercado Pago long-term.

Bull Case:

(Ryan) Continuing to grow their TPV and take rate. Simon Erickson has written about MercadoLibre before and he said something interesting. “It is the most telling sign of whether MercadoLibre’s hefty investments in infrastructure and digital payments are indeed being valued and utilized by the buyers and sellers using its platform.” However, I think they have to grow GMV & GPV by 20%+ annually over the next 5 years and sustain their current take rate for this to make a market-beating investment.

(Brett) Revenue has grown at a rapid rate (even in USD terms) over the last decade. With such a large market opportunity and the early days of e-commerce in Latin America, the bull case is that this continues and Mercado Libre starts generating $30 billion, $40 billion in sales annually. If margins expand, the business could be doing $4 billion - $5 billion in operating income annually, which would likely equate to solid returns from this share price.

Bear Case:

(Ryan) The first risk is the loan book. That complicates the business and could be a serious headwind to earnings if they have to write down a big chunk of it. Second, is simply multiple compression. If anything less than 20% growth (reported currency not CC), I think they’ll have a hard time beating the market.

(Brett) The valuation bear case is simple, the stock trades at an earnings multiple north of 50. However, from a fundamental/business case I think there are risks that margins will be permanently low, foreign exchange will always be a nuisance, and something within the financial services segment turns into a black hole.

More or less interested?

(Ryan) More interested. Love the opportunity within their core markets and I think there’s a good chance they’ve widened their moat over the next 5 years.

(Brett) More interested. This looks like a business with multiple competitive advantages, but the price is too expensive for me at the moment.

Sources and Further Reading

App store rankings: https://app.sensortower.com/top-charts?country=BR&category=shopping

2021 Annual Report: https://investor.mercadolibre.com/static-files/5d0af003-73a2-4e5e-898c-95957b644583

2022 Proxy Statement: https://investor.mercadolibre.com/static-files/5e2df931-e082-49f0-9f55-38309c99b758